Cash Value Of Life Insurance

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their families. One of the key aspects of life insurance policies is the cash value, which offers policyholders additional benefits and flexibility beyond the traditional death benefit. In this comprehensive article, we will delve into the world of life insurance cash value, exploring its definition, how it works, the factors that influence its growth, and the various ways it can be utilized. By understanding the cash value of life insurance, you can make informed decisions and maximize the potential of your policy.

Understanding the Concept of Cash Value

The cash value of a life insurance policy refers to the accumulated savings component within the policy. It is essentially the portion of your premium payments that is set aside and invested by the insurance company. Over time, this cash value grows and can be accessed by the policyholder during their lifetime, offering a range of financial benefits.

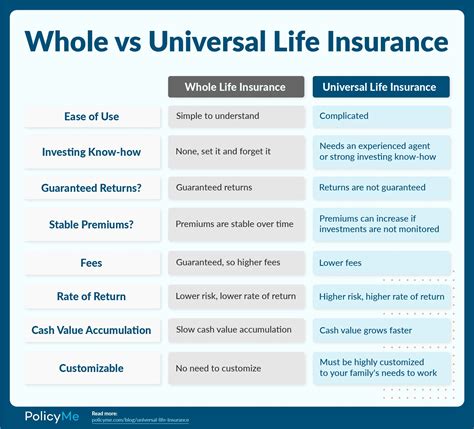

Unlike term life insurance, which focuses solely on providing a death benefit, permanent life insurance policies, such as whole life, universal life, and variable life insurance, offer the added advantage of cash value accumulation. This cash value acts as a financial reserve that policyholders can tap into, providing them with options beyond the traditional insurance coverage.

How Does Cash Value Work in Life Insurance?

When you purchase a permanent life insurance policy with a cash value component, a portion of your premium is allocated towards building this cash value. The insurance company invests this money, typically in a conservative manner, to ensure its growth over time. The exact investment strategy may vary depending on the type of policy and the insurance provider.

As the cash value accumulates, it earns interest or returns based on the performance of the investments. This growth is tax-deferred, meaning that any gains are not subject to immediate taxation. The cash value continues to grow until the policyholder decides to utilize it or until the policy matures.

Factors Influencing Cash Value Growth

Several factors play a role in determining the growth and performance of the cash value in a life insurance policy:

Premium Payments

The frequency and amount of premium payments significantly impact the growth of cash value. Consistent and timely payments ensure a steady contribution towards the policy’s cash value, allowing it to accumulate over time.

Policy Type

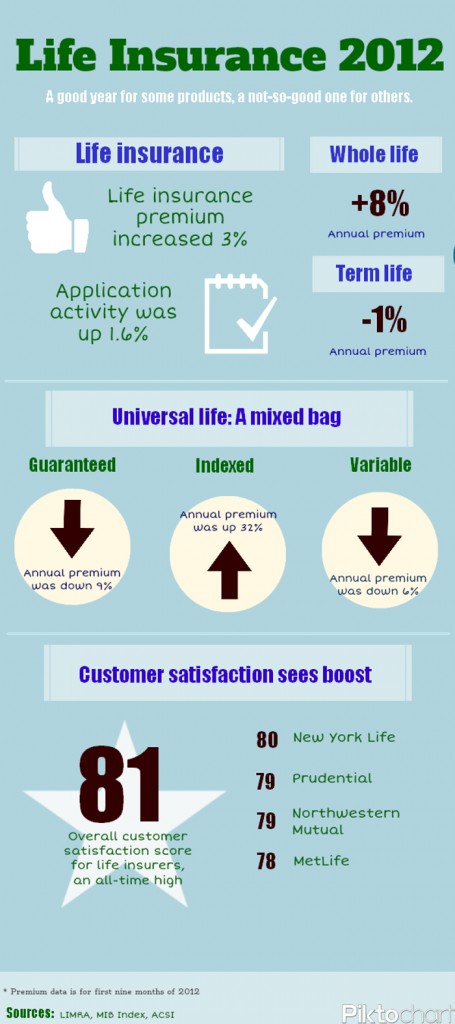

Different types of permanent life insurance policies offer varying levels of cash value accumulation. Whole life policies, for instance, typically have a fixed cash value growth rate, providing a stable and predictable accumulation. On the other hand, universal life policies offer more flexibility, allowing policyholders to adjust premiums and allocate funds between the death benefit and cash value.

Interest Rates and Investment Performance

The cash value growth is influenced by the prevailing interest rates and the performance of the investments made by the insurance company. Higher interest rates and strong investment returns can lead to faster cash value accumulation. It is important to note that the insurance company bears the investment risk, and the actual returns may vary.

