Insurance Car Aaa

In today's world, having reliable car insurance is essential for every vehicle owner. With countless insurance providers in the market, it can be a daunting task to choose the right one that offers comprehensive coverage at an affordable price. One name that often comes up in discussions about car insurance is AAA. But what sets AAA insurance apart, and is it the right choice for your automotive needs? In this comprehensive guide, we will delve into the world of AAA car insurance, exploring its features, benefits, and everything you need to know to make an informed decision.

Understanding AAA Car Insurance

AAA, or the American Automobile Association, is a well-established organization that has been providing a range of services to its members for over a century. While AAA is perhaps best known for its roadside assistance programs, the organization also offers a comprehensive suite of insurance products, including car insurance. AAA’s insurance services are designed to cater to the unique needs of drivers, offering personalized coverage options and a wide range of benefits.

AAA car insurance is available to members and non-members alike, although members do enjoy certain perks and discounts. The company's insurance policies are underwritten by reputable insurance carriers, ensuring financial stability and reliable coverage. With a strong focus on customer service and a commitment to providing value, AAA has become a trusted name in the insurance industry.

Key Features of AAA Car Insurance

AAA car insurance offers a comprehensive set of features and benefits that set it apart from many other insurance providers. Here are some of the key aspects that make AAA insurance a compelling choice:

- Customizable Coverage Options: AAA understands that every driver has unique needs. Their insurance policies offer a high degree of customization, allowing you to tailor your coverage to your specific requirements. Whether you need basic liability coverage or extensive protection for your vehicle, AAA provides flexible options to meet your needs.

- Comprehensive Roadside Assistance: As a leading provider of roadside assistance, AAA integrates this crucial service into its insurance offerings. With AAA insurance, you gain access to a network of professional roadside assistance providers, ensuring prompt help in case of emergencies such as flat tires, dead batteries, or even towing services.

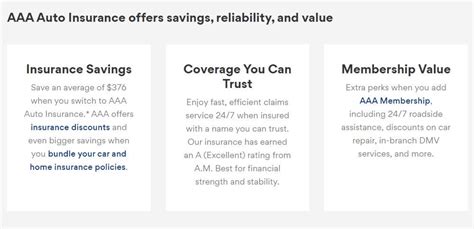

- Discounts and Rewards: AAA is renowned for its commitment to providing value to its members and customers. The company offers a range of discounts and rewards programs, allowing you to save on your insurance premiums. These discounts may include multi-policy discounts, safe driver incentives, and loyalty rewards, making AAA insurance even more affordable.

- Digital Convenience: In today's digital age, AAA recognizes the importance of convenient and accessible services. Their insurance platform offers a user-friendly online experience, allowing you to manage your policy, file claims, and access important documents anytime, anywhere. Additionally, AAA provides mobile apps for easy policy management on the go.

- Claims Handling and Customer Support: AAA takes pride in its exceptional customer service. The company's claims handling process is designed to be efficient and hassle-free, ensuring prompt resolution of claims. With a dedicated team of professionals, AAA provides personalized support and guidance throughout the claims process, making it a seamless experience.

| Coverage Options | AAA Car Insurance |

|---|---|

| Liability Coverage | Covers bodily injury and property damage caused by the insured. |

| Collision Coverage | Protects against damage to the insured vehicle in an accident. |

| Comprehensive Coverage | Covers non-collision incidents like theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides protection in case of an accident with an uninsured or underinsured driver. |

| Roadside Assistance | Includes emergency services like towing, battery jumps, and flat tire changes. |

AAA Car Insurance: The Benefits

Choosing AAA car insurance comes with a multitude of benefits that enhance your overall driving experience and provide peace of mind. Here are some of the key advantages you can expect when opting for AAA insurance:

Comprehensive Coverage Options

AAA offers a wide range of coverage options to ensure that your vehicle and personal assets are adequately protected. From liability coverage to comprehensive and collision insurance, AAA provides the necessary safeguards against financial liabilities arising from accidents or other incidents. Whether you’re involved in a minor fender bender or a more severe collision, AAA’s coverage options have you covered.

Exceptional Customer Service

AAA is renowned for its exceptional customer service, and this extends to its insurance offerings. The company’s dedicated customer support team is available 24⁄7 to assist you with any queries or concerns you may have. Whether you need help understanding your policy, filing a claim, or simply seeking advice, AAA’s knowledgeable and friendly staff are always ready to provide personalized assistance.

Roadside Assistance Integration

As mentioned earlier, AAA’s expertise in roadside assistance is seamlessly integrated into its insurance services. With AAA insurance, you gain access to a vast network of trusted roadside providers, ensuring prompt assistance whenever you need it. Whether you’re stranded on the side of the road or require a simple battery jump, AAA’s roadside assistance program is there to ensure your safety and get you back on the road quickly.

Discounts and Rewards Programs

AAA understands the importance of rewarding its members and customers. The company offers a variety of discounts and rewards programs that can significantly reduce your insurance premiums. These discounts may include multi-policy discounts if you bundle your car insurance with other AAA services, safe driver incentives for maintaining a clean driving record, and loyalty rewards for long-term members. By taking advantage of these programs, you can make your AAA insurance policy even more affordable.

Digital Convenience and Accessibility

In today’s fast-paced world, convenience and accessibility are essential. AAA recognizes this and has invested in a user-friendly digital platform that allows you to manage your insurance policy with ease. You can access your policy information, make payments, file claims, and even download important documents directly from your computer or mobile device. Additionally, AAA’s mobile app provides on-the-go convenience, allowing you to stay connected and manage your insurance wherever you are.

