Life Policy Insurance

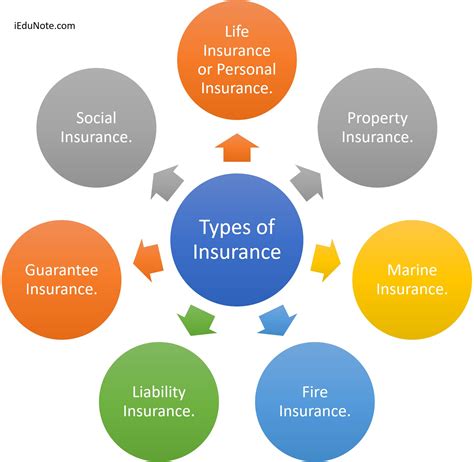

Life Policy Insurance, also known as life insurance, is a crucial financial tool that offers protection and peace of mind to individuals and their loved ones. It is a contract between an insurance policyholder and an insurance company, where the policyholder pays premiums in exchange for a financial benefit to their beneficiaries in the event of their death. This type of insurance has a rich history and has evolved significantly over time to cater to diverse needs and circumstances.

The concept of life insurance dates back centuries, with early forms of protection appearing in various civilizations. However, it was in the 17th century that modern life insurance began to take shape, with the establishment of the first life insurance companies in England. Since then, the industry has grown exponentially, offering a wide range of policies and benefits tailored to individual needs.

Understanding Life Policy Insurance

Life Policy Insurance is designed to provide financial security and stability to the policyholder’s beneficiaries, typically their family members or dependents. The primary purpose is to ensure that, in the event of the policyholder’s untimely death, their loved ones are not left with financial burdens or uncertainties. The insurance company pays out a sum of money, known as the death benefit, to the designated beneficiaries, which can be used to cover various expenses, including funeral costs, outstanding debts, daily living expenses, or even long-term financial goals such as education funds.

There are several key components to understanding life insurance:

- Policyholder: The individual who purchases the life insurance policy and pays the premiums.

- Beneficiaries: The individuals or entities designated by the policyholder to receive the death benefit upon their passing.

- Premiums: Regular payments made by the policyholder to the insurance company to keep the policy active.

- Death Benefit: The sum of money paid out by the insurance company to the beneficiaries upon the policyholder's death.

- Coverage Amount: The chosen amount of financial protection, which can vary based on the policyholder's needs and preferences.

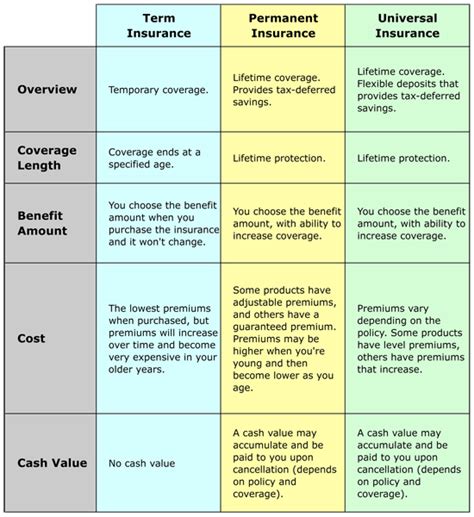

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, often ranging from 10 to 30 years. It offers a straightforward and affordable way to protect your loved ones during key life stages, such as raising a family or paying off a mortgage. The policy pays out a death benefit only if the policyholder dies during the term of the policy. If the policyholder outlives the term, the coverage expires, and no payout is made. Term life insurance is ideal for individuals seeking temporary coverage to cover specific financial obligations.

| Pros of Term Life Insurance | Cons of Term Life Insurance |

|---|---|

| Affordable premiums | Coverage expires after the term |

| Flexible coverage periods | May need to renew or convert to permanent life insurance |

| Caters to specific financial needs | Limited coverage if needs change |

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage. It offers a more comprehensive approach to financial protection, combining insurance coverage with an investment component. There are several types of permanent life insurance, including whole life, universal life, and variable life insurance. These policies typically have higher premiums compared to term life insurance, but they offer the advantage of building cash value over time, which can be borrowed against or withdrawn in certain circumstances.

| Pros of Permanent Life Insurance | Cons of Permanent Life Insurance |

|---|---|

| Lifetime coverage | Higher premiums compared to term life |

| Builds cash value | May require more complex financial planning |

| Flexible investment options | Slower cash value growth in early years |

The Importance of Life Policy Insurance

Life insurance plays a vital role in financial planning and risk management. It provides a safety net for individuals and their families, ensuring that their financial goals and obligations are met, even in the face of unforeseen circumstances. Here are some key reasons why life insurance is important:

- Financial Security: Life insurance provides a lump-sum payment to beneficiaries, helping them cover immediate and long-term expenses, such as funeral costs, outstanding debts, and daily living expenses.

