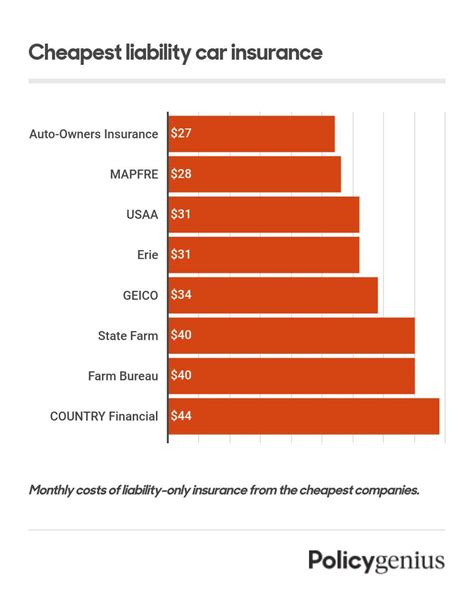

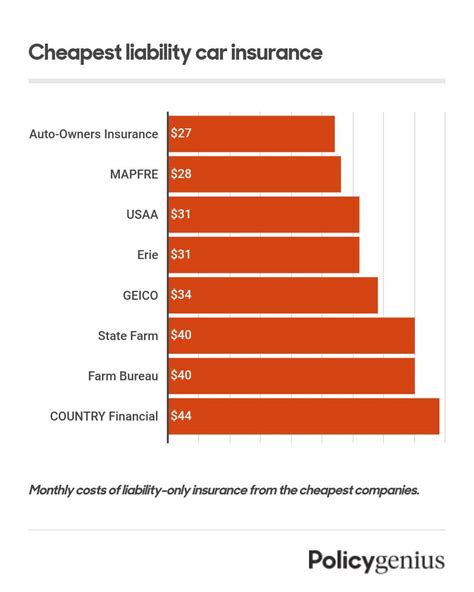

Cheapest Insurance For Liability

When it comes to insurance, finding the cheapest option for liability coverage is a common concern for many individuals and businesses. Liability insurance is essential as it provides protection against claims arising from accidents, injuries, or property damage caused by the policyholder. In this comprehensive guide, we will delve into the world of liability insurance, exploring the factors that influence its cost, the various coverage options available, and strategies to secure the most affordable policies.

Understanding Liability Insurance

Liability insurance serves as a crucial safeguard, offering financial protection in the event of unforeseen circumstances that lead to legal claims against the insured party. This type of insurance is designed to cover the costs associated with lawsuits, settlements, and damages, ensuring that policyholders are not left financially devastated by unexpected liabilities.

The coverage provided by liability insurance can vary depending on the specific policy and the nature of the risk being insured. Common types of liability insurance include general liability, product liability, professional liability (also known as errors and omissions insurance), and employer's liability. Each of these policies caters to different scenarios and industries, highlighting the importance of understanding one's unique risk profile when selecting liability coverage.

Factors Influencing the Cost of Liability Insurance

The cost of liability insurance can fluctuate based on several factors, each playing a significant role in determining the premium rates. These factors include the type of coverage required, the level of risk associated with the insured’s activities or business, the policy limits chosen, and the location where the policyholder operates.

The type of coverage selected is a critical factor, as different types of liability insurance cater to distinct risks. For instance, general liability insurance covers a broad range of common risks faced by businesses, such as slip-and-fall accidents or property damage, whereas product liability insurance specifically addresses risks associated with manufacturing or selling products. The level of risk associated with the insured's activities or business is another key consideration, as higher-risk industries or activities may attract higher premium rates to account for the increased likelihood of claims.

The policy limits chosen by the insured also impact the cost of liability insurance. Policy limits refer to the maximum amount the insurance company will pay out for a covered claim. Higher policy limits provide greater financial protection but typically come with a higher premium. It's essential for policyholders to strike a balance between the desired level of coverage and the affordability of the policy, ensuring they have adequate protection without paying excessive premiums.

Additionally, the location where the policyholder operates can influence the cost of liability insurance. Certain areas may have a higher frequency of claims or a greater risk of certain types of incidents, leading to higher premium rates. It's crucial for policyholders to assess the specific risks associated with their location and choose a policy that provides adequate coverage for those risks.

Exploring Coverage Options for Affordable Liability Insurance

When seeking affordable liability insurance, it’s essential to explore a range of coverage options to find the best fit for your needs. Here are some key considerations to keep in mind:

Assess Your Specific Risk Profile

Understanding your unique risk profile is the first step towards securing affordable liability insurance. Evaluate the specific risks associated with your activities or business and identify the areas where you may be vulnerable to claims. By pinpointing these risks, you can tailor your coverage to address them effectively, ensuring you have the necessary protection without paying for unnecessary coverage.

Compare Multiple Quotes

Obtaining multiple quotes from different insurance providers is crucial to finding the most affordable liability insurance. Each insurer has its own methodology for assessing risk and determining premium rates, so shopping around can reveal significant variations in pricing. Take the time to compare quotes from various providers, ensuring you understand the coverage details and policy limits to make an informed decision.