Performance Analysis and Comparison

To further understand the value of AAA car insurance, let’s delve into a detailed performance analysis and compare it with other leading insurance providers. This section will provide you with an in-depth look at AAA’s offerings, helping you make an informed decision.

Financial Stability and Reputation

When choosing an insurance provider, financial stability and a solid reputation are crucial factors to consider. AAA has a long-standing history of financial strength and reliability. The organization’s insurance policies are underwritten by reputable carriers, ensuring that policyholders have access to the necessary financial resources in case of claims. Additionally, AAA’s commitment to customer satisfaction and its positive reputation in the industry further reinforce its reliability.

Claims Handling Efficiency

Efficient claims handling is a key aspect of any insurance provider. AAA has invested in a streamlined claims process to ensure prompt and fair resolution of claims. With a dedicated claims team and a focus on customer service, AAA aims to make the claims experience as hassle-free as possible. The company’s digital platform also facilitates the claims process, allowing policyholders to file claims online and track their progress in real-time.

Competitive Pricing and Discounts

AAA understands that affordability is a significant concern for many drivers. The company offers competitive pricing for its insurance policies, ensuring that its coverage options are accessible to a wide range of customers. Additionally, AAA’s extensive discounts and rewards programs further enhance the affordability of its insurance offerings. By taking advantage of these incentives, you can potentially save a significant amount on your insurance premiums.

Customer Satisfaction and Reviews

Customer satisfaction is a strong indicator of an insurance provider’s overall performance. AAA consistently receives positive reviews and high customer satisfaction ratings. Many customers praise AAA’s excellent customer service, efficient claims handling, and the comprehensive nature of its insurance policies. Real-life testimonials highlight AAA’s commitment to providing a seamless and satisfying insurance experience.

Future Implications and Industry Insights

As the insurance industry continues to evolve, AAA remains at the forefront of innovation and customer-centric solutions. Here are some future implications and industry insights that showcase AAA’s ongoing commitment to excellence:

Digital Transformation

AAA recognizes the importance of embracing digital technologies to enhance the customer experience. The company is continuously investing in its digital platform, introducing new features and improvements to provide a seamless and intuitive user experience. From online policy management to digital claim filing, AAA is dedicated to making insurance services more accessible and convenient for its members and customers.

Telematics and Usage-Based Insurance

With the advancement of telematics technology, AAA is exploring the potential of usage-based insurance (UBI) programs. UBI offers customized insurance rates based on an individual’s driving behavior and habits. AAA is committed to leveraging this technology to provide fair and personalized insurance rates, encouraging safe driving practices and rewarding responsible drivers.

Expanded Product Offerings

AAA is committed to meeting the diverse needs of its members and customers. As such, the organization is continuously expanding its product offerings beyond car insurance. AAA now provides a comprehensive range of insurance products, including home, life, and travel insurance. This diversification allows AAA to become a one-stop shop for all insurance needs, providing convenience and value to its customers.

Partnerships and Collaborations

AAA understands the value of strategic partnerships and collaborations in the insurance industry. The organization actively seeks partnerships with reputable companies and organizations to enhance its services and provide additional benefits to its members. By collaborating with industry leaders, AAA can offer exclusive discounts, rewards, and access to a wider range of services, further enhancing the value proposition for its customers.

Is AAA car insurance only available to AAA members?

+AAA car insurance is available to both members and non-members. However, members enjoy additional perks and discounts, making it more advantageous to become a member. By joining AAA, you gain access to a wide range of services and benefits beyond car insurance, including roadside assistance, travel planning, and exclusive discounts.

What are the average AAA car insurance rates?

+AAA car insurance rates can vary depending on several factors, including your location, driving history, and the coverage options you choose. On average, AAA insurance rates are competitive and offer excellent value for money. To get an accurate quote, it's recommended to obtain a personalized estimate based on your specific circumstances.

How can I get a quote for AAA car insurance?

+Obtaining a quote for AAA car insurance is straightforward. You can visit the AAA website and use their online quoting tool to receive an estimate based on your specific needs. Alternatively, you can contact AAA directly or visit your local AAA branch to speak with a representative who can guide you through the quoting process and answer any questions you may have.

Does AAA offer any additional benefits or perks with its car insurance policies?

+Yes, AAA car insurance policies come with a range of additional benefits and perks. These may include roadside assistance, rental car discounts, accident forgiveness programs, and loyalty rewards. AAA also offers specialized coverage options such as gap insurance and custom parts coverage, ensuring you have the protection you need for your unique driving situation.

How does AAA's claims process work, and what can I expect if I need to file a claim?

+AAA's claims process is designed to be efficient and customer-centric. If you need to file a claim, you can do so online, over the phone, or by visiting your local AAA branch. AAA's dedicated claims team will guide you through the process, providing prompt and personalized assistance. You can expect a thorough investigation of your claim and a fair resolution, ensuring your satisfaction.

In conclusion, AAA car insurance offers a compelling combination of comprehensive coverage, exceptional customer service, and valuable perks. With its customizable policies, integrated roadside assistance, and a focus on digital convenience, AAA provides a seamless insurance experience. Whether you’re a new driver or a seasoned motorist, AAA’s insurance services are designed to meet your unique needs and provide peace of mind on the road. Consider exploring AAA’s insurance offerings to discover the benefits and value they bring to your automotive journey.