Are Joint Accounts Fdicinsured To $500 000

The Federal Deposit Insurance Corporation (FDIC) is a U.S. government corporation that provides deposit insurance to protect bank and savings association customers. The FDIC insurance covers both single accounts and certain types of joint accounts, ensuring that depositors' funds are secure even if their financial institution fails.

Yes, both right of survivorship and non-right of survivorship joint accounts are FDIC-insured up to 500,000 per owner. However, the combined insurance coverage may vary depending on the specific ownership structure and the number of account holders.">Are all types of joint accounts FDIC-insured up to 500,000 per owner? +

If a joint account balance exceeds 500,000 per owner, the excess amount may not be FDIC-insured. It’s important to regularly monitor account balances and consider distributing funds across multiple accounts to maintain full insurance coverage.">What happens if a joint account balance exceeds 500,000 per owner? +

When it comes to joint accounts, the FDIC insurance coverage extends to $500,000, offering peace of mind to individuals who choose to share their finances with a trusted partner, family member, or friend.

Understanding FDIC Insurance for Joint Accounts

Joint accounts are a popular choice for couples, business partners, or family members who wish to manage their finances together. These accounts allow multiple individuals to have access and control over the funds, making it convenient for shared expenses, savings goals, or investment strategies.

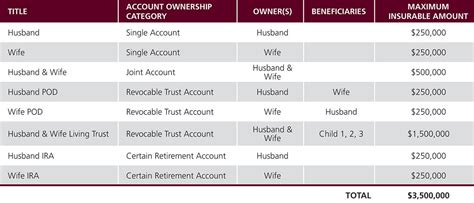

The FDIC insurance coverage for joint accounts is based on the ownership and relationship between the account holders. The key principle is that each account owner is entitled to a separate insurance coverage, up to the maximum limit of $500,000.

How FDIC Insurance Works for Joint Accounts

To understand the FDIC insurance coverage for joint accounts, it's essential to consider the different types of ownership and the insurance limits associated with each.

- Right of Survivorship Joint Accounts: In this type of joint account, both account holders have equal access and control over the funds. Upon the death of one account holder, the surviving account holder becomes the sole owner of the account and its contents. FDIC insurance covers each account holder up to $500,000, meaning that a joint account with two account holders would have a combined insurance coverage of $1,000,000.

- Non-Right of Survivorship Joint Accounts: This type of joint account is similar to a right of survivorship account, but with one crucial difference. If one account holder passes away, the funds are distributed according to the deceased holder's will or the state's intestacy laws. Each account holder is still insured up to $500,000, but the combined insurance coverage may be less than $1,000,000 depending on the specific arrangement and ownership structure.

It's important to note that the FDIC insurance coverage for joint accounts applies to the ownership structure and not necessarily to the number of account holders. For example, a joint account with three account holders, each with equal ownership, would still have a maximum insurance coverage of $500,000 per owner, totaling $1,500,000 for the entire account.

Maximizing FDIC Insurance Coverage for Joint Accounts

To ensure that your joint account is fully protected by FDIC insurance, it's essential to understand the ownership structure and how it affects the insurance limits. Here are some strategies to maximize your FDIC insurance coverage for joint accounts:

- Review Account Ownership Structure: When opening a joint account, carefully consider the ownership structure and its implications for FDIC insurance. Right of survivorship accounts provide the highest level of insurance coverage for joint accounts, so choose this option if it aligns with your financial goals and plans.

- Diversify Ownership: If you have multiple joint accounts with the same financial institution, consider diversifying the ownership structure to maximize your insurance coverage. For example, you could have one joint account with right of survivorship and another with non-right of survivorship, ensuring that each account holder has the maximum $500,000 insurance coverage.

- Separate Ownership for Different Purposes: If you have specific savings goals or investment strategies, consider opening separate joint accounts with different ownership structures. This allows you to tailor the insurance coverage to your needs and ensure that each account is fully protected.

- Monitor Account Balances: It's crucial to regularly monitor the balances in your joint accounts to ensure that they remain within the FDIC insurance limits. If the account balance exceeds $500,000 per owner, consider distributing the funds across multiple accounts or taking other steps to maintain adequate insurance coverage.

Additional Considerations for Joint Accounts

While FDIC insurance provides significant protection for joint accounts, it's important to be aware of other factors that can impact your financial security.

- Account Ownership Changes: If there are changes in the ownership structure of your joint account, such as the addition or removal of an account holder, be sure to review the FDIC insurance coverage and make any necessary adjustments to ensure continued protection.

- Account Aggregation: The FDIC insurance coverage for joint accounts applies to each account holder's ownership interest. If you have multiple accounts with the same financial institution, the FDIC aggregates the balances to determine the insurance coverage. Ensure that the total balance across all your accounts does not exceed the insurance limits to maintain full protection.

- Fraud and Identity Theft: While FDIC insurance protects against financial institution failures, it does not cover losses due to fraud or identity theft. Be vigilant about protecting your personal and financial information, and report any suspicious activity or unauthorized transactions immediately to your financial institution and the relevant authorities.

By understanding the FDIC insurance coverage for joint accounts and implementing strategies to maximize protection, you can enjoy the convenience and benefits of shared finances while maintaining the security of your funds.

FAQs

Are all types of joint accounts FDIC-insured up to 500,000 per owner?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, both right of survivorship and non-right of survivorship joint accounts are FDIC-insured up to 500,000 per owner. However, the combined insurance coverage may vary depending on the specific ownership structure and the number of account holders.

What happens if a joint account balance exceeds 500,000 per owner?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If a joint account balance exceeds 500,000 per owner, the excess amount may not be FDIC-insured. It’s important to regularly monitor account balances and consider distributing funds across multiple accounts to maintain full insurance coverage.

Can I have multiple joint accounts with the same financial institution and still receive full FDIC insurance coverage?

+

Yes, you can have multiple joint accounts with the same financial institution and still receive full FDIC insurance coverage. However, the FDIC aggregates the balances across all your accounts to determine the insurance limits. Ensure that the total balance does not exceed the insurance limits to maintain full protection.

Are there any limitations to FDIC insurance coverage for joint accounts?

+

FDIC insurance coverage for joint accounts has certain limitations. It does not cover losses due to fraud, identity theft, or unauthorized transactions. It’s important to be vigilant about protecting your personal and financial information and to promptly report any suspicious activity.