Most Affordable Health Insurance In Florida

Health insurance is a vital aspect of healthcare, providing financial protection and access to essential medical services. In the state of Florida, residents are fortunate to have a range of options when it comes to affordable health insurance plans. Understanding the landscape of affordable healthcare options is crucial for individuals and families seeking cost-effective coverage.

Navigating Affordable Health Insurance Options in Florida

Florida, known for its diverse population and sunny climate, presents a unique healthcare landscape. With a focus on affordability, residents can explore various pathways to secure comprehensive health coverage. This guide aims to shed light on the most affordable health insurance options available in the Sunshine State, offering a comprehensive overview for those seeking accessible and cost-effective healthcare solutions.

Florida’s Healthcare Landscape: An Overview

Florida boasts a robust healthcare system, catering to the diverse needs of its residents. The state’s healthcare market offers a range of insurance providers, each with its own set of plans and pricing structures. Understanding the key players and their offerings is essential for making informed decisions about health insurance.

One of the primary considerations for Florida residents is the availability of affordable plans. The state’s insurance market is regulated, ensuring that providers offer a range of options to cater to different budgets and healthcare needs. From individual plans to family coverage, Florida’s healthcare landscape is designed to provide accessibility and choice.

Key Factors Influencing Affordable Health Insurance in Florida

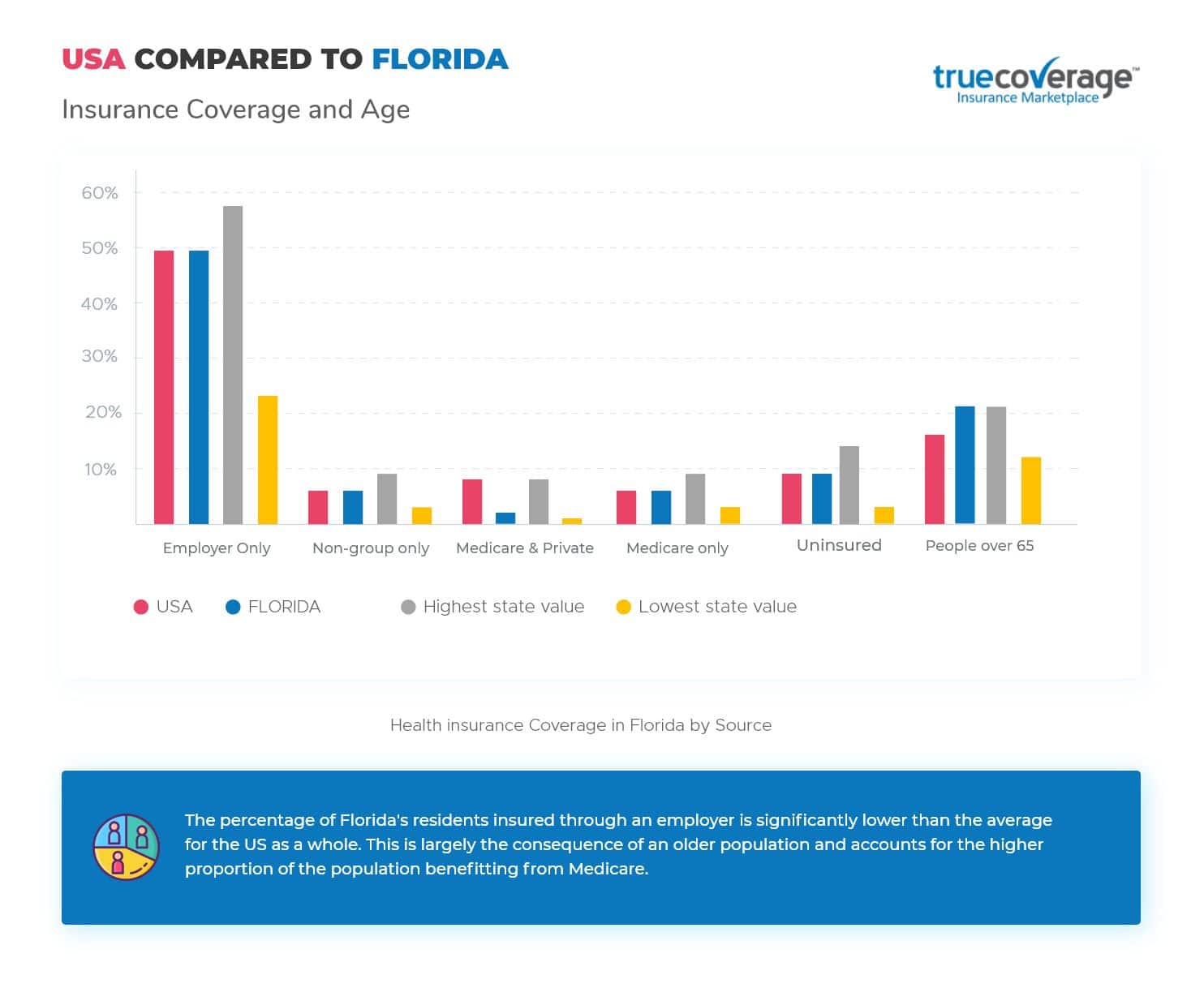

Several factors come into play when determining the affordability of health insurance in Florida. These include the resident’s age, location, and the specific plan chosen. Additionally, the state’s healthcare market is influenced by federal and state regulations, which can impact the pricing and availability of insurance plans.

