State Farm Car Insurance Card

Welcome to a comprehensive guide to the State Farm Car Insurance Card, an essential document for all State Farm auto insurance policyholders. In this article, we will delve into the details of this important card, its features, and its significance in the world of car insurance. With State Farm being one of the leading insurance providers in the United States, understanding the intricacies of their insurance card is crucial for any driver.

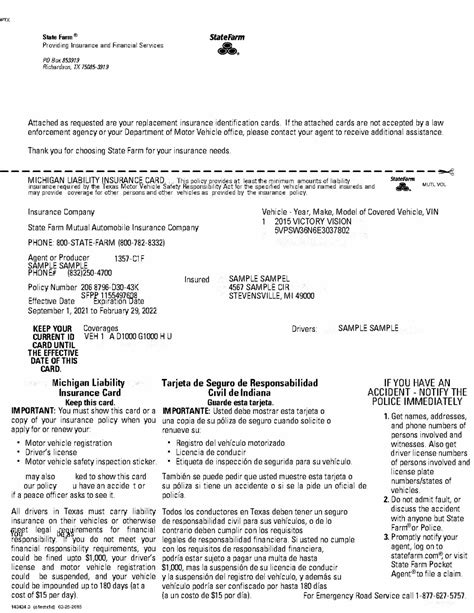

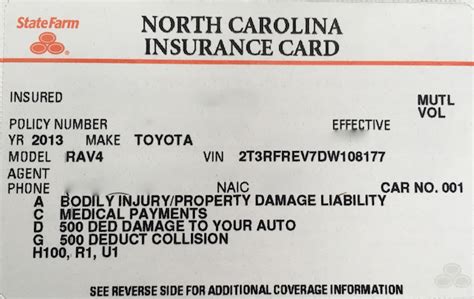

Unveiling the State Farm Car Insurance Card

The State Farm Car Insurance Card, often referred to as the “proof of insurance card,” is a compact yet powerful document that serves as legal proof of your auto insurance coverage. It is a vital tool for drivers to carry with them at all times, as it can be presented to law enforcement officers during traffic stops or in the event of an accident.

This card holds valuable information about your insurance policy, including your policy number, the effective dates of coverage, the type of insurance you have, and the insured vehicles. It also contains State Farm's contact details, ensuring easy access to their services in times of need.

Key Features and Benefits

The State Farm Car Insurance Card offers several advantages to policyholders, making it an indispensable part of their driving experience. Let’s explore some of its key features:

- Portability: The card is designed to be compact and easily carried in your wallet or glove compartment, ensuring it is readily accessible when needed.

- Quick Reference: All the essential details about your insurance policy are summarized on the card, providing quick access to critical information during emergencies or routine checks.

- Verification: Law enforcement officers can quickly verify your insurance coverage by examining the card, ensuring compliance with state laws and reducing the likelihood of penalties.

- State Farm's Commitment: The card symbolizes State Farm's commitment to providing reliable insurance coverage and customer support. It serves as a reminder of the comprehensive protection you have in place.

Understanding the Information on the Card

Let’s take a closer look at the information presented on the State Farm Car Insurance Card and its significance:

| Field | Description |

|---|---|

| Policy Number | A unique identifier for your insurance policy. This number is essential for accessing your policy details and making any necessary updates. |

| Effective Dates | The dates indicate the period during which your insurance coverage is valid. It ensures you remain protected throughout the specified timeframe. |

| Insured Vehicles | This section lists the vehicles covered under your policy, ensuring you know which vehicles are protected and which are not. |

| Policyholder's Name | Your name appears on the card, confirming that you are the policyholder and have the necessary coverage. |

| State Farm's Contact Information | The card provides State Farm's contact details, including phone numbers and website addresses, making it easy for you to reach out for assistance or additional information. |

How to Obtain and Maintain Your State Farm Car Insurance Card

Obtaining your State Farm Car Insurance Card is a straightforward process. When you purchase an auto insurance policy from State Farm, you will typically receive a physical copy of the card along with your policy documents. However, if you misplace your card or require a replacement, you have several options to obtain a new one:

- Online Access: State Farm provides an online platform where policyholders can access their insurance information, including downloading or printing a copy of their insurance card. This digital copy can be saved on your device or printed for easy reference.

- Mobile App: State Farm's mobile app offers a convenient way to access your insurance card. You can download the app, log in to your account, and quickly retrieve your card details, ensuring you always have a digital copy readily available.

- Contact State Farm: If you prefer a more traditional approach, you can contact State Farm's customer service team. They can assist you in obtaining a replacement card or providing the necessary information to ensure you have a valid proof of insurance.

It is important to keep your State Farm Car Insurance Card up-to-date and valid. Here are some tips to ensure its accuracy and relevance:

- Regular Updates: If you make any changes to your policy, such as adding or removing a vehicle, ensure you update your insurance card accordingly. State Farm will provide you with an updated card reflecting these changes.

- Renewal Process: When your insurance policy nears its renewal date, State Farm will typically send you a new insurance card, ensuring you have a valid proof of insurance for the upcoming coverage period.

