Auto Insurance Multiple Quotes

When it comes to securing auto insurance, one of the most crucial steps is obtaining multiple quotes. This practice not only empowers you to make an informed decision about your coverage but also ensures you get the best possible deal. In this comprehensive guide, we will delve into the world of auto insurance quotes, exploring the key factors that influence rates, the benefits of obtaining multiple quotes, and the process of comparing and selecting the ideal policy for your needs. By the end of this article, you'll have the knowledge and tools to navigate the auto insurance market with confidence, ultimately saving money and securing the protection you deserve.

Understanding the Factors That Impact Auto Insurance Quotes

Before we dive into the process of obtaining multiple quotes, it’s essential to grasp the key factors that insurance companies consider when calculating your premium. These factors play a pivotal role in determining the cost of your auto insurance and understanding them can help you anticipate potential rate fluctuations.

Your Driving Record

One of the most significant determinants of your auto insurance premium is your driving history. Insurance companies thoroughly examine your record, taking into account any violations, accidents, or claims you’ve made in the past. A clean driving record generally leads to lower premiums, while multiple infractions or accidents can significantly increase your rates. It’s crucial to maintain a safe driving habit to keep your insurance costs manageable.

| Driving Record Status | Potential Impact on Premium |

|---|---|

| Clean Record | Lower Rates |

| Minor Violations | Moderate Increase |

| Major Offenses or Accidents | Significant Premium Hike |

Vehicle Type and Usage

The type of vehicle you drive and how you use it also play a crucial role in determining your insurance rates. Generally, newer, more expensive cars or those with powerful engines tend to have higher insurance costs due to their replacement and repair expenses. Additionally, the purpose for which you use your vehicle can impact your premium. For instance, if you use your car for business purposes or commute long distances, your rates may be higher compared to someone who primarily drives for pleasure.

Age, Gender, and Location

Demographic factors such as age, gender, and location can also influence your auto insurance rates. Statistics show that younger drivers, particularly males, tend to be involved in more accidents, leading to higher premiums for this demographic. Similarly, living in an area with a higher crime rate or a history of frequent accidents can increase your insurance costs. Insurance companies use these demographic factors to assess the potential risk associated with insuring you.

Credit Score

Surprisingly, your credit score can also impact your auto insurance rates. Many insurance companies consider creditworthiness as an indicator of overall financial responsibility. Individuals with higher credit scores are often viewed as more reliable and less likely to file claims, resulting in lower insurance premiums. Conversely, those with lower credit scores may face higher rates.

Claims History

Your history of insurance claims is another critical factor that insurance companies scrutinize. Frequent claims, even for minor incidents, can signal a higher risk profile, leading to increased premiums. It’s important to note that while a single claim may not significantly impact your rates, multiple claims over a short period can result in a substantial premium increase.

The Benefits of Obtaining Multiple Auto Insurance Quotes

Now that we’ve explored the key factors influencing auto insurance quotes, let’s delve into the advantages of obtaining multiple quotes. This practice is a cornerstone of savvy insurance shopping and can yield significant benefits, including cost savings and a better understanding of your options.

Increased Savings

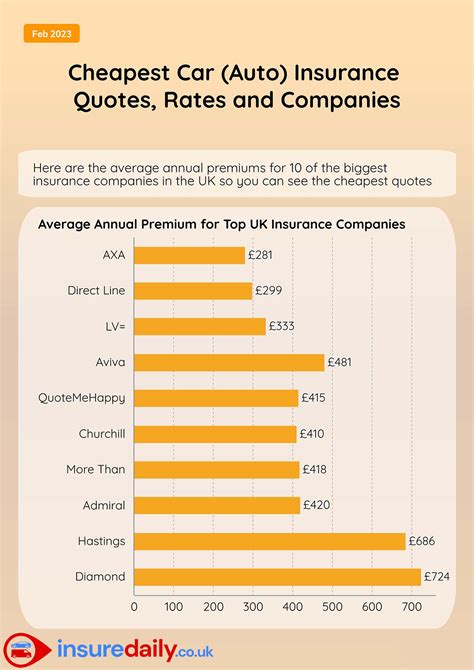

One of the most compelling reasons to obtain multiple quotes is the potential for substantial savings. By comparing quotes from various insurers, you can identify the most competitive rates available for your specific circumstances. This process allows you to leverage the competitive nature of the insurance market, ensuring you get the best deal on your auto insurance coverage.

