Military Family Insurance

Military Family Insurance is a vital component of the comprehensive support system provided to military personnel and their families. This specialized insurance caters to the unique needs and circumstances faced by those serving their country, offering financial protection and peace of mind during challenging times. With a rich history dating back to the early 20th century, military insurance has evolved significantly, adapting to the changing needs of modern military families.

The Evolution of Military Family Insurance

The concept of military insurance emerged during the First World War, recognizing the need to provide financial support to soldiers and their dependents. Over the decades, these insurance programs have transformed, expanding their coverage and benefits to address the diverse requirements of military families.

One of the key milestones in the evolution of military insurance was the introduction of the Servicemen's Group Life Insurance (SGLI) program in 1965. SGLI offered low-cost life insurance to active-duty service members, providing a significant financial safety net for their families in the event of their death. This program was later expanded to include additional benefits such as disability coverage and long-term care insurance.

In recent years, military insurance has further evolved to address the unique challenges faced by modern military families. With an increasing number of female service members and dual-military couples, insurance providers have adapted their policies to offer more inclusive coverage. Additionally, the rise of remote work and technological advancements has enabled insurance companies to provide more efficient and accessible services to military families, regardless of their deployment locations.

Key Features of Military Family Insurance

Military Family Insurance offers a range of essential benefits tailored to the specific needs of military personnel and their families. Here are some key features of these insurance programs:

- Life Insurance: Provides financial protection to the family in the event of the service member's death. The coverage amounts can vary based on the rank and years of service.

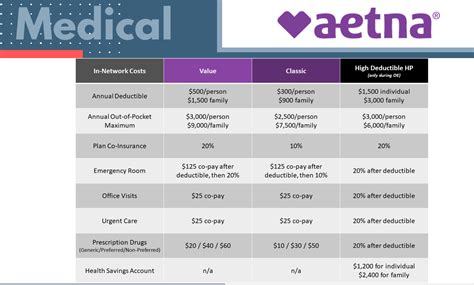

- Health Insurance: Offers comprehensive medical coverage, including access to specialized military healthcare facilities and providers. This ensures that military families receive the necessary healthcare services without financial strain.

- Dental and Vision Insurance: Covers routine dental and vision care, as well as emergency dental and vision services. These plans often include discounts on various dental and vision procedures.

- Disability Insurance: Provides financial support in the event of a service-related injury or illness that results in a permanent disability. This coverage ensures that the service member and their family can maintain their standard of living despite the disability.

- Survivor Benefits: In the unfortunate event of the service member's death, this insurance provides ongoing financial support to the surviving spouse and children. The benefits can include monthly payments, education assistance, and access to additional military benefits.

- Home and Property Insurance: Offers protection against damages to the service member's home and personal property, including coverage for natural disasters and theft. This insurance is particularly crucial for military families who frequently relocate.

- Auto Insurance: Provides coverage for the service member's vehicle, including liability, collision, and comprehensive insurance. Many military insurance providers offer discounts and additional benefits specifically for military personnel.

| Insurance Type | Key Benefits |

|---|---|

| Life Insurance | Financial protection for the family in case of the service member's death. |

| Health Insurance | Comprehensive medical coverage with access to military healthcare facilities. |

| Dental and Vision Insurance | Coverage for routine and emergency dental and vision care, with discounts on procedures. |

| Disability Insurance | Financial support for service-related disabilities, ensuring continued financial stability. |

| Survivor Benefits | Ongoing financial assistance for the surviving spouse and children, including education support. |

| Home and Property Insurance | Protection against damages and natural disasters, catering to military families' frequent relocations. |

| Auto Insurance | Coverage for the service member's vehicle, with military-specific discounts and benefits. |

Real-Life Impact and Success Stories

Military Family Insurance has had a profound impact on the lives of countless military families, providing them with the necessary financial resources to navigate through difficult situations. Here are a few real-life success stories that highlight the importance and effectiveness of military insurance:

Story 1: Overcoming a Medical Emergency

Sarah, a military spouse, faced a medical emergency when her husband, John, was deployed overseas. Sarah was diagnosed with a severe illness requiring immediate surgery and ongoing medical treatment. Fortunately, their military insurance covered the entire cost of Sarah’s medical care, allowing her to focus on her recovery without worrying about the financial burden.

