Car Renters Insurance

In the world of car rentals, understanding the intricacies of insurance coverage is crucial. Car renters insurance, often overlooked, plays a pivotal role in ensuring a smooth and worry-free rental experience. This comprehensive guide aims to demystify the concept, highlighting its importance and providing valuable insights for informed decision-making.

Unveiling the World of Car Renters Insurance

Car renters insurance is a specialized type of coverage designed specifically for individuals renting vehicles. It acts as a safety net, protecting both the renter and the rental company in the event of accidents, damage, or other unforeseen circumstances. With the rising popularity of car rentals, whether for leisure or business, having adequate insurance coverage is essential to navigate potential pitfalls.

This insurance coverage offers a range of benefits, from liability protection to collision and comprehensive coverage. It provides peace of mind, ensuring that renters are not left financially burdened in the face of unexpected events. Furthermore, it streamlines the rental process, allowing renters to focus on their journey rather than worrying about potential liabilities.

Key Components of Car Renters Insurance

Understanding the key components of car renters insurance is fundamental to making informed choices. Here’s a breakdown of the essential elements:

- Liability Coverage: This aspect of the insurance policy protects renters against claims arising from bodily injury or property damage caused to others during an accident. It covers medical expenses, lost wages, and other related costs, providing a crucial safety net.

- Collision Coverage: Collision coverage is designed to cover the cost of repairing or replacing the rental vehicle in case of an accident. It ensures that renters are not held responsible for expensive repairs, making it an essential component of comprehensive coverage.

- Comprehensive Coverage: Beyond collision, comprehensive coverage steps in to address non-collision-related incidents. This includes damage caused by natural disasters, theft, vandalism, or even damage sustained while the vehicle is parked. It offers an extra layer of protection, ensuring renters are covered in a wide range of scenarios.

- Personal Effects Coverage: Many car renters insurance policies also provide coverage for personal belongings left in the rental vehicle. This aspect is particularly valuable, as it safeguards against theft or damage to items such as laptops, cameras, and other valuable possessions.

- Roadside Assistance: An often-overlooked benefit, roadside assistance is a vital component of car renters insurance. It provides emergency services such as towing, flat tire changes, jump-starts, and fuel delivery, ensuring renters are never stranded on the roadside.

By understanding these key components, renters can make informed decisions, tailoring their insurance coverage to their specific needs and ensuring a stress-free rental experience.

Comparative Analysis: Car Renters Insurance vs. Personal Auto Insurance

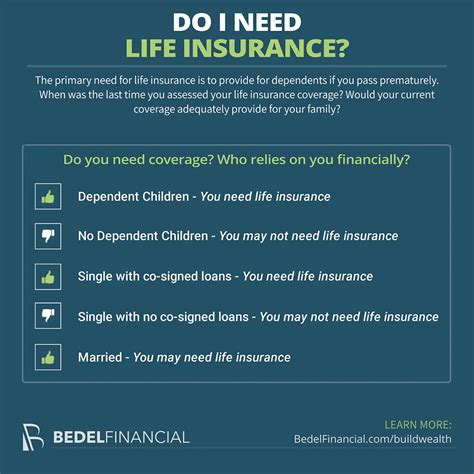

When it comes to insurance coverage for car rentals, a common question arises: Is it necessary to purchase car renters insurance when one already has personal auto insurance? Let’s delve into a comparative analysis to shed light on this dilemma.

Personal Auto Insurance Coverage for Rentals

Personal auto insurance policies often extend some level of coverage to rental vehicles. However, the extent of this coverage varies greatly depending on the policy and the specific circumstances of the rental. Here’s a breakdown of the key considerations:

- Liability Coverage: Personal auto insurance policies typically provide liability coverage for rental cars, protecting the insured against claims for bodily injury or property damage caused to others. This coverage is often sufficient for most rental scenarios.

- Collision and Comprehensive Coverage: While personal auto insurance may provide some collision and comprehensive coverage for rental vehicles, there are often limitations and exclusions. For instance, the coverage may not apply if the rental exceeds a certain number of days or if the renter is traveling internationally.

- Deductibles and Out-of-Pocket Expenses: Personal auto insurance policies often come with deductibles, which the insured must pay before the insurance coverage kicks in. Additionally, there may be out-of-pocket expenses, such as rental car company fees or administrative charges, that are not covered by the personal auto insurance policy.

Benefits of Car Renters Insurance

Car renters insurance, on the other hand, is specifically designed to address the unique needs and challenges of car rentals. Here’s why it can be a valuable addition to your rental experience:

- Comprehensive Coverage: Car renters insurance typically offers more comprehensive coverage than personal auto insurance policies. It includes collision, comprehensive, and liability coverage, ensuring that renters are protected against a wide range of scenarios, including accidents, theft, and vandalism.

- No Deductibles or Out-of-Pocket Expenses: One of the significant advantages of car renters insurance is the absence of deductibles or out-of-pocket expenses. This means that in the event of a claim, the renter is not required to pay any upfront costs, making it a more cost-effective option in the long run.

- Flexibility and Customization: Car renters insurance policies can be tailored to the specific needs of the renter. This flexibility allows individuals to choose the level of coverage that suits their budget and requirements, ensuring they are adequately protected without overspending.

- Enhanced Peace of Mind: With car renters insurance, renters can enjoy their trip without the constant worry of potential liabilities. The comprehensive coverage and lack of financial burdens in the event of an accident provide a significant peace of mind, allowing individuals to focus on their travels.

