Do You Need Life Insurance

When it comes to financial planning and ensuring the security of our loved ones, life insurance is a topic that often sparks curiosity and raises important questions. The decision to purchase life insurance is a significant one, and it's crucial to understand the benefits, considerations, and potential implications it carries. In this comprehensive guide, we will delve into the world of life insurance, exploring its purpose, types, and the factors that can help you determine if it's a necessity for your unique circumstances.

Understanding the Purpose of Life Insurance

Life insurance is a financial safety net designed to provide peace of mind and protect your loved ones from financial hardship in the event of your untimely passing. It serves as a crucial tool to ensure that your family, dependents, or beneficiaries can maintain their standard of living and meet their financial obligations even in your absence.

The primary purpose of life insurance is to offer a lump-sum payment, known as the death benefit, to your designated beneficiaries. This payment can cover a wide range of expenses, including funeral and burial costs, outstanding debts, daily living expenses, education funds for children, and even legacy-building opportunities. By securing life insurance, you are essentially creating a financial cushion to help your loved ones navigate the challenges that may arise after your passing.

Key Considerations Before Purchasing Life Insurance

Before making the decision to invest in life insurance, it’s essential to carefully evaluate your personal circumstances and financial situation. Here are some key considerations to guide your thought process:

Assessing Financial Responsibilities

Evaluate your current and future financial responsibilities. Do you have dependents who rely on your income for their daily needs? Are you the primary breadwinner in your household? Do you have outstanding debts, such as a mortgage or student loans, that would create a financial burden for your family if left unpaid? Considering these factors will help you understand the potential financial impact your absence could have on your loved ones.

Weighing the Cost-Benefit Ratio

Life insurance policies come with varying premium costs, and it’s crucial to strike a balance between the coverage you need and your financial capabilities. Assess your budget and determine how much you can reasonably afford to allocate towards life insurance premiums. Remember, the goal is to find a policy that provides adequate coverage without straining your finances.

Considering Future Plans and Goals

Think about your short-term and long-term financial goals. Are you planning to start a family, purchase a new home, or save for your children’s education? Life insurance can be a valuable tool to secure these future plans and ensure that your loved ones can continue pursuing their dreams even if you’re no longer able to provide for them financially.

Understanding Different Types of Life Insurance

Life insurance is not a one-size-fits-all product. There are various types of policies available, each with its own unique features and benefits. Understanding the differences between these types is crucial to making an informed decision:

| Type of Life Insurance | Description |

|---|---|

| Term Life Insurance | Term life insurance provides coverage for a specified period, often ranging from 10 to 30 years. It offers a death benefit to your beneficiaries if you pass away during the term of the policy. Term life insurance is generally more affordable than permanent life insurance and is ideal for covering temporary financial needs or protecting against specific risks. |

| Whole Life Insurance | Whole life insurance, also known as permanent life insurance, provides coverage for your entire life as long as premiums are paid. It offers a guaranteed death benefit and often accumulates cash value over time. Whole life insurance is more expensive but provides long-term financial protection and can be used as an investment vehicle. |

| Universal Life Insurance | Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefit amounts. It allows you to adjust your premiums and coverage based on your changing needs and financial situation. Universal life insurance typically has a cash value component that can be accessed during your lifetime. |

| Final Expense Insurance | Final expense insurance, also known as burial insurance, is a specialized type of life insurance designed to cover funeral and burial costs. It typically has lower coverage amounts and is intended to provide immediate funds to cover end-of-life expenses. |

Analyzing Your Specific Needs

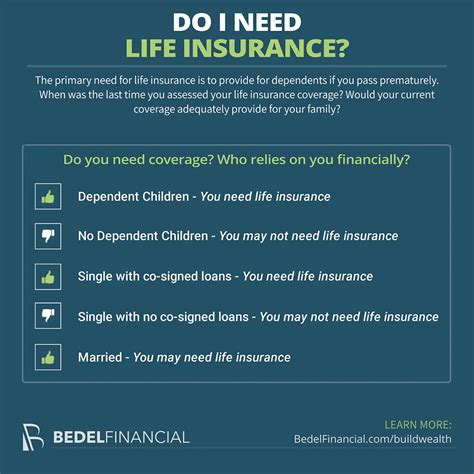

To determine if life insurance is a necessity for you, it’s essential to analyze your unique circumstances and financial goals. Here are some factors to consider:

Family Size and Dependents

If you have a spouse, children, or other dependents who rely on your income, life insurance becomes a crucial consideration. It ensures that your loved ones can maintain their financial stability and cover their daily expenses even if you’re no longer around to provide for them.

Debt and Financial Obligations

Evaluate your current debt load, including mortgages, credit card balances, and any other outstanding loans. Life insurance can help your beneficiaries pay off these debts and avoid the burden of financial obligations falling solely on them.

Income Replacement

Consider your current and future income potential. If your income is vital to your family’s financial well-being, life insurance can provide a replacement stream of income to support their lifestyle and cover essential expenses.

