Number To Progressive Insurance

In the ever-evolving world of insurance, where customers seek convenience and cost-effectiveness, the rise of direct-to-consumer (DTC) models has revolutionized the industry. Among these, Progressive Insurance has emerged as a prominent player, offering a unique and streamlined approach to insurance services. This article delves into the intricacies of Progressive's operations, its impact on the market, and the key factors contributing to its success.

Unraveling the Progressive Insurance Model

Progressive Insurance, with its headquarters in Mayfield Village, Ohio, has solidified its position as a leader in the insurance industry through a strategic shift towards a direct-to-consumer approach. This model, in contrast to traditional agency-based systems, has enabled Progressive to cut out the middleman and provide customers with a more efficient and personalized experience.

At the core of Progressive's success is its innovative use of technology. The company has embraced digital transformation, leveraging advanced algorithms and data analytics to streamline the insurance process. This has not only enhanced customer convenience but also improved risk assessment and pricing accuracy.

A Technological Revolution

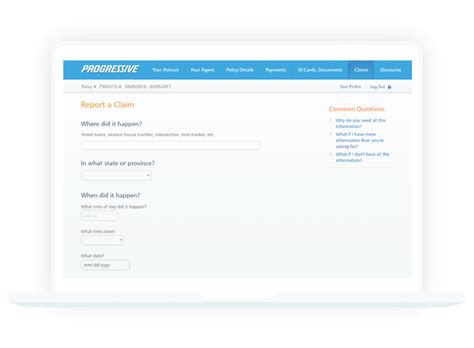

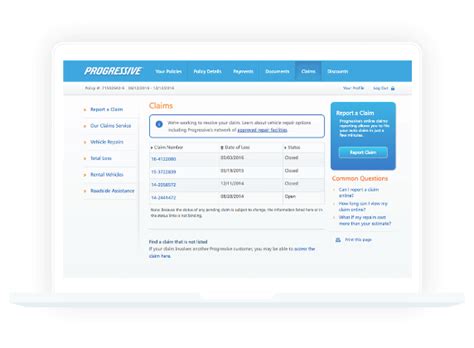

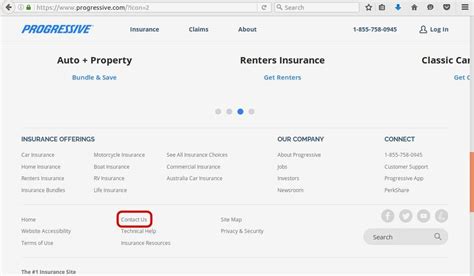

Progressive’s technological prowess is evident in its suite of digital tools and platforms. The company’s website, for instance, serves as a one-stop shop for customers, offering an intuitive interface for policy management, claims submission, and even real-time quotes. This digital-first approach has not only attracted tech-savvy millennials but has also proven to be a time-saver for busy professionals.

One of the standout features of Progressive's digital strategy is its mobile app. The app, available on both iOS and Android platforms, provides users with on-the-go access to their policies, allowing them to make changes, pay premiums, and even file claims with just a few taps.

Furthermore, Progressive has been at the forefront of implementing AI and machine learning technologies. These advanced systems assist in risk assessment, helping to provide more accurate quotes and personalized recommendations to customers. By analyzing vast amounts of data, Progressive's algorithms can identify trends and patterns, enabling the company to offer competitive rates and tailored coverage options.

Direct-to-Consumer Advantages

The direct-to-consumer model adopted by Progressive brings a host of benefits for both the company and its customers. For starters, by eliminating the need for intermediaries, Progressive can offer more competitive pricing. This is because the traditional agent-based model often includes additional costs, such as agent commissions, which can drive up insurance premiums.

Additionally, the DTC approach allows Progressive to provide a more personalized experience. With direct access to customers, the company can gather valuable feedback and tailor its services to meet individual needs. This level of customization not only enhances customer satisfaction but also fosters brand loyalty.

Progressive's direct-to-consumer model also facilitates a faster and more efficient claims process. Customers can file claims online or via the mobile app, providing real-time updates and simplifying the entire claims journey. This streamlined approach not only saves time but also reduces administrative burdens, benefiting both the customer and the insurer.

