How Much Is Homeowner Insurance

Homeowner insurance is a vital aspect of protecting one's most significant investment—their home. It provides financial security and peace of mind, covering a range of potential risks and liabilities associated with homeownership. Understanding the factors that influence the cost of homeowner insurance is crucial for making informed decisions and ensuring adequate coverage.

In this comprehensive guide, we will delve into the world of homeowner insurance, exploring the key considerations that impact its cost. From the location and type of your home to the level of coverage and deductibles you choose, we will uncover the intricate details that contribute to the overall price. Additionally, we will examine the role of claims history and insurance providers, offering valuable insights to help you navigate the process effectively.

Factors Influencing Homeowner Insurance Costs

The cost of homeowner insurance is determined by a combination of various factors, each playing a significant role in the overall premium. Let’s explore these factors in detail to gain a deeper understanding of what influences the price tag on this essential protection.

Location and Property Type

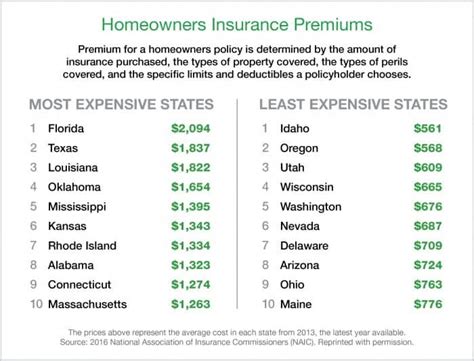

The geographic location of your home is a primary factor in determining the cost of homeowner insurance. Different regions face unique risks, such as natural disasters, crime rates, and weather patterns. For instance, homes in areas prone to hurricanes, tornadoes, or earthquakes may incur higher insurance premiums due to the increased likelihood of damage. Additionally, the type of property you own, whether it’s a single-family home, condominium, or mobile home, can also impact the cost. Each property type has its own set of risks and potential hazards, which insurance providers take into account when calculating premiums.

Consider the case of Sarah, a homeowner in a coastal region prone to hurricanes. Her insurance premiums are likely to be higher compared to John, who resides in an inland area with minimal natural disaster risks. This disparity highlights the significant influence of location on homeowner insurance costs.

Coverage Limits and Deductibles

The level of coverage you choose for your homeowner insurance policy directly affects the premium. Higher coverage limits, which provide more extensive protection, typically result in higher costs. For example, if you opt for a policy that covers the full replacement cost of your home and its contents, you can expect a higher premium compared to a policy with lower coverage limits. Additionally, the deductible, which is the amount you pay out of pocket before the insurance coverage kicks in, also plays a role. A higher deductible often leads to a lower premium, as it reduces the insurer’s financial responsibility.

Imagine a scenario where Mike decides to increase his coverage limits to ensure his expensive art collection is fully protected. As a result, his insurance premium increases to accommodate the higher level of coverage. This illustrates the direct correlation between coverage limits and insurance costs.

Claims History and Credit Score

Your claims history is a crucial factor considered by insurance providers when determining your premium. A history of frequent claims or major incidents can lead to higher insurance costs, as it indicates a higher risk profile. Insurance companies assess the likelihood of future claims based on past experiences, and a pattern of claims may result in increased premiums. Additionally, your credit score can also impact your insurance rates. A higher credit score is often associated with lower insurance costs, as it indicates financial stability and a lower risk of defaulting on payments.

Take the example of Lisa, who has consistently filed claims for minor incidents over the years. As a result, her insurance provider has categorized her as a higher risk, leading to increased premiums. On the other hand, Robert, with a pristine claims history and an excellent credit score, enjoys lower insurance rates due to his favorable risk profile.