Age plays a significant role in determining insurance premiums. Generally, younger individuals tend to have lower premiums, while older adults may face higher costs. This age-based pricing structure is a common practice in the insurance industry and is reflected in Florida’s healthcare market.

The cost of living and healthcare facilities in different regions of Florida also impact insurance rates. Urban areas, for instance, may have higher premiums due to the concentration of medical services and higher costs of living. In contrast, rural areas might offer more affordable options, although access to specialized care could be limited.

Exploring Affordable Health Insurance Plans

Florida residents have a variety of affordable health insurance plans to choose from. These plans are designed to provide essential healthcare coverage at a lower cost, making them an attractive option for those on a budget. Here’s a breakdown of some of the most popular and affordable plans available in Florida:

| Plan Type | Description | Average Monthly Premium |

|---|---|---|

| Bronze Plans | These plans have lower premiums but higher deductibles and out-of-pocket costs. They are suitable for healthy individuals who rarely need medical attention. | $250 - $350 |

| Silver Plans | Silver plans offer a balance between premiums and out-of-pocket expenses. They are a popular choice for individuals and families, providing comprehensive coverage at a reasonable cost. | $300 - $450 |

| Catastrophic Plans | Designed for young adults under 30 or those who qualify due to financial hardship, catastrophic plans have low premiums and high deductibles. They provide basic coverage for unexpected emergencies. | $150 - $250 |

| Short-Term Plans | Short-term plans offer temporary coverage and are ideal for those transitioning between jobs or waiting for a more comprehensive plan to take effect. They have low premiums but limited coverage. | $100 - $200 |

Comparing Florida’s Affordable Health Insurance Providers

Florida is home to several reputable insurance providers that offer affordable health insurance plans. These providers compete to offer the best value to residents, ensuring a range of options to choose from. Here’s a comparison of some of the leading providers in Florida:

| Provider | Average Monthly Premium | Plan Variety | Customer Satisfaction |

|---|---|---|---|

| Florida Blue | $320 | Extensive range of plans, including Bronze, Silver, and Gold options. | 4.5/5 |

| UnitedHealthcare | $350 | Offers a selection of Bronze, Silver, and Catastrophic plans. | 4.2/5 |

| Aetna | $300 | Focuses on Bronze and Silver plans, with a strong network of providers. | 4.3/5 |

| Cigna | $370 | Provides a mix of Bronze, Silver, and Gold plans with additional wellness benefits. | 4.4/5 |

Maximizing Affordability: Tips and Strategies

To ensure you secure the most affordable health insurance in Florida, consider these tips and strategies:

- Compare multiple plans and providers to find the best fit for your healthcare needs and budget.

- Review your healthcare requirements and select a plan that aligns with your expected medical needs.

- Consider the out-of-pocket costs, deductibles, and copayments when evaluating the overall affordability of a plan.

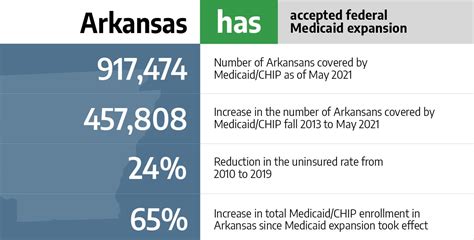

- Explore government-subsidized programs like Medicaid or the Health Insurance Marketplace for additional support.

- Stay informed about any changes to healthcare policies and regulations that could impact your insurance coverage and costs.

Conclusion: Florida’s Affordable Health Insurance Landscape

Florida’s healthcare market offers a diverse range of affordable health insurance options, catering to the unique needs of its residents. By understanding the factors that influence affordability and exploring the various plans and providers available, individuals and families can make informed decisions to secure comprehensive and cost-effective healthcare coverage.

Staying proactive and informed is key to navigating the complex world of health insurance. With the right plan, Florida residents can access the care they need without breaking the bank.

FAQ

Can I get health insurance if I have a pre-existing condition in Florida?

+

Yes, thanks to the Affordable Care Act, insurance providers cannot deny coverage based on pre-existing conditions. However, the cost of your plan may vary depending on the condition and its severity.

Are there any discounts or subsidies available for health insurance in Florida?

+

Absolutely! Florida residents with low to moderate incomes may qualify for subsidies through the Health Insurance Marketplace. These subsidies can significantly reduce monthly premiums.

What is the difference between a Bronze and Silver health insurance plan in terms of affordability and coverage?

+

Bronze plans typically have lower premiums but higher deductibles and out-of-pocket costs. Silver plans offer a balance, providing more comprehensive coverage at a slightly higher premium. The choice depends on your expected healthcare needs and budget.