Car Insurance Quotes Full Coverage

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. Obtaining accurate and comprehensive car insurance quotes is crucial for ensuring adequate coverage at an affordable rate. This comprehensive guide will delve into the intricacies of car insurance quotes, specifically focusing on full coverage options, to help you make informed decisions and navigate the insurance landscape effectively.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive insurance policy that offers a broad range of protections for your vehicle. Unlike liability-only insurance, which covers damages caused to others, full coverage insurance also safeguards your own vehicle against various risks, including accidents, theft, and natural disasters. It is designed to provide a more complete level of protection, ensuring that you are not left with significant out-of-pocket expenses in the event of an incident.

Full coverage typically includes two main components: collision coverage and comprehensive coverage. Collision coverage helps pay for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. On the other hand, comprehensive coverage protects against non-collision incidents, such as vandalism, theft, natural disasters, or damage caused by animals. By combining these two coverages, full coverage insurance offers a robust shield against a wide array of potential risks.

The Benefits of Full Coverage

Opting for full coverage car insurance brings several advantages. Firstly, it provides a higher level of financial security, as it covers a broader range of situations compared to liability-only insurance. This means you are protected not only when you cause an accident but also when your vehicle is damaged due to other circumstances beyond your control. Additionally, full coverage often includes rental car reimbursement and roadside assistance, further enhancing your peace of mind.

Another benefit of full coverage is the flexibility it offers in terms of customizing your policy. Insurers typically allow you to choose specific coverage limits and deductibles, enabling you to balance the level of protection you desire with the cost of your insurance premiums. This customization ensures that you can tailor your policy to your individual needs and budget.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

| Rental Car Reimbursement | Provides coverage for rental car expenses if your vehicle is in the shop for repairs. |

| Roadside Assistance | Offers emergency services like towing, flat tire changes, and fuel delivery. |

Factors Influencing Car Insurance Quotes

When seeking car insurance quotes for full coverage, several factors come into play, each influencing the final premium amount. Understanding these factors can help you navigate the quote process more effectively and potentially secure a better deal.

Vehicle Type and Age

The type and age of your vehicle are significant determinants of your insurance quote. Newer and more expensive vehicles generally attract higher insurance costs due to their higher replacement and repair values. Additionally, certain vehicle types, such as sports cars or SUVs, may be considered higher risk by insurers and thus command higher premiums.

Driving History and Record

Your driving history and record play a crucial role in shaping your insurance quote. Insurers carefully examine your past driving behavior, including any accidents, traffic violations, or claims made. A clean driving record with no recent incidents or claims typically results in lower insurance premiums, as it indicates a lower risk profile.

Location and Usage

Your location and the primary usage of your vehicle also impact your insurance quote. Urban areas often experience higher rates of accidents and theft, leading to increased insurance costs. Similarly, if you primarily use your vehicle for commuting or business purposes, your insurance premiums may be higher due to the increased mileage and potential exposure to risk.

Credit Score and Personal Factors

Believe it or not, your credit score can also affect your insurance quote. Insurers often use credit-based insurance scores to assess your financial responsibility and predict the likelihood of future claims. A higher credit score may result in lower insurance premiums, as it suggests a lower risk of non-payment or frequent claims.

Furthermore, personal factors such as your age, gender, and marital status can influence your insurance quote. For instance, younger drivers are often considered higher risk due to their lack of experience, leading to higher premiums. Similarly, single drivers may face slightly higher rates compared to married individuals, as marriage is sometimes associated with a lower risk profile.

| Factor | Impact on Insurance Quote |

|---|---|

| Vehicle Type and Age | Newer, more expensive vehicles typically result in higher premiums. |

| Driving History and Record | A clean record with no recent incidents or claims often leads to lower premiums. |

| Location and Usage | Urban areas and higher mileage usage may increase insurance costs. |

| Credit Score | A higher credit score can result in lower insurance premiums. |

| Personal Factors | Age, gender, and marital status can influence insurance rates. |

Tips for Obtaining the Best Car Insurance Quotes

Now that we’ve explored the key factors influencing car insurance quotes, let’s delve into some practical tips to help you secure the best possible deal for your full coverage insurance.

Shop Around and Compare

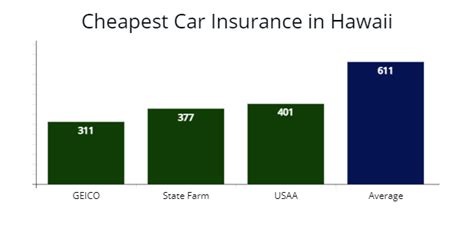

One of the most effective ways to find the best car insurance quote is to shop around and compare multiple offers. Different insurance providers may offer varying rates and coverage options, so it’s crucial to explore several options. Utilize online quote comparison tools, but also consider reaching out to individual insurers to discuss your specific needs and potential discounts.