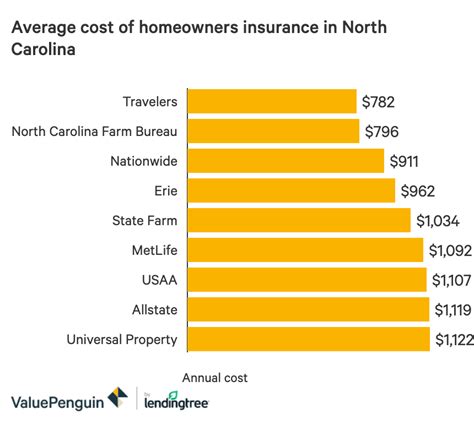

Insurance Provider and Policy Add-Ons

The choice of insurance provider can significantly impact the cost of your homeowner insurance. Different companies offer varying rates and policy options, so it’s essential to compare quotes from multiple providers to find the most competitive prices. Additionally, the policy add-ons and endorsements you select can affect the overall cost. These add-ons provide extra coverage for specific risks, such as flood insurance, earthquake coverage, or jewelry and fine art protection. While these add-ons increase the premium, they offer valuable protection for valuable possessions.

John, for instance, decides to add flood insurance to his policy due to the proximity of his home to a river. This add-on increases his premium, but it provides the necessary protection against the risk of flooding in his area.

Analyzing Real-World Homeowner Insurance Costs

To gain a deeper understanding of homeowner insurance costs, let’s examine some real-world examples and analyze the factors that influence premiums in different scenarios.

Case Study 1: Suburban Family Home

Consider the Jones family, who reside in a suburban neighborhood with a low crime rate and minimal natural disaster risks. Their home is a single-family dwelling with a moderate coverage limit of 300,000 and a deductible of 1,000. Given the low-risk location and standard coverage, their annual homeowner insurance premium is approximately $1,200.

| Factor | Description |

|---|---|

| Location | Suburban neighborhood with low crime and natural disaster risks |

| Property Type | Single-family dwelling |

| Coverage Limit | $300,000 |

| Deductible | $1,000 |

| Annual Premium | $1,200 |

Case Study 2: Coastal Condominium

Now, let’s examine the scenario of the Smith family, who own a condominium in a coastal area prone to hurricanes. Their coverage limit is set at 250,000, and they have chosen a higher deductible of 2,000 to reduce their premium. Given the higher risk of natural disasters and the property type, their annual homeowner insurance premium amounts to $2,500.

| Factor | Description |

|---|---|

| Location | Coastal area prone to hurricanes |

| Property Type | Condominium |

| Coverage Limit | $250,000 |

| Deductible | $2,000 |

| Annual Premium | $2,500 |

Case Study 3: Rural Farm Property

For our final case study, let’s explore the situation of the Green family, who own a rural farm property with a unique set of risks. Their coverage limit is set at 500,000 to accommodate the value of their home and extensive farmland. With a low-crime rural location and a higher deductible of 3,000, their annual homeowner insurance premium is approximately $1,800.

| Factor | Description |

|---|---|

| Location | Rural area with low crime |

| Property Type | Farm property |

| Coverage Limit | $500,000 |

| Deductible | $3,000 |

| Annual Premium | $1,800 |

Tips for Managing Homeowner Insurance Costs

While the cost of homeowner insurance is influenced by various factors beyond your control, there are strategies you can employ to manage and potentially reduce your premiums. Here are some valuable tips to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the most competitive rates. Each provider has its own underwriting guidelines and pricing structures, so shopping around can reveal significant differences in premiums.

- Increase Deductibles: Opting for a higher deductible can lead to lower insurance premiums. By assuming a larger portion of the financial responsibility in the event of a claim, you can reduce the cost of your insurance.

- Bundle Policies: Consider bundling your homeowner insurance with other policies, such as auto insurance or life insurance. Many providers offer discounts when you combine multiple policies, resulting in cost savings.

- Maintain a Good Credit Score: A strong credit score can positively impact your insurance rates. Insurance companies often consider credit scores as an indicator of financial stability and responsibility, so maintaining a good credit history can lead to lower premiums.