Consider the following scenario: you've recently moved to a new state with higher insurance rates. By obtaining quotes from local insurers, you can quickly identify companies offering more affordable coverage, potentially saving hundreds of dollars annually. This simple act of comparison shopping can make a significant difference in your insurance expenses.

Enhanced Understanding of Coverage Options

Obtaining multiple quotes provides a unique opportunity to gain a deeper understanding of the coverage options available to you. Each insurance company offers a range of policies with varying levels of coverage, deductibles, and add-on features. By comparing quotes, you can evaluate these options and make informed decisions about the level of protection that best suits your needs and budget.

For instance, you might discover that a slightly higher premium from one insurer provides significantly more comprehensive coverage, including roadside assistance and rental car benefits. On the other hand, another insurer might offer a lower premium with a higher deductible, which could be a more cost-effective option if you're a safe driver and rarely file claims.

Improved Negotiation Position

Having multiple quotes in hand gives you a stronger negotiating position when discussing coverage and rates with your current insurer. By presenting competitive offers from other companies, you can leverage this information to negotiate better terms or discounts from your existing provider. This approach can lead to substantial savings without having to switch insurers, providing you with the best of both worlds: familiarity and cost-effectiveness.

Navigating the Process of Obtaining and Comparing Quotes

Obtaining multiple auto insurance quotes is a straightforward process, but it requires some organization and attention to detail to ensure you’re comparing apples to apples. Here’s a step-by-step guide to help you navigate this process efficiently.

Identify Reputable Insurance Providers

Start by compiling a list of reputable insurance companies in your area. You can use online resources, consumer reviews, and recommendations from friends and family to create a comprehensive list. It’s important to choose insurers that have a solid reputation for customer service and financial stability to ensure a smooth experience.

Gather Necessary Information

To obtain accurate quotes, you’ll need to provide specific details about yourself, your driving history, and your vehicle. Ensure you have the following information readily available:

- Personal details: Name, date of birth, contact information, and social security number.

- Vehicle information: Make, model, year, VIN number, and estimated annual mileage.

- Driving record: Any violations, accidents, or claims made in the past.

- Credit score: Although not required, having this information can help you understand how it impacts your rates.

Request Quotes

Reach out to the insurance providers on your list and request quotes. You can do this online, over the phone, or in person. Provide the requested information accurately to ensure you receive precise quotes. It’s essential to ensure that each quote you receive covers the same level of coverage to facilitate accurate comparisons.

Compare Quotes

Once you’ve gathered quotes from multiple insurers, it’s time to compare them side by side. Look at the following aspects to make an informed decision:

- Premium Cost: Compare the annual or monthly premiums to understand the overall cost of coverage.

- Coverage Levels: Ensure that each quote offers the same coverage limits and deductibles. Compare the scope of coverage, including liability, collision, comprehensive, and any additional features like rental car coverage or roadside assistance.

- Discounts and Incentives: Many insurers offer discounts for safe driving records, bundling policies, or loyalty. Compare these discounts to see if one insurer provides more significant savings.

- Customer Service and Claims Handling: Consider the reputation and reliability of each insurer. Look for reviews and ratings to gauge their customer service and claims handling processes.

Make an Informed Decision

After thoroughly comparing the quotes, it’s time to make a decision. Choose the insurer that offers the best combination of competitive rates, comprehensive coverage, and reliable customer service. Don’t forget to consider any unique benefits or features that might be valuable to you, such as digital claims processing or flexible payment options.