Policy Duration

The longer a life insurance policy remains in force, the more time the cash value has to grow. Over time, the compounding effect of interest and investment returns can significantly boost the cash value, making it an attractive long-term financial tool.

Utilizing the Cash Value of Life Insurance

The cash value of a life insurance policy offers policyholders a range of options to utilize their accumulated savings. Here are some common ways in which the cash value can be utilized:

Policy Loans

Policyholders can take out loans against the cash value of their life insurance policy. These loans are typically interest-free and do not require a credit check, as the policy itself serves as collateral. The loan amount and interest rate may vary depending on the insurance company and the policy terms.

Withdrawal of Cash Value

In certain situations, policyholders may choose to withdraw a portion or the entire cash value from their life insurance policy. This can be particularly useful for covering unexpected expenses, funding a specific financial goal, or supplementing retirement income. However, it’s important to consider the potential impact on the death benefit and the policy’s future value.

Premium Payment Flexibility

The cash value of a life insurance policy can be used to cover future premium payments. This flexibility allows policyholders to skip premium payments during times of financial hardship or to reduce the frequency of payments. By utilizing the cash value, policyholders can maintain their coverage without interruption.

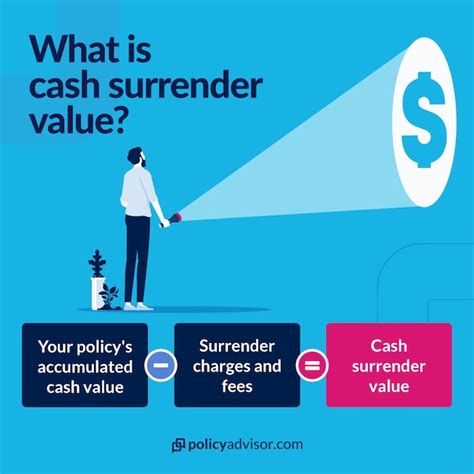

Policy Surrender

In some cases, policyholders may decide to surrender their life insurance policy and receive the cash value as a lump sum. This option is typically considered when the policyholder no longer needs the coverage or wants to access the accumulated savings. However, it’s essential to understand the potential tax implications and the impact on future insurance needs.

Policy Riders and Enhancements

The cash value of a life insurance policy can be used to enhance the policy with additional riders or benefits. For example, policyholders may add riders for long-term care coverage, waiver of premium, or accelerated death benefits. These riders can provide extra protection and peace of mind, utilizing the policy’s cash value to tailor the coverage to specific needs.

Potential Risks and Considerations

While the cash value of life insurance offers numerous benefits, it’s important to be aware of certain risks and considerations:

Policy Lapse

If policyholders fail to make premium payments, the policy may lapse, resulting in the loss of both the death benefit and the accumulated cash value. It is crucial to maintain timely premium payments to ensure the policy remains in force and the cash value continues to grow.

Tax Implications

When utilizing the cash value through policy loans or withdrawals, it’s essential to understand the potential tax consequences. Policy loans are generally tax-free, but withdrawals may be subject to income tax, depending on the policy’s tax status and the amount withdrawn.

Impact on Death Benefit

Taking out a policy loan or withdrawing cash value may reduce the policy’s death benefit. It is important to carefully consider the balance between accessing the cash value and maintaining an adequate death benefit to meet the intended protection goals.

Real-Life Examples and Case Studies

Let’s explore a few real-life scenarios to better understand the practical applications of the cash value of life insurance:

Case Study 1: Funding Retirement

John, a 65-year-old retiree, has a whole life insurance policy with a substantial cash value. He decides to withdraw a portion of the cash value to supplement his retirement income, ensuring a comfortable lifestyle during his golden years. By strategically utilizing the cash value, John can maintain his standard of living while enjoying the benefits of his long-term financial planning.

Case Study 2: Emergency Fund

Sarah, a young professional, has a universal life insurance policy. When faced with an unexpected medical expense, she chooses to take out a policy loan to cover the costs. The interest-free loan allows her to access the funds quickly and easily, providing much-needed financial relief during a challenging time. Once her financial situation stabilizes, Sarah can repay the loan, maintaining the integrity of her policy.

Case Study 3: Business Expansion

David, a small business owner, has a variable life insurance policy with a growing cash value. He decides to utilize this cash value to inject capital into his business, allowing him to expand his operations and take advantage of new market opportunities. By leveraging the cash value, David can support his business growth while maintaining the security of a life insurance policy.

