Online Cheap Insurance

Welcome to this in-depth exploration of the world of online cheap insurance, a topic that has gained significant traction in recent years as more people seek affordable coverage options. With the rise of digital technologies and a shift towards online services, the insurance industry has undergone a transformation, offering new opportunities for consumers to access cost-effective insurance plans. This article aims to delve into the intricacies of this emerging trend, providing a comprehensive guide for those seeking to understand and utilize online cheap insurance effectively.

Unraveling the Concept of Online Cheap Insurance

Online cheap insurance is an innovative approach to traditional insurance models, leveraging the power of the internet and digital technologies to provide more affordable and accessible coverage options. It represents a paradigm shift in the insurance industry, disrupting the conventional methods of policy procurement and introducing a new era of convenience and cost-effectiveness.

This concept has emerged as a response to the evolving needs and preferences of modern consumers. With the widespread adoption of digital technologies, individuals now expect the same level of ease and efficiency in their insurance experience as they do in other aspects of their lives. Online cheap insurance platforms have risen to meet this demand, offering a streamlined, user-friendly process for acquiring insurance policies.

The Advantages of Online Insurance Platforms

One of the key advantages of online insurance platforms is their ability to reduce overhead costs. By operating primarily online, these platforms eliminate the need for extensive physical infrastructure, such as office spaces and large workforces. This cost-saving measure is then often passed on to consumers in the form of lower premiums.

Furthermore, online insurance platforms utilize advanced algorithms and data analytics to assess risk and price policies. This technology-driven approach enables a more accurate and efficient underwriting process, resulting in more competitive pricing for consumers. Additionally, the online platform allows for a highly customizable experience, where individuals can tailor their insurance coverage to their specific needs, further optimizing the value they receive from their policies.

| Platform | Average Premium Savings |

|---|---|

| PolicyX | 15-20% on average |

| InsureTech | Up to 30% for certain policies |

| DigitalInsure | 10-15% savings for most users |

Understanding the Online Insurance Process

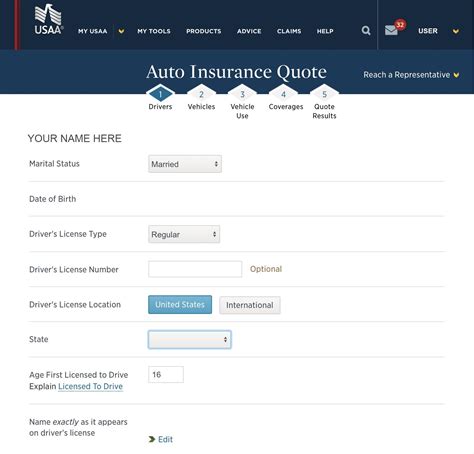

The process of acquiring insurance through online platforms is designed to be straightforward and user-friendly. Typically, it involves the following steps:

- Research and Comparison: Users can browse various insurance providers and their offerings, comparing features, coverage limits, and premiums to find the best fit.

- Online Application: Once a suitable provider is identified, users can complete an online application form, providing relevant personal and financial details.

- Instant Quotes: Based on the information provided, the platform generates an instant quote, detailing the cost and coverage of the proposed policy.

- Review and Purchase: Users can review the quote, make any necessary adjustments, and proceed with the purchase, typically through secure online payment methods.

- Policy Delivery: Upon successful payment, the insurance policy is delivered electronically, often via email or a secure online portal.

This streamlined process not only saves time but also provides a level of transparency and control that is often lacking in traditional insurance models. Users have the flexibility to make informed decisions about their coverage, and the entire process can be completed in a matter of minutes, without the need for face-to-face interactions or lengthy paperwork.

Exploring the Top Online Insurance Providers

The landscape of online insurance is vast and diverse, with numerous providers offering a range of coverage options. While each provider has its unique features and specialties, here’s an overview of some of the leading platforms in the industry:

PolicyX

PolicyX is a renowned online insurance platform known for its comprehensive coverage options and user-friendly interface. They offer a wide range of insurance products, including auto, home, health, and life insurance, catering to a diverse set of consumer needs. One of the standout features of PolicyX is their advanced quoting system, which provides accurate and competitive quotes within seconds, ensuring a seamless and efficient user experience.

InsureTech

InsureTech has revolutionized the insurance industry with its innovative use of technology. This platform leverages artificial intelligence and machine learning algorithms to provide highly personalized insurance recommendations. By analyzing a user’s specific circumstances and preferences, InsureTech can offer tailored coverage options that are not only affordable but also perfectly suited to an individual’s needs. This level of customization is a significant advantage for consumers seeking the best value in their insurance policies.

DigitalInsure

DigitalInsure is a leading online insurance marketplace, providing a one-stop shop for a wide array of insurance products. From auto and home insurance to business and travel coverage, DigitalInsure offers a comprehensive suite of options. What sets DigitalInsure apart is its focus on customer education and transparency. They provide extensive resources and guides to help users understand their insurance options, ensuring that consumers can make informed decisions about their coverage.