Tips for Maximizing Your Savings and Coverage

Beyond the process of obtaining multiple quotes, there are additional strategies you can employ to maximize your savings and ensure you have the right level of coverage.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By consolidating your insurance needs with a single provider, you can often save a significant amount on your overall premiums. It’s a simple way to streamline your insurance management and reduce costs.

Maintain a Good Driving Record

As mentioned earlier, your driving record is a critical factor in determining your insurance rates. By maintaining a clean record, you can keep your premiums low. Avoid violations, practice defensive driving, and regularly review your driving habits to reduce the risk of accidents or claims.

Explore Discounts and Incentives

Insurance companies offer a variety of discounts and incentives to attract customers. These can include safe driver discounts, loyalty rewards, good student discounts, or discounts for completing defensive driving courses. Stay informed about these opportunities and take advantage of them to reduce your insurance costs.

Adjust Your Coverage as Needed

Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances. For instance, if you’ve paid off your car loan, you may no longer need comprehensive coverage. By adjusting your coverage to match your needs, you can avoid unnecessary expenses.

The Future of Auto Insurance: Technological Innovations and Trends

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. As we move forward, several trends and innovations are likely to shape the way we obtain and manage our auto insurance policies.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs leverage this technology to offer personalized rates based on how, when, and where you drive. This innovative approach allows insurers to more accurately assess risk and provide customized premiums, often resulting in significant savings for safe drivers.

Digital Claims Processing and Self-Service

The digital transformation of the insurance industry is making it easier and faster for policyholders to file claims. Many insurers now offer digital claims processing, allowing customers to submit claims online or through mobile apps. This self-service approach streamlines the claims process, reducing the time and effort required to resolve issues.

AI and Machine Learning in Underwriting

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the way insurers assess risk and underwrite policies. These technologies enable insurers to analyze vast amounts of data, including driving behavior, weather patterns, and traffic conditions, to more accurately predict risks and offer personalized coverage options.

Personalized Coverage Options

The future of auto insurance is moving towards personalized coverage plans tailored to individual needs and preferences. Insurers are developing innovative products and services, such as customizable coverage packages, pay-as-you-drive policies, and add-on features like roadside assistance or rental car coverage, to meet the diverse needs of modern drivers.

Conclusion: Empowering Your Auto Insurance Decision

Obtaining multiple auto insurance quotes is a powerful tool in your insurance shopping arsenal. By understanding the factors that influence rates, recognizing the benefits of comparison shopping, and employing strategic tactics to maximize savings, you can make informed decisions about your coverage. As the auto insurance industry continues to evolve with technological advancements and innovative trends, staying informed and proactive will ensure you get the best value for your insurance dollar.

How often should I obtain new auto insurance quotes?

+It’s generally recommended to obtain new quotes annually or whenever your circumstances change significantly. This could include moving to a new area, purchasing a new vehicle, getting married, or turning a certain age. Regularly comparing quotes ensures you’re always getting the best deal and that your coverage remains up-to-date with your needs.

What are some common discounts offered by auto insurers?

+Common discounts include safe driver discounts, multi-policy discounts (for bundling auto and home insurance), good student discounts, loyalty rewards, and discounts for completing defensive driving courses. Some insurers also offer discounts for paying your premium in full or for using certain safety features in your vehicle.

How can I improve my chances of getting lower auto insurance rates?

+To increase your chances of obtaining lower rates, focus on maintaining a clean driving record, improving your credit score, and shopping around for the best deals. Additionally, consider increasing your deductible (if you’re financially able to do so) and exploring usage-based insurance programs, which can offer significant savings for safe drivers.

What should I do if I’m unhappy with my current auto insurance provider?

+If you’re dissatisfied with your current provider, it’s essential to research and compare quotes from other insurers. Obtain multiple quotes to find a company that offers better rates, more comprehensive coverage, or improved customer service. Remember to cancel your existing policy once you’ve found a new provider to avoid paying for overlapping coverage.