Insurance And Types

In the complex landscape of financial protection and risk management, insurance stands as a cornerstone, offering a crucial safety net for individuals, businesses, and even nations. The concept of insurance, with its rich historical roots dating back centuries, has evolved into a multifaceted industry, catering to an array of needs and risks. This article aims to delve into the world of insurance, shedding light on its diverse types, the mechanisms that underpin its operation, and the profound impact it has on our lives and economies.

The Evolution of Insurance: A Historical Perspective

The origins of insurance can be traced back to ancient civilizations, where concepts of communal risk-sharing and indemnification were first introduced. The ancient Greeks and Romans, for instance, employed rudimentary forms of marine insurance to safeguard maritime trade. However, it was during the medieval period in Europe that insurance began to take shape as a more formal practice. The development of guilds and trade organizations led to the establishment of mutual aid societies, which provided early forms of life and health insurance.

The modern insurance industry as we know it today, however, emerged during the Enlightenment period. The establishment of Lloyd's of London in the 17th century marked a significant milestone, providing a marketplace for the insurance of marine risks. This era also saw the development of the first life insurance policies, which were initially sold as a form of investment rather than risk protection.

The Industrial Revolution further accelerated the growth and diversification of the insurance industry. With the emergence of new technologies and the rise of large-scale manufacturing, the need for property and liability insurance became apparent. This period also saw the birth of workers' compensation insurance, providing a safety net for employees injured on the job.

Understanding the Fundamentals of Insurance

At its core, insurance is a mechanism that allows individuals and entities to transfer the financial risk of potential losses to an insurance company, in exchange for regular premium payments. This transfer of risk is based on the principle of indemnity, where the insurer agrees to compensate the insured for covered losses, up to the limits specified in the insurance policy.

The operation of insurance is governed by several key principles. The principle of utmost good faith mandates that both the insurer and the insured must disclose all relevant information truthfully and completely. This principle ensures that the insurer can accurately assess the risk they are taking on. Additionally, the principle of insurable interest requires that the insured must have a legitimate stake in the outcome of the event being insured. This principle helps prevent speculative insurance, where individuals or entities stand to gain financially from a loss that does not affect them directly.

Insurance also operates on the principle of subrogation, which allows the insurer to step into the shoes of the insured to pursue legal rights against a third party responsible for the loss. This principle ensures that insurers can recover costs from those responsible for causing the insured loss.

The Diverse Landscape of Insurance Types

The insurance industry is incredibly diverse, offering a wide array of products to cater to the unique needs and risks faced by individuals and businesses. Here, we explore some of the most common types of insurance and their specific applications.

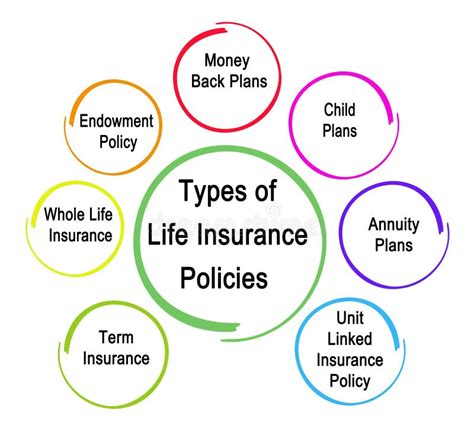

Life Insurance

Life insurance provides financial protection to individuals and their families in the event of the policyholder’s death. It can be a crucial tool for ensuring financial stability and security for loved ones, particularly in cases where the policyholder is the primary breadwinner. Life insurance policies can also offer additional benefits, such as savings and investment components, making them an attractive long-term financial planning tool.

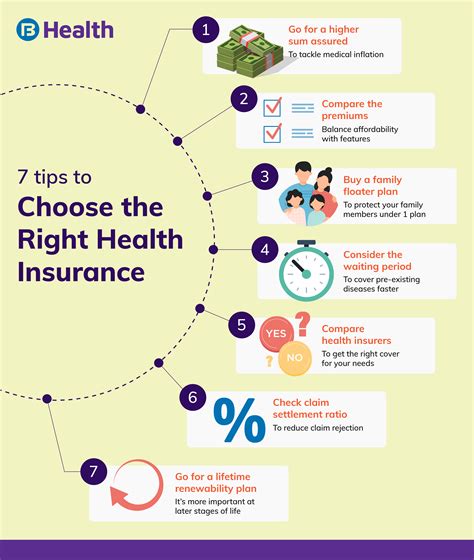

Health Insurance

Health insurance is designed to cover the cost of medical and surgical expenses, providing a safety net for individuals and families in the event of illness or injury. With rising healthcare costs, health insurance has become increasingly vital, offering peace of mind and ensuring access to necessary medical care without the burden of substantial out-of-pocket expenses.

