Car Insurance Telephone Numbers

When it comes to car insurance, having access to the right contact information can make all the difference in resolving queries, filing claims, and seeking assistance. This article aims to provide a comprehensive guide to the telephone numbers associated with various car insurance companies, offering an invaluable resource for policyholders and prospective customers alike.

Navigating the Complexities of Car Insurance: A Guide to Contact Numbers

The world of car insurance is intricate, with a multitude of providers, policies, and services. Amidst this complexity, having direct and reliable contact information is essential for efficient customer service and swift resolution of issues. This section will delve into the importance of having access to car insurance telephone numbers and the various ways in which these numbers can be utilized.

Understanding the Role of Car Insurance Contact Numbers

Car insurance contact numbers serve as a direct line of communication between policyholders and insurance companies. These numbers are a vital tool for policyholders to:

- Report accidents or incidents and initiate the claims process.

- Seek clarification on policy terms and conditions.

- Inquire about coverage options and additional services.

- Receive assistance during emergencies or breakdowns.

- Discuss billing and payment inquiries.

For insurance companies, these numbers are a means to provide efficient customer service, build trust, and maintain a positive relationship with their clientele. By offering prompt and reliable support, insurance providers can ensure customer satisfaction and loyalty.

The Variety of Car Insurance Contact Numbers

Car insurance providers typically offer multiple telephone numbers to cater to different needs and situations. Here’s a breakdown of the various types of contact numbers you might encounter:

| Contact Type | Description |

|---|---|

| Customer Service | A general number for policy-related inquiries, billing questions, and basic assistance. |

| Claims Reporting | A dedicated line for reporting accidents and initiating the claims process. |

| Roadside Assistance | A number to call for emergency assistance, such as towing, flat tire repair, or fuel delivery. |

| Sales and New Policies | A contact for prospective customers to inquire about policies, coverage, and to initiate the purchasing process. |

| Complaints and Disputes | A dedicated line for customers to voice concerns or file complaints. |

Each insurance company may have a unique structure for their contact numbers, so it's essential to familiarize yourself with the specific numbers offered by your provider.

Maximizing the Benefits of Car Insurance Contact Numbers

Knowing the right number to call and when to call it can significantly impact the efficiency and outcome of your interaction with the insurance company. Here are some tips to maximize the benefits of car insurance contact numbers:

- Save the numbers: Keep the contact numbers for your insurance provider readily accessible, such as in your phone’s contacts or wallet.

- Understand the hierarchy: Recognize the purpose of each number and call the appropriate line for your specific need.

- Prepare for calls: Have your policy number and relevant details ready to provide accurate and efficient assistance.

- Utilize online resources: Many insurance companies offer online portals or mobile apps that can streamline the claims process and reduce the need for phone calls.

- Explore additional contact methods: Some providers offer live chat, email, or social media support, which can be more convenient for certain inquiries.

Real-World Examples: Case Studies of Effective Use of Car Insurance Contact Numbers

To illustrate the importance and impact of having access to car insurance contact numbers, let’s explore some real-world case studies:

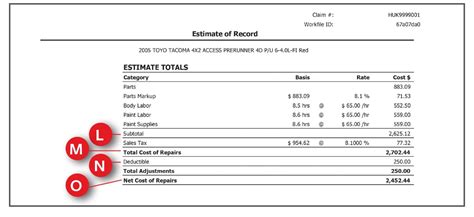

Case Study 1: Swift Claims Resolution

Sarah, a policyholder with Example Insurance, was involved in a minor accident while driving. She immediately called the dedicated claims reporting number provided by her insurance company. The claims representative guided her through the process, ensuring all necessary information was gathered, and within a few days, her claim was approved, and repairs were initiated.

Case Study 2: Emergency Roadside Assistance

John, a frequent traveler, encountered a flat tire during a road trip. He called the roadside assistance number provided by his insurance company. Within an hour, a tow truck arrived, and he was on his way again, thanks to the prompt and efficient service.

Case Study 3: Policy Clarification

Emily, a new policyholder, had questions about her coverage. She called the customer service number and received detailed explanations from a knowledgeable representative, helping her understand her policy and feel confident in her choice.

The Future of Car Insurance Contact Numbers

As technology advances, the way we interact with insurance companies is evolving. While telephone numbers remain a vital part of customer service, the rise of digital communication channels is shaping the future of car insurance support. Here’s a glimpse into what we can expect:

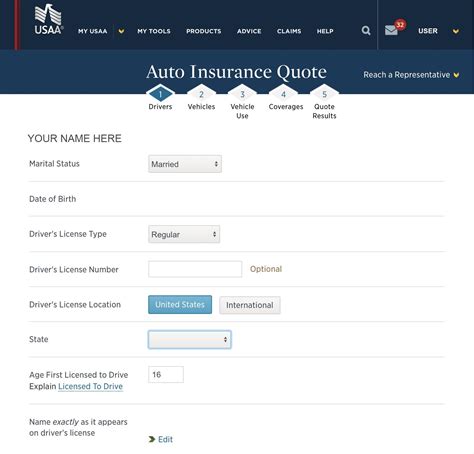

- Enhanced Online Portals: Insurance companies are investing in user-friendly online platforms that allow policyholders to manage their policies, file claims, and receive updates in real-time.

- Live Chat and Messaging: Real-time chat support and messaging services are becoming more prevalent, offering policyholders instant assistance without the need for phone calls.

- Video Conferencing: Some insurers are exploring video conferencing as a means to provide personalized support and streamline the claims process.

- AI-Powered Assistance: Artificial Intelligence is being leveraged to provide automated support, answer common queries, and guide policyholders through the claims process.

Conclusion: Empowering Policyholders with Knowledge

Car insurance telephone numbers are a crucial tool for policyholders to navigate the complex world of insurance. By understanding the different types of contact numbers and how to utilize them effectively, policyholders can ensure a smooth and stress-free experience when dealing with insurance-related matters. As the industry continues to evolve, embracing new technologies, staying informed about the available contact methods will empower policyholders to make the most of their insurance coverage.

How do I find the contact numbers for my insurance provider?

+You can typically find the contact numbers for your insurance provider on their website, policy documents, or by searching for their name online. Additionally, many providers have dedicated apps that provide easy access to contact information and other policy-related details.

What should I do if I cannot reach my insurance provider by phone?

+If you are unable to reach your insurance provider by phone, try alternative contact methods such as email, live chat, or social media. Additionally, you can check their website for online resources or portals that may offer self-service options.

Are there any costs associated with calling car insurance contact numbers?

+The cost of calling car insurance contact numbers can vary depending on the provider and the nature of the call. Some providers offer toll-free numbers, while others may have local or long-distance rates. It’s advisable to check with your insurance provider or refer to your policy documents for specific information.

Can I use car insurance contact numbers for non-emergency inquiries?

+Absolutely! Car insurance contact numbers are not just for emergencies. You can use them for a variety of non-emergency inquiries, such as policy updates, billing questions, or to seek general advice. Just ensure you call the appropriate number for your specific inquiry.