Comprehensive House Insurance

Ensuring your home is adequately protected is a critical aspect of responsible homeownership. Comprehensive house insurance, often referred to as homeowners insurance, is a vital tool to safeguard your biggest investment and provide peace of mind. This guide will delve into the intricacies of comprehensive house insurance, offering an expert analysis of its components, benefits, and implications.

Understanding Comprehensive House Insurance

Comprehensive house insurance is a policy designed to cover a wide range of potential risks and damages that could affect your home and its contents. It goes beyond basic coverage, offering a more extensive protection plan tailored to the specific needs of homeowners. Here’s a detailed breakdown of what it entails and why it’s essential.

Coverage Scope

The coverage scope of comprehensive house insurance is extensive. It typically includes:

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and permanent fixtures. It ensures that in the event of damage caused by covered perils, you can repair or rebuild your home.

- Personal Property Coverage: This aspect of the policy protects your personal belongings inside the home. From furniture and appliances to clothing and electronics, it provides financial assistance in case of theft, damage, or destruction.

- Liability Protection: Comprehensive insurance often includes liability coverage, which protects you if someone is injured on your property or if your actions cause damage to others’ property.

- Additional Living Expenses: In the event you need to evacuate your home due to a covered peril, this coverage helps cover the costs of temporary accommodation and other living expenses.

- Medical Payments: If someone is injured on your property, this coverage provides for their medical expenses, regardless of liability.

Additionally, comprehensive insurance may offer optional endorsements or riders to customize coverage further. For instance, you might add coverage for specific valuables like jewelry or artwork, or choose to increase your liability protection limits.

Covered Perils and Exclusions

Comprehensive house insurance typically covers a wide range of perils, including fire, lightning, windstorms, hail, explosions, vandalism, and theft. However, it’s crucial to understand that certain events are often excluded from standard policies. These may include:

- Flood damage (requiring separate flood insurance)

- Earthquake damage (usually requiring a separate policy)

- War or nuclear incidents

- Intentional damage or acts of terrorism

- Gradual damage due to wear and tear or aging

Understanding the specific perils covered and excluded from your policy is essential to ensure you have the right protection for your home and circumstances.

Benefits of Comprehensive House Insurance

The advantages of comprehensive house insurance are multifaceted and can provide significant value to homeowners.

Financial Security and Peace of Mind

One of the primary benefits of comprehensive insurance is the financial security it offers. In the event of a covered loss, the policy provides the necessary funds to repair or rebuild your home and replace your belongings. This can be a lifesaver, especially for those who might struggle to afford such expenses out of pocket.

Additionally, knowing that you're protected against a wide range of potential risks can provide immense peace of mind. It allows homeowners to focus on enjoying their homes without constant worry about potential disasters.

Customization and Flexibility

Comprehensive house insurance policies are highly customizable. Homeowners can choose the level of coverage they need, including the amount of dwelling and personal property coverage, as well as liability limits. This flexibility ensures that the policy aligns with the specific needs and budget of each homeowner.

Furthermore, with the option to add endorsements or riders, homeowners can tailor their coverage to account for unique circumstances or high-value items. For instance, if you have valuable jewelry or artwork, you can increase the limits for these items to ensure they're adequately protected.

Legal and Financial Protection

The liability protection offered by comprehensive insurance is a critical aspect. It safeguards homeowners against financial losses resulting from lawsuits or claims related to accidents or injuries that occur on their property. This protection can be invaluable, especially in situations where the injured party seeks significant damages.

Performance and Real-World Examples

Comprehensive house insurance has proven its worth in countless real-world scenarios. Here are a few examples of how it has benefited homeowners:

Case Study: Hurricane Damage

In the aftermath of a severe hurricane, a homeowner with comprehensive insurance found their roof severely damaged. The policy covered the cost of repairs, ensuring the home was once again safe and secure. Without insurance, the homeowner would have faced a significant financial burden, potentially compromising the structural integrity of their home.

Example: Theft and Vandalism

Imagine returning home to find your house has been vandalized and some valuable electronics stolen. With comprehensive insurance, the policy can help replace the stolen items and cover the costs of repairing any damage caused by the vandals. This can make a significant difference in the homeowner’s ability to recover from such a traumatic event.

Liability Protection in Action

Consider a scenario where a guest slips and falls on your icy driveway, resulting in a severe injury. Comprehensive insurance’s liability coverage would step in to cover the medical expenses and any potential legal costs associated with the accident. This protection can be a lifeline for homeowners facing unexpected financial burdens.

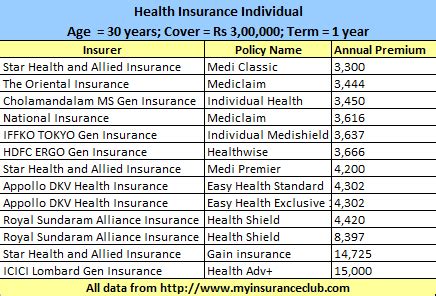

Technical Specifications and Data

When considering comprehensive house insurance, it’s essential to understand the technical aspects and data associated with policies.

| Coverage Type | Average Coverage Limit |

|---|---|

| Dwelling Coverage | $300,000 - $500,000 |

| Personal Property Coverage | 50% - 70% of Dwelling Coverage |

| Liability Coverage | $100,000 - $300,000 |

Note: The above limits are average estimates and can vary based on location, home value, and personal preferences. It's essential to consult with an insurance professional to determine the appropriate coverage limits for your specific circumstances.

