Auto Insurance Payments

Auto insurance is a necessity for every vehicle owner, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The cost of auto insurance, often referred to as the premium, can vary significantly based on numerous factors, making it a topic of great interest for drivers seeking the best coverage at an affordable price.

This in-depth analysis aims to explore the key aspects of auto insurance payments, offering valuable insights into the factors that influence premium rates, the payment methods available, and strategies to reduce costs without compromising on essential coverage. By understanding these elements, drivers can make informed decisions to secure the right auto insurance policy for their needs.

Factors Influencing Auto Insurance Premiums

The cost of auto insurance is determined by a complex interplay of various factors, each contributing to the overall risk assessment made by insurance providers. Here’s a detailed look at some of the primary factors that can influence your auto insurance premiums:

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining your insurance premium. Generally, sports cars, luxury vehicles, and high-performance SUVs tend to attract higher premiums due to their association with increased accident risks and higher repair costs. Additionally, the primary usage of your vehicle, whether for personal, commercial, or business purposes, can also impact your rates.

Driver Profile and History

Insurance companies carefully scrutinize your driving history when determining your premium. Factors such as the number of years you’ve been driving, any previous accidents or claims, and the number of traffic violations on your record can significantly affect your insurance rates. Younger drivers, especially those under the age of 25, often face higher premiums due to their statistically higher risk of being involved in accidents.

| Risk Factor | Impact on Premium |

|---|---|

| At-Fault Accidents | Can lead to higher premiums or non-renewal of policy |

| Speeding Tickets | May result in increased rates for a period of time |

| DUIs or DWIs | Often lead to substantial rate increases and mandatory SR-22 filing |

Location and Usage Patterns

The geographic location where you primarily drive your vehicle can significantly influence your insurance rates. Areas with higher population densities, busy city centers, or regions with a history of frequent accidents or thefts may experience higher insurance costs. Additionally, the distance you commute daily and the purpose of your trips (e.g., work, pleasure, or business) can also impact your premium.

Credit Score and Financial History

Believe it or not, your credit score can play a role in determining your auto insurance premium. Insurance companies often use credit-based insurance scores to assess risk, and individuals with lower credit scores may face higher premiums. This practice is based on the correlation between credit scores and the likelihood of filing claims.

Coverage and Deductibles

The level of coverage you choose for your auto insurance policy directly affects your premium. Comprehensive and collision coverage, which protect against damage to your vehicle from accidents, theft, or natural disasters, typically increase your premium. Conversely, choosing higher deductibles can lower your premium, as you’ll be paying more out-of-pocket before your insurance coverage kicks in.

Understanding Auto Insurance Payment Methods

Auto insurance providers offer a range of payment methods to accommodate different financial preferences and circumstances. Here’s an overview of the common payment options available:

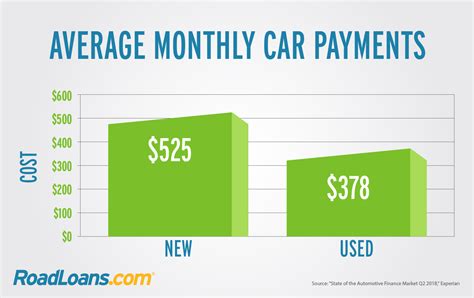

Monthly Payments

Monthly payments are the most common and convenient method for many policyholders. By dividing the annual premium into 12 equal installments, monthly payments make it easier to manage the cost of insurance. However, it’s important to note that some insurance companies may charge a small fee for this payment option, as it involves additional administrative costs.

Semi-Annual or Quarterly Payments

For those who prefer longer payment terms, semi-annual (twice a year) or quarterly (four times a year) payments are available. These payment plans offer a balance between convenience and cost, as they typically don’t incur the same fees as monthly payments. By paying in larger installments, you can also benefit from potential discounts for timely payments.

Annual Lump-Sum Payment

Paying your auto insurance premium in full for the entire year is often the most cost-effective option. Insurance companies usually offer a significant discount for annual payments, as it reduces administrative costs and provides them with a stable cash flow. This method is ideal for those who have the financial means to pay upfront and want to maximize their savings.

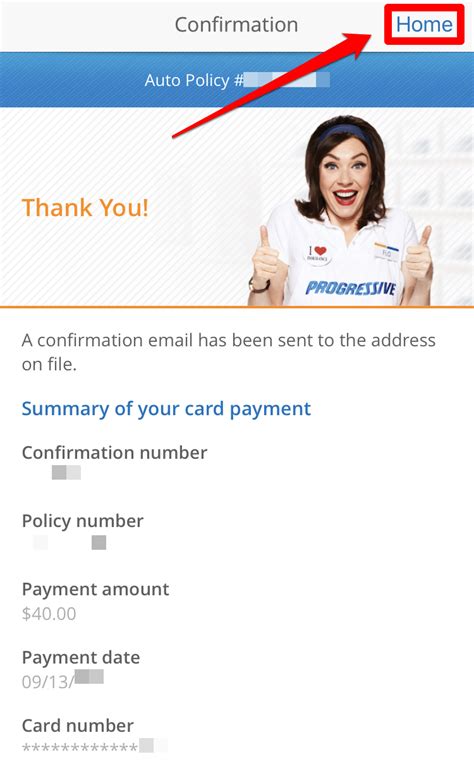

Electronic Payment Options

In today’s digital age, insurance companies offer a variety of electronic payment methods to enhance convenience and security. These include online payments through the insurance provider’s website or app, automatic payments from a bank account, and even mobile payment options like Apple Pay or Google Pay. These methods ensure timely payments and often come with added incentives like discounts or waiver of certain fees.

