State Farm Automobile Insurance

Welcome to a comprehensive guide on State Farm Automobile Insurance, a trusted provider in the world of automotive coverage. With a rich history spanning decades, State Farm has become a household name synonymous with reliable insurance solutions. In this article, we will delve into the intricacies of their automobile insurance offerings, exploring the benefits, coverage options, and the impact they have on policyholders.

A Legacy of Trust: State Farm’s Automobile Insurance Journey

State Farm’s story began in 1922, when a young George J. Mecherle, an insurance salesman, recognized the need for affordable auto insurance for responsible drivers. His vision laid the foundation for what would become one of the largest insurance providers in the United States. Over the years, State Farm has evolved to meet the changing needs of drivers, offering a comprehensive suite of insurance products.

Today, State Farm Automobile Insurance stands as a pillar of the industry, known for its commitment to customer satisfaction and innovative coverage options. Let's explore the key features and advantages that make State Farm a preferred choice for millions of drivers across the nation.

Comprehensive Coverage Options: Tailored to Your Needs

State Farm understands that every driver has unique requirements when it comes to automobile insurance. To cater to this diversity, they offer a wide range of coverage options, ensuring that policyholders can customize their plans to fit their specific needs and budgets.

Liability Coverage

Liability coverage is a cornerstone of any automobile insurance policy. State Farm provides robust protection for policyholders, covering bodily injury and property damage liabilities that may arise from at-fault accidents. This coverage ensures that you are financially safeguarded in the event of an unfortunate incident, providing peace of mind on the road.

Collision and Comprehensive Coverage

For comprehensive protection, State Farm offers collision and comprehensive coverage. Collision coverage steps in to cover the costs of repairing or replacing your vehicle in the event of an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against damages caused by non-collision incidents such as theft, vandalism, or natural disasters. This dual coverage provides a safety net for your vehicle, ensuring it remains protected under various circumstances.

Medical Payments and Personal Injury Protection

State Farm prioritizes the well-being of its policyholders by offering medical payments and personal injury protection (PIP) coverage. Medical payments coverage assists with the medical expenses incurred by you or your passengers after an accident, regardless of fault. PIP coverage goes a step further, providing broader medical, disability, and even funeral expense coverage, ensuring that you and your loved ones are taken care of during challenging times.

Uninsured/Underinsured Motorist Coverage

In a world where not all drivers carry adequate insurance, State Farm offers uninsured/underinsured motorist coverage. This coverage protects you in the event of an accident caused by a driver who lacks sufficient insurance coverage. By including this coverage in your policy, State Farm ensures that you are not left financially burdened in such scenarios, providing an extra layer of security.

Innovative Features and Benefits: Enhancing Your Insurance Experience

State Farm is not just about comprehensive coverage; they continuously innovate to enhance the overall insurance experience for their policyholders. Let’s explore some of the unique features and benefits that set State Farm Automobile Insurance apart from the competition.

Drive Safe & Save®

State Farm’s Drive Safe & Save® program is a game-changer for safe drivers. This innovative program utilizes telematics technology to track and reward safe driving habits. By installing a small device in your vehicle, State Farm can monitor your driving behavior, including factors like speed, acceleration, and braking. Safe driving habits can lead to discounts on your insurance premiums, making this program a win-win for both State Farm and its policyholders.

Accident Forgiveness

Accidents happen, and State Farm understands that a single mistake shouldn’t define your entire driving record. With their Accident Forgiveness feature, State Farm rewards policyholders for their long-term loyalty by forgiving their first at-fault accident. This means that your premiums won’t increase after your first accident, providing a much-needed safety net for drivers who have maintained a clean record.

