What Is The Fdic Insurance Limit

The Federal Deposit Insurance Corporation (FDIC) is a US government agency that provides deposit insurance to banks and financial institutions, protecting customers' deposits in the event of bank failure. FDIC insurance is a critical component of the US financial system, offering a safety net for depositors and fostering confidence in the banking sector. This article aims to delve into the FDIC insurance limit, its history, how it works, and its implications for consumers and the financial industry.

Understanding the FDIC Insurance Limit

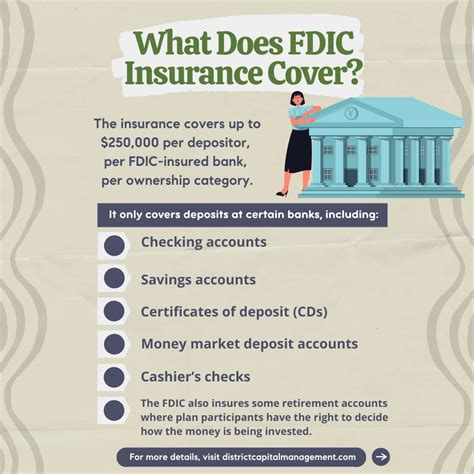

The FDIC insurance limit refers to the maximum amount of deposit coverage provided by the Federal Deposit Insurance Corporation. This limit ensures that even in the event of a bank failure, depositors can recover their funds up to a specified amount, providing a crucial layer of protection for their savings. As of my last update in January 2023, the FDIC insurance limit stands at $250,000 per depositor, per insured bank, for each ownership category.

Ownership Categories and Coverage

The FDIC insurance limit applies to different ownership categories, allowing depositors to maximize their coverage. These categories include:

- Single Accounts: Coverage up to 250,000 for individual accounts.</li> <li><strong>Joint Accounts</strong>: Each co-owner is insured for up to 250,000, allowing for a combined coverage of 500,000.</li> <li><strong>Revocable Trust Accounts</strong>: Each beneficiary is insured for up to 250,000, with coverage depending on the number of beneficiaries and their respective ownership stakes.

- Business Accounts: Each business entity, such as a corporation or LLC, is insured for up to 250,000.</li> <li><strong>Retirement Accounts (IRAs)</strong>: Each IRA account is insured for up to 250,000.

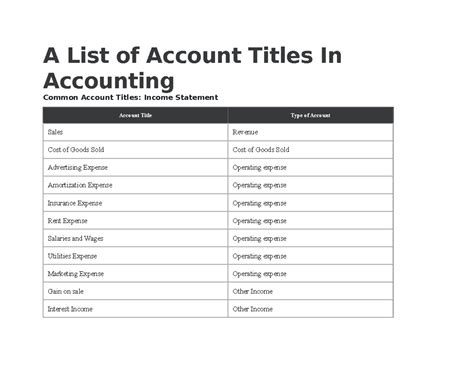

| Ownership Category | FDIC Insurance Limit |

|---|---|

| Single Accounts | $250,000 |

| Joint Accounts | $500,000 (combined) |

| Revocable Trust Accounts | Varies based on beneficiaries |

| Business Accounts | $250,000 per entity |

| Retirement Accounts (IRAs) | $250,000 per account |

History of the FDIC Insurance Limit

The FDIC was established during the Great Depression in 1933, as part of the Banking Act. Initially, the insurance limit was set at $2,500, providing a much-needed boost to confidence in the banking system during a period of widespread bank failures. Over the years, the insurance limit has been adjusted to keep pace with inflation and changing economic conditions.

A significant increase occurred in 1980, when the limit was raised to $100,000, followed by another hike to $250,000 in 2010, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. This increase aimed to further protect depositors during the financial crisis and encourage a return to stability in the banking sector.

How FDIC Insurance Works

FDIC insurance covers various types of deposit accounts, including checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs). It’s important to note that FDIC insurance does not cover investments such as stocks, bonds, mutual funds, or life insurance policies. Additionally, safe deposit boxes and certain cash value insurance policies are also not covered.