Policy Terms and Conditions

Comprehensive house insurance policies typically have a term of one year, after which they can be renewed. The policy document outlines the specific terms and conditions, including the coverage limits, deductibles, and any exclusions or limitations. It’s crucial to review this document thoroughly to understand your rights and responsibilities as a policyholder.

Comparative Analysis

When comparing comprehensive house insurance policies, several factors come into play. Here’s a breakdown of some key considerations:

Cost and Value

The cost of comprehensive insurance can vary significantly based on factors like location, home value, and the level of coverage chosen. It’s essential to balance the cost with the value of the protection provided. A policy with a lower premium might not offer sufficient coverage, while a more comprehensive policy might be overkill for some homeowners.

Coverage and Deductibles

Different policies offer varying levels of coverage. Some might provide more extensive protection but come with higher deductibles, meaning you’ll pay more out of pocket before the insurance kicks in. Others might have lower deductibles but provide less coverage. It’s crucial to find a balance that aligns with your financial situation and risk tolerance.

Reputation and Service

The reputation and service quality of the insurance provider are critical factors. Look for companies with a strong track record of paying claims promptly and providing excellent customer service. Reviews and ratings from independent sources can be valuable in assessing an insurer’s reliability.

Future Implications and Considerations

As the housing market and insurance landscape evolve, it’s essential to stay informed and adaptable. Here are some key considerations for the future of comprehensive house insurance:

Changing Risks and Coverage Needs

The risks faced by homeowners can evolve over time. Climate change, for instance, might lead to an increased risk of natural disasters like hurricanes or wildfires. As such, it’s crucial to periodically review your insurance coverage to ensure it aligns with changing risks and your current circumstances.

Technological Advances and Home Protection

Advancements in home security and technology can also impact insurance. For instance, installing smart home security systems or fire prevention technology might qualify you for discounts or more favorable policy terms. Staying updated on these advancements can help you leverage them to your advantage.

Regulatory Changes and Industry Trends

The insurance industry is subject to regulatory changes and market trends. Keeping abreast of these developments can help you understand potential shifts in coverage options and pricing. It’s also essential to be aware of any changes in state or local laws that might impact your insurance coverage.

Conclusion

Comprehensive house insurance is a vital tool for homeowners to protect their investments and ensure financial security. By understanding the coverage, benefits, and technical aspects, homeowners can make informed decisions about their insurance needs. With the right policy, homeowners can enjoy peace of mind, knowing they’re protected against a wide range of potential risks.

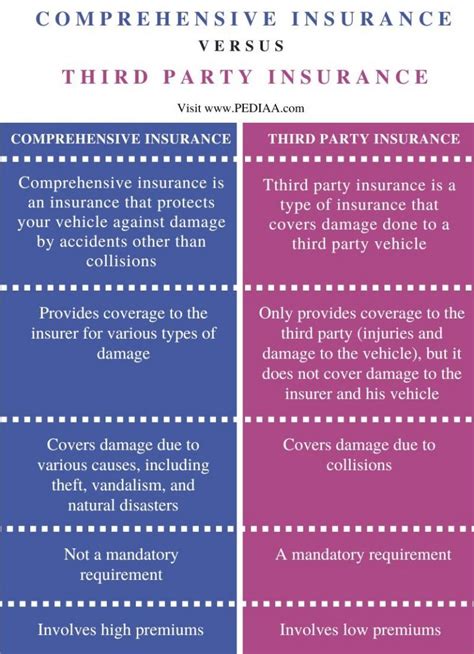

What is the difference between comprehensive and basic house insurance?

+

Comprehensive house insurance, or homeowners insurance, offers a more extensive coverage scope compared to basic policies. While basic insurance provides essential coverage for your home and its contents, comprehensive insurance includes additional protections like liability coverage, additional living expenses, and coverage for specific perils like vandalism or theft. It also typically allows for more customization to tailor the policy to your specific needs.

How much does comprehensive house insurance typically cost?

+

The cost of comprehensive house insurance can vary significantly based on factors like the location of your home, its value, the level of coverage chosen, and any endorsements or riders added to the policy. On average, homeowners can expect to pay between 500 and 1,500 annually for comprehensive insurance. However, it’s essential to obtain quotes from multiple insurers to find the best coverage at a competitive rate.

What are some common exclusions in comprehensive house insurance policies?

+

Common exclusions in comprehensive house insurance policies include damage caused by floods, earthquakes, nuclear incidents, intentional acts, gradual wear and tear, and war. It’s crucial to review your policy’s exclusions carefully to understand what perils are not covered and consider purchasing separate policies or endorsements for these specific risks if necessary.