Business Services Insurance

Business Services Insurance: Protecting Your Enterprise’s Vital Operations

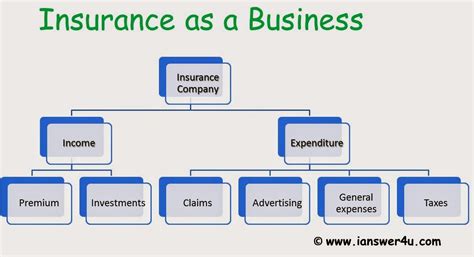

In the dynamic world of commerce, businesses face a myriad of challenges and risks that can impact their operations, finances, and reputation. One of the most crucial steps a business can take to safeguard its interests is investing in comprehensive Business Services Insurance. This specialized insurance coverage acts as a safety net, offering protection and peace of mind to businesses of all sizes and across various industries. In this in-depth exploration, we will delve into the intricacies of Business Services Insurance, examining its importance, coverage options, and how it can fortify your enterprise against unforeseen circumstances.

As businesses navigate an increasingly complex and competitive landscape, the need for robust risk management strategies has never been more critical. Business Services Insurance is not merely a legal requirement but a strategic tool that enables companies to mitigate potential losses, ensure continuity, and maintain a strong financial foundation. In this article, we will provide a comprehensive guide to understanding and leveraging this vital form of insurance coverage.

Understanding the Scope of Business Services Insurance

Business Services Insurance, often referred to as Professional Liability Insurance or Errors and Omissions (E&O) Insurance, is a specialized type of coverage designed to protect businesses that provide professional services or advice. It offers financial protection against claims arising from alleged or actual negligence, errors, or omissions in the services provided by the insured business. This coverage is particularly crucial for professionals such as consultants, accountants, lawyers, architects, and a wide range of other service providers.

The scope of Business Services Insurance is broad and tailored to the specific needs of each industry. It can include coverage for legal defense costs, settlements, and judgments arising from claims of professional malpractice, breach of contract, or negligence. This insurance acts as a vital safety net, ensuring that businesses can continue to operate smoothly even in the face of potential litigation or financial losses due to professional errors.

Key Coverage Components

- Professional Liability: This core component of Business Services Insurance provides coverage for claims arising from the insured’s professional services. It can include errors or omissions that result in financial loss for clients, breach of professional duty, or failure to deliver promised services.

- Legal Defense Costs: In the event of a claim or lawsuit, this coverage pays for the insured’s legal defense expenses, including attorney fees and court costs. This protection is crucial as it ensures that the business can afford the legal representation necessary to defend itself.

- Loss of Documents: Business Services Insurance often includes coverage for the loss, damage, or destruction of important documents, which can be critical for ongoing business operations and client relationships.

- Breach of Confidentiality: Many policies provide coverage for instances where sensitive client information is accidentally disclosed, which can lead to significant legal and financial repercussions.

- Intellectual Property Infringement: In an era where intellectual property rights are highly valued, this coverage protects the insured against claims of copyright infringement, trademark violation, or trade secret misappropriation.

By understanding the scope and coverage options within Business Services Insurance, businesses can tailor their policies to address their unique risks and vulnerabilities. This ensures that they are not only compliant with industry standards but also well-prepared to face the challenges and uncertainties of the modern business environment.

The Importance of Business Services Insurance

In today’s fast-paced and interconnected business world, the need for comprehensive insurance coverage is more crucial than ever. Business Services Insurance plays a pivotal role in safeguarding enterprises against a myriad of risks and potential liabilities. Here are some key reasons why investing in this specialized insurance is essential for any business:

Protecting Your Professional Reputation

One of the most significant assets a business possesses is its reputation. A single mistake or oversight can lead to catastrophic consequences, damaging the trust and confidence clients have in your services. Business Services Insurance provides a vital safety net, ensuring that even if an error occurs, the financial burden and legal repercussions do not destroy your hard-earned reputation.

Consider the case of a renowned accounting firm that accidentally files incorrect tax returns for multiple clients. Without Business Services Insurance, the firm could face a slew of lawsuits, significant financial penalties, and a severe loss of trust from its clients. However, with the right insurance coverage, the firm can mitigate these risks, allowing it to focus on rectifying the errors and rebuilding client relationships.

