Einsurance

Welcome to the world of eInsurance, a digital revolution transforming the traditional insurance industry. In today's fast-paced and technology-driven era, eInsurance platforms have emerged as a game-changer, offering convenient, efficient, and accessible insurance solutions to individuals and businesses alike. This article will delve into the intricacies of eInsurance, exploring its history, key features, benefits, and the impact it has had on the insurance landscape. So, fasten your seatbelts as we embark on a journey to uncover the secrets of eInsurance and its potential to shape the future of insurance.

Unraveling the eInsurance Phenomenon

eInsurance, short for electronic insurance, represents a significant evolution in the way insurance services are delivered and accessed. It leverages the power of the internet and digital technologies to streamline the insurance process, making it more customer-centric and efficient. With the rise of eInsurance platforms, individuals can now obtain insurance quotes, purchase policies, and manage their coverage entirely online, without the need for physical paperwork or face-to-face interactions.

A Brief History of eInsurance

The concept of eInsurance can be traced back to the early days of the internet when insurance companies began experimenting with online presence. In the late 1990s and early 2000s, several insurers started creating basic websites to provide information about their products and services. However, it was not until the mid-2000s that the true potential of eInsurance began to unfold.

The turning point came with the introduction of robust e-commerce platforms and the widespread adoption of smartphones. These technological advancements paved the way for the development of comprehensive eInsurance solutions, enabling consumers to access and manage insurance policies with ease. Since then, eInsurance has gained momentum, with numerous insurance companies and startups embracing digital transformation to enhance their services.

Key Features of eInsurance Platforms

eInsurance platforms offer a wide range of features that revolutionize the insurance experience. Here are some of the key components that make eInsurance a compelling choice:

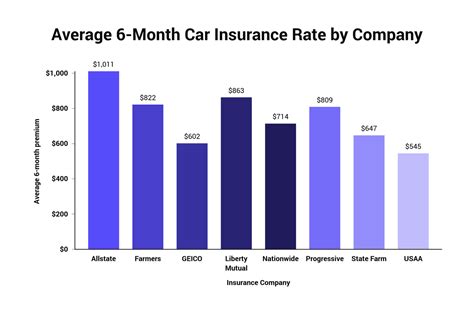

- Online Quoting and Comparison: eInsurance platforms provide users with an easy-to-use interface to obtain insurance quotes for various types of coverage, such as health, auto, home, and life insurance. The ability to compare multiple quotes from different insurers in real-time empowers consumers to make informed decisions.

- Paperless Transactions: One of the significant advantages of eInsurance is the elimination of paperwork. From application to policy issuance, the entire process can be completed digitally, making it convenient and environmentally friendly.

- Personalized Insurance Plans: eInsurance platforms often utilize advanced algorithms and data analytics to offer personalized insurance plans tailored to individual needs. By considering factors like age, health status, and lifestyle, these platforms can provide customized coverage options.

- Digital Claims Processing: eInsurance simplifies the claims process by allowing policyholders to submit claims online, often with the option to upload supporting documents digitally. This streamlined approach reduces administrative burdens and accelerates claim settlements.

- 24/7 Access and Self-Service: eInsurance platforms are accessible anytime, anywhere, providing policyholders with round-the-clock access to their insurance accounts. This self-service feature enables them to manage their policies, make payments, and view policy details without relying on intermediaries.

- Integration with IoT and Telematics: eInsurance leverages the power of the Internet of Things (IoT) and telematics to collect real-time data. For instance, in auto insurance, telematics devices can track driving behavior, offering personalized premiums based on usage and safety practices.

The Benefits of eInsurance

The rise of eInsurance has brought about a multitude of benefits for both consumers and insurance providers. Let’s explore some of the key advantages:

Enhanced Customer Experience

eInsurance platforms prioritize customer convenience and satisfaction. By providing a seamless digital experience, insurers can attract and retain customers more effectively. The ability to obtain quotes, purchase policies, and manage coverage online saves time and effort, leading to higher customer satisfaction and loyalty.

Increased Accessibility

eInsurance breaks down geographical barriers, making insurance services accessible to a wider audience. Individuals living in remote areas or with limited access to traditional insurance agents can now easily obtain insurance coverage. This inclusivity ensures that more people can protect their assets and secure their financial well-being.

Cost Efficiency and Transparency

The digital nature of eInsurance reduces operational costs for insurers, which can translate into lower premiums for consumers. Additionally, eInsurance platforms often provide transparent pricing and coverage details, allowing customers to make informed choices without the need for complex negotiations.

Data-Driven Insights

eInsurance platforms collect and analyze vast amounts of data, enabling insurers to gain valuable insights into customer behavior, preferences, and risk profiles. This data-driven approach helps insurers develop more accurate pricing models, improve risk assessment, and offer targeted insurance products.