In conclusion, while personal auto insurance may provide some coverage for rental cars, car renters insurance offers a more specialized and comprehensive solution. By opting for car renters insurance, individuals can ensure they are fully protected, enjoy a stress-free rental experience, and have the flexibility to choose the coverage that best suits their needs.

Real-World Examples: Case Studies of Car Renters Insurance in Action

To truly grasp the impact and importance of car renters insurance, let’s explore some real-world examples and case studies where this specialized coverage made a significant difference.

Case Study 1: Accident and Liability Protection

Imagine a scenario where a family is on a road trip across the country, renting a vehicle for their journey. During their trip, an unfortunate accident occurs, resulting in bodily injuries to the occupants of the other vehicle involved. Without car renters insurance, the family would be personally liable for the medical expenses, lost wages, and other related costs, potentially leading to significant financial burdens.

However, with comprehensive car renters insurance in place, the family's liability coverage kicks in. The insurance policy covers the medical expenses and other associated costs, ensuring that the family is protected from financial ruin. This real-world example highlights the crucial role of liability coverage in car renters insurance, providing a safety net for renters in the face of unforeseen accidents.

Case Study 2: Collision Coverage and Repairs

In another scenario, a business traveler rents a vehicle for a week-long trip to attend meetings and conferences. Unfortunately, during their stay, the rental vehicle is involved in a collision, resulting in significant damage to the front end of the car. Without collision coverage, the traveler would be responsible for the costly repairs, potentially impacting their business expenses and personal finances.

Fortunately, with collision coverage included in their car renters insurance policy, the traveler is not left to bear the brunt of the repairs. The insurance company steps in to cover the cost of repairing or replacing the damaged vehicle, ensuring that the traveler can continue their business trip without financial strain. This case study underscores the importance of collision coverage, providing peace of mind and financial protection in the event of accidents.

Case Study 3: Comprehensive Coverage for Unexpected Events

Consider a couple renting a convertible for a romantic getaway along the coast. During their trip, a sudden storm hits, causing damage to the soft top of the rental car. Without comprehensive coverage, the couple would be responsible for the repairs, potentially dampening their vacation experience.

However, with comprehensive car renters insurance, the couple is covered for a wide range of unexpected events, including damage caused by natural disasters. The insurance policy steps in to repair or replace the damaged soft top, ensuring that the couple can continue their vacation without worry. This case study emphasizes the value of comprehensive coverage, offering protection against a variety of unforeseen circumstances.

These real-world examples illustrate the tangible benefits of car renters insurance. By providing liability protection, collision coverage, and comprehensive coverage, this specialized insurance policy ensures that renters are adequately protected, allowing them to focus on their journeys rather than worrying about potential liabilities.

The Future of Car Renters Insurance: Trends and Innovations

As the world of car rentals continues to evolve, so too does the landscape of car renters insurance. Let’s explore some of the emerging trends and innovations shaping the future of this specialized coverage.

Digital Transformation and Convenience

The digital age has brought about a revolution in the insurance industry, and car renters insurance is no exception. With the rise of online platforms and mobile apps, renting a vehicle and purchasing insurance coverage has become more accessible and convenient than ever before. Renters can now compare policies, purchase coverage, and manage their policies entirely online, streamlining the entire process.

Additionally, digital platforms offer enhanced transparency and ease of use. Renters can easily access their policy information, make changes, and file claims with just a few clicks. This digital transformation not only improves customer experience but also allows for more efficient and accurate insurance processes.

Personalized Coverage and Customization

One of the key trends in car renters insurance is the shift towards personalized coverage and customization. Insurance providers are recognizing the diverse needs and preferences of renters and are offering tailored solutions to meet these unique requirements. Renters can now choose from a range of coverage options, allowing them to select the specific protections that align with their budget and travel plans.

Whether it's opting for higher liability limits, adding personal effects coverage, or including rental car company fees in their policy, renters have the flexibility to create a customized insurance package that suits their individual needs. This level of personalization ensures that renters are not overpaying for coverage they don't need, providing a more cost-effective and tailored solution.

Integration of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are emerging as game-changers in the car renters insurance space. With the integration of telematics devices and advanced analytics, insurance providers can gain insights into driving behavior and usage patterns. This data-driven approach allows for more accurate risk assessment and pricing, benefiting both renters and insurance companies.

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, offers renters the opportunity to pay premiums based on their actual driving behavior. This innovative model rewards safe driving practices and can lead to significant cost savings for renters. By incentivizing responsible driving, usage-based insurance promotes safer roads and a more sustainable insurance ecosystem.

As the future unfolds, car renters insurance is set to become even more accessible, personalized, and data-driven. These trends and innovations not only enhance the customer experience but also contribute to a more efficient and sustainable insurance industry, benefiting renters and insurance providers alike.

How much does car renters insurance typically cost?

+The cost of car renters insurance can vary depending on several factors, including the rental duration, the type of vehicle, and the level of coverage desired. On average, renters can expect to pay between 10 and 30 per day for basic liability and collision coverage. However, prices may fluctuate based on individual circumstances and the specific insurance provider.

Can I purchase car renters insurance at the rental counter?

+Yes, many rental car companies offer car renters insurance at the rental counter. However, it’s important to carefully review the terms and conditions of the policy and compare it with your existing insurance coverage to ensure you are not paying for duplicate protection.

What should I do if I get into an accident while renting a car?

+If you are involved in an accident while renting a car, it’s crucial to remain calm and follow these steps: First, ensure the safety of all individuals involved. Then, contact the rental car company and inform them of the accident. Provide them with all the necessary details, including the location, any injuries sustained, and the contact information of the other party involved. Finally, report the accident to your insurance provider and provide them with the rental car company’s information.