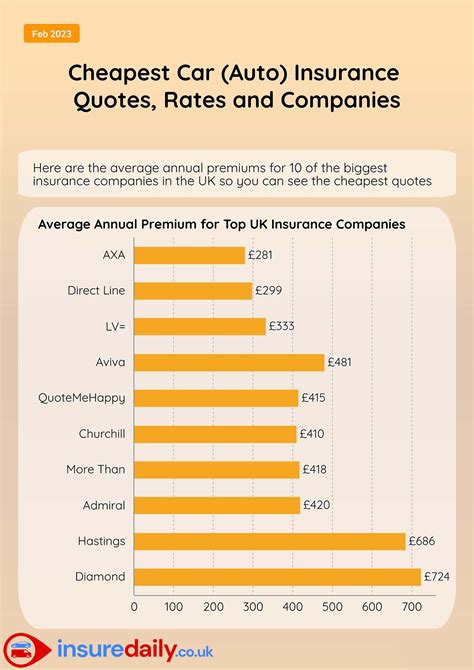

Cheapest Vehicle Insurance

When it comes to finding the cheapest vehicle insurance, there are several factors at play that can influence the cost of your policy. The insurance industry is highly competitive, and understanding these factors can help you make informed decisions to secure the most affordable coverage for your vehicle.

Understanding Vehicle Insurance Costs

Vehicle insurance costs can vary significantly depending on various elements, including your personal circumstances, the type of vehicle you own, and the coverage options you choose. By delving into these factors, you can identify strategies to minimize your insurance expenses.

Personal Factors Impacting Insurance Rates

Your age, gender, driving history, and location play a pivotal role in determining your insurance premiums. For instance, young drivers under the age of 25 often face higher premiums due to their perceived risk profile. Similarly, males under the age of 25 are statistically more likely to be involved in accidents, leading to increased insurance costs.

Your driving history is another crucial factor. A clean driving record with no accidents or traffic violations can significantly reduce your insurance costs. Conversely, a history of accidents or traffic violations may lead to higher premiums.

Your location also matters. Insurance rates can vary greatly from one state to another and even between different ZIP codes within the same state. This is primarily due to variations in the frequency and severity of accidents, as well as the cost of living and repair expenses.

Vehicle-Related Factors

The type of vehicle you own and its usage can impact your insurance costs. Certain makes and models of vehicles may be more expensive to insure due to their higher repair costs or theft frequency. Additionally, the purpose for which you use your vehicle can influence your insurance rates. For instance, if you use your vehicle for business purposes, your insurance premiums may be higher.

Coverage Options and Their Costs

The level of coverage you choose for your vehicle is another significant factor in determining your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. On the other hand, liability-only coverage, which only covers damages to other people or property, is often more affordable.

It's important to note that while opting for liability-only coverage may seem like a cost-saving measure, it leaves you vulnerable to significant out-of-pocket expenses in the event of an accident. Therefore, it's crucial to strike a balance between affordability and adequate coverage.

Strategies to Find the Cheapest Vehicle Insurance

Now that we’ve explored the factors influencing vehicle insurance costs, let’s delve into some strategies to help you secure the cheapest insurance for your vehicle.

Compare Quotes from Multiple Insurers

One of the most effective ways to find cheap vehicle insurance is to compare quotes from multiple insurers. Insurance companies use different methodologies to calculate premiums, and rates can vary significantly between providers. By obtaining quotes from several insurers, you can identify the most affordable option for your specific circumstances.

Online insurance marketplaces can be a convenient way to compare quotes from multiple insurers in one place. These platforms allow you to input your details once and receive multiple quotes, making the comparison process more efficient.

Utilize Discounts and Bundles

Insurance companies often offer discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Multi-Policy Discounts: If you bundle your vehicle insurance with other insurance policies, such as homeowners or renters insurance, you may be eligible for a discount.

- Safe Driver Discounts: Many insurers offer discounts to drivers with clean driving records. These discounts reward drivers for maintaining a safe driving history.

- Loyalty Discounts: Staying with the same insurer for an extended period can lead to loyalty discounts. These discounts incentivize customer retention and can result in significant savings over time.

