Cost Pet Insurance

Pet insurance has become an increasingly popular topic of discussion among pet owners, especially as veterinary costs continue to rise. With the rising concern for pet health and the financial burden of unexpected illnesses or accidents, understanding the cost of pet insurance is essential for pet owners looking to safeguard their furry companions' well-being. This comprehensive article will delve into the factors influencing the cost of pet insurance, provide real-world examples, and offer insights to help you make informed decisions about your pet's healthcare.

Understanding the Cost Structure of Pet Insurance

The cost of pet insurance is influenced by a multitude of factors, including the type of coverage, the age and breed of your pet, your location, and any pre-existing conditions. It’s important to note that, like human health insurance, pet insurance policies vary widely, and the cost can differ significantly depending on the chosen plan and provider.

Factors Influencing the Cost of Pet Insurance

Let’s break down the key factors that affect the price of pet insurance:

Type of Coverage

Pet insurance plans can be broadly categorized into accident-only, illness-only, and comprehensive coverage. Accident-only plans typically cover injuries resulting from accidents like broken bones or cuts, while illness-only plans cover conditions such as diabetes, cancer, or gastrointestinal issues. Comprehensive plans, as the name suggests, offer coverage for both accidents and illnesses. Naturally, the more extensive the coverage, the higher the premium.

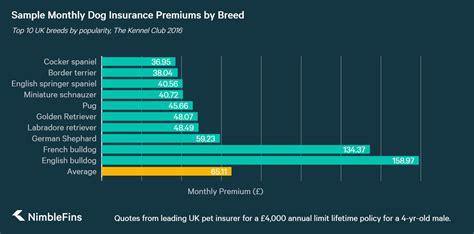

Age and Breed of Your Pet

The age and breed of your pet play a significant role in determining the cost of insurance. Younger pets are generally cheaper to insure as they are less likely to develop age-related health issues. Certain breeds, especially those prone to genetic conditions, may also be more expensive to insure. For example, breeds like Bulldogs or Pugs, which are prone to respiratory issues, may have higher premiums.

Your Location

The cost of living and veterinary care in your area can influence the price of pet insurance. In regions with higher living costs, the premiums are often higher to account for the increased cost of veterinary services.

Pre-existing Conditions

If your pet has a pre-existing condition, it may be more challenging to find affordable insurance, as some providers may exclude these conditions from coverage or charge a higher premium. However, certain providers offer policies specifically for pets with pre-existing conditions, although these may be more expensive.

Real-World Examples of Pet Insurance Costs

To give you a clearer picture, here are some real-world examples of pet insurance costs, based on average premiums for various pets and coverage types:

| Pet Type | Coverage Type | Average Premium (Monthly) |

|---|---|---|

| Dog | Accident-only | $15 - $25 |

| Dog | Illness-only | $25 - $40 |

| Dog | Comprehensive | $40 - $60 |

| Cat | Accident-only | $10 - $20 |

| Cat | Illness-only | $20 - $35 |

| Cat | Comprehensive | $30 - $50 |

Analyzing the Performance and Value of Pet Insurance

Pet insurance can offer significant value to pet owners, especially when unexpected medical emergencies arise. The peace of mind that comes with knowing your pet’s health is protected can be invaluable. However, it’s crucial to analyze the performance of your chosen insurance plan to ensure it meets your needs and expectations.

Performance Analysis of Pet Insurance Plans

When evaluating the performance of a pet insurance plan, consider the following aspects:

Coverage Limits and Deductibles

Understand the coverage limits and deductibles of your plan. Coverage limits refer to the maximum amount the insurance company will pay out for a specific condition or annually. Deductibles, on the other hand, are the amount you must pay out of pocket before the insurance coverage kicks in. Higher deductibles can result in lower premiums, but they also mean you’ll have to pay more out of pocket before the insurance coverage begins.

Reimbursement Process

Familiarize yourself with the reimbursement process. Some insurance companies require you to pay the veterinary bill upfront and then reimburse you, while others may directly pay the veterinarian. Understanding this process can help you manage your finances more effectively.

Exclusions and Fine Print

Carefully read the policy’s fine print to understand any exclusions. Exclusions are conditions or treatments that are not covered by the insurance plan. Being aware of these exclusions can help you make informed decisions about your pet’s healthcare and avoid unexpected out-of-pocket expenses.

Customer Satisfaction and Provider Reputation

Research the reputation and customer satisfaction ratings of the insurance provider. Check online reviews and testimonials to gauge the provider’s performance in terms of claim processing, customer service, and overall satisfaction. A provider with a good reputation and high customer satisfaction is often a safer bet.

Evidence-Based Future Implications

The pet insurance market is evolving, and its future implications are worth considering. As more pet owners recognize the value of insurance, the market is expected to grow, leading to more competitive pricing and innovative coverage options. Additionally, advancements in veterinary medicine may lead to increased costs for treatments, making pet insurance an even more essential aspect of pet ownership.

Conclusion: Making Informed Decisions for Your Pet’s Well-being

Understanding the cost of pet insurance and analyzing the performance of various plans is crucial for ensuring your pet’s health is adequately protected. By considering the factors that influence the cost, analyzing the fine details of different plans, and staying informed about the evolving pet insurance market, you can make well-informed decisions that align with your pet’s needs and your financial capabilities.

FAQ

How do I choose the right pet insurance provider?

+

When selecting a pet insurance provider, consider factors such as the range of coverage options, the clarity of their policy terms, their reputation for claim processing, and customer service. Online reviews and testimonials can provide valuable insights into a provider’s performance. Additionally, ensure that the provider offers coverage for the specific needs of your pet, whether it’s accident-only, illness-only, or comprehensive coverage.

Can I insure an older pet?

+

Yes, you can insure an older pet, but it may be more expensive due to the increased likelihood of age-related health issues. Some providers offer specific policies for senior pets, and it’s worth shopping around to find the best coverage and pricing for your older furry companion.

What happens if I switch pet insurance providers?

+

Switching pet insurance providers may impact your coverage, especially if your pet has developed any new conditions or injuries during the previous coverage period. It’s important to understand the new provider’s policy regarding pre-existing conditions and any waiting periods they may impose before certain conditions are covered. Always read the fine print and understand the terms of the new policy before making the switch.

Are there any government initiatives or subsidies for pet insurance?

+

Currently, there are no widespread government initiatives or subsidies specifically for pet insurance. However, it’s worth checking with local or regional government bodies to see if there are any specific programs or grants available for pet owners in your area. Additionally, some employers may offer pet insurance as a benefit, so it’s worth checking with your employer’s HR department.