Cobra Health Insurance Rates

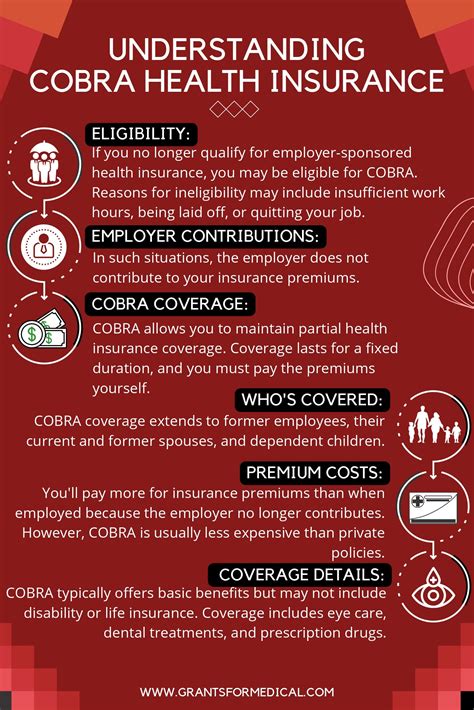

Cobra Health Insurance, a prominent player in the healthcare sector, has been a trusted name for many individuals and families seeking comprehensive health coverage. Understanding the rates and coverage options offered by Cobra Health Insurance is crucial for making informed decisions about your healthcare needs. In this comprehensive guide, we will delve into the world of Cobra Health Insurance rates, exploring the factors that influence them, the various plans available, and the steps you can take to secure the best coverage for yourself and your loved ones.

Understanding Cobra Health Insurance Rates

Cobra Health Insurance rates are determined by a combination of factors, each playing a significant role in shaping the overall cost of your health coverage. By comprehending these factors, you can better navigate the insurance landscape and make choices that align with your budget and healthcare requirements.

Key Factors Influencing Cobra Health Insurance Rates

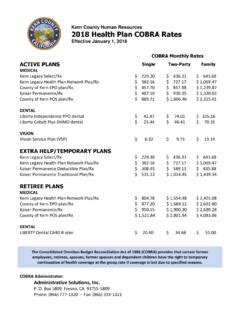

Age: One of the primary factors that impact Cobra Health Insurance rates is the age of the policyholder. Generally, younger individuals tend to have lower premiums, as they are statistically less likely to require extensive medical care. As you age, the cost of coverage may increase gradually.

Medical History: Your past and current medical conditions, as well as any pre-existing health issues, can greatly influence the rates you receive from Cobra Health Insurance. Insurers carefully assess your medical history to determine the level of risk associated with covering your healthcare needs.

Geographic Location: The state or region where you reside can also impact your insurance rates. Healthcare costs vary across different areas, and this variation is often reflected in the premiums offered by Cobra Health Insurance.

Coverage Type: The type of health insurance coverage you choose will directly affect your rates. Cobra Health Insurance provides a range of plans, each with its own set of benefits and costs. From basic plans with limited coverage to comprehensive plans offering extensive benefits, the choice of coverage type is a critical factor in determining your insurance costs.

Tobacco Use: If you are a tobacco user, whether through smoking or other forms of consumption, your insurance rates may be higher. This is because tobacco use is associated with an increased risk of various health issues, leading to potentially higher healthcare costs for insurers.

Plan Duration: The length of your insurance plan can also influence your rates. Short-term plans, which typically last for a few months, may have higher premiums compared to long-term plans that extend over a year or more.

Family Size: When purchasing Cobra Health Insurance for your family, the number of family members covered under the plan will impact the overall rate. Each additional family member adds to the overall risk and cost of coverage.

| Factor | Impact on Rates |

|---|---|

| Age | Lower rates for younger individuals; gradual increase with age |

| Medical History | Extensive medical history or pre-existing conditions may lead to higher rates |

| Geographic Location | Healthcare costs vary by region, influencing insurance premiums |

| Coverage Type | Different plans offer varying benefits and costs |

| Tobacco Use | Tobacco users may face higher insurance rates |

| Plan Duration | Short-term plans may have higher premiums than long-term plans |

| Family Size | Larger families may result in higher overall rates |

Exploring Cobra Health Insurance Plans

Cobra Health Insurance offers a diverse range of plans to cater to the varied needs of its policyholders. Each plan comes with its own set of benefits, coverage limits, and, of course, associated costs. By exploring the different plan options, you can find the one that best aligns with your healthcare requirements and financial capabilities.

Cobra Basic Health Plan

The Basic Health Plan from Cobra Health Insurance is designed for individuals seeking essential coverage at an affordable rate. This plan typically covers basic medical services such as primary care visits, preventive care, and some emergency treatments. It may also include limited prescription drug coverage. While the Basic Health Plan provides a solid foundation for healthcare, it may have higher deductibles and out-of-pocket expenses compared to more comprehensive plans.

Cobra Standard Health Plan

The Standard Health Plan offers a balanced approach to healthcare coverage. It provides a broader range of benefits, including expanded prescription drug coverage, mental health services, and specialized treatments. This plan is ideal for those who require regular medical attention or have specific healthcare needs. The Standard Health Plan typically has lower deductibles and out-of-pocket costs compared to the Basic Plan, making it a popular choice for many individuals and families.

Cobra Premier Health Plan

For those seeking top-tier healthcare coverage, the Premier Health Plan from Cobra Health Insurance delivers an extensive range of benefits. This plan offers comprehensive coverage for a wide array of medical services, including specialty care, advanced treatments, and extensive prescription drug coverage. The Premier Plan is tailored for individuals and families who prioritize access to the best medical care without worrying about high out-of-pocket expenses. While it may come with a higher premium, the Premier Plan provides peace of mind and exceptional healthcare benefits.

