Insurance Florida Car

Insurance is a vital aspect of car ownership, especially in a state like Florida, where a unique set of rules and regulations apply. With a large population and a high volume of traffic, Florida's insurance landscape is complex and dynamic. This article aims to provide an in-depth exploration of car insurance in Florida, offering valuable insights and information to help drivers make informed decisions.

Understanding Florida’s Car Insurance Landscape

Florida stands out among US states with its no-fault insurance system. This means that, in the event of an accident, drivers typically turn to their own insurance provider for compensation, regardless of who is at fault. This system aims to streamline the claims process and reduce legal disputes.

However, Florida's no-fault system has its complexities. For instance, there are certain situations where a driver can file a lawsuit against another driver. These situations often involve severe injuries or property damage, making it crucial for drivers to understand the state's specific insurance laws.

The Basics of Florida Car Insurance Policies

A standard car insurance policy in Florida typically includes the following coverage types:

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and provides financial protection for medical expenses and lost wages up to $10,000. It covers the policyholder, passengers, and, in some cases, relatives.

- Property Damage Liability: Covers damage to other people’s property, such as vehicles or structures, in an accident caused by the policyholder.

- Bodily Injury Liability: Pays for the medical bills and lost wages of those injured in an accident caused by the policyholder.

- Uninsured/Underinsured Motorist Coverage: Provides protection if the at-fault driver has insufficient insurance coverage.

- Collision Coverage: Covers the cost of repairing or replacing the policyholder’s vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, natural disasters, and animal collisions.

While these are the core components of a Florida car insurance policy, drivers can also opt for additional coverages like rental car reimbursement, roadside assistance, and gap insurance, depending on their specific needs and budget.

| Coverage Type | Minimum Requirement (Limits) |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability | $10,000 |

| Bodily Injury Liability | $10,000 per person / $20,000 per accident |

Factors Influencing Car Insurance Rates in Florida

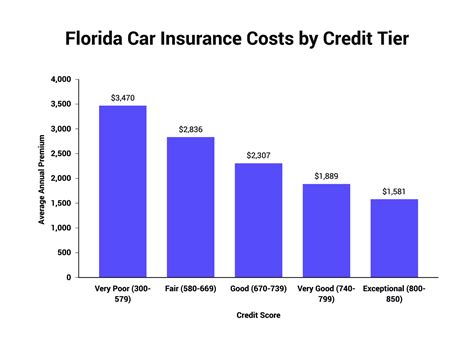

Like any other state, car insurance rates in Florida are influenced by a multitude of factors. These factors help insurance companies assess the risk associated with insuring a particular driver and determine the premium they charge.

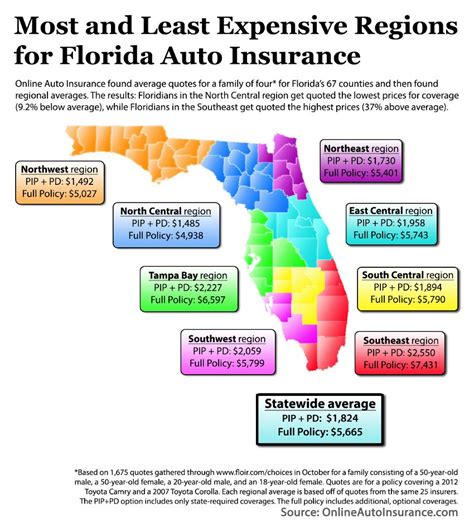

Demographics and Location

The city and region in which a driver resides can significantly impact their insurance rates. Urban areas with higher population densities and traffic volumes tend to have higher rates due to the increased risk of accidents. For instance, drivers in Miami, one of Florida’s largest cities, often pay higher premiums compared to those in smaller towns.

Similarly, demographic factors like age, gender, and marital status play a role. Young drivers, particularly those under 25, are often considered high-risk due to their lack of driving experience and may face higher premiums. Gender and marital status can also affect rates, with some insurers offering discounts for married couples or female drivers.

Driving History and Claims

A driver’s history is a crucial factor in determining insurance rates. A clean driving record, free of accidents and violations, is favorable and can lead to lower premiums. Conversely, a history of accidents or moving violations can result in higher rates or even non-renewal of the policy.

The frequency and severity of claims also impact rates. Multiple claims, especially for high-value repairs or injuries, can significantly increase premiums. Insurance companies use complex algorithms to assess the risk associated with each driver, taking into account the type and frequency of claims.

Vehicle Factors

The type of vehicle a driver operates can influence insurance rates. Generally, more expensive vehicles or those with high-performance engines may face higher premiums due to the cost of repairs and the increased risk of theft or vandalism. Similarly, vehicles with advanced safety features may qualify for discounts, as they are often associated with lower accident rates.