Mitigating Financial Risks

The financial implications of professional errors or omissions can be devastating for businesses. Legal fees, settlements, and judgments can quickly deplete a company’s resources, leading to financial instability or even bankruptcy. Business Services Insurance acts as a financial buffer, covering these costs and ensuring that the business can continue to operate smoothly without incurring excessive financial burdens.

For instance, a consulting firm that provides strategic advice to startups might inadvertently offer flawed recommendations that lead to significant financial losses for its clients. Without insurance, the firm could face multiple lawsuits, each demanding substantial compensation. However, with Business Services Insurance, the firm can defend itself, negotiate settlements, and potentially avoid devastating financial repercussions.

Ensuring Business Continuity

In the event of a claim or lawsuit, businesses without adequate insurance coverage may find themselves in a precarious position. They may be forced to divert significant resources and attention away from their core operations, disrupting their business continuity and growth plans. Business Services Insurance provides the stability and security needed to navigate such challenges, allowing businesses to maintain their focus on delivering quality services and growing their operations.

Imagine a law firm specializing in intellectual property law that is sued for allegedly mismanaging a high-profile patent case. Without insurance, the firm might have to dedicate an extensive amount of time and resources to the lawsuit, potentially neglecting other cases and clients. With Business Services Insurance, the firm can delegate the legal defense to insurance-provided attorneys, ensuring that the lawsuit does not disrupt the firm's overall operations.

Tailoring Business Services Insurance to Your Needs

Every business is unique, with its own set of risks and vulnerabilities. Therefore, it is crucial to tailor your Business Services Insurance policy to address your specific needs and potential exposures. Here are some key considerations to keep in mind when customizing your insurance coverage:

Assessing Your Business Risks

The first step in tailoring your insurance coverage is to conduct a thorough risk assessment. Identify the potential liabilities and risks associated with your industry, your specific services, and your client base. Consider factors such as the complexity of your services, the level of trust and confidentiality involved, and the potential impact of errors or omissions.

For example, a software development firm might face risks related to coding errors, data breaches, or intellectual property infringement. By understanding these risks, the firm can ensure that its Business Services Insurance policy provides adequate coverage for these specific vulnerabilities.

Choosing the Right Policy Limits

Policy limits refer to the maximum amount of coverage provided by your insurance policy. It is essential to choose limits that align with the potential financial risks your business faces. Consider the average and maximum financial losses your business could incur due to professional errors, and set your policy limits accordingly.

A consulting firm, for instance, might choose higher policy limits if it works with high-value clients or provides services with significant financial implications. This ensures that the firm is adequately protected against potential large-scale claims or lawsuits.

Incorporating Additional Coverages

Business Services Insurance policies often come with standard coverages, but it is essential to review and consider additional coverages that address your specific needs. Some policies may offer optional extensions or endorsements that provide protection for unique risks or industry-specific exposures.

For instance, a marketing agency might opt for coverage that includes intellectual property infringement, as it frequently works with clients' brands and trademarks. Similarly, a medical practice might choose to add coverage for patient confidentiality breaches, given the sensitive nature of their work.

| Coverage Type | Description |

|---|---|

| Professional Liability | Covers claims arising from professional errors, negligence, or omissions. |

| Legal Defense Costs | Pays for legal expenses incurred during the defense of a claim or lawsuit. |

| Loss of Documents | Provides coverage for the loss, damage, or destruction of important business documents. |

| Breach of Confidentiality | Protects against accidental disclosure of sensitive client information. |

| Intellectual Property Infringement | Covers claims arising from copyright, trademark, or trade secret violations. |

Common Misconceptions About Business Services Insurance

Despite its critical importance, Business Services Insurance is often misunderstood or overlooked by businesses. Here, we debunk some common misconceptions to help you make informed decisions about this vital coverage:

Myth: It’s Only Necessary for Large Enterprises

A common misconception is that Business Services Insurance is exclusively relevant to large corporations with complex operations. However, the reality is that businesses of all sizes, from startups to established enterprises, can benefit from this type of insurance.

Even small businesses, such as freelance consultants or boutique law firms, face potential liabilities and risks. A single mistake or omission can have significant financial and legal consequences, making Business Services Insurance an essential tool for risk management, regardless of the size of the business.

Myth: It’s Too Expensive

Another common misconception is that Business Services Insurance is prohibitively expensive, making it an unnecessary expense for cost-conscious businesses. While it is true that insurance premiums can vary based on the level of coverage and the specific risks associated with a business, the cost of insurance is often far outweighed by the potential financial losses that can be avoided.

