Affordable Life Insurance Policies

In today's world, life insurance is an essential financial tool that provides peace of mind and security for individuals and their families. However, the cost of life insurance policies can often be a barrier for many people, especially those on a tight budget or with specific financial constraints. The good news is that there are affordable life insurance options available that offer comprehensive coverage without breaking the bank. In this article, we will delve into the world of affordable life insurance policies, exploring the factors that influence their cost, the different types of policies available, and strategies to find the best value for your money.

Understanding Affordable Life Insurance Policies

Affordable life insurance policies are designed to offer adequate coverage at a price that is within the reach of a broad range of individuals. These policies prioritize accessibility and cater to those who may not have significant financial resources but still recognize the importance of protecting their loved ones’ future. By understanding the key factors that impact the cost of life insurance, you can make informed decisions and find a policy that aligns with your budget and needs.

Factors Influencing Policy Cost

The cost of a life insurance policy is determined by several factors, each playing a crucial role in the overall premium. Here are some of the key considerations:

- Age: Age is a significant factor in determining life insurance premiums. Generally, younger individuals pay lower premiums as they are considered to be at a lower risk of health issues and mortality.

- Health Status: Your current health and medical history are vital in assessing the risk associated with insuring you. Pre-existing conditions, lifestyle habits, and overall health can impact the cost of your policy.

- Coverage Amount: The amount of coverage you require directly influences the cost. Higher coverage amounts typically result in higher premiums.

- Policy Type: Different types of life insurance policies carry varying costs. Term life insurance, for instance, is often more affordable compared to permanent life insurance policies like whole life or universal life.

- Tobacco Use: Smoking or using tobacco products can significantly increase your life insurance premiums due to the associated health risks.

- Occupation and Hobbies: Certain high-risk occupations or hobbies may lead to higher premiums as they increase the likelihood of accidents or health complications.

- Gender: In some regions, gender is considered a factor in life insurance pricing, with men often paying slightly higher premiums due to historical differences in life expectancy.

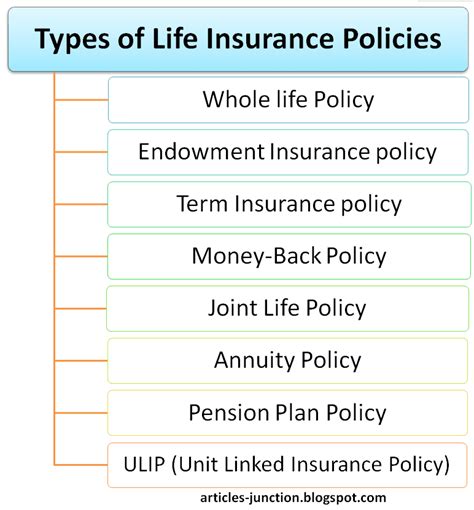

Types of Affordable Life Insurance Policies

Understanding the different types of life insurance policies is essential when seeking affordable coverage. Here are some common options to consider:

Term Life Insurance

Term life insurance is a popular choice for those seeking affordable coverage. This type of policy provides coverage for a specified term, typically ranging from 10 to 30 years. During the term, the policy offers a fixed death benefit, and the premiums remain constant. Term life insurance is ideal for individuals who require coverage for a specific period, such as until their children become independent or until their mortgage is paid off. The affordability of term life insurance makes it an attractive option for budget-conscious individuals.

Simplified Issue or Guaranteed Issue Policies

Simplified issue and guaranteed issue life insurance policies are designed to provide coverage without extensive medical underwriting. These policies are often more accessible to individuals with pre-existing health conditions or those who may have difficulty qualifying for traditional life insurance. Simplified issue policies require a simplified application process and may involve a few health-related questions, while guaranteed issue policies provide coverage without any medical examination or health questions. While these policies may have higher premiums due to the increased risk, they offer an affordable solution for those who may be denied coverage elsewhere.

Group Life Insurance

Group life insurance policies are commonly offered through employers or membership organizations. These policies provide coverage to a group of individuals, often at a discounted rate. The affordability of group life insurance stems from the fact that the risk is spread across a large pool of policyholders. Additionally, group policies may offer additional benefits and features, making them an attractive option for employees or members.

Final Expense or Burial Insurance

Final expense or burial insurance policies are designed to cover the costs associated with end-of-life expenses, including funeral and burial costs. These policies typically have lower coverage amounts and are intended to provide peace of mind for individuals who wish to ensure their final arrangements are taken care of. Final expense insurance is often affordable and accessible, making it a popular choice for seniors or those with specific end-of-life planning needs.

Strategies for Finding Affordable Life Insurance

When seeking affordable life insurance, there are several strategies you can employ to ensure you get the best value for your money. Here are some tips to consider:

Shop Around and Compare

Life insurance is a competitive market, and rates can vary significantly between providers. Shopping around and comparing quotes from multiple insurers is essential to finding the most affordable policy for your needs. Online comparison tools and independent insurance brokers can simplify this process, allowing you to quickly assess different options.

Consider Your Needs and Prioritize Coverage

Before purchasing a life insurance policy, it’s crucial to assess your specific needs and determine the level of coverage required. Consider your financial obligations, such as outstanding debts, mortgage payments, and the financial well-being of your loved ones. By understanding your needs, you can choose a policy that provides adequate coverage without paying for unnecessary extras.

Review Your Policy Regularly

Life insurance policies should be reviewed periodically to ensure they remain aligned with your changing circumstances and needs. As your financial situation evolves, your life insurance coverage may need to be adjusted. Regular reviews can help you identify opportunities to optimize your policy, whether it’s increasing coverage, adjusting beneficiaries, or exploring more affordable options.