Explore Discounts and Bundles

Insurance companies often provide a range of discounts to attract customers and encourage loyalty. Common discounts include safe driver discounts, multi-policy discounts (bundling your car insurance with other policies like home or life insurance), and loyalty discounts for long-term customers. Additionally, some insurers offer discounts for specific vehicle safety features or green initiatives. Be sure to inquire about all available discounts when obtaining quotes.

Adjust Your Deductible and Coverage Limits

Your deductible and coverage limits play a significant role in determining your insurance premiums. Generally, opting for a higher deductible can result in lower premiums, as you’re agreeing to pay more out-of-pocket before your insurance kicks in. Similarly, adjusting your coverage limits, such as raising your collision and comprehensive coverage limits, can impact your premium amount. However, it’s essential to strike a balance between cost savings and adequate protection.

Consider Payment Options

Insurance companies often provide flexibility in payment options, including monthly, quarterly, or annual payments. While monthly payments may be more manageable for some, they often come with additional fees. Consider whether you can afford to pay annually or quarterly to potentially save on administrative costs.

Review and Negotiate

Once you’ve obtained several quotes, carefully review the coverage details and premiums offered by each insurer. Compare the policies side by side to identify the best combination of coverage and cost. If you find a quote that meets your needs, don’t hesitate to negotiate. Contact the insurer and inquire about potential discounts or adjustments to bring the premium down further.

The Future of Car Insurance Quotes

The landscape of car insurance quotes is continually evolving, driven by technological advancements and changing consumer expectations. As we move forward, several key trends and developments are shaping the future of car insurance quotes.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction in the insurance industry. Usage-based insurance (UBI) policies utilize telematics to offer customized insurance rates based on individual driving habits. This data-driven approach allows insurers to more accurately assess risk and offer personalized premiums, rewarding safe drivers with lower rates.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the way insurance companies operate. These technologies enable insurers to analyze vast amounts of data quickly and accurately, improving risk assessment and quote accuracy. AI-powered chatbots and virtual assistants are also becoming more prevalent, offering instant support and streamlining the quote process for customers.

Digital Transformation and Online Platforms

The digital transformation of the insurance industry is another significant trend. Online platforms and digital tools are making it easier and more convenient for customers to obtain car insurance quotes. Insurers are investing in user-friendly websites and mobile apps, allowing customers to compare policies, customize coverage, and purchase insurance with just a few clicks.

Emerging Technologies and Risk Assessment

Emerging technologies like autonomous vehicles and advanced driver-assistance systems (ADAS) are also influencing the future of car insurance quotes. As these technologies become more prevalent, insurers will need to adapt their risk assessment models to account for the changing dynamics of driving. This may lead to new coverage options and potentially lower premiums for drivers utilizing these advanced safety features.

| Future Trend | Impact on Car Insurance Quotes |

|---|---|

| Telematics and Usage-Based Insurance | Personalized premiums based on driving behavior. |

| Artificial Intelligence and Machine Learning | Improved risk assessment and quote accuracy. |

| Digital Transformation and Online Platforms | Convenient, user-friendly quote comparison and purchase. |

| Emerging Technologies and Risk Assessment | New coverage options and potential premium reductions. |

Conclusion

Obtaining car insurance quotes for full coverage requires a careful consideration of various factors and a proactive approach to shopping around and comparing options. By understanding the factors that influence insurance quotes and utilizing the tips provided, you can navigate the insurance landscape with confidence and secure a policy that offers the right balance of coverage and cost.

As the future of car insurance unfolds, advancements in technology and changing consumer expectations will continue to shape the quote process. Embracing these changes and staying informed about the latest trends will ensure that you remain well-positioned to make informed decisions and access the best insurance options available.

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance provides comprehensive protection, covering damage to your own vehicle in addition to liability for damages caused to others. Liability-only insurance, on the other hand, only covers damages you cause to others, excluding coverage for your own vehicle.

How much does full coverage car insurance typically cost?

+The cost of full coverage car insurance varies widely based on individual factors such as driving history, vehicle type, location, and coverage limits. On average, full coverage insurance can range from a few hundred to a few thousand dollars annually.

Can I customize my full coverage car insurance policy?

+Yes, full coverage insurance policies are highly customizable. You can typically choose specific coverage limits, deductibles, and optional add-ons to tailor your policy to your needs and budget.