Personal Disability Insurance

Personal Disability Insurance is an essential financial safety net that offers protection and peace of mind to individuals facing unforeseen circumstances. This specialized insurance policy provides a vital income stream when an insured person becomes unable to work due to illness, injury, or other specified reasons. In today's uncertain world, having such coverage is more crucial than ever, as it ensures individuals and their families can maintain their financial stability during challenging times.

Understanding the Importance of Personal Disability Insurance

In the face of unexpected events that can render an individual incapable of working, Personal Disability Insurance steps in as a crucial safeguard. This insurance policy ensures that policyholders receive a regular income, helping them meet their financial obligations and maintain their standard of living. The significance of this coverage becomes evident when considering the potential long-term impacts of a disability on an individual’s finances and overall well-being.

Financial Protection and Peace of Mind

The primary benefit of Personal Disability Insurance is the financial protection it provides. When an insured individual becomes disabled and unable to work, the insurance policy kicks in, offering a replacement income to cover essential expenses. This financial support can be particularly crucial for individuals with significant financial responsibilities, such as mortgages, loans, or family dependencies.

Furthermore, Personal Disability Insurance offers peace of mind, knowing that even in the face of a disability, one's financial stability remains intact. This assurance can significantly reduce the stress and anxiety associated with an unexpected health crisis, allowing individuals to focus on their recovery without the added burden of financial worries.

Eligibility and Coverage Options

Personal Disability Insurance is available to a wide range of individuals, including professionals, business owners, and even stay-at-home parents. The eligibility criteria may vary depending on the insurance provider, but generally, anyone who is currently working and in good health can apply for coverage.

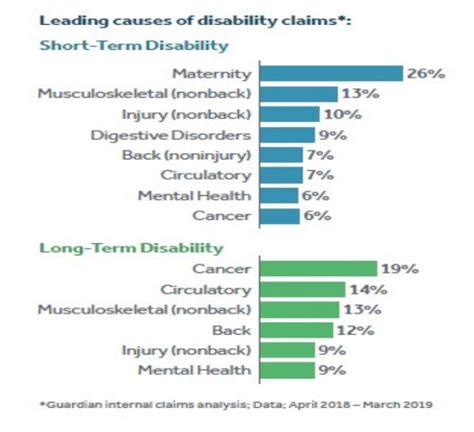

When it comes to coverage options, Personal Disability Insurance offers a variety of plans to suit different needs. Policyholders can choose from short-term or long-term disability coverage, with the former providing benefits for a specified period, typically up to a year, and the latter offering ongoing support until the insured individual reaches retirement age.

| Coverage Type | Description |

|---|---|

| Short-Term Disability | Provides benefits for a limited period, typically up to 1 year. |

| Long-Term Disability | Offers ongoing support until the insured individual reaches retirement age. |

Claim Process and Benefits

The claim process for Personal Disability Insurance is straightforward and designed to be as stress-free as possible. Policyholders are required to provide medical documentation and evidence of their disability, which is then reviewed by the insurance provider. Once the claim is approved, the insured individual begins receiving regular benefit payments as specified in their policy.

The benefit amount and duration are determined by the policy terms and can be tailored to the individual's needs. Typically, Personal Disability Insurance policies offer a benefit amount that replaces a percentage of the insured individual's income, ensuring they can maintain their financial commitments.

Case Studies: Real-Life Impact of Personal Disability Insurance

To illustrate the tangible benefits of Personal Disability Insurance, let’s explore two real-life case studies.

John’s Story: A Business Owner’s Recovery

John, a successful business owner, suffered a severe injury in a car accident, leaving him temporarily unable to work. Thanks to his Personal Disability Insurance policy, John received monthly benefit payments, which covered his business expenses and personal financial obligations during his recovery period. This financial support allowed John to focus on his rehabilitation without worrying about the future of his business or his personal finances.

