Health Insurance In Arkansas

Health insurance is a vital aspect of personal and family well-being, providing financial protection and access to essential healthcare services. In the state of Arkansas, understanding the landscape of health insurance options is crucial for individuals and families to make informed decisions about their coverage. This comprehensive guide aims to explore the unique features of health insurance in Arkansas, offering insights into plans, providers, and the impact on residents' healthcare experiences.

The Arkansas Health Insurance Market: An Overview

Arkansas, like many states, offers a diverse range of health insurance plans tailored to meet the needs of its residents. The market is characterized by a mix of private and public insurance providers, each with its own network of healthcare facilities and professionals. Understanding the intricacies of this market is key to navigating the path towards adequate healthcare coverage.

Private Health Insurance Providers in Arkansas

Several prominent private insurance companies operate in Arkansas, each with its unique selling points and network of healthcare providers. Blue Cross Blue Shield of Arkansas, for instance, is a well-established player in the state, offering a wide array of plans including individual, family, and employer-sponsored options. Their plans often include comprehensive coverage for essential health benefits such as doctor visits, hospital stays, and prescription medications.

Another notable player is Arkwright Mutual Insurance Company, which specializes in providing insurance solutions for businesses and individuals. Arkwright offers flexible plans that can be customized to meet the specific needs of their policyholders, making them a popular choice for those seeking tailored coverage.

Additionally, UnitedHealthcare, a nationwide provider, has a strong presence in Arkansas. Their plans often feature extensive provider networks, ensuring policyholders have access to a wide range of healthcare professionals and facilities across the state.

| Insurance Provider | Plan Options | Key Features |

|---|---|---|

| Blue Cross Blue Shield of Arkansas | Individual, Family, Employer-sponsored | Comprehensive coverage, extensive provider network |

| Arkwright Mutual Insurance Company | Customizable plans | Flexibility, tailored coverage options |

| UnitedHealthcare | Individual, Family, Medicare | Large provider network, innovative health programs |

Public Health Insurance Programs

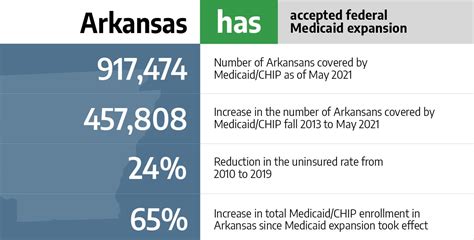

Arkansas also offers public health insurance programs to ensure access to healthcare for vulnerable populations. The Medicaid program, administered by the state, provides coverage to low-income individuals and families, as well as those with disabilities. Additionally, the Children’s Health Insurance Program (CHIP) extends coverage to children whose families may not qualify for Medicaid but still struggle to afford private insurance.

Furthermore, Medicare, a federal program, plays a significant role in Arkansas. This program provides health coverage for individuals aged 65 and older, as well as those with certain disabilities. Private insurance companies in Arkansas often offer Medicare Advantage plans, which provide an alternative way to receive Medicare benefits.

Navigating the Health Insurance Landscape in Arkansas

With a plethora of options available, navigating the health insurance landscape in Arkansas can be daunting. Here are some key considerations and resources to guide your decision-making process.

Understanding Your Needs

Before choosing a health insurance plan, it’s crucial to assess your personal and family healthcare needs. Consider factors such as the frequency of doctor visits, prescription requirements, and potential for major medical procedures. Understanding your healthcare history and any pre-existing conditions is vital for selecting a plan that provides adequate coverage without excessive out-of-pocket costs.

Exploring Plan Options

Arkansas residents have access to a variety of health insurance plans, each with its own set of benefits and drawbacks. Health Maintenance Organization (HMO) plans, for instance, typically offer lower premiums but may have more limited provider networks. On the other hand, Preferred Provider Organization (PPO) plans provide more flexibility in choosing healthcare providers but often come with higher premiums.

For those seeking more affordable options, High Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) can be a viable choice. These plans have lower premiums and allow individuals to save for future healthcare expenses on a tax-advantaged basis. However, it's important to note that HDHPs generally require higher out-of-pocket costs before coverage kicks in.

Comparing Provider Networks

The provider network associated with a health insurance plan is a critical factor to consider. Ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid unexpected out-of-network charges. Some plans, particularly those offered by larger insurance companies, may have more extensive networks, providing greater flexibility in choosing healthcare providers.

Understanding Coverage and Benefits

Reviewing the specifics of coverage and benefits is essential to ensure the plan aligns with your healthcare needs. This includes understanding the plan’s deductibles, co-pays, and coinsurance structures, as well as the specific services and treatments covered. Pay attention to any exclusions or limitations, especially for pre-existing conditions or specialized treatments.

| Plan Type | Key Features |

|---|---|

| HMO | Lower premiums, limited provider network, often requires referrals for specialist care |

| PPO | Higher premiums, more flexible provider choice, typically no referral requirement |

| HDHP with HSA | Lower premiums, tax-advantaged savings for healthcare expenses, higher out-of-pocket costs before coverage |

The Impact of Health Insurance on Arkansas Residents

Health insurance plays a pivotal role in the lives of Arkansas residents, influencing their access to healthcare services and overall well-being. Adequate coverage can mean the difference between timely access to necessary treatments and potential financial strain or health complications.