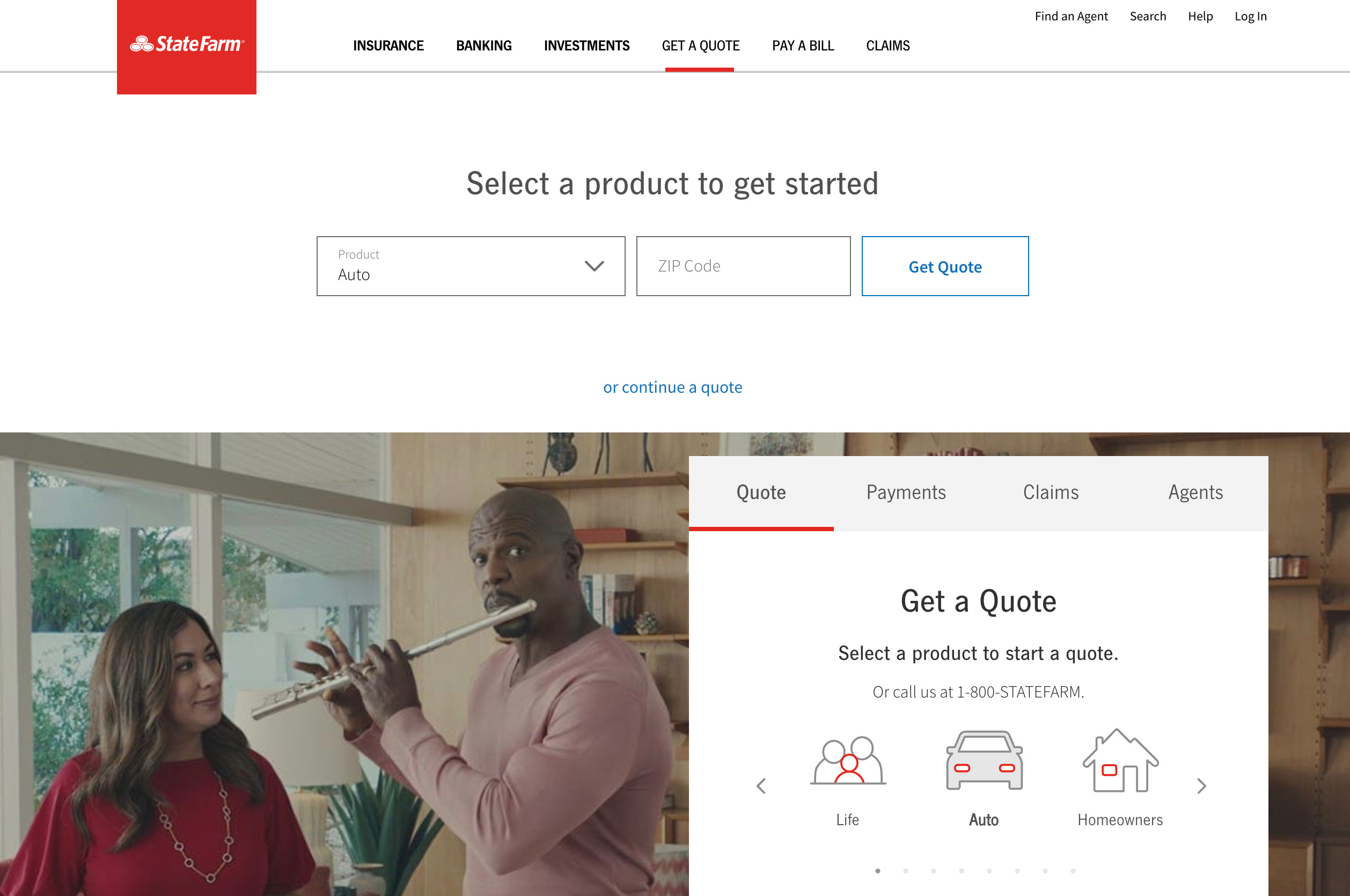

Mobile App and Digital Tools

State Farm embraces the digital age by offering a user-friendly mobile app and a suite of online tools. Policyholders can manage their accounts, file claims, and access important policy information with just a few taps on their smartphones. The app also includes features like digital ID cards and accident checklists, making it easier than ever to stay organized and informed.