Strategies to Reduce Auto Insurance Payments

While auto insurance is a necessary expense, there are several strategies you can employ to reduce your payments without compromising on essential coverage. Here are some effective approaches to consider:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from multiple insurance providers. Each company has its own unique rating system and factors that influence premiums, so you may find significant variations in quotes. Online insurance marketplaces or comparison websites can be a great starting point to quickly gather multiple quotes.

Bundle Policies for Discounts

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer multi-policy discounts, which can result in substantial savings. By consolidating your insurance needs, you not only simplify your insurance management but also benefit from reduced rates.

Maintain a Clean Driving Record

Your driving record is a key factor in determining your insurance premium. A clean driving history with no accidents, claims, or traffic violations can lead to significant savings. Avoid risky behaviors like speeding, driving under the influence, or using a cell phone while driving. Additionally, consider taking defensive driving courses, which can often result in insurance discounts and improved driving skills.

Increase Your Deductibles

Opting for higher deductibles can lower your insurance premium. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. By increasing your deductible, you’re assuming more financial responsibility in the event of a claim, which can lead to reduced premiums. However, it’s important to choose a deductible amount that you’re comfortable paying in case of an accident or other covered event.

Explore Discounts and Special Programs

Insurance companies offer a range of discounts and special programs to attract and retain customers. These can include discounts for safe driving, good student discounts, loyalty rewards, or even discounts for belonging to certain professional organizations or alumni associations. Stay informed about the discounts available and don’t hesitate to ask your insurance provider about any applicable programs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or pay-per-mile insurance, is an innovative approach that allows you to pay premiums based on your actual driving behavior and mileage. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as miles driven, time of day, and driving behavior. By adopting safer driving habits and reducing your mileage, you can potentially lower your insurance costs.

Future Implications and Industry Trends

The auto insurance industry is continually evolving, with new technologies and changing consumer preferences driving innovation. Here are some key trends and future implications to consider:

Advanced Telematics and Data Analytics

The use of telematics and data analytics is expected to grow significantly in the auto insurance industry. These technologies enable insurance providers to gather and analyze real-time driving data, offering a more accurate assessment of individual risk. As a result, insurance premiums are likely to become even more personalized, with drivers who exhibit safer driving behaviors potentially benefiting from lower rates.

Increased Focus on Preventative Measures

Insurance companies are increasingly investing in preventative measures to reduce the frequency and severity of accidents. This includes promoting safe driving practices, offering discounts for installing safety features in vehicles, and providing resources for driver education. By incentivizing safer driving, insurance providers aim to create a culture of prevention, ultimately leading to reduced claims and more stable insurance premiums.

Expansion of Usage-Based Insurance

Usage-based insurance is expected to gain wider adoption in the coming years. As more drivers become comfortable with the idea of sharing their driving data, insurance providers will have a more accurate understanding of individual risks. This shift towards pay-as-you-drive models could lead to significant savings for drivers who adopt safer driving practices and reduce their mileage.

Integration of Autonomous Vehicle Technologies

The rise of autonomous vehicle technologies is set to revolutionize the auto insurance industry. As self-driving cars become more prevalent, insurance providers will need to adapt their models to account for the reduced risk of human error. This could potentially lead to lower insurance premiums for autonomous vehicles, as they are expected to significantly reduce the number of accidents on the road.

Personalization of Insurance Policies

In the future, insurance policies are likely to become even more personalized, catering to the unique needs and circumstances of individual drivers. With the advancement of data analytics and artificial intelligence, insurance providers will be able to offer tailored coverage options and pricing based on a comprehensive understanding of each driver’s risk profile.

Collaboration with Mobility Service Providers

The emergence of mobility service providers, such as ride-sharing and car-sharing platforms, is changing the way people use vehicles. Insurance providers are increasingly collaborating with these companies to offer specialized coverage options for shared mobility services. As the sharing economy continues to grow, insurance policies will need to adapt to cover a wider range of vehicle usage scenarios.

How often should I review my auto insurance policy and premiums?

+It’s recommended to review your auto insurance policy and premiums at least once a year, or whenever you experience a significant life event such as a marriage, the birth of a child, or a change in your employment status. Regular reviews allow you to ensure your coverage remains adequate and take advantage of any available discounts.

Can I switch insurance providers to save money on my auto insurance payments?

+Absolutely! Shopping around for auto insurance quotes is a great way to potentially save money. Remember to compare not only the premiums but also the coverage offered by different providers to ensure you’re getting the best value for your money.

What are some common discounts available for auto insurance policies?

+Common discounts for auto insurance policies include safe driver discounts, good student discounts, loyalty rewards, multi-policy discounts (for bundling multiple insurance policies with the same provider), and discounts for belonging to certain professional organizations or alumni associations.

How can I dispute an auto insurance premium increase?

+If you receive a notice of an auto insurance premium increase, it’s important to review the reasons provided by your insurance company. You can dispute the increase by contacting your insurer and providing any relevant information or documentation that may support your case. It’s also beneficial to shop around for quotes from other providers to see if you can find a better rate.