Thanks to the comprehensive health insurance provided by the military, Sarah received excellent medical attention and was able to make a full recovery. The insurance not only covered the hospital stay and surgery but also provided access to specialized medical professionals who offered ongoing support during her recovery process. Sarah's experience highlights the critical role of military insurance in providing peace of mind and ensuring access to quality healthcare, even during challenging times.

Story 2: Navigating a Service-Related Disability

Michael, a veteran, sustained a service-related injury that left him with a permanent disability. The injury impacted his ability to work and support his family financially. However, Michael’s military insurance came to his rescue, providing him with disability benefits that ensured a steady income stream.

With the support of his disability insurance, Michael was able to adapt to his new circumstances and focus on his rehabilitation. The insurance coverage not only provided financial stability but also gave him the time and resources to explore new career paths and adjust to his disability. Michael's story emphasizes the crucial role of military insurance in helping veterans transition into civilian life with dignity and financial security.

Story 3: Ensuring a Bright Future for Military Children

Emily, a military child, faced the challenge of transitioning to a new school due to her family’s frequent relocations. Her parents, both service members, were concerned about the financial burden of covering the costs associated with her education. Fortunately, their military insurance included survivor benefits that provided Emily with access to education assistance.

Through the survivor benefits program, Emily received financial support for her tuition fees, books, and other educational expenses. This assistance not only relieved the financial stress on her parents but also ensured that Emily could continue her education uninterrupted. Emily's story showcases how military insurance helps military families navigate the unique challenges of military life, providing stability and opportunities for their children's future.

The Future of Military Family Insurance

As the needs of military families continue to evolve, so too must the insurance programs that support them. The future of Military Family Insurance lies in further innovation and adaptation to address emerging challenges and changing circumstances.

Emerging Trends and Innovations

One of the key trends in military insurance is the increasing focus on wellness and preventative care. Insurance providers are recognizing the importance of promoting healthy lifestyles among military families, offering incentives and discounts for fitness programs, healthy eating initiatives, and mental health support. By encouraging proactive health management, these initiatives aim to reduce the incidence of chronic diseases and improve overall well-being.

Another emerging trend is the integration of technology into military insurance services. Insurance providers are leveraging digital platforms and mobile apps to enhance the accessibility and convenience of their services. From online policy management to telemedicine options, these technological advancements aim to streamline the insurance experience for military families, regardless of their deployment locations.

Addressing Emerging Challenges

Military families face unique challenges, and insurance providers must adapt their offerings to meet these evolving needs. One such challenge is the increasing prevalence of mental health issues among military personnel and their families. Insurance providers are expanding their coverage to include more comprehensive mental health services, such as counseling, therapy, and support groups. By addressing mental health proactively, insurance companies aim to improve the overall well-being and resilience of military families.

Additionally, with an increasing number of military families engaging in remote work and entrepreneurship, insurance providers are exploring ways to provide tailored coverage for these new working arrangements. This includes offering flexible insurance options that cater to the unique needs of military entrepreneurs and remote workers, ensuring they have the necessary protection for their businesses and personal assets.

What are the eligibility criteria for Military Family Insurance?

+Eligibility for Military Family Insurance typically depends on the service member’s rank, years of service, and active-duty status. Spouses and dependent children of eligible service members can also access these insurance programs. It’s important to note that specific eligibility requirements may vary based on the insurance provider and the type of coverage.

How can I choose the right Military Family Insurance plan for my needs?

+Choosing the right Military Family Insurance plan involves assessing your unique needs and priorities. Consider factors such as your family’s healthcare requirements, financial goals, and specific risks associated with your military service. Research and compare different insurance providers and their offerings to find a plan that provides comprehensive coverage at an affordable cost.

Are there any discounts or special benefits available for military families?

+Yes, many insurance providers offer discounts and special benefits exclusively for military families. These may include reduced rates, waivers for certain fees, and additional coverage options tailored to the unique needs of military personnel and their families. It’s worth exploring these benefits when selecting your insurance plan.