The primary use of the vehicle also matters. Drivers who use their vehicles for business purposes or as part of their occupation may face higher rates, as these activities are considered higher risk. Conversely, drivers who primarily use their vehicles for pleasure or personal travel may benefit from lower rates.

Tips for Finding Affordable Car Insurance in Florida

Given the unique insurance landscape in Florida, finding affordable car insurance can be a challenge. However, there are several strategies drivers can employ to secure the best rates:

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, even for identical coverage. By obtaining multiple quotes, drivers can identify the most competitive rates. Online comparison tools can be especially useful for quickly gathering quotes from various insurers.

Bundle Policies

Many insurance companies offer discounts when a customer bundles multiple policies, such as car insurance with home or renters’ insurance. This not only simplifies insurance management but also often results in substantial savings.

Consider Usage-Based Insurance (UBI)

UBI programs, also known as Pay-As-You-Drive or Mileage-Based Insurance, offer discounts based on how, when, and where a vehicle is driven. These programs use telematics devices or smartphone apps to track driving behavior and reward safe driving habits with lower premiums.

Choose a Higher Deductible

Increasing the deductible on a policy can lead to significant savings on premiums. A deductible is the amount a driver pays out of pocket before their insurance coverage kicks in. While a higher deductible means a driver will pay more in the event of a claim, it can result in substantial savings on monthly premiums.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep insurance rates low. Avoiding accidents and moving violations not only keeps premiums affordable but also ensures eligibility for various discounts and rewards programs offered by insurers.

Future Trends and Innovations in Florida Car Insurance

The car insurance industry in Florida, like the rest of the world, is evolving rapidly. Technological advancements and changing consumer preferences are driving significant innovations. Here are some trends to watch out for:

Telematics and Connected Cars

The integration of telematics and connected car technologies is revolutionizing insurance. These technologies provide real-time data on driving behavior, vehicle performance, and location, allowing insurers to offer more personalized and precise coverage. Drivers who embrace these technologies can benefit from more accurate risk assessments and potentially lower premiums.

Artificial Intelligence and Machine Learning

AI and machine learning are increasingly being used to enhance the accuracy of risk assessments and claims processing. These technologies can analyze vast amounts of data, including driver behavior, vehicle performance, and external factors like weather and road conditions, to predict and prevent accidents. This not only improves safety but also allows insurers to offer more tailored coverage and pricing.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize insurance by creating a secure, transparent, and tamper-proof record of insurance transactions. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, such as policy issuance, claim management, and fraud detection. This can lead to faster, more efficient, and more secure insurance transactions.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is also expected to impact the insurance industry. Electric vehicles (EVs) have different maintenance and repair needs compared to traditional internal combustion engine vehicles, which may affect insurance rates. Autonomous vehicles, while still in their early stages, have the potential to significantly reduce accident rates, leading to lower insurance premiums over time.

Digital Insurance and Customer Experience

The digital transformation of the insurance industry is improving the overall customer experience. Online and mobile insurance platforms are making it easier for customers to manage their policies, file claims, and receive real-time updates. This shift towards digital insurance is not only convenient for customers but also helps insurers reduce operational costs and improve efficiency.

Conclusion

Florida’s car insurance landscape is complex but offers a range of opportunities for drivers to secure affordable and comprehensive coverage. By understanding the state’s unique insurance laws, factors influencing rates, and the latest innovations, drivers can make informed decisions and navigate the insurance market effectively. With the right knowledge and strategies, Florida drivers can find the best insurance options to suit their needs and budgets.

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida can vary significantly based on numerous factors. According to recent data, the average annual premium in Florida is around 2,000, but this can range from as low as 1,200 to over $3,000 depending on the driver’s profile and coverage needs.

Are there any discounts available for car insurance in Florida?

+Yes, there are several discounts available for car insurance in Florida. These include safe driver discounts, good student discounts, multi-policy discounts, and even discounts for specific vehicle safety features. It’s worth shopping around and comparing quotes to identify the best discounts for your specific situation.

How can I lower my car insurance rates in Florida?

+There are several strategies to lower your car insurance rates in Florida. These include maintaining a clean driving record, shopping around for quotes, increasing your deductible, bundling policies, and considering usage-based insurance programs. Additionally, you can review your coverage levels to ensure you’re not paying for more coverage than you need.

What should I do if I’m involved in an accident in Florida?

+If you’re involved in an accident in Florida, the first step is to ensure your safety and the safety of others involved. Then, contact the police to file a report. It’s important to gather as much information as possible at the scene, including the other driver’s details, insurance information, and any witness statements. Finally, notify your insurance company as soon as possible to initiate the claims process.