Expert Insights and Tips

Here are some valuable insights and tips from industry experts regarding the cash value of life insurance:

💡 Consider Your Goals: Before purchasing a life insurance policy with a cash value component, clearly define your financial goals. Whether it's funding retirement, providing an emergency fund, or supporting business ventures, understanding your objectives will help you choose the right policy and maximize its benefits.

💡 Policy Selection: When selecting a life insurance policy, compare different options and consider your long-term financial plans. Whole life policies offer stability and predictability, while universal life policies provide flexibility. Evaluate your risk tolerance and financial goals to make an informed decision.

💡 Regular Review: Regularly review your life insurance policy and its cash value accumulation. Stay updated on market trends, interest rates, and investment performance to make informed decisions about policy adjustments or utilization of the cash value.

💡 Tax Strategy: Consult with a tax professional to understand the potential tax implications of utilizing the cash value through loans or withdrawals. By being aware of the tax consequences, you can plan accordingly and minimize any adverse financial impact.

💡 Balance Coverage and Cash Value: It's important to strike a balance between maintaining an adequate death benefit and accessing the cash value. Ensure that your policy's death benefit meets your protection needs while allowing for the flexibility to utilize the cash value when necessary.

Future Implications and Trends

The cash value of life insurance continues to evolve, offering new opportunities and considerations for policyholders. Here are some potential future implications and trends:

Innovative Policy Designs

Insurance companies are constantly innovating and introducing new policy designs to meet the evolving needs of policyholders. We can expect to see more flexible and customizable life insurance policies that offer enhanced cash value accumulation and utilization options.

Technology Integration

The integration of technology and digital tools is transforming the life insurance industry. Policyholders can expect easier access to their policy information, including real-time updates on cash value accumulation and investment performance. Online platforms and mobile apps may provide additional convenience and transparency.

Increased Focus on Longevity

As life expectancy continues to rise, there is a growing emphasis on longevity and retirement planning. Life insurance policies with cash value components are well-positioned to support individuals in funding their retirement years, providing a stable source of income and financial security.

Enhanced Policy Riders

Insurance companies are likely to continue developing and offering enhanced policy riders that utilize the cash value. These riders may provide additional benefits, such as long-term care coverage, critical illness protection, or accelerated death benefits, allowing policyholders to tailor their coverage to their specific needs.

Market Volatility and Risk Management

With market volatility and economic uncertainties, there may be a greater focus on risk management within life insurance policies. Insurance companies may explore new investment strategies and diversify their portfolios to ensure the stability and growth of policyholders’ cash value.

Conclusion

The cash value of life insurance is a powerful financial tool that offers policyholders flexibility, security, and long-term savings. By understanding the concept, growth factors, and utilization options, individuals can make informed decisions to maximize the potential of their life insurance policies. Whether it’s funding retirement, covering unexpected expenses, or supporting business ventures, the cash value provides a range of benefits that go beyond traditional insurance coverage.

As the life insurance industry continues to evolve, policyholders can expect innovative policy designs, enhanced technological integration, and an increased focus on longevity planning. By staying informed and working with trusted advisors, individuals can navigate the complexities of life insurance cash value and make the most of their financial investments.

How does the cash value of life insurance differ from other investment options?

+The cash value of life insurance offers unique advantages, including tax-deferred growth, policy guarantees, and the added protection of a death benefit. While other investment options may provide higher returns, life insurance cash value offers a stable and secure savings component, making it a valuable financial tool.

Can I access the cash value of my life insurance policy at any time?

+Yes, policyholders have the flexibility to access their cash value through policy loans or withdrawals. However, it’s important to consider the potential impact on the death benefit and understand the tax implications associated with these actions.

Are there any penalties for withdrawing the cash value of a life insurance policy?

+Withdrawing the cash value may have tax consequences, especially if the policy has not been held for a certain period of time. It’s crucial to consult with a tax professional to understand the potential penalties and plan accordingly.

How does the interest rate on policy loans work?

+Policy loans are typically interest-free, as the policy itself serves as collateral. However, some insurance companies may charge a nominal interest rate, which is often lower than traditional loans. The interest rate and terms can vary, so it’s important to review the policy documents and understand the loan provisions.

Can I use the cash value of my life insurance policy to pay for my child’s education expenses?

+Absolutely! The cash value of a life insurance policy can be a valuable source of funding for various financial goals, including education expenses. By strategically utilizing the cash value, policyholders can support their children’s education while maintaining the security of a life insurance policy.