How Do I Change My Health Insurance

Changing your health insurance can be a complex process, but it is an essential step to ensure you have the coverage you need. Whether you're looking to switch providers, upgrade your plan, or make adjustments to better suit your current circumstances, understanding the steps involved and being aware of potential challenges can make the transition smoother. This guide aims to provide a comprehensive roadmap to navigate the process effectively.

Why Consider Changing Your Health Insurance

There are several compelling reasons why you might decide to make a change to your health insurance coverage. Firstly, your personal circumstances may have evolved, such as getting married, having children, or starting a new job with different benefits. These life changes often necessitate a reevaluation of your insurance needs.

Additionally, the insurance market itself is dynamic. Plans and their associated costs can change annually, and what was once a suitable option might no longer be the best fit. By staying informed about market trends and plan updates, you can identify opportunities to improve your coverage or save on premiums.

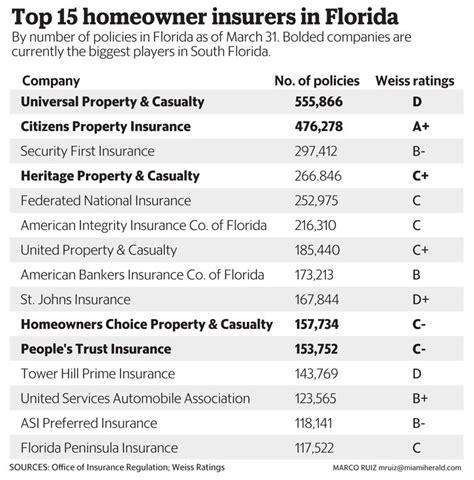

Lastly, it's crucial to keep an eye on the quality and reputation of your current provider. A poor track record or a decline in service quality can be valid reasons to seek alternative options. Regularly assessing your insurance needs and staying up-to-date with market offerings can help you make informed decisions and ensure you have the right coverage when you need it.

Step-by-Step Guide to Changing Your Health Insurance

Switching health insurance providers or plans can be daunting, but breaking it down into manageable steps can make the process more straightforward. Here’s a detailed guide to help you navigate the transition smoothly.

1. Evaluate Your Current Coverage

Before making any changes, it’s essential to understand your existing health insurance plan inside out. This includes knowing your deductibles, co-pays, and out-of-pocket maximums, as well as the specifics of your coverage, such as which treatments, medications, and providers are included.

Take stock of your medical needs and expenses over the past year. Identify areas where your current plan might be lacking or where you've had to pay more out of pocket than you'd like. This evaluation will help you pinpoint the aspects of your coverage that need improvement.

| Coverage Aspect | Current Plan Details |

|---|---|

| Deductible | $[Amount] |

| Co-pay for Doctor Visits | $[Amount] |

| Out-of-Pocket Maximum | $[Amount] |

| Covered Treatments/Medications | [List of Covered Items] |

2. Identify Your Needs and Priorities

Once you’ve evaluated your current coverage, it’s time to determine your specific needs and priorities for your new health insurance plan. Consider factors such as your health status, prescription medication requirements, and the providers you prefer or need access to.

If you have a pre-existing condition or anticipate needing specialized medical care, ensure that potential new plans cover these adequately. For example, if you require regular specialist appointments or have a chronic illness, look for plans with generous coverage limits and low co-pays for these services.

3. Research Available Options

With your needs and priorities defined, it’s time to explore the range of health insurance plans on the market. Start by checking with your employer if you have access to group health insurance plans. These often offer competitive rates and comprehensive coverage. If you’re self-employed or prefer an individual plan, you can compare options on the health insurance marketplace in your state.

When researching plans, pay attention to the network of providers they cover. Ensure that your preferred doctors, hospitals, and specialists are included. Also, carefully review the coverage details, including deductibles, co-pays, and any limits or exclusions that might impact your specific medical needs.

4. Compare Costs and Coverage

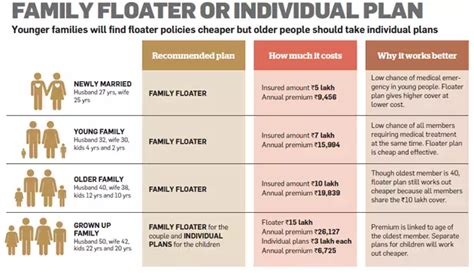

Now that you’ve identified a few potential plans, it’s time to compare their costs and coverage in detail. While it’s tempting to choose the plan with the lowest premium, remember that lower premiums often come with higher deductibles and co-pays, which can increase your out-of-pocket expenses in the long run.

Consider your expected medical needs for the upcoming year and calculate how much you'd likely spend on deductibles and co-pays for each plan. This will help you strike a balance between affordability and adequate coverage. Don't forget to factor in additional costs, such as prescription drug costs or specialist visit fees, which can vary significantly between plans.

5. Assess Transition Challenges

Changing health insurance plans can come with its own set of challenges, particularly when it comes to transitioning your medical care. If you’re currently receiving ongoing treatment or have established relationships with specific healthcare providers, ensure that your new plan covers these services and that your providers are in-network.

If you have pre-authorization requirements for certain procedures or medications, be sure to understand the process for obtaining these under your new plan. You may need to start the authorization process again, which can impact your treatment timeline.

