Insurance Premium Definition

In the world of finance and risk management, insurance plays a pivotal role in safeguarding individuals, businesses, and assets against unforeseen events. At the heart of this intricate system lies the concept of insurance premiums, which serve as the financial cornerstone upon which the entire insurance industry is built. Understanding insurance premiums is essential for anyone seeking to navigate the complex landscape of risk protection and financial planning.

The Essence of Insurance Premiums

Insurance premiums can be defined as the monetary amount paid by policyholders to insurance companies in exchange for coverage against specific risks. These risks can range from health issues and property damage to liability claims and business interruptions. The premium is essentially the price an individual or entity pays to transfer the financial burden of potential losses to an insurance provider.

The concept of insurance premiums is rooted in the fundamental principle of risk sharing. By pooling resources from a large number of policyholders, insurance companies can provide coverage for a diverse range of risks. The premium collected from each policyholder is then used to compensate those who suffer losses or require medical treatment. This system ensures that the financial burden of an unforeseen event is shared by a larger community, making it more manageable for the affected individuals.

Factors Influencing Insurance Premiums

The calculation of insurance premiums is a meticulous process that takes into account various factors. These factors are designed to assess the level of risk associated with the insured individual or entity and, consequently, determine the appropriate premium.

Risk Assessment

Risk assessment is a critical component in determining insurance premiums. Insurance companies employ sophisticated actuarial science techniques to evaluate the likelihood of various risks occurring. This assessment considers factors such as the policyholder’s age, health status, occupation, and location. For instance, a young, healthy individual is likely to pay a lower premium for health insurance compared to an older person with pre-existing medical conditions.

Similarly, the risk of property damage varies depending on factors like the location of the property and the level of security measures in place. A home in an area prone to natural disasters or with inadequate security systems may attract a higher premium.

Coverage and Limits

The extent of coverage and the limits set by the insurance policy also influence the premium. Policies with broader coverage and higher limits generally command a higher premium. This is because the insurance company assumes a greater financial responsibility in the event of a claim. For example, a car insurance policy with comprehensive coverage and high liability limits will likely cost more than a basic policy with limited coverage.

Historical Claims Data

Insurance companies maintain extensive records of historical claims data. This data provides valuable insights into the frequency and severity of claims within specific risk categories. By analyzing past claims, insurance providers can identify patterns and trends, which in turn help them accurately price premiums. For instance, if a particular area has a high rate of car accidents, insurance premiums for auto policies in that region may be higher.

Competition and Market Factors

The insurance market is highly competitive, and market factors play a significant role in premium determination. Insurance companies must balance the need to remain competitive with the requirement to adequately cover the risks they insure. This delicate balance often results in premium variations across different providers for similar policies.

Types of Insurance Premiums

Insurance premiums can be categorized into several types, each serving a specific purpose and catering to different risk management needs.

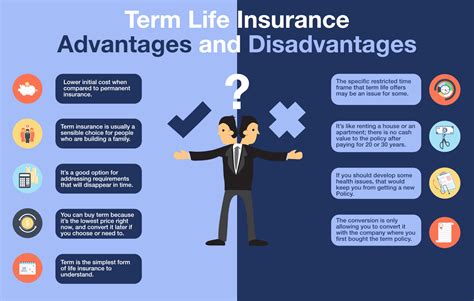

Level Premium

A level premium policy is one where the premium remains constant throughout the duration of the policy. This type of premium is particularly attractive to policyholders as it provides predictability and stability in their financial planning. Level premiums are commonly associated with life insurance policies, where the premium is set based on the policyholder’s age and health at the time of purchase.

Stepped Premium

In contrast to level premiums, stepped premiums increase over time. This type of premium is often seen in health insurance policies, where the premium rises as the policyholder ages. The rationale behind stepped premiums is that the risk of health issues generally increases with age, so the premium must be adjusted accordingly to maintain adequate coverage.

Experience-Rated Premium

Experience-rated premiums are based on the specific experience of the policyholder. This type of premium is commonly used in commercial insurance policies, where the premium is adjusted based on the insured entity’s claims history. If the entity has a low claims record, the premium may decrease, whereas a high claims record may lead to an increase in the premium.

Community-Rated Premium

Community-rated premiums are calculated based on the risk profile of a specific community or group. This approach is often used in group health insurance plans, where the premium is determined by the overall risk of the group rather than the individual risk of each member. Community-rated premiums aim to distribute the financial burden more evenly among the group members.

The Role of Insurance Premiums in Risk Management

Insurance premiums are not merely financial transactions; they are integral to effective risk management strategies. By paying premiums, policyholders transfer the financial risk associated with potential losses to insurance companies. This transfer of risk provides individuals and businesses with peace of mind, knowing that they are financially protected against unforeseen events.

Furthermore, insurance premiums play a crucial role in encouraging risk prevention and mitigation. Policyholders have an incentive to take measures to reduce their risk exposure, as this can lead to lower premiums. For example, homeowners may invest in home security systems or fire prevention measures to lower their home insurance premiums.

Conclusion: The Complex Dynamics of Insurance Premiums

Insurance premiums are a multifaceted aspect of the insurance industry, influenced by a myriad of factors. From risk assessment and coverage limits to historical data and market competition, the calculation of premiums is a delicate balance of actuarial science and financial strategy. Understanding the dynamics of insurance premiums is essential for policyholders to make informed decisions about their risk management needs and financial planning.

How often do insurance premiums change?

+Insurance premiums can change annually or even more frequently, depending on various factors such as changes in risk assessment, claims experience, and market competition. Policyholders should review their policies regularly to stay informed about any premium adjustments.

Can I negotiate insurance premiums?

+While insurance premiums are primarily determined by actuarial calculations, policyholders may have some negotiating power, especially with commercial insurance policies. Factors such as a good claims history or implementing risk mitigation measures can sometimes lead to lower premiums.

What happens if I can’t afford the insurance premium?

+If you find yourself in a situation where you cannot afford the insurance premium, it’s important to reach out to your insurance provider. They may offer payment plans or provide information about government assistance programs that can help make insurance more accessible.