- Student Discounts: Some insurers offer discounts to students who maintain good grades or are enrolled in certain safety courses.

It's worth exploring the discounts available from different insurers to determine which provider offers the best combination of discounts for your specific situation.

Adjust Your Coverage Levels

While it’s important to have adequate coverage, you may be able to reduce your insurance costs by adjusting your coverage levels. Here are some strategies to consider:

- Increase Your Deductible: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your insurance premiums. However, it's important to ensure that you can afford the increased deductible in the event of an accident.

- Consider State Minimum Coverage: In some cases, opting for the state minimum coverage requirements may be sufficient for your needs. This can help reduce your insurance costs, especially if you have an older vehicle or a tight budget.

- Remove Unnecessary Coverage: Review your current coverage and assess whether you have any unnecessary add-ons. For instance, if you have an older vehicle, you may not need comprehensive or collision coverage, as the cost of these coverages may exceed the vehicle's value.

Shop Around Regularly

Insurance rates can change over time, and what was the cheapest option a year ago may no longer be the case today. It’s a good practice to shop around for vehicle insurance at least once a year to ensure you’re still getting the best deal. This is especially important if your circumstances have changed, such as a clean driving record or a new vehicle purchase.

Explore Telematics Insurance

Telematics insurance, also known as usage-based insurance, is a relatively new concept that rewards safe driving habits. With telematics insurance, your driving behavior is monitored through a device installed in your vehicle or an app on your smartphone. Insurers use this data to assess your risk profile and set your premiums accordingly.

If you're a safe and cautious driver, telematics insurance can be an excellent way to reduce your insurance costs. By demonstrating your safe driving habits, you may be eligible for significant discounts.

The Future of Vehicle Insurance

The insurance industry is constantly evolving, and new technologies and trends are shaping the future of vehicle insurance. Here are some key developments to watch:

Connected Car Technology

Connected car technology is gaining traction, and insurers are leveraging this data to offer more personalized insurance products. Connected cars generate vast amounts of data, including driving behavior, vehicle diagnostics, and real-time traffic information. Insurers can use this data to offer usage-based insurance and provide more accurate risk assessments.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the insurance industry. These technologies enable insurers to analyze vast amounts of data, identify patterns, and make more accurate predictions. AI and ML can be used to automate claims processing, improve fraud detection, and personalize insurance products based on individual risk profiles.

Autonomous Vehicles

The rise of autonomous vehicles is set to revolutionize the insurance industry. As self-driving cars become more prevalent, the risk profile of drivers will shift, potentially leading to lower insurance costs. However, the introduction of autonomous vehicles also presents new challenges and opportunities for insurers, such as determining liability in accidents and developing new insurance products.

Digital Transformation

The insurance industry is undergoing a digital transformation, with insurers investing in technology to enhance the customer experience and improve operational efficiency. Digital tools and platforms are making it easier for customers to obtain quotes, manage policies, and file claims. This shift towards digital insurance is expected to continue, with insurers leveraging technology to offer more convenient and cost-effective insurance solutions.

Conclusion

Finding the cheapest vehicle insurance requires a combination of understanding the factors that influence insurance costs and employing strategic approaches to reduce your premiums. By comparing quotes, utilizing discounts, adjusting your coverage levels, and exploring emerging insurance technologies, you can secure affordable insurance while maintaining adequate coverage.

As the insurance industry continues to evolve, staying informed about the latest trends and developments can help you make informed decisions and ensure you're getting the best value for your insurance dollar.

How do insurance companies determine my premium?

+Insurance companies use a combination of factors to calculate your premium, including your age, gender, driving history, location, and the type of vehicle you own. They also consider the level of coverage you choose and any applicable discounts.

Can I switch insurance companies to save money?

+Yes, switching insurance companies can be an effective way to save money on your vehicle insurance. By comparing quotes from multiple insurers, you can identify the most affordable option for your specific circumstances.

What is usage-based insurance, and how can it save me money?

+Usage-based insurance, also known as telematics insurance, monitors your driving behavior through a device or app. If you demonstrate safe driving habits, you may be eligible for significant discounts, potentially reducing your insurance costs.