Market Impact and Competitive Advantage

Progressive’s innovative approach has had a significant impact on the insurance market. By challenging traditional norms, the company has set a new standard for efficiency and customer-centricity. This has not only attracted a new generation of tech-savvy customers but has also prompted traditional insurers to rethink their strategies and embrace digital transformation.

Customer Experience and Satisfaction

Progressive’s focus on customer experience is a key differentiator. The company understands that insurance is not just about coverage; it’s about providing peace of mind and support during challenging times. Through its digital platforms and personalized services, Progressive ensures that customers feel valued and understood.

Customer reviews and feedback highlight Progressive's success in this regard. Many customers appreciate the ease of doing business with Progressive, citing the user-friendly interfaces and efficient claims processes. The company's commitment to customer satisfaction has earned it a strong reputation and a loyal customer base.

Competitive Landscape and Industry Response

Progressive’s success has not gone unnoticed by its competitors. Traditional insurers, once reliant on agent-based models, have begun to recognize the importance of digital transformation. Many have started investing in their own digital platforms and enhancing their online presence to keep up with the changing market dynamics.

However, Progressive's edge lies not just in its technological advancements but also in its holistic approach to insurance. The company's comprehensive suite of products, coupled with its innovative distribution model, has made it a formidable force in the market. Progressive's ability to adapt and stay ahead of the curve ensures its continued success and market leadership.

Performance Analysis and Future Prospects

Progressive’s performance over the years has been nothing short of impressive. The company has consistently reported strong financial results, with its revenue and market share steadily increasing. This growth can be attributed to its effective marketing strategies, innovative product offerings, and, of course, its direct-to-consumer model.

Financial Performance and Growth

In the past decade, Progressive has seen significant growth in its net premiums written. This metric, a key indicator of an insurer’s financial health, has grown by over 50%, reflecting the company’s expanding market presence and customer base. Additionally, Progressive’s return on equity (ROE) has consistently outperformed the industry average, highlighting its efficient use of capital and strong profitability.

Progressive's financial success has also translated into shareholder value. The company's stock price has seen a steady upward trajectory, outpacing the broader market indices. This performance is a testament to Progressive's ability to create long-term value for its investors.

Future Implications and Industry Trends

Looking ahead, Progressive is well-positioned to continue its growth trajectory. The company’s focus on innovation and technology ensures that it remains adaptable to changing market conditions and customer preferences. As the insurance industry continues to evolve, Progressive’s direct-to-consumer model and digital-first approach will likely remain key differentiators.

Furthermore, Progressive's recent initiatives, such as its expansion into new markets and product offerings, indicate a commitment to growth and diversification. By leveraging its existing strengths and exploring new opportunities, Progressive is poised to maintain its market leadership and stay ahead of the competition.

| Metric | Value |

|---|---|

| Net Premiums Written (2022) | $37.9 Billion |

| Return on Equity (2022) | 20.3% |

| Stock Price (52-Week High) | $144.29 |

Conclusion

In a highly competitive insurance market, Progressive Insurance has emerged as a trailblazer, transforming the industry with its direct-to-consumer model and digital innovations. Through its commitment to customer satisfaction, technological prowess, and strategic initiatives, Progressive has solidified its position as a leader in the industry. As we look to the future, Progressive’s success story serves as an inspiration and a benchmark for other insurers looking to stay relevant and thrive in a digital-first world.

How does Progressive’s direct-to-consumer model benefit customers?

+Progressive’s DTC model offers customers competitive pricing by cutting out intermediary costs. It also provides a personalized experience, allowing customers to manage their policies and file claims conveniently through digital platforms.

What sets Progressive apart from traditional insurers?

+Progressive’s innovative use of technology and direct-to-consumer approach give it a competitive edge. The company’s digital platforms, AI-powered risk assessment, and personalized services set it apart from traditional insurers.

How has Progressive’s performance been over the years?

+Progressive has demonstrated strong financial performance, with consistent growth in net premiums written and return on equity. Its stock price has also outperformed the market, indicating its success in creating shareholder value.