6. Enroll in Your New Plan

Once you’ve selected your new health insurance plan, it’s time to enroll. For employer-sponsored plans, enrollment periods typically coincide with open enrollment windows, which occur annually. If you’re outside of this window, you may need to qualify for a special enrollment period due to a qualifying life event, such as marriage, birth of a child, or loss of previous coverage.

For individual plans, you can enroll during the annual open enrollment period or at any time if you qualify for a special enrollment period due to a life event. Be sure to understand the enrollment deadlines and complete the necessary paperwork accurately and promptly.

7. Maintain Records and Coverage Continuity

As you transition to your new plan, it’s crucial to keep detailed records of your enrollment and coverage changes. This includes summaries of benefits and coverage documents from your new provider. Ensure that your new plan’s effective date provides continuous coverage without any gaps.

If you have ongoing treatments or prescriptions, communicate with your providers and pharmacies to ensure a smooth transition. You may need to provide new insurance information and obtain updated prescriptions or authorizations to continue your care seamlessly.

Common Challenges and How to Navigate Them

Changing health insurance plans can present various challenges, but being prepared and informed can help you navigate these hurdles effectively. Here are some common issues you might encounter and strategies to overcome them.

1. Gaps in Coverage

One of the most significant concerns when changing health insurance is the risk of gaps in coverage. This can occur if there’s a delay in processing your new plan’s enrollment or if there’s a lapse between the end of your old plan and the start of your new one.

To avoid this, coordinate closely with your insurance provider during the enrollment process. Ensure that they understand your need for continuous coverage and that they process your application promptly. If you have any concerns about potential gaps, consider obtaining short-term health insurance to bridge the period until your new plan takes effect.

2. Network Changes

When switching plans, you might find that your preferred providers or specialists are no longer in-network with your new insurance provider. This can be a significant challenge, especially if you have established relationships with these healthcare professionals or require specialized care.

To address this, research the network of providers for your new plan thoroughly before making the switch. If possible, choose a plan that includes your current providers. If this isn't an option, consider the feasibility of changing providers or the potential impact on your treatment plan. In some cases, you may be able to pay out-of-pocket to continue seeing your preferred specialists, but this should be carefully evaluated to ensure it's a financially viable option.

3. Pre-Existing Condition Concerns

If you have a pre-existing medical condition, changing health insurance plans can be more complex. Some plans may have waiting periods or exclusions for certain conditions, which can impact your coverage and out-of-pocket costs.

When researching new plans, carefully review the coverage details for pre-existing conditions. Look for plans that offer immediate coverage or have short waiting periods for these conditions. If you anticipate challenges with a new plan, consider reaching out to your current insurance provider to discuss your options and potential solutions.

4. Prescription Medication Management

Changing health insurance plans often means a change in prescription drug coverage as well. Different plans may have different formularies, which can impact the cost and availability of your medications.

Before making the switch, obtain a list of your current medications and check their coverage under potential new plans. Ensure that your preferred pharmacy is in-network and that your medications are covered at a reasonable cost. If there are concerns about medication availability or cost, discuss these with your pharmacist and consider alternatives or generic options if necessary.

Tips for a Successful Transition

To ensure a smooth transition when changing your health insurance, consider these practical tips and strategies.

- Start the process early to allow sufficient time for research, enrollment, and potential challenges.

- Keep detailed records of your enrollment, coverage changes, and communication with insurance providers.

- Reach out to your current and prospective insurance providers with any questions or concerns. They can provide valuable insights and guidance specific to your situation.

- If you have ongoing treatments or medications, communicate with your healthcare providers to ensure a seamless transition and to address any potential issues promptly.

- Stay informed about your rights and protections under health insurance laws, such as the Affordable Care Act, to ensure you receive the coverage and care you're entitled to.

Conclusion: Taking Control of Your Health Insurance

Changing your health insurance is a critical step in ensuring you have the coverage you need to protect your well-being and financial stability. By understanding your options, researching plans thoroughly, and addressing potential challenges, you can make informed decisions that align with your health and lifestyle needs.

Stay proactive in managing your health insurance, and don't hesitate to seek guidance and support when needed. With the right plan in place, you can have peace of mind knowing you're covered when it matters most.

How often can I change my health insurance plan?

+Typically, you can change your health insurance plan during the annual open enrollment period, which occurs once a year. However, you may also be eligible for a special enrollment period if you experience a qualifying life event, such as marriage, birth of a child, or loss of previous coverage.

What if I need to change my health insurance outside of open enrollment due to a life event?

+In such cases, you may qualify for a special enrollment period. Contact your insurance provider or visit the health insurance marketplace to understand the specific requirements and deadlines for your situation.

How can I compare health insurance plans effectively?

+When comparing plans, focus on coverage details, including deductibles, co-pays, and out-of-pocket maximums. Also, consider the network of providers and specialty services covered. Online tools and resources can help you compare plans side by side to make an informed decision.

Are there any hidden costs associated with changing health insurance plans?

+Yes, there may be additional costs to consider, such as prescription drug costs and specialist visit fees, which can vary significantly between plans. Be sure to review these details carefully when comparing options.