By investing in Business Services Insurance, businesses can mitigate the risk of catastrophic financial losses, ensuring their long-term viability and stability. Furthermore, many insurance providers offer flexible payment options and customized policies to accommodate the unique needs and budgets of different businesses.

Myth: It’s Not Worth the Hassle

Some businesses may view the process of obtaining and maintaining Business Services Insurance as cumbersome and time-consuming, leading them to believe that it is not worth the effort. However, the reality is that the potential benefits far outweigh the minor inconveniences of acquiring and managing insurance coverage.

Business Services Insurance provides a critical layer of protection, allowing businesses to focus on their core operations and growth strategies without the constant worry of potential liabilities. It offers peace of mind, knowing that even if an error occurs, the financial and legal consequences can be effectively managed.

The Future of Business Services Insurance

As the business landscape continues to evolve, driven by technological advancements, changing consumer preferences, and emerging risks, the role of Business Services Insurance is set to become even more crucial. Here’s a glimpse into the future of this vital insurance coverage:

Adapting to Digital Risks

With the increasing digitization of businesses and the rise of cybersecurity threats, Business Services Insurance will need to evolve to address these emerging risks. This may include coverage for data breaches, cyber attacks, and other digital vulnerabilities that can have severe financial and reputational consequences.

Insurance providers will need to stay abreast of technological advancements and understand the unique risks associated with digital operations. By incorporating cyber insurance and other digital risk management tools into Business Services Insurance policies, businesses can better protect themselves in the digital age.

Embracing Sustainability and Social Responsibility

As sustainability and social responsibility become core aspects of corporate strategy, Business Services Insurance will play a role in supporting and incentivizing these initiatives. Insurance policies may offer incentives or reduced premiums for businesses that adopt sustainable practices or demonstrate a commitment to social responsibility.

For instance, insurance providers might offer discounts to businesses that implement eco-friendly practices or contribute to environmental initiatives. This alignment of insurance with sustainability goals can drive positive change and encourage businesses to adopt more responsible practices.

Personalized Insurance Solutions

The future of Business Services Insurance is likely to be characterized by increasingly personalized solutions. Insurance providers will leverage advanced analytics and data-driven insights to offer tailored coverage options that address the unique risks and vulnerabilities of each business.

By analyzing a business's operations, client base, and industry trends, insurance providers can develop customized policies that provide the right level of coverage at a competitive price. This personalized approach ensures that businesses receive the protection they need without paying for unnecessary coverage.

Frequently Asked Questions (FAQ)

What is the difference between Business Services Insurance and General Liability Insurance?

+Business Services Insurance, also known as Professional Liability Insurance, covers claims arising from professional errors, negligence, or omissions. It is specifically designed for businesses that provide professional services or advice. On the other hand, General Liability Insurance provides broader coverage for bodily injury, property damage, and personal injury claims that may occur in the course of business operations.

How much does Business Services Insurance typically cost?

+The cost of Business Services Insurance can vary significantly depending on factors such as the type of business, the industry, the level of coverage required, and the business’s risk profile. It’s essential to consult with insurance professionals to obtain accurate quotes tailored to your specific needs.

Can Business Services Insurance cover claims arising from employee negligence?

+Yes, Business Services Insurance can provide coverage for claims arising from employee negligence or errors, as long as the employees are acting within the scope of their employment and the business’s services. It’s important to review the policy terms and conditions to understand the specific coverage provided.

What should I do if I receive a claim or lawsuit related to my professional services?

+If you receive a claim or lawsuit related to your professional services, it’s crucial to act promptly and notify your insurance provider as soon as possible. Follow the guidance provided by your insurance company, and consider seeking legal advice to understand your rights and responsibilities.

How often should I review and update my Business Services Insurance policy?

+It’s recommended to review your Business Services Insurance policy annually or whenever there are significant changes to your business operations, client base, or industry. Regular reviews ensure that your coverage remains up-to-date and aligned with your evolving risks and needs.

In conclusion, Business Services Insurance is a vital component of any business’s risk management strategy. By understanding the scope, importance, and customization options of this insurance coverage, businesses can protect their interests, maintain their reputation, and ensure their long-term success and stability. As the business landscape continues to evolve, Business Services Insurance will remain a critical tool for mitigating risks and fostering resilience in the face of uncertainty.