When a bank fails, the FDIC steps in to resolve the issue. This process typically involves the sale of the failed bank's deposits and assets to another bank, ensuring continuity of services for depositors. The FDIC then reimburses depositors for any amounts exceeding their insured balance, up to the insurance limit.

To ensure that depositors are protected, the FDIC maintains a fund, known as the Deposit Insurance Fund (DIF), which is funded by premiums paid by insured banks. This fund acts as a financial buffer, ensuring that the FDIC has the resources to cover insured deposits in the event of bank failures.

Maximizing FDIC Insurance Coverage

Depositors can take advantage of the FDIC insurance limit to maximize their coverage. Here are some strategies:

- Diversify Accounts: Spread your deposits across multiple ownership categories and banks to ensure maximum coverage. For example, you can have a single account, a joint account with a spouse, and a business account, each insured for up to $250,000.

- Use Multiple Banks: Consider opening accounts at different FDIC-insured banks to increase your coverage. This strategy is particularly useful for high-net-worth individuals or businesses with substantial deposits.

- Understand Ownership Categories: Be aware of the different ownership categories and how they affect your coverage. For instance, joint accounts offer double the coverage, while revocable trust accounts provide coverage based on the number of beneficiaries.

- Monitor Account Balances: Regularly review your account balances to ensure they stay within the FDIC insurance limit. If your balance exceeds the limit, consider spreading your funds across multiple accounts to maintain full coverage.

FDIC Insurance and Bank Safety

FDIC insurance plays a crucial role in promoting the safety and stability of the banking system. By providing deposit insurance, the FDIC encourages depositors to keep their money in insured banks, fostering confidence in the financial sector. This, in turn, allows banks to lend and invest more freely, contributing to economic growth.

Moreover, FDIC insurance acts as a safeguard against bank runs, where a large number of depositors withdraw their funds simultaneously, potentially causing a bank to fail. With the knowledge that their deposits are insured, depositors are less likely to engage in panic withdrawals, maintaining stability in the banking system.

Limitations and Considerations

While FDIC insurance provides a robust safety net for depositors, it’s important to be aware of certain limitations and considerations:

- Excess Deposits: Deposits exceeding the FDIC insurance limit are not insured. It’s crucial to monitor your account balances and ensure they remain within the insured limit to avoid potential losses.

- Non-FDIC Insured Institutions: FDIC insurance only applies to member banks and financial institutions. It’s essential to verify that your bank is FDIC-insured to benefit from deposit protection.

- Time Lag in Reimbursement: In the event of a bank failure, it may take some time for the FDIC to resolve the issue and reimburse depositors. While the FDIC aims to minimize disruption, there can be delays in accessing your funds during this process.

Conclusion: FDIC Insurance Limit and its Impact

The FDIC insurance limit of $250,000 per depositor, per insured bank, is a critical component of the US financial system, offering a vital layer of protection for depositors. By understanding the ownership categories, depositors can maximize their coverage, ensuring their funds are safe and secure. The FDIC insurance limit promotes confidence in the banking sector, encourages economic growth, and safeguards against potential bank failures.

As the financial landscape continues to evolve, the FDIC remains an essential guardian of depositors' funds, adapting its policies to meet the changing needs of the banking industry. By staying informed about FDIC insurance and its limits, depositors can make informed decisions to protect their financial well-being.

Is FDIC insurance applicable to all banks and financial institutions?

+No, FDIC insurance only applies to member banks and financial institutions that have chosen to participate in the FDIC insurance program. It’s important to verify that your bank is FDIC-insured to benefit from deposit protection.

Are there any changes planned for the FDIC insurance limit in the near future?

+As of my knowledge cutoff in January 2023, there were no announced plans to change the FDIC insurance limit. However, it’s always advisable to stay updated with any financial regulatory changes that may impact deposit insurance.

What happens if my bank fails, and my deposits exceed the FDIC insurance limit?

+In the event of a bank failure, the FDIC will attempt to resolve the issue by selling the failed bank’s deposits and assets to another bank. If your deposits exceed the FDIC insurance limit, you may experience a delay in accessing your funds, and there is a risk of losing any amount over the insured limit.