- Digital Storage: Consider saving a digital copy of your insurance card on your phone or device. This way, you always have a backup and can easily access it when needed.

State Farm’s Comprehensive Insurance Coverage

The State Farm Car Insurance Card is a representation of the comprehensive insurance coverage offered by State Farm. Their policies provide protection against various risks and liabilities associated with driving, ensuring peace of mind for policyholders.

State Farm offers a range of coverage options, including:

- Liability Coverage: This covers the costs of bodily injury and property damage you may cause to others in an accident.

- Collision Coverage: It provides protection for damage to your own vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has insufficient or no insurance.

- Medical Payments Coverage: It covers the medical expenses of you and your passengers in the event of an accident, regardless of fault.

State Farm’s Commitment to Customer Service

State Farm is renowned for its exceptional customer service and dedication to meeting the needs of its policyholders. Their commitment extends beyond providing insurance coverage, offering a range of additional services and resources to enhance the overall customer experience.

Here are some highlights of State Farm's customer-centric approach:

- 24/7 Customer Support: State Farm offers round-the-clock assistance, ensuring you can reach out for help whenever needed. Their customer service team is readily available to address your inquiries, provide guidance, and assist with any insurance-related matters.

- Online and Mobile Resources: State Farm provides a user-friendly website and mobile app, allowing policyholders to manage their insurance policies, access important documents, and stay informed about their coverage.

- Claims Assistance: In the event of an accident or claim, State Farm's dedicated claims team is on hand to guide you through the process. They offer timely and efficient claim handling, ensuring a smooth and stress-free experience.

- Agent Support: State Farm agents are highly trained professionals who are committed to providing personalized service. They can offer expert advice, assist with policy customization, and ensure you have the coverage that best suits your needs.

The Future of Insurance: State Farm’s Digital Innovations

State Farm is at the forefront of the digital transformation in the insurance industry, continuously innovating to enhance the customer experience and streamline processes. Their focus on technology and digital solutions has led to several notable advancements:

- Digital Claims Processing: State Farm has implemented advanced digital tools for claims processing, allowing for faster and more efficient handling of claims. Policyholders can submit claims online, upload necessary documents, and track the progress of their claims in real-time.

- Telematics and Usage-Based Insurance: State Farm offers innovative telematics programs that utilize technology to monitor driving behavior and reward safe driving habits. This data-driven approach allows for more accurate pricing and personalized coverage options.

- Mobile App Enhancements: The State Farm mobile app continues to evolve, offering new features and functionalities. Policyholders can now access their insurance cards, view policy details, and manage their accounts seamlessly through the app.

- Online Policy Management: State Farm's online platform provides a comprehensive dashboard for policyholders to manage their insurance policies. From making policy changes to accessing important documents, the online platform offers convenience and control.

Frequently Asked Questions

What should I do if I lose my State Farm Car Insurance Card?

+

If you misplace your State Farm Car Insurance Card, you can easily obtain a replacement. State Farm provides several options for accessing your insurance card, including their online platform and mobile app. You can log in to your account and download or print a new copy. Additionally, you can contact State Farm’s customer service team, who will assist you in obtaining a replacement card.

Can I use a digital copy of my insurance card as proof of insurance?

+

Absolutely! State Farm recognizes the importance of digital accessibility and accepts digital copies of insurance cards as valid proof of insurance. You can save a digital version of your insurance card on your phone or device, ensuring you always have it readily available. This digital option provides convenience and peace of mind.

How often should I update my State Farm Car Insurance Card?

+

It is crucial to keep your State Farm Car Insurance Card up-to-date. Whenever you make changes to your policy, such as adding or removing a vehicle, ensure you obtain an updated card from State Farm. Additionally, when your policy nears its renewal date, State Farm will typically provide you with a new insurance card, reflecting any changes and ensuring you have valid coverage for the upcoming period.

What additional services does State Farm offer to policyholders?

+

State Farm goes beyond providing insurance coverage. They offer a range of additional services to enhance the customer experience. This includes 24⁄7 customer support, online and mobile resources for policy management, dedicated claims assistance, and personalized guidance from their trained agents. State Farm’s commitment to customer service ensures you receive comprehensive support throughout your insurance journey.

How does State Farm utilize technology to improve its services?

+

State Farm embraces digital innovation to enhance its services and provide a seamless experience for policyholders. They have implemented digital claims processing, allowing for faster and more efficient handling of claims. Telematics and usage-based insurance programs utilize technology to monitor driving behavior and offer personalized coverage options. Additionally, State Farm’s mobile app and online platform offer convenient access to insurance cards, policy management, and other valuable resources.

In conclusion, the State Farm Car Insurance Card is more than just a piece of paper; it is a symbol of the comprehensive insurance coverage and exceptional customer service provided by State Farm. With its portability, quick reference, and verification capabilities, the insurance card plays a vital role in ensuring compliance and providing peace of mind to policyholders. State Farm’s commitment to innovation and customer-centric approach further enhances the overall insurance experience.