Education Funding

If you have children or plan to have them in the future, life insurance can be a valuable tool to secure their education. It can provide funds to cover tuition fees, books, and other educational expenses, ensuring that your children’s future is not compromised.

Factors Influencing Life Insurance Necessity

While personal circumstances play a significant role in determining the need for life insurance, there are other factors that can influence this decision. Here are some additional considerations to keep in mind:

Health and Lifestyle Factors

Your overall health and lifestyle choices can impact the cost and availability of life insurance. Individuals with pre-existing medical conditions or high-risk lifestyles may face higher premiums or even denial of coverage. It’s essential to disclose all relevant health information to obtain an accurate assessment of your insurance needs.

Employment Benefits

Some employers offer group life insurance policies as part of their employee benefits package. These policies often provide a basic level of coverage at a reduced cost. However, it’s important to evaluate whether this coverage is sufficient for your needs and whether it will remain in place if you change jobs or retire.

Government Assistance Programs

In certain situations, government assistance programs may provide some financial support to your loved ones in the event of your passing. However, these programs often have strict eligibility criteria and may not cover all expenses. Life insurance can complement these programs and ensure a more comprehensive financial safety net.

The Benefits of Life Insurance

Purchasing life insurance offers a range of benefits that go beyond simply providing a death benefit. Here are some key advantages to consider:

Peace of Mind

Knowing that your loved ones are financially protected can bring immense peace of mind. Life insurance allows you to focus on living your life to the fullest without the constant worry of leaving them in a difficult financial situation.

Debt Elimination

Life insurance can help your beneficiaries pay off debts, such as mortgages, car loans, or credit card balances. This can alleviate the financial burden on your loved ones and prevent them from inheriting a heavy debt load.

Financial Security for Dependents

If you have young children or elderly parents who rely on your income, life insurance ensures that they will have the financial means to continue their daily lives without disruption. It provides a stable source of income to cover their living expenses, education, and other essential needs.

Legacy Building

Life insurance can be a powerful tool for legacy building. By investing in a permanent life insurance policy, you can accumulate cash value over time, which can be used for various purposes, such as funding a business venture, starting a charitable foundation, or leaving a financial legacy for future generations.

Obtaining Life Insurance: A Step-by-Step Guide

If you’ve determined that life insurance is a necessity for your situation, here’s a step-by-step guide to help you through the process:

-

Research and Compare Providers: Start by researching reputable life insurance providers in your area. Compare their policies, coverage options, and premium costs to find the best fit for your needs. Consider reading reviews and seeking recommendations from trusted sources.

-

Assess Your Coverage Needs: Determine the amount of coverage you require based on your financial responsibilities and goals. Use online calculators or consult with a financial advisor to get an accurate estimate of the death benefit you should aim for.

-

Choose the Right Type of Policy: Based on your assessment, select the type of life insurance policy that aligns with your needs and budget. Consider whether you require temporary coverage (term life) or long-term financial protection (whole or universal life).

-

Apply for Coverage: Contact the insurance provider of your choice and initiate the application process. Be prepared to provide personal information, including your health history, occupation, and lifestyle details. The provider will assess your application and determine your eligibility and premium rate.

-

Review and Understand the Policy: Once your application is approved, carefully review the policy documents. Ensure that you understand the terms, conditions, and any exclusions or limitations. Seek clarification if any aspects are unclear.

-

Make Timely Premium Payments: To maintain your coverage, it's crucial to make timely premium payments. Set up automatic payments or reminders to ensure that your policy remains in force. Consistent premium payments are essential to keeping your loved ones protected.

Frequently Asked Questions (FAQ)

Is life insurance necessary for everyone?

+The need for life insurance depends on individual circumstances. If you have financial responsibilities or dependents, life insurance can provide crucial financial protection. However, for individuals with no dependents or significant financial obligations, life insurance may not be a necessity.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your financial goals and obligations. It’s recommended to calculate your coverage needs based on factors like income, debts, and future expenses. Online calculators or financial advisors can assist in determining an appropriate coverage amount.

What are the main types of life insurance policies available?

+The main types of life insurance policies include term life insurance, which provides coverage for a specified period, and permanent life insurance, such as whole life or universal life, which offers coverage for your entire life. Each type has its own advantages and considerations.

Can I change my life insurance policy if my circumstances change?

+Yes, life insurance policies can be adjusted to accommodate changing circumstances. You may have the option to increase or decrease coverage, change beneficiaries, or switch policy types. It’s important to review your policy regularly and make adjustments as needed to ensure it aligns with your current needs.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on your policy and the number of missed payments. Some policies offer a grace period, while others may lapse or be canceled. It’s essential to stay current with premium payments to maintain uninterrupted coverage.

In conclusion, the decision to purchase life insurance is a personal one, influenced by various factors such as financial responsibilities, family size, and future goals. By carefully assessing your needs and considering the benefits and types of life insurance available, you can make an informed choice to protect your loved ones and provide them with the financial security they deserve. Remember, life insurance is a powerful tool to ensure a brighter future for those who matter most.