Property Insurance

Property insurance provides protection against damage or loss to one’s property, whether it’s a home, business premises, or valuable possessions. This type of insurance can cover a wide range of risks, including fire, theft, natural disasters, and liability claims. Property insurance is essential for safeguarding one’s financial interests and can provide critical support during times of crisis.

| Type of Property Insurance | Coverage |

|---|---|

| Homeowners Insurance | Covers dwelling, personal property, liability, and additional living expenses. |

| Renters Insurance | Protects personal property and provides liability coverage for renters. |

| Commercial Property Insurance | Covers buildings, inventory, equipment, and business interruption losses. |

Automobile Insurance

Automobile insurance, also known as car insurance, is a type of insurance that provides coverage for vehicles, including cars, motorcycles, and other types of motor vehicles. It is designed to protect drivers and vehicle owners against financial loss in the event of an accident, theft, or other vehicle-related incidents. Automobile insurance typically includes liability coverage, which pays for damages or injuries caused to others, as well as optional coverage for the insured vehicle itself.

Travel Insurance

Travel insurance offers coverage for various risks associated with travel, including trip cancellations, medical emergencies, lost luggage, and other unforeseen events. It can provide financial protection and peace of mind for travelers, ensuring that unexpected expenses or disruptions do not derail their journeys.

Business Insurance

Business insurance is a broad category encompassing various types of insurance designed to protect businesses from a range of risks. This can include property insurance for business premises, liability insurance to cover legal claims, business interruption insurance to provide financial support during temporary closures, and professional indemnity insurance to protect against claims of negligence or malpractice.

Specialty Insurance

The insurance industry also offers a myriad of specialty insurance products tailored to unique risks. This can include pet insurance, wedding insurance, identity theft insurance, and even insurance for specific types of art or collectibles. These specialty products are designed to provide comprehensive coverage for specific assets or situations, offering peace of mind and financial protection for niche needs.

The Role of Insurance in Risk Management

Insurance plays a critical role in risk management, providing a structured approach to handling potential losses. By transferring the financial burden of risk to insurance companies, individuals and businesses can focus on their core activities without the fear of catastrophic financial losses. This allows for better planning, investment, and growth, knowing that they are protected against unforeseen events.

Insurance also fosters a sense of financial security and stability, both for individuals and the broader economy. In the event of a disaster or unforeseen circumstance, insurance can provide the necessary financial resources to rebuild and recover, preventing long-term economic disruption. This stability is particularly crucial for businesses, as it allows them to continue operations and fulfill their obligations, even in the face of adversity.

The Future of Insurance: Technological Innovations and Emerging Trends

The insurance industry is undergoing significant transformation driven by technological advancements and changing consumer preferences. The rise of digital platforms and data analytics is revolutionizing the way insurance is delivered and consumed. Insurers are leveraging big data and artificial intelligence to offer more personalized and efficient products, while also improving risk assessment and underwriting processes.

The concept of parametric insurance, for instance, is gaining traction. This type of insurance provides coverage based on the occurrence of a specific event, such as a natural disaster, rather than the actual loss incurred. It offers a faster and more efficient claims process, as payments can be triggered automatically based on predefined parameters, without the need for traditional loss assessment.

The emergence of insurtech companies is also reshaping the insurance landscape. These innovative startups are leveraging technology to offer more agile and customer-centric insurance solutions, often disrupting traditional insurance models. They are particularly adept at utilizing digital platforms and data-driven approaches to enhance the customer experience, streamline processes, and offer more tailored insurance products.

Conclusion

Insurance is a vital component of our modern society, providing a safety net against an array of risks and uncertainties. From its ancient origins to its modern-day innovations, the insurance industry has evolved to meet the diverse needs of individuals and businesses. With its multifaceted nature and continuous evolution, insurance remains a cornerstone of financial protection and risk management, offering stability and security in an ever-changing world.

What are the key benefits of having insurance?

+Insurance offers several key benefits. Firstly, it provides financial protection, ensuring that policyholders are not left with significant out-of-pocket expenses in the event of a covered loss. It also offers peace of mind, knowing that you and your loved ones are protected against potential risks. Additionally, insurance can help prevent long-term financial strain and promote stability, especially in the face of unforeseen circumstances.

How does insurance contribute to economic stability?

+Insurance plays a crucial role in economic stability by providing a safety net against financial losses. It ensures that individuals and businesses can recover from unforeseen events without facing significant financial hardship. This, in turn, helps maintain consumer confidence, encourages investment, and supports economic growth. By spreading risk across a large pool of policyholders, insurance companies can provide financial support when needed, preventing widespread economic disruption.

What are some common challenges faced by the insurance industry today?

+The insurance industry faces several challenges, including evolving consumer expectations, increasing competition from insurtech startups, and the need to adapt to rapidly changing technologies. Additionally, insurers must navigate complex regulatory environments and address issues related to climate change, which can lead to increased frequency and severity of natural disasters. Managing these challenges effectively is crucial for the industry’s continued growth and relevance.