- Review Coverage Regularly: Periodically review your homeowner insurance policy to ensure it aligns with your current needs and circumstances. As your home and possessions change in value, your coverage limits may need adjustment. Regular reviews can help you avoid overpaying or being underinsured.

The Future of Homeowner Insurance: Emerging Trends and Technologies

The world of homeowner insurance is continually evolving, and emerging trends and technologies are shaping the industry. Let’s explore some of the developments that are likely to impact the cost and coverage of homeowner insurance in the future.

Use of Data Analytics

Insurance companies are increasingly leveraging data analytics and advanced technologies to assess risks and determine premiums. By analyzing vast amounts of data, including historical claims data, weather patterns, and geographic information, insurers can more accurately predict potential risks and price policies accordingly. This data-driven approach can lead to more precise pricing and potentially lower premiums for homeowners.

Adoption of Smart Home Technologies

The integration of smart home technologies is gaining traction in the insurance industry. Insurers are recognizing the potential of these technologies to reduce risks and mitigate losses. Smart home devices, such as security systems, smoke detectors, and water leak sensors, can help prevent accidents and detect issues early on. As more homeowners adopt smart home technologies, insurers may offer discounts or reduced premiums to incentivize their use.

Rise of Telematics and Usage-Based Insurance

Telematics, the use of technology to monitor and analyze data, is gaining popularity in the insurance industry. Usage-based insurance, also known as pay-as-you-go insurance, allows insurers to assess risk based on real-time data rather than historical information. For homeowner insurance, this could mean tracking factors such as home occupancy, energy usage, or even behavioral patterns to determine premiums. This approach offers a more personalized and dynamic pricing model, potentially benefiting homeowners who demonstrate responsible behaviors.

Impact of Climate Change and Natural Disasters

Climate change is a pressing concern that affects the insurance industry, including homeowner insurance. As extreme weather events become more frequent and severe, insurers are adapting their risk assessment models to account for these changing patterns. This may result in increased premiums for homeowners in high-risk areas or the development of specialized insurance products to address specific climate-related risks.

Evolution of Policy Terms and Conditions

The terms and conditions of homeowner insurance policies are continually evolving to reflect changing risks and industry standards. Insurance providers may introduce new coverage options or adjust existing policies to address emerging risks, such as cyber attacks or liability issues related to home-sharing platforms. Staying informed about policy updates and understanding the implications for your coverage is essential to ensure adequate protection.

Frequently Asked Questions

How often should I review my homeowner insurance policy?

+It is recommended to review your homeowner insurance policy annually or whenever there are significant changes to your home, possessions, or personal circumstances. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

Can I negotiate my homeowner insurance premium?

+While insurance premiums are largely determined by risk assessment, you can negotiate certain aspects of your policy. Discuss your options with your insurance provider and explore ways to reduce your premium, such as increasing deductibles or combining policies.

What factors can lead to an increase in my homeowner insurance premium?

+Several factors can contribute to an increase in your homeowner insurance premium. These include a history of frequent claims, changes in your home’s value or location, increases in local crime rates, or changes in insurance regulations.

Are there any discounts available for homeowner insurance?

+Yes, many insurance providers offer discounts for homeowner insurance. Common discounts include multi-policy discounts (bundling home and auto insurance), safety device discounts (for smoke detectors or security systems), loyalty discounts, and discounts for certain occupations or affiliations.

How can I improve my chances of getting a lower homeowner insurance premium?

+To improve your chances of obtaining a lower homeowner insurance premium, consider factors such as increasing your deductible, maintaining a good credit score, installing safety devices, and regularly reviewing your coverage to ensure you are not overinsured or underinsured.

Understanding the factors that influence homeowner insurance costs is essential for making informed decisions about your coverage. By considering location, property type, coverage limits, deductibles, claims history, and insurance provider choices, you can navigate the process effectively and secure the best possible protection for your home and possessions.