Access to Healthcare Services

With health insurance, Arkansas residents gain access to a wide range of healthcare services, from preventive care to specialized treatments. This includes regular check-ups, screenings, and vaccinations, which are crucial for maintaining good health and catching potential issues early on. Additionally, health insurance provides coverage for emergency care, ensuring individuals can receive prompt treatment without worrying about the financial burden.

Financial Protection and Peace of Mind

One of the primary benefits of health insurance is the financial protection it offers. Without insurance, the cost of healthcare services can be prohibitively expensive, leading to significant financial strain or even bankruptcy. Health insurance helps mitigate these risks by covering a substantial portion of medical expenses, providing peace of mind that necessary healthcare is accessible without causing financial hardship.

Promoting Healthy Lifestyles

Health insurance often encourages and supports healthy lifestyles through various programs and incentives. Many insurance providers offer wellness programs, providing resources and incentives for policyholders to adopt healthier habits. This can include discounts on gym memberships, access to nutrition counseling, or even rewards for reaching certain health goals.

Future Outlook and Trends in Arkansas Health Insurance

The landscape of health insurance in Arkansas is continually evolving, shaped by various factors including advancements in healthcare, changes in legislation, and shifts in the broader insurance market. Here’s a glimpse into the potential future of health insurance in the state.

Technology and Innovation

Advancements in technology are expected to play a significant role in the future of health insurance. Telehealth services, for instance, have gained prominence during the pandemic and are likely to continue growing in popularity. This trend allows for remote healthcare consultations, improving access to care for individuals in rural areas or those with limited mobility.

Additionally, the integration of artificial intelligence and machine learning in healthcare is poised to transform the insurance industry. These technologies can enhance claims processing, fraud detection, and personalized healthcare recommendations, leading to more efficient and effective insurance processes.

Focus on Preventive Care

There is a growing emphasis on preventive care in the healthcare industry, and this trend is likely to continue. Health insurance providers in Arkansas may increasingly incentivize policyholders to prioritize preventive measures, such as regular check-ups, screenings, and immunizations. By catching potential health issues early, insurance companies can help mitigate the need for more costly treatments down the line, benefiting both the individual and the insurer.

Potential Challenges and Opportunities

The health insurance market in Arkansas, like many other states, faces various challenges and opportunities. One ongoing challenge is ensuring that insurance remains accessible and affordable for all residents, particularly in the context of rising healthcare costs. Additionally, the state may need to address potential gaps in coverage, especially for those with unique healthcare needs or those transitioning between insurance plans.

On the other hand, opportunities exist for innovative solutions to enhance the healthcare experience. This includes the development of more tailored insurance plans, leveraging data analytics to offer personalized coverage options, and exploring new models of care delivery to improve access and affordability.

Conclusion: Empowering Arkansas Residents with Informed Choices

Understanding the intricacies of health insurance in Arkansas is a crucial step towards making informed decisions about coverage. By familiarizing yourself with the various plan options, provider networks, and coverage benefits, you can select a plan that best aligns with your healthcare needs and financial situation. Remember, health insurance is not just about coverage; it’s about ensuring access to quality healthcare and providing peace of mind for you and your family.

What is the Affordable Care Act (ACA) and how does it impact health insurance in Arkansas?

+

The Affordable Care Act (ACA) is a federal law that introduced significant reforms to the U.S. healthcare system, including the establishment of health insurance marketplaces and the expansion of Medicaid. In Arkansas, the ACA has played a crucial role in increasing access to health insurance, particularly through the state’s decision to expand Medicaid coverage. The ACA also mandates certain essential health benefits that must be covered by qualified health plans, ensuring that individuals have access to a range of necessary healthcare services.

How can I determine if I’m eligible for Medicaid or CHIP in Arkansas?

+

Eligibility for Medicaid and CHIP in Arkansas is primarily based on income and family size. The state’s Department of Human Services provides resources to help individuals determine their eligibility. You can visit their website or contact their helpline for more information and guidance on the application process.

What are some common exclusions or limitations in health insurance plans, and how can I avoid them?

+

Common exclusions or limitations in health insurance plans can include pre-existing conditions, certain types of treatments or procedures, and specific services like dental or vision care. To avoid unexpected exclusions, carefully review the plan’s coverage details, including the summary of benefits and coverage, before enrolling. Consider consulting with a licensed insurance agent or using online tools that provide detailed plan information to ensure you understand the plan’s exclusions and limitations.