A M Best Ratings For Insurance Companies

In the world of insurance, ratings play a crucial role in evaluating the financial strength and stability of insurance companies. One of the most widely recognized and respected rating agencies is A.M. Best, a global credit rating organization specializing in the insurance industry. A.M. Best provides comprehensive ratings and analysis, offering insights into the financial health and performance of insurance providers. In this article, we delve into the world of A.M. Best ratings, exploring their significance, rating categories, and how they impact insurance companies and policyholders.

Understanding A.M. Best Ratings

A.M. Best has been a trusted source of insurance ratings for over a century, establishing itself as a leader in the industry. Their ratings provide a valuable assessment of an insurance company’s ability to meet its financial obligations, including paying claims to policyholders. These ratings are widely used by various stakeholders, including investors, regulators, and consumers, to make informed decisions regarding insurance companies.

The A.M. Best rating system is based on a comprehensive evaluation of an insurance company's financial strength, operational performance, and market profile. They employ a sophisticated methodology, considering various factors such as risk management, underwriting practices, investment portfolio, and overall financial stability. By analyzing these aspects, A.M. Best assigns ratings that reflect the company's creditworthiness and ability to withstand adverse economic conditions.

The Rating Scale

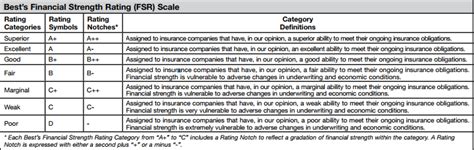

A.M. Best utilizes a straightforward alphanumeric rating scale to categorize insurance companies. The ratings range from the highest level of financial strength, denoted by A++ (Superior), to the lowest level, F (In Liquidation). Here’s a breakdown of the rating scale, along with the associated categories and their implications:

| Rating Category | Description |

|---|---|

| A++ (Superior) | Companies with this rating exhibit exceptional financial strength and are considered to have the highest level of creditworthiness. They have an outstanding ability to meet their obligations and are well-positioned to withstand potential adverse events. |

| A+ (Superior) | A+ rated companies also demonstrate strong financial strength and are highly regarded for their creditworthiness. They have a solid track record and are well-prepared to handle financial challenges. |

| A (Excellent) | Insurance companies with an A rating are considered financially strong and have a strong capacity to meet their obligations. While not at the highest level, they still provide a high level of security for policyholders. |

| A- (Excellent) | A- rated companies exhibit good financial strength, although they may have slightly lower levels of creditworthiness compared to higher-rated companies. They are still considered reliable and pose a low risk to policyholders. |

| B++ (Good) | Companies in the B++ category demonstrate adequate financial strength and are considered stable. While they may have some vulnerabilities, they are generally capable of meeting their obligations. |

| B+ (Good) | B+ rated companies have similar characteristics to B++ companies but may have slightly higher vulnerabilities. They are still regarded as financially stable but may require closer monitoring. |

| B (Good) | Insurance companies with a B rating have satisfactory financial strength but may face certain challenges or weaknesses. Policyholders should exercise caution and closely monitor their financial performance. |

| B- (Fair) | Companies rated B- exhibit financial weaknesses and may face significant challenges. Policyholders should exercise extreme caution and consider alternative options. |

| C++ (Fair) | C++ rated companies have very limited financial strength and are at a high risk of default. Policyholders should carefully assess the potential risks before choosing these companies. |

| C+ (Fair) | C+ rated companies are in a similar situation to C++ companies but may have slightly better financial stability. However, they still pose a significant risk to policyholders. |

| C (Fair) | Insurance companies with a C rating have very limited financial resources and are considered high-risk. Policyholders should avoid these companies unless they have no other options. |

| D (Weak) | D rated companies are in a critical financial situation and may be on the brink of default. Policyholders should avoid these companies at all costs. |

| E (Weak) | E rated companies are in an extremely weak financial position and are at a high risk of insolvency. Policyholders should immediately review their coverage and explore alternatives. |

| F (In Liquidation) | Companies with an F rating are in the process of liquidation or are already in a state of insolvency. Policyholders should take immediate action to protect their interests. |

The Impact of A.M. Best Ratings

A.M. Best ratings have a significant impact on various aspects of the insurance industry and play a crucial role in shaping the market.

Investor Confidence and Market Stability

A.M. Best ratings are closely watched by investors, particularly those looking to invest in insurance-related securities. A strong rating from A.M. Best boosts investor confidence, attracting capital and fostering market stability. On the other hand, a downgrade or a weak rating can lead to investor withdrawal, potentially causing financial strain on the insurance company.

Regulatory Oversight

Insurance regulators utilize A.M. Best ratings as a key tool in their oversight responsibilities. These ratings provide an independent assessment of an insurance company’s financial health, allowing regulators to identify potential risks and take necessary actions to protect policyholders and maintain market integrity.