Claims Handling Excellence

When it matters most, State Farm excels in claims handling. Their dedicated claims team is known for its efficiency and empathy, ensuring that policyholders receive prompt and fair settlements. State Farm’s claims process is designed to be seamless, with a focus on minimizing stress during already challenging times.

Real-World Performance: A Track Record of Excellence

State Farm’s commitment to excellence is not just a marketing slogan; it’s a reality reflected in their outstanding performance metrics and customer satisfaction ratings.

| Metric | Performance |

|---|---|

| Customer Satisfaction | State Farm consistently ranks among the top insurance providers in customer satisfaction surveys, with a strong focus on building long-lasting relationships. |

| Claims Handling | State Farm's claims team has a reputation for efficiency and empathy, ensuring timely and fair settlements. |

| Financial Strength | With a long history of financial stability, State Farm maintains an A++ rating from A.M. Best, indicating its ability to meet policyholder obligations. |

| Innovation | State Farm's commitment to innovation is evident in its Drive Safe & Save® program and other digital initiatives, keeping it at the forefront of the industry. |

These performance metrics showcase State Farm's dedication to its policyholders and its ability to adapt to the evolving needs of the automotive insurance landscape.

The Future of Automobile Insurance: State Farm’s Vision

As the automotive industry continues to evolve, State Farm remains at the forefront, embracing new technologies and trends to enhance its automobile insurance offerings. Here’s a glimpse into the future of State Farm Automobile Insurance.

Autonomous Vehicles and New Risks

With the rise of autonomous and semi-autonomous vehicles, the insurance industry faces new challenges. State Farm is actively researching and developing coverage options to address the unique risks associated with these advanced technologies. By staying ahead of the curve, State Farm ensures that its policyholders are protected in an increasingly complex automotive landscape.

Digital Transformation and Personalization

State Farm recognizes the importance of digital transformation in meeting the expectations of modern consumers. They continue to invest in enhancing their digital platforms, ensuring that policyholders can access their accounts and manage their insurance needs efficiently. Additionally, State Farm aims to personalize the insurance experience further, offering tailored coverage options based on individual driving behaviors and preferences.

Community Engagement and Safety Initiatives

Beyond providing insurance coverage, State Farm is dedicated to improving road safety and engaging with the communities it serves. They actively support various safety initiatives, educational programs, and community events, aiming to make a positive impact beyond the insurance industry. This commitment to community engagement reinforces State Farm’s position as a trusted partner in the eyes of its policyholders.

Conclusion: State Farm Automobile Insurance - A Trusted Companion on the Road

In a world where automotive insurance is a necessity, State Farm Automobile Insurance stands as a reliable and innovative partner. With a rich history, a comprehensive suite of coverage options, and a customer-centric approach, State Farm has earned its place as one of the most trusted names in the industry. As we look to the future, State Farm’s commitment to innovation and community ensures that it will continue to adapt and thrive, providing peace of mind to millions of drivers on the road ahead.

What makes State Farm Automobile Insurance unique compared to other providers?

+State Farm stands out with its comprehensive coverage options, innovative features like Drive Safe & Save®, and a strong focus on customer satisfaction. Their commitment to adapting to new technologies and trends sets them apart in an evolving industry.

How does State Farm’s Accident Forgiveness feature work?

+State Farm’s Accident Forgiveness rewards loyal policyholders by forgiving their first at-fault accident. This means that their premiums won’t increase after the first accident, providing a safety net for drivers with a clean record.

What is State Farm’s Drive Safe & Save® program, and how does it benefit policyholders?

+Drive Safe & Save® is a telematics-based program that tracks and rewards safe driving habits. Policyholders can earn discounts on their premiums by maintaining safe driving behaviors, creating a win-win situation for both State Farm and its customers.