Sarah’s Experience: Supporting Family During Illness

Sarah, a dedicated mother and wife, was diagnosed with a chronic illness that required extensive medical treatment. Her Personal Disability Insurance policy provided a much-needed income stream, ensuring her family’s financial stability during her illness. With the support of her insurance benefits, Sarah was able to concentrate on her health and spend quality time with her family, knowing that their financial future was secure.

Expert Insights: Maximizing Your Personal Disability Insurance Coverage

To make the most of your Personal Disability Insurance coverage, consider the following expert insights and strategies.

Tailoring Your Policy to Your Needs

When selecting a Personal Disability Insurance policy, it’s crucial to assess your specific needs and tailor your coverage accordingly. Consider factors such as your income level, financial responsibilities, and the likelihood of various types of disabilities. Working with an experienced insurance advisor can help you identify the right coverage limits, benefit periods, and other policy features to ensure you have adequate protection.

Understanding Policy Exclusions and Limitations

While Personal Disability Insurance offers comprehensive protection, it’s important to be aware of any exclusions or limitations in your policy. These may include pre-existing conditions, specific types of disabilities, or activities that are not covered. By thoroughly understanding your policy, you can avoid any unexpected gaps in coverage and ensure you have the protection you need.

Regular Policy Reviews and Updates

As your life circumstances change, it’s essential to review and update your Personal Disability Insurance policy accordingly. Major life events such as marriage, the birth of a child, or a significant change in income can impact your insurance needs. Regular policy reviews, ideally conducted annually or after significant life changes, can help you maintain adequate coverage and ensure your policy remains aligned with your evolving financial situation.

Future Implications and Industry Trends

The Personal Disability Insurance industry is continually evolving to meet the changing needs and circumstances of policyholders. As medical advancements and societal trends shape the landscape of disabilities, insurance providers are adapting their policies to provide more comprehensive coverage.

Expanding Coverage for Mental Health

In recent years, there has been a growing recognition of the importance of mental health in disability insurance coverage. Insurance providers are increasingly expanding their policies to include mental health-related disabilities, recognizing the impact of conditions such as depression, anxiety, and burnout on an individual’s ability to work. This trend reflects a broader societal shift towards prioritizing mental health and ensuring it is adequately supported through insurance coverage.

Technology-Driven Innovations

The insurance industry is embracing technological advancements to enhance the efficiency and accessibility of Personal Disability Insurance. Online platforms and mobile apps are being developed to streamline the application process, making it easier for individuals to obtain coverage. Additionally, digital tools are being utilized to improve the claim process, providing policyholders with a more seamless and convenient experience.

The Role of Data Analytics

Data analytics is playing an increasingly significant role in the Personal Disability Insurance industry. Insurance providers are leveraging data-driven insights to better understand the risks and needs of their policyholders, allowing them to offer more tailored and efficient coverage. By analyzing large datasets, insurance companies can identify trends, predict potential risks, and develop innovative solutions to meet the evolving needs of their customers.

How does Personal Disability Insurance differ from other types of insurance, such as health insurance or life insurance?

+Personal Disability Insurance focuses specifically on providing financial protection in the event of an insured individual becoming unable to work due to illness or injury. While health insurance covers medical expenses and life insurance provides a death benefit, Personal Disability Insurance offers a regular income stream to replace lost wages, ensuring financial stability during a disability.

What factors determine the cost of Personal Disability Insurance premiums?

+The cost of Personal Disability Insurance premiums is influenced by various factors, including the policyholder’s age, occupation, income level, and the level of coverage chosen. High-risk occupations, such as those involving manual labor or hazardous activities, may incur higher premiums. Additionally, the benefit amount and duration selected will impact the premium cost.

Can Personal Disability Insurance be customized to meet specific needs?

+Yes, Personal Disability Insurance policies can be tailored to meet individual needs. Policyholders can choose the benefit amount, benefit period, and specific exclusions or inclusions to align with their financial responsibilities and circumstances. Working with an insurance advisor can help ensure the policy is customized to provide the right level of protection.