Consumer Choices and Trust

For consumers, A.M. Best ratings are invaluable. Policyholders can make informed decisions by understanding the financial stability of insurance companies. A strong rating instills confidence and trust, while a weak rating may prompt consumers to seek alternative providers. By relying on A.M. Best ratings, consumers can ensure their financial protection and peace of mind.

The Rating Process

A.M. Best employs a rigorous and comprehensive process to determine an insurance company’s rating. This process involves a detailed examination of various financial and operational metrics, as well as qualitative assessments.

Financial Analysis

The financial analysis is a critical component of the rating process. A.M. Best evaluates an insurance company’s financial statements, including its balance sheet, income statement, and cash flow statement. They assess the company’s capital adequacy, profitability, liquidity, and overall financial stability. By analyzing these metrics, A.M. Best can identify potential risks and strengths, forming the basis for the rating.

Operational Assessment

In addition to financial analysis, A.M. Best conducts a thorough operational assessment. This involves evaluating the insurance company’s business model, risk management practices, underwriting standards, and claims handling processes. They examine the company’s ability to effectively manage risks, its operational efficiency, and its overall market position. This assessment provides insights into the company’s long-term sustainability and its ability to adapt to changing market conditions.

Market Profile and Reputation

A.M. Best also considers the insurance company’s market profile and reputation. They analyze the company’s market share, its competitive positioning, and its reputation among industry peers and consumers. A strong market position and a positive reputation can enhance an insurance company’s rating, while a weak market presence or negative reputation may lead to a downgrade.

Rating Outlook and Stability

A.M. Best ratings are not static; they are subject to periodic reviews and adjustments based on the insurance company’s performance and market conditions. The rating outlook, which can be positive, negative, or stable, provides insights into the potential direction of the rating in the near future.

A positive outlook indicates that A.M. Best expects the insurance company's financial strength and performance to improve. This could be due to factors such as successful strategic initiatives, improved financial results, or enhanced risk management practices. A negative outlook, on the other hand, suggests that the company's financial health may deteriorate, potentially leading to a downgrade.

A stable outlook indicates that A.M. Best believes the insurance company's rating is likely to remain unchanged in the short to medium term. This stability is based on the company's consistent financial performance, effective risk management, and its ability to navigate market challenges.

A.M. Best’s Role in Insurance Industry Oversight

A.M. Best plays a vital role in overseeing the insurance industry and ensuring its stability and integrity. By providing independent and transparent ratings, they help maintain market discipline and promote best practices among insurance companies. Their ratings serve as a benchmark for industry standards, encouraging companies to maintain robust financial health and strong risk management practices.

A.M. Best's ratings also provide an early warning system for potential financial distress. By closely monitoring insurance companies, they can identify emerging risks and provide timely alerts to stakeholders. This proactive approach helps prevent systemic issues and protects policyholders' interests.

The Future of A.M. Best Ratings

As the insurance industry continues to evolve, A.M. Best remains committed to adapting its rating methodologies to reflect changing market dynamics and emerging risks. They continuously refine their models and criteria to ensure their ratings remain relevant and reliable.

One of the key areas of focus for A.M. Best is the impact of technological advancements and digital transformation on the insurance industry. As insurance companies embrace innovative technologies, A.M. Best evaluates the potential risks and opportunities associated with these changes. They aim to incorporate the impact of technology into their rating assessments, ensuring that ratings accurately reflect the evolving landscape.

Conclusion

A.M. Best ratings are an essential tool for evaluating the financial strength and stability of insurance companies. These ratings provide valuable insights for investors, regulators, and consumers, helping them make informed decisions. By understanding the A.M. Best rating scale, the rating process, and the implications of ratings, stakeholders can navigate the insurance market with confidence and ensure their financial protection.

Frequently Asked Questions

How often does A.M. Best update its ratings for insurance companies?

+A.M. Best conducts periodic reviews of insurance companies’ financial health and market performance. The frequency of updates can vary, but typically, companies are reviewed annually or as significant changes occur. A.M. Best may also initiate special reviews if new information becomes available or if there are concerns about an insurance company’s financial stability.

Can an insurance company’s rating improve or worsen over time?

+Absolutely. A.M. Best’s ratings are dynamic and can change based on an insurance company’s performance and market conditions. If a company demonstrates improved financial strength, risk management practices, or market position, its rating may be upgraded. Conversely, if the company experiences financial challenges or fails to meet expectations, its rating may be downgraded.

What factors can lead to a downgrade in an insurance company’s rating?

+A downgrade in an insurance company’s rating can be triggered by various factors. These may include financial losses, poor risk management practices, declining market share, increased regulatory scrutiny, or a deterioration in the company’s overall financial health. A.M. Best continuously monitors these factors and adjusts ratings accordingly.

Are A.M. Best ratings the only consideration when choosing an insurance company?

+While A.M. Best ratings are a crucial factor in evaluating an insurance company’s financial stability, they are not the sole consideration. Consumers should also assess the company’s reputation, customer service, product offerings, and personalized needs. It’s important to strike a balance between financial stability and the company’s overall fit for the individual or business seeking insurance coverage.