How Does Sr22 Insurance Work

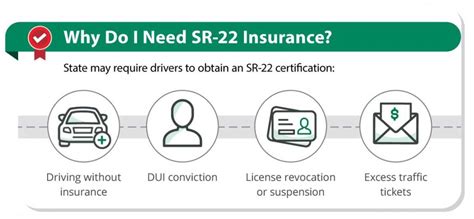

SR22 insurance is a specialized type of coverage that plays a crucial role in the realm of automotive insurance, particularly for individuals with a less-than-stellar driving record. This unique policy comes into play when drivers face legal consequences due to certain offenses, such as driving under the influence (DUI), driving without insurance, or accumulating multiple traffic violations. In this article, we will delve into the intricacies of SR22 insurance, exploring how it works, its purpose, and its significance in the world of automotive safety and compliance.

Understanding SR22 Insurance

SR22 insurance, often referred to as a Certificate of Financial Responsibility, is a document that proves to the state that a driver has met the minimum liability insurance requirements. It is not a traditional insurance policy but rather a guarantee of financial responsibility. This certificate is typically required by state authorities when a driver has committed a serious traffic offense or has had their license suspended or revoked.

The SR22 serves as a promise from the insurance provider to the state that the insured driver has obtained the necessary liability coverage. It ensures that the driver is capable of paying for any damages or injuries they may cause in the event of an accident. By requiring SR22 insurance, states aim to promote safer roads and hold drivers accountable for their actions.

The Process of Obtaining SR22 Insurance

The process of obtaining SR22 insurance begins when a driver is mandated by the state to provide proof of financial responsibility. This mandate is usually triggered by a specific offense or violation. The driver then needs to contact an insurance provider that offers SR22 insurance policies.

The insurance company will guide the driver through the process, which typically involves the following steps:

- Application and Assessment: The driver fills out an application, providing details about their driving record, the nature of the offense, and their current insurance needs.

- Policy Selection: Based on the driver's profile and requirements, the insurance company offers suitable SR22 insurance policies. These policies often have higher premiums due to the increased risk associated with the driver's history.

- SR22 Form Submission: Once the policy is selected, the insurance company completes and submits the SR22 form to the state's Department of Motor Vehicles (DMV) or the relevant authority. This form officially notifies the state that the driver has the required insurance coverage.

- Proof of Insurance: The insurance company provides the driver with proof of insurance, which may include a digital copy of the SR22 certificate. This proof is crucial for reinstating the driver's license and meeting the state's requirements.

It's important to note that SR22 insurance policies are typically valid for a set period, often one or two years. During this time, the driver must maintain continuous coverage to avoid further legal consequences. If the policy lapses or is canceled, the insurance company is required to notify the state, which may result in additional penalties and license suspension.

Coverage and Costs

SR22 insurance policies typically provide the minimum liability coverage required by the state. This coverage includes bodily injury liability, property damage liability, and sometimes additional protections like uninsured/underinsured motorist coverage. The specific coverage limits can vary depending on the state’s regulations and the driver’s preferences.

The cost of SR22 insurance can be significantly higher than standard auto insurance policies. This is because insurance providers consider drivers with SR22 requirements to be high-risk due to their past driving behaviors. The premiums can vary widely based on factors such as the nature of the offense, the driver's location, and their driving record.

Additionally, some insurance companies may offer SR22 insurance on a non-owner basis, which covers the driver only when they are borrowing or renting a vehicle. This option is suitable for individuals who do not own a vehicle but still need to meet SR22 requirements.

| State | Minimum Liability Coverage (SR22) |

|---|---|

| California | 15/30/5 (Bodily Injury/Property Damage) |

| Texas | 30/60/25 (Bodily Injury/Property Damage) |

| New York | 25/50/10 (Bodily Injury/Property Damage) |

Implications and Future Outlook

SR22 insurance plays a critical role in promoting safer roads and ensuring that drivers who have made mistakes in the past are held accountable. By requiring these drivers to maintain liability coverage, states aim to reduce the financial burden on victims of accidents caused by uninsured or underinsured motorists.

The future of SR22 insurance is closely tied to advancements in automotive technology and changes in driving behaviors. As autonomous vehicles and advanced driver-assistance systems become more prevalent, the nature of traffic violations and accidents may evolve. States and insurance providers will need to adapt their policies and requirements to keep up with these changes.

Furthermore, the increasing focus on data-driven insurance and the use of telematics devices may impact SR22 insurance. Insurance providers may leverage real-time driving data to assess risk more accurately, potentially offering incentives or discounts to SR22 policyholders who demonstrate improved driving behaviors.

FAQs

Can I get SR22 insurance if I have a perfect driving record?

+No, SR22 insurance is specifically designed for individuals with a less-than-perfect driving record who have committed serious traffic offenses or had their license suspended. If you have a clean driving record, you would not typically need SR22 insurance.

How long does an SR22 insurance policy last?

+SR22 insurance policies typically have a set duration, often one or two years. After this period, the driver may need to renew the policy or provide a new SR22 certificate to maintain compliance with state requirements.

What happens if I let my SR22 insurance lapse?

+If your SR22 insurance policy lapses or is canceled, the insurance company is required to notify the state. This can result in further penalties, including license suspension or additional fees. It’s crucial to maintain continuous coverage to avoid these consequences.