Streamlined Claims Process

eInsurance simplifies the claims process, making it more efficient and less burdensome for policyholders. With digital claims submission and processing, insurers can reduce the time taken to settle claims, enhancing customer satisfaction and trust.

Impact on the Insurance Industry

The advent of eInsurance has had a profound impact on the insurance industry, shaping its future trajectory. Here’s how eInsurance has influenced various aspects of the industry:

Digital Transformation

eInsurance has accelerated the digital transformation of the insurance sector. Insurers that embrace eInsurance platforms and digital technologies gain a competitive edge, attracting tech-savvy consumers and staying relevant in a rapidly changing market.

Disruption of Traditional Models

eInsurance has disrupted the traditional insurance broker and agent-based model. With direct access to insurance products and services online, consumers can bypass intermediaries, leading to a shift in the power dynamics within the industry.

Emerging InsurTech Startups

The rise of eInsurance has spurred the growth of InsurTech startups, which leverage technology to offer innovative insurance solutions. These startups often challenge established insurers with their agility, focus on customer experience, and ability to leverage emerging technologies.

Data-Driven Risk Assessment

eInsurance platforms collect and analyze vast amounts of data, enabling insurers to develop more sophisticated risk assessment models. This data-driven approach enhances accuracy and allows for more precise pricing, leading to a fairer insurance market.

Improved Customer Engagement

eInsurance platforms provide insurers with valuable opportunities to engage with customers directly. Through personalized recommendations, educational content, and interactive tools, insurers can foster stronger relationships and build customer loyalty.

The Future of eInsurance

As technology continues to advance, the future of eInsurance looks promising. Here are some trends and developments to watch out for:

- Artificial Intelligence (AI) Integration: AI and machine learning will play a significant role in eInsurance, enabling more accurate risk assessment, fraud detection, and personalized insurance offerings.

- Blockchain Technology: Blockchain has the potential to revolutionize eInsurance by enhancing security, streamlining transactions, and improving data sharing among insurers and customers.

- Wearable Technology and Health Insurance: Wearable devices and health monitoring technologies can provide real-time health data, leading to more accurate health insurance assessments and personalized coverage options.

- Cyber Insurance and Digital Risks: With the increasing prevalence of cyber threats, eInsurance platforms are likely to expand their focus on cyber insurance, offering protection against digital risks.

- Partnerships and Ecosystems: eInsurance platforms may collaborate with other digital services and ecosystems to offer integrated insurance solutions, providing customers with a seamless experience across various domains.

The future of eInsurance is filled with exciting possibilities, and its impact on the insurance industry is set to deepen. As consumers become more digitally savvy and demand convenience and personalization, eInsurance platforms will continue to evolve, shaping the way insurance services are delivered and experienced.

Conclusion

eInsurance has emerged as a transformative force, reshaping the insurance landscape and offering a more accessible, efficient, and customer-centric approach to insurance. With its digital prowess and focus on innovation, eInsurance is well-positioned to meet the evolving needs of consumers and drive the industry forward. As we move towards a more digital future, eInsurance platforms will undoubtedly play a pivotal role in protecting individuals, businesses, and communities.

What are the key advantages of eInsurance for consumers?

+eInsurance offers consumers a range of advantages, including enhanced convenience, accessibility, and transparency. With eInsurance, consumers can obtain insurance quotes and purchase policies online, eliminating the need for physical paperwork and face-to-face interactions. The digital nature of eInsurance also provides real-time access to policy information and the ability to manage coverage anytime, anywhere. Additionally, eInsurance platforms often offer personalized insurance plans tailored to individual needs, ensuring customers receive coverage that aligns with their specific circumstances.

How has eInsurance impacted the insurance industry’s profitability?

+The introduction of eInsurance has had a positive impact on the insurance industry’s profitability. By leveraging digital technologies, insurers can reduce operational costs associated with traditional paper-based processes. This cost reduction often translates into lower premiums for consumers, making insurance more affordable and accessible. Additionally, eInsurance platforms enable insurers to reach a wider customer base, including those in remote areas or with limited access to physical insurance agents. As a result, insurers can expand their market reach and potentially increase their customer base, leading to higher profitability.

What role does data play in eInsurance platforms?

+Data plays a crucial role in eInsurance platforms, driving various aspects of the insurance process. eInsurance platforms collect and analyze vast amounts of data, including customer demographics, behavior, and risk profiles. This data-driven approach enables insurers to develop more accurate risk assessment models, leading to fairer and more precise pricing. Additionally, data analytics help insurers identify trends, detect potential fraud, and offer personalized insurance products and recommendations to customers. By leveraging data effectively, eInsurance platforms can enhance customer satisfaction, improve risk management, and drive overall operational efficiency.