Consider Term Conversion Options

If you have a term life insurance policy, it’s essential to understand your conversion options. Many term policies allow you to convert your coverage to a permanent life insurance policy, such as whole life or universal life, without undergoing a new medical exam. This can be beneficial if your financial situation improves over time, allowing you to transition to a more comprehensive policy without worrying about health-related exclusions.

Bundle Policies and Explore Discounts

Some life insurance providers offer discounts when you bundle multiple policies or combine life insurance with other insurance products. For example, you may be eligible for a discount if you already have auto or home insurance with the same provider. Exploring these bundling options and discounts can help you save on your life insurance premiums.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle can have a positive impact on your life insurance premiums. Insurers often reward policyholders who maintain good health and engage in healthy habits. Regular exercise, a balanced diet, and avoiding tobacco products can lead to lower premiums and improved overall health.

Performance and Value Analysis

When evaluating the performance and value of affordable life insurance policies, it’s essential to consider various factors. Here’s a breakdown of key considerations:

Coverage Amount and Flexibility

Affordable life insurance policies should offer sufficient coverage to meet your specific needs. Assess the coverage amount provided by different policies and ensure it aligns with your financial obligations and goals. Additionally, consider the flexibility of the policy. Some policies allow for adjustments to coverage amounts over time, accommodating changes in your financial situation.

Premiums and Payment Options

Premiums are a critical aspect of any life insurance policy. Compare the premiums offered by different insurers and assess the payment options available. Many insurers offer flexible payment plans, such as monthly, quarterly, or annual payments. Evaluate the affordability of the premiums and consider whether you prefer a fixed or variable premium structure.

Policy Riders and Additional Benefits

Affordable life insurance policies may include additional riders or benefits that enhance the value of your coverage. Common riders include accelerated death benefits, waiver of premium, and accidental death benefits. These riders can provide extra protection and support in specific situations. Assess the availability and cost of these riders to determine their value and whether they align with your needs.

Claims Process and Customer Service

The claims process and customer service offered by the insurer are vital aspects to consider. Evaluate the insurer’s reputation for prompt and efficient claims handling. Read reviews and seek recommendations from friends and family to gain insights into their customer service experience. A responsive and supportive insurer can provide peace of mind during challenging times.

Future Implications and Industry Trends

The life insurance industry is continually evolving, and several trends and developments are shaping the future of affordable life insurance policies. Here’s a glimpse into the potential implications:

Digital Transformation

The increasing adoption of digital technologies is transforming the life insurance industry. Insurers are leveraging digital platforms and tools to streamline the application process, provide personalized quotes, and offer enhanced customer service. This digital transformation can lead to more efficient and accessible insurance options, benefiting consumers seeking affordable coverage.

Health and Wellness Initiatives

Many life insurance providers are incorporating health and wellness initiatives into their policies. These initiatives aim to encourage policyholders to adopt healthier lifestyles, often resulting in lower premiums. By promoting wellness and providing incentives for healthy habits, insurers can reduce the risk associated with certain policies, making them more affordable for individuals who embrace a healthy lifestyle.

Customized and Personalized Coverage

The future of affordable life insurance lies in customized and personalized coverage options. Insurers are increasingly utilizing data and analytics to offer tailored policies that align with individual needs and circumstances. This shift towards personalized coverage ensures that policyholders only pay for the coverage they require, maximizing the value and affordability of their life insurance.

Increased Competition and Innovation

The life insurance market is highly competitive, and insurers are constantly innovating to gain a competitive edge. This competition drives down prices and encourages the development of more affordable and accessible policies. As the industry evolves, we can expect to see continued innovation and a wider range of affordable life insurance options.

Integration of New Technologies

Advancements in technology, such as artificial intelligence and machine learning, are shaping the future of the life insurance industry. These technologies can streamline the underwriting process, reduce administrative costs, and enhance the accuracy of risk assessment. The integration of new technologies can lead to more efficient and affordable life insurance options, benefiting consumers seeking accessible coverage.

Conclusion

Affordable life insurance policies are a vital component of financial planning, providing security and peace of mind for individuals and their families. By understanding the factors that influence policy cost, exploring the different types of affordable policies, and employing strategic approaches to finding the best value, you can secure comprehensive coverage without straining your budget. As the life insurance industry continues to evolve, embracing digital transformation, health initiatives, and personalized coverage, the future looks bright for affordable life insurance options.

How much does life insurance cost on average?

+The average cost of life insurance can vary significantly based on factors such as age, health status, coverage amount, and policy type. As a general guideline, a healthy 30-year-old non-smoker can expect to pay around 20 to 30 per month for a $500,000 term life insurance policy. However, it’s important to note that rates can differ widely, and shopping around for quotes is essential to find the most affordable option.

Can I get life insurance if I have a pre-existing medical condition?

+Absolutely! While pre-existing medical conditions may impact the cost and availability of life insurance, there are options available for individuals with health concerns. Simplified issue or guaranteed issue policies are designed to provide coverage without extensive medical underwriting, making them accessible to those with pre-existing conditions. It’s important to carefully review the policy terms and conditions to understand any potential limitations or exclusions.

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years. It offers a fixed death benefit and is often more affordable compared to permanent life insurance policies. Permanent life insurance, such as whole life or universal life, provides coverage for the insured’s entire life and typically includes a cash value component that can be accessed during the policyholder’s lifetime. Permanent life insurance policies are often more expensive but offer long-term financial benefits.