Consider Bundle Options

Bundling your insurance policies can often result in substantial savings. Many insurance providers offer discounts when you combine multiple policies, such as liability insurance with property insurance or auto insurance. By consolidating your insurance needs with a single provider, you may be eligible for bundle discounts that reduce the overall cost of your liability insurance.

Explore Different Policy Limits

As mentioned earlier, policy limits play a significant role in determining the cost of liability insurance. While it’s essential to have adequate coverage to protect against potential claims, choosing excessively high policy limits may result in unnecessary expenses. Assess your risk tolerance and financial capabilities to determine the appropriate policy limits that provide sufficient protection without breaking the bank.

Utilize Online Insurance Marketplaces

Online insurance marketplaces have revolutionized the way individuals and businesses shop for insurance. These platforms aggregate quotes from multiple insurers, making it convenient to compare rates and coverage options in one place. By leveraging online marketplaces, you can efficiently explore a wide range of options and find the most affordable liability insurance that meets your specific needs.

Strategies for Securing the Cheapest Liability Insurance

To further enhance your chances of securing the cheapest liability insurance, consider implementing the following strategies:

Improve Your Risk Profile

Taking proactive steps to improve your risk profile can make you a more attractive candidate for insurance providers, potentially leading to lower premium rates. Implement safety measures, train your employees on risk mitigation, and maintain a clean claims history to demonstrate your commitment to reducing the likelihood of incidents and claims. A positive risk profile can signal to insurers that you are a low-risk policyholder, which may result in more favorable premium rates.

Increase Your Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can reduce your premium costs. By assuming a larger portion of the financial responsibility in the event of a claim, you signal to insurers that you are willing to share the risk. While this strategy may require you to have a higher financial buffer to cover potential claims, it can result in significant savings on your liability insurance premiums.

Shop Around Regularly

Insurance rates can fluctuate over time, and it’s essential to stay updated on the latest offerings from different providers. Regularly shopping around for liability insurance can help you identify changes in the market and take advantage of new discounts or promotions. Even if you’re satisfied with your current policy, periodically reviewing your options can ensure you’re not missing out on more affordable alternatives.

Negotiate with Your Insurer

Don’t hesitate to negotiate with your insurance provider to secure the best possible rate for your liability insurance. Discuss your specific needs, risk profile, and any changes in your circumstances that may impact your risk level. Insurers often have flexibility in setting premium rates, and by engaging in open communication, you may be able to negotiate a more favorable rate that aligns with your budget and coverage requirements.

The Role of Technology in Affordable Liability Insurance

Advancements in technology have revolutionized the insurance industry, making it easier and more efficient to secure affordable liability insurance. Online insurance platforms and digital tools have streamlined the quoting and purchasing process, providing policyholders with instant access to a wide range of options. These technological innovations have not only increased convenience but have also contributed to greater competition among insurers, leading to more competitive pricing and a wider array of coverage options.

Additionally, technology has enabled insurers to implement more sophisticated risk assessment models, leveraging data analytics and machine learning to accurately evaluate policyholders' risk profiles. This enhanced risk assessment capability allows insurers to offer more tailored coverage options and price policies based on an individual's specific risk factors, resulting in more accurate and potentially lower premium rates for policyholders.

Conclusion: Navigating the Path to Affordable Liability Insurance

Securing the cheapest liability insurance requires a comprehensive understanding of the factors that influence premium rates and a proactive approach to shopping around and comparing options. By assessing your specific risk profile, exploring different coverage options, and implementing strategic measures to improve your risk profile and negotiate favorable terms, you can significantly reduce the cost of your liability insurance while maintaining adequate protection.

As the insurance landscape continues to evolve with technological advancements, staying informed and leveraging digital tools can further enhance your ability to find affordable liability insurance. Remember, finding the right balance between coverage and cost is crucial, ensuring you have the necessary protection without straining your finances. With the right knowledge and strategies, you can navigate the path to affordable liability insurance with confidence and peace of mind.

What is the average cost of liability insurance?

+The average cost of liability insurance can vary significantly based on the type of coverage, the policy limits, and the industry or activity being insured. As a general guideline, small businesses can expect to pay anywhere from 300 to 1,000 per year for general liability insurance, while larger businesses or those with higher risk profiles may pay significantly more. It’s important to obtain multiple quotes to get an accurate understanding of the cost for your specific situation.

Are there any ways to reduce the cost of liability insurance without compromising coverage?

+Absolutely! There are several strategies you can employ to reduce the cost of liability insurance while maintaining adequate coverage. These include improving your risk profile by implementing safety measures and training, increasing your deductible to share more of the financial burden in the event of a claim, and regularly shopping around for the best rates. Additionally, consider bundle discounts and negotiating with your insurer to secure the most favorable terms.

How often should I review my liability insurance coverage and rates?

+It’s recommended to review your liability insurance coverage and rates at least once a year, or whenever significant changes occur in your business or personal circumstances. Regular reviews ensure that your coverage remains aligned with your evolving needs and that you are not paying more than necessary. Additionally, keeping up with industry trends and advancements in insurance technology can help you identify new opportunities for cost savings.