Cheap Good Car Insurance

When it comes to finding affordable car insurance, many drivers seek a balance between cost-effectiveness and adequate coverage. With the numerous insurance providers in the market, navigating the complex world of automotive insurance can be daunting. This comprehensive guide aims to shed light on the factors influencing cheap yet good car insurance, offering insights to help drivers make informed decisions without compromising on essential coverage.

Understanding the Cost Factors

The cost of car insurance is influenced by a multitude of factors, and understanding these elements is crucial for securing the best value. Firstly, your vehicle’s make and model play a significant role. High-end sports cars or luxury vehicles often attract higher insurance premiums due to their costly repair and replacement expenses. In contrast, sedans and compact cars are generally more affordable to insure.

Secondly, your personal profile significantly impacts insurance rates. This includes your age, gender, and driving history. Young drivers, especially males under 25, tend to be associated with higher risk and, consequently, higher premiums. On the other hand, mature drivers with a clean driving record often enjoy more competitive rates. Additionally, factors like your credit score and the number of years you've been licensed can affect the cost of your insurance.

The geographical location where you reside or primarily drive also influences insurance rates. Areas with high crime rates, frequent accidents, or dense populations often result in higher premiums. Conversely, more rural or safer regions may offer more affordable insurance options.

Tips for Finding Cheap Car Insurance

Securing cheap car insurance requires a strategic approach. Here are some expert tips to guide you:

Shop Around and Compare

The insurance market is highly competitive, and rates can vary significantly between providers. Take the time to compare quotes from multiple insurers. Online comparison tools can be particularly useful for this task, providing a quick and efficient way to assess various options.

When comparing quotes, ensure you're comparing like for like. This means ensuring the quotes cover the same level of coverage and benefits. Look beyond just the price and consider the insurer's reputation, financial stability, and customer service ratings.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, if you have home insurance and car insurance, consider consolidating them with the same insurer. Bundling can result in substantial savings, especially if you’re already a loyal customer with a good track record.

Increase Your Deductible

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. While a higher deductible means you’ll pay more in the event of a claim, it can significantly reduce your monthly or annual insurance costs.

Explore Discounts

Insurance providers often offer a variety of discounts to attract and retain customers. These can include discounts for safe driving records, loyalty rewards, defensive driving courses, or even for having certain safety features in your vehicle. Be sure to ask your insurer about available discounts and take advantage of those that apply to you.

Maintain a Good Driving Record

Your driving history is a significant factor in determining your insurance rates. Maintaining a clean driving record by avoiding accidents, traffic violations, and claims can help keep your premiums low. Insurance companies view drivers with clean records as lower risk, making them more desirable customers.

Evaluating Coverage and Benefits

While cost is an important consideration, it’s essential not to compromise on coverage and benefits. Different insurance policies offer varying levels of protection, and understanding these differences is crucial for making an informed decision.

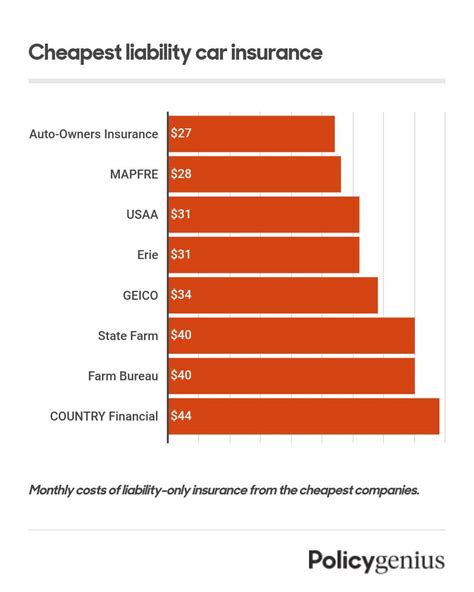

Liability Coverage

Liability coverage is a fundamental component of any car insurance policy. It covers the costs associated with damages or injuries you cause to others in an accident. This includes property damage, medical expenses, and legal fees. Ensure your liability coverage limits are sufficient to protect you financially in the event of a serious accident. While higher limits often mean higher premiums, they provide greater peace of mind.