- Estate Planning: It allows individuals to leave a legacy and ensure their loved ones are provided for, even after their passing. Life insurance proceeds can be used to pay estate taxes, settle debts, and fund trust funds.

- Business Continuity: For business owners, life insurance can provide funds to buy out a deceased partner's share, ensuring the business can continue without disruption.

- Peace of Mind: Knowing that your loved ones are financially protected can bring immense peace of mind, allowing you to focus on living life to the fullest.

- Retirement Planning: Some permanent life insurance policies, like whole life insurance, can be used as a tax-efficient retirement savings vehicle, offering tax-deferred growth and tax-free withdrawals.

Key Considerations for Choosing Life Insurance

When selecting a life insurance policy, it’s essential to consider several factors to ensure you choose the right coverage for your needs:

- Coverage Amount: Determine the amount of financial protection you need based on your current and future financial obligations. Consider factors like outstanding debts, funeral costs, and the income needed to support your family's lifestyle.

- Term or Permanent: Decide whether you need temporary coverage (term life) or lifelong protection (permanent life). Consider your financial goals and the duration of your financial obligations.

- Policy Features: Review the policy's features, such as riders (additional benefits) and the potential for cash value accumulation.

- Cost: Compare premiums and consider your budget. Remember that life insurance is a long-term commitment, so ensure you can afford the premiums over the policy's duration.

- Reputation of the Insurer: Choose a reputable and financially stable insurance company to ensure your policy is secure and will be honored.

The Future of Life Policy Insurance

The life insurance industry is continuously evolving to meet the changing needs of policyholders. With advancements in technology and a growing focus on personalization, we can expect to see several key trends shaping the future of life insurance:

Digitalization and Convenience

The digital transformation of the insurance industry is already well underway. Insurers are embracing digital tools and platforms to enhance the customer experience, making it easier and more convenient for policyholders to manage their policies. From online applications and policy management to digital claim submissions, the industry is moving towards a more streamlined and efficient process.

Personalized Policies

With the availability of vast amounts of data, insurers are now able to offer more personalized policies. By analyzing an individual’s health, lifestyle, and financial situation, insurers can tailor policies to meet specific needs. This level of personalization ensures that policyholders receive coverage that is truly relevant to their circumstances.

Wellness and Health-Focused Policies

The growing emphasis on wellness and healthy lifestyles is influencing the life insurance industry. Insurers are incentivizing policyholders to adopt healthier habits by offering discounts or rewards for activities like regular exercise, healthy eating, and participation in wellness programs. These initiatives not only benefit policyholders but also contribute to a healthier society.

Innovative Products

The life insurance industry is constantly innovating to meet the diverse needs of policyholders. We can expect to see the development of new products that offer greater flexibility and customization. For example, some insurers are introducing policies with adjustable coverage amounts, allowing policyholders to increase or decrease their coverage based on changing financial needs.

Environmental and Social Impact

With the increasing focus on sustainability and social responsibility, some insurers are incorporating environmental and social impact considerations into their policies. This includes offering discounts for eco-friendly lifestyles or supporting initiatives that promote social good. By aligning with these values, insurers can appeal to a broader range of consumers.

The Role of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to play a significant role in the future of life insurance. These technologies can analyze vast amounts of data to identify trends and patterns, helping insurers make more accurate predictions and offering more precise underwriting. Additionally, AI-powered chatbots and virtual assistants can provide instant support and guidance to policyholders, further enhancing the customer experience.

What is the average cost of life insurance per month?

+The cost of life insurance can vary widely based on factors such as age, health, lifestyle, and the type of policy. On average, a 30-year-old in good health can expect to pay around 20-30 per month for a $500,000 term life insurance policy. However, this is just an estimate, and the actual cost can be significantly higher or lower depending on individual circumstances.

Can I change my beneficiaries after purchasing a life insurance policy?

+Yes, you can typically change your beneficiaries at any time. It’s a good idea to review and update your beneficiaries periodically, especially after significant life events like marriage, divorce, or the birth of a child. Most insurers provide a simple form to make these changes.

Is life insurance tax-deductible?

+In most cases, the premiums paid for life insurance are not tax-deductible. However, the death benefit received by beneficiaries is generally tax-free. It’s important to consult with a tax professional to understand the specific tax implications in your situation.