Cobra Custom Health Plan

Recognizing that every individual's healthcare needs are unique, Cobra Health Insurance offers a Custom Health Plan option. This plan allows you to tailor your coverage to your specific requirements. Whether you need specialized coverage for a particular health condition or want to prioritize certain benefits, the Custom Health Plan gives you the flexibility to design your insurance coverage. By working closely with Cobra Health Insurance representatives, you can create a plan that meets your unique needs and budget.

| Plan Type | Key Features |

|---|---|

| Basic Health Plan | Affordable, covers essential medical services, higher deductibles |

| Standard Health Plan | Balanced coverage, expanded benefits, lower out-of-pocket costs |

| Premier Health Plan | Comprehensive coverage, includes advanced treatments, higher premiums |

| Custom Health Plan | Tailored coverage, designed to meet unique healthcare needs |

Securing the Best Cobra Health Insurance Rates

Securing the best Cobra Health Insurance rates requires a strategic approach and a thorough understanding of the insurance landscape. By following these steps, you can navigate the process effectively and find the coverage that best suits your needs while keeping your costs manageable.

Shop Around and Compare Rates

Begin your search by comparing rates from multiple insurance providers, including Cobra Health Insurance. Utilize online tools and resources to gather quotes and assess the coverage and costs offered by different plans. By comparing rates, you can identify the most competitive options and make informed decisions about your healthcare coverage.

Understand Your Healthcare Needs

Take the time to assess your current and future healthcare needs. Consider any ongoing medical conditions, the likelihood of requiring specialized treatments, and your preferences for healthcare providers. By understanding your needs, you can choose a plan that provides adequate coverage without unnecessary expenses.

Consider Family Size and Composition

If you are purchasing insurance for your family, carefully consider the size and composition of your household. Cobra Health Insurance offers family plans that cover all family members under one policy. Assess the healthcare needs of each family member and choose a plan that provides comprehensive coverage for everyone.

Review Your Medical History

Your medical history is a critical factor in determining your insurance rates. Take the time to review your past and current medical conditions, and be transparent with your insurance provider. By providing accurate information, you can avoid potential issues down the line and ensure that your coverage is tailored to your specific health needs.

Evaluate Plan Benefits and Limitations

When comparing Cobra Health Insurance plans, pay close attention to the benefits and limitations of each. Assess the coverage for essential services like primary care, specialist visits, prescription drugs, and emergency treatments. Understand any exclusions or limitations within the plan to ensure it aligns with your healthcare requirements.

Consider Additional Coverage Options

In addition to health insurance, Cobra Health Insurance may offer other coverage options such as dental, vision, and life insurance. Evaluate your needs for these additional coverages and consider bundling them with your health insurance plan to potentially save on overall costs.

Work with an Insurance Agent

Consider working with a licensed insurance agent who specializes in health insurance. They can provide valuable insights, answer your questions, and guide you through the process of selecting the right Cobra Health Insurance plan. An insurance agent can also help you navigate any complexities and ensure that your coverage meets your specific needs.

Stay Informed About Plan Changes

Health insurance plans, including those offered by Cobra Health Insurance, may undergo changes over time. Stay informed about any updates to plan benefits, coverage limits, and rates. Regularly review your coverage to ensure it continues to meet your needs and consider making adjustments as necessary.

Utilize Online Resources and Tools

In today's digital age, online resources and tools can be invaluable in your search for the best Cobra Health Insurance rates. Use online comparison platforms, insurance calculators, and reviews to gather information, assess plan options, and make informed decisions about your healthcare coverage.

Conclusion

Understanding Cobra Health Insurance rates and the factors that influence them is a crucial step in making informed decisions about your healthcare coverage. By exploring the various plan options, comparing rates, and assessing your specific needs, you can secure the best coverage at a competitive price. Remember, your health is a top priority, and having the right insurance plan can provide peace of mind and access to quality healthcare when you need it most.

Frequently Asked Questions

Can I switch to Cobra Health Insurance if I’m currently insured with another provider?

+

Yes, you can switch to Cobra Health Insurance from another provider. However, it’s important to review your existing policy’s terms and conditions to understand any potential penalties or fees associated with switching. Additionally, ensure that Cobra Health Insurance offers plans that meet your specific healthcare needs.

How often should I review my Cobra Health Insurance plan?

+

It’s recommended to review your Cobra Health Insurance plan annually or whenever there are significant changes in your life, such as marriage, the birth of a child, or a change in employment status. Regular reviews ensure that your coverage remains aligned with your current needs and any plan updates or changes.

What happens if I need to file a claim with Cobra Health Insurance?

+

If you need to file a claim with Cobra Health Insurance, you’ll typically need to complete a claim form and provide supporting documentation, such as medical records and receipts. The claims process can vary, so it’s essential to review your plan’s specific guidelines and contact Cobra Health Insurance’s claims department for assistance.

Can I add my spouse and children to my Cobra Health Insurance plan?

+

Yes, Cobra Health Insurance offers family plans that cover spouses and dependent children. When selecting a family plan, consider the healthcare needs of each family member and choose a plan that provides comprehensive coverage for everyone.

Are there any discounts or incentives available for Cobra Health Insurance plans?

+

Cobra Health Insurance may offer discounts or incentives for various reasons, such as enrolling in a wellness program or bundling multiple insurance policies. It’s worth inquiring about potential discounts to reduce your overall insurance costs.