Collision and Comprehensive Coverage

Collision coverage pays for the repair or replacement of your vehicle if you’re involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. Consider your vehicle’s value and the likelihood of these events when deciding whether to include these coverages. For older vehicles with lower market value, these coverages may not be cost-effective.

Additional Benefits and Add-Ons

Some insurance providers offer additional benefits or add-ons that can enhance your coverage. These might include rental car reimbursement, roadside assistance, or glass repair coverage. While these add-ons can be valuable, they often come at an extra cost. Assess your needs and priorities to determine which, if any, are worth including in your policy.

The Role of Technology in Affordable Insurance

Advancements in technology have revolutionized the insurance industry, offering new opportunities for drivers to save on their premiums.

Telematics and Usage-Based Insurance

Telematics devices or smartphone apps can monitor your driving behavior, such as acceleration, braking, and mileage. Insurance providers often offer discounts for drivers who use these devices and demonstrate safe driving habits. This type of insurance, known as usage-based insurance or pay-as-you-drive insurance, can be particularly beneficial for safe drivers who want their premiums to reflect their positive driving record.

Online Quoting and Policy Management

The ability to obtain quotes and manage policies online has made the insurance process more efficient and cost-effective. Online quoting tools allow you to quickly compare rates and coverage options from multiple insurers, saving you time and potentially reducing overhead costs for insurers, which can translate to lower premiums.

The Future of Affordable Car Insurance

The insurance industry is continually evolving, and several trends are shaping the future of affordable car insurance.

Autonomous Vehicles and Safety Technology

The increasing adoption of autonomous and semi-autonomous vehicle technologies is expected to significantly reduce the number of accidents. This shift could lead to lower insurance premiums in the long term, as insurers assess the reduced risk associated with these advanced safety features.

Personalized Insurance Policies

With the rise of data analytics and artificial intelligence, insurance providers are moving towards more personalized policies. By analyzing individual driving behavior and preferences, insurers can offer tailored coverage options, ensuring drivers only pay for the coverage they need. This level of customization has the potential to make insurance more affordable and efficient.

InsurTech Innovations

The emergence of InsurTech startups and innovations is disrupting the traditional insurance model. These companies are leveraging technology to offer innovative solutions, such as on-demand insurance, peer-to-peer insurance, and blockchain-based insurance platforms. These new models often focus on efficiency and customization, which can lead to more affordable options for consumers.

| Factor | Impact on Insurance Rates |

|---|---|

| Vehicle Make and Model | High-end vehicles often attract higher premiums due to costly repairs. |

| Driver Profile | Young drivers and those with a history of accidents or violations may face higher rates. |

| Geographical Location | Areas with high crime rates or frequent accidents often result in higher premiums. |

What is the average cost of car insurance in the United States?

+

The average cost of car insurance varies depending on several factors, including your location, driving record, and the type of coverage you choose. As of recent data, the national average for car insurance premiums is approximately 1,674 per year, or about 140 per month. However, this can range significantly, with some states and regions having much higher or lower averages.

How can I lower my car insurance premiums if I’m a young driver?

+

Young drivers often face higher insurance premiums due to their perceived higher risk. To lower your premiums, consider the following: Maintain a clean driving record, take a defensive driving course to earn a discount, ask about student discounts if you’re a full-time student, and explore policies with higher deductibles. Additionally, if you’re a young driver living with your parents, you may benefit from being added to their policy, as this can often result in lower overall premiums.

Are there any government programs that can help me get cheaper car insurance?

+

Some states offer programs to assist drivers who may have difficulty obtaining affordable car insurance due to their driving history or other factors. These programs, often called Assigned Risk or Assigned Risk Pool plans, ensure that drivers who might otherwise be uninsured can obtain the legally required minimum level of coverage. However, these policies often come with higher premiums and more limited coverage options. Check with your state’s insurance department to see if such programs are available.