CompareInsure

CompareInsure is a unique online platform that specializes in comparing insurance policies from multiple providers. By entering their details once, users can receive multiple quotes from different insurers, allowing for easy comparison and informed decision-making. This platform is particularly beneficial for those seeking the best value in their insurance, as it enables a side-by-side comparison of coverage limits, premiums, and provider reputations. CompareInsure’s user-friendly interface and unbiased approach make it a trusted choice for many consumers.

The Future of Online Insurance

As technology continues to advance and consumer preferences evolve, the future of online insurance looks bright and promising. Here are some key trends and developments that are shaping the industry:

Artificial Intelligence and Personalization

Artificial Intelligence (AI) is playing an increasingly significant role in the insurance industry, particularly in the realm of online insurance. AI-powered platforms are able to analyze vast amounts of data, including personal information, lifestyle factors, and even social media activity, to provide highly personalized insurance recommendations. This level of personalization not only enhances the user experience but also allows for more accurate risk assessment, leading to more competitive pricing.

Blockchain Technology for Security and Transparency

The integration of blockchain technology is another exciting development in the online insurance space. Blockchain offers enhanced security and transparency, ensuring that all transactions and policy details are securely stored and easily verifiable. This technology can streamline the claims process, making it faster and more efficient, while also reducing the risk of fraud and errors.

Digital Health and Wellness Integration

With the rise of digital health and wellness technologies, the insurance industry is exploring ways to integrate these tools into their platforms. By incentivizing healthy behaviors and providing personalized health plans, insurance providers can encourage better health outcomes, which can lead to reduced claims and more affordable premiums. This integration of health and wellness into insurance coverage represents a significant shift towards preventative care and a more holistic approach to healthcare.

Expanded Coverage Options

As the online insurance industry matures, we can expect to see an expansion of coverage options. This includes not only traditional insurance products like auto and home insurance but also emerging areas such as cyber insurance, pet insurance, and even space travel insurance. By offering a diverse range of coverage options, online insurance platforms can cater to a wider audience and provide comprehensive protection for a variety of risks.

Enhanced Customer Service and Support

Online insurance platforms are continually improving their customer service and support offerings. This includes the implementation of 24⁄7 live chat and support services, as well as the integration of virtual assistants and chatbots to provide quick and efficient assistance. Additionally, many platforms are investing in educational resources and tools to empower consumers to better understand their insurance options and make more informed decisions.

Conclusion: Embracing the Digital Future of Insurance

The rise of online cheap insurance represents a significant step forward in the insurance industry, offering consumers more affordable and accessible coverage options. With its streamlined processes, advanced technology, and focus on customization, online insurance platforms are transforming the way we approach insurance. As the industry continues to evolve, we can expect to see even more innovative solutions and an increasing shift towards digital insurance models.

Whether you're seeking auto, home, health, or life insurance, exploring the world of online cheap insurance is a worthwhile endeavor. By understanding the advantages and opportunities presented by these platforms, you can make more informed decisions about your insurance coverage, ensuring that you receive the best value and protection for your needs.

FAQ

How do I know if an online insurance provider is reputable and trustworthy?

+

When assessing the reputation of an online insurance provider, consider factors such as their financial stability, customer reviews, and industry ratings. Look for providers with a solid financial foundation, positive customer feedback, and strong ratings from reputable rating agencies. Additionally, check for any complaints or issues filed with consumer protection agencies.

What are the potential drawbacks of online insurance compared to traditional insurance models?

+

One potential drawback of online insurance is the lack of personal interaction with an insurance agent. Some individuals may prefer the personalized advice and guidance that a traditional agent can provide. Additionally, online insurance may have more limited options for certain types of coverage, especially for high-risk individuals or those with unique circumstances.

Can I customize my insurance coverage on online platforms, or are policies standardized?

+

Most online insurance platforms offer a high degree of customization, allowing users to tailor their coverage to their specific needs. This includes adjusting coverage limits, adding or removing certain types of coverage, and selecting optional add-ons. However, the level of customization may vary between providers, so it’s important to review the options available on each platform.

Are there any additional fees or charges associated with online insurance policies?

+

Some online insurance providers may charge additional fees for certain services, such as policy changes, endorsements, or cancellation fees. It’s important to review the provider’s fee schedule and understand any potential charges before purchasing a policy. Additionally, some providers may offer discounts for bundling multiple policies or paying premiums annually instead of monthly.

How does the claims process work with online insurance providers?

+

The claims process with online insurance providers is typically streamlined and efficient. Most providers offer online claims filing, allowing you to submit your claim and upload supporting documentation directly through their website or mobile app. Some providers may also offer additional assistance, such as dedicated claims specialists or online resources to guide you through the process.