Cars Insurance Quote

Welcome to the comprehensive guide on understanding and navigating the world of car insurance quotes. In today's fast-paced and dynamic automotive landscape, having a solid grasp of insurance options is crucial for every vehicle owner. This article aims to demystify the process, empowering you with the knowledge to make informed decisions about your car insurance coverage.

Demystifying Car Insurance Quotes

Obtaining a car insurance quote is the first step towards securing financial protection for your vehicle. It involves an evaluation of various factors to determine the cost of your insurance policy. The quote process considers the make and model of your car, your personal details, and the level of coverage you require. Understanding this process is essential, as it ensures you receive an accurate and tailored quote that meets your specific needs.

Factors Influencing Your Quote

Several key factors play a role in determining the cost of your car insurance quote. These include:

- Vehicle Details: The type, age, and value of your car significantly impact your quote. High-performance or luxury vehicles often result in higher insurance costs due to their repair and replacement expenses.

- Driver Information: Your personal details, such as age, driving record, and location, are crucial. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums.

- Coverage Requirements: The level of coverage you choose affects your quote. Comprehensive coverage, which includes damage from accidents, theft, and natural disasters, typically costs more than basic liability coverage.

- Deductibles: The deductible is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible can lower your monthly premiums, but it also means you’ll pay more in the event of a claim.

| Factor | Impact on Quote |

|---|---|

| Vehicle Type | Higher-end or sports cars often have higher premiums. |

| Driver's Age | Younger drivers tend to have higher insurance costs. |

| Driving Record | Clean records lead to lower premiums. |

| Coverage Level | Comprehensive coverage increases the cost. |

| Deductible Amount | Higher deductibles result in lower monthly premiums. |

Comparing Quotes: A Step-by-Step Guide

Comparing car insurance quotes is a strategic process that can help you find the best coverage at the most competitive price. Here’s a systematic approach to make it easier:

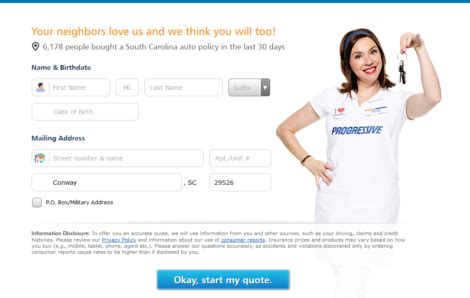

- Gather Information: Start by collecting essential details about your vehicle, driving history, and desired coverage levels. This information will be crucial for accurate quotes.

- Research Insurers: Explore a variety of insurance providers. Look for reputable companies with a solid track record and positive customer reviews. Consider both traditional insurers and online-based providers.

- Get Quotes: Request quotes from at least three to five insurers. Ensure you provide consistent information to each company to make accurate comparisons. Most insurers offer online quote tools, making the process quick and convenient.

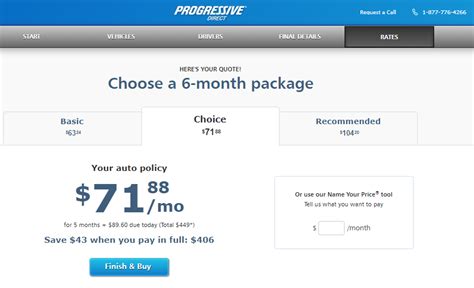

- Analyze Coverage: When comparing quotes, pay close attention to the coverage details. Ensure that the policies offer the same level of protection so you can make an apples-to-apples comparison. Look for any differences in deductibles, coverage limits, and additional benefits.

- Consider Customer Service: While price is important, don’t overlook the quality of customer service. Read reviews and check the insurer’s reputation for handling claims and customer satisfaction. A responsive insurer can make a big difference during a stressful claim process.

- Review Discounts: Many insurers offer discounts for various reasons, such as safe driving records, multiple policy bundles, or safety features in your vehicle. Inquire about these discounts and see if you qualify. They can significantly reduce your overall premium.

- Understand Policy Exclusions: Be aware of what’s not covered in each policy. Some insurers may have specific exclusions, so it’s essential to understand these limitations to avoid any surprises later.

- Make an Informed Decision: Finally, choose the insurer that offers the best combination of coverage, price, and customer service. Don’t forget to periodically review your policy and shop around for better deals, especially when your circumstances change or when your policy is up for renewal.

Maximizing Your Car Insurance Experience

Navigating the world of car insurance doesn’t have to be daunting. By understanding the factors that influence your quote and adopting a strategic approach to comparison, you can secure the best coverage at a competitive price. Remember, your car insurance policy is your financial safety net, so it’s crucial to choose wisely and stay informed.

Enhancing Your Policy with Add-Ons

Beyond the basic coverage, car insurance policies offer a range of add-ons or optional extras that can provide additional protection tailored to your specific needs. These add-ons can enhance your policy and provide peace of mind, especially in unexpected situations. Here are some common add-ons to consider:

- Rental Car Coverage: If your vehicle is in the shop for repairs, this add-on covers the cost of renting a substitute vehicle.

- Roadside Assistance: Provides emergency services like towing, battery jumps, or fuel delivery in case of a breakdown.

- Gap Insurance: Covers the difference between what your insurance pays and what you still owe on your car loan if your vehicle is totaled.

- Personal Injury Protection (PIP): Offers additional medical coverage for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has little or no insurance.

The Future of Car Insurance: Technology and Innovation

The car insurance industry is rapidly evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of car insurance:

- Telematics and Usage-Based Insurance (UBI): With the advent of telematics devices and smartphone apps, insurers can now track driving behavior in real-time. This data is used to offer personalized insurance rates based on how, when, and where you drive. UBI rewards safe drivers with lower premiums.

- AI and Machine Learning: Artificial intelligence is transforming the way claims are processed and fraud is detected. AI-powered systems can analyze vast amounts of data to identify suspicious patterns and speed up the claims process.

- Blockchain Technology: Blockchain’s secure and transparent nature is being explored for insurance purposes. It can streamline the claims process, reduce fraud, and provide a secure platform for peer-to-peer insurance transactions.

- Autonomous Vehicles: The rise of self-driving cars presents a unique challenge for insurers. As these vehicles become more prevalent, insurance policies will need to adapt to cover potential risks associated with autonomous technology.

- Digital Transformation: Insurers are increasingly embracing digital platforms and online tools to enhance the customer experience. From digital quotes to paperless policies, the industry is becoming more accessible and efficient.

Navigating Claims: A Smooth Process

When the unexpected happens and you need to make an insurance claim, it’s essential to know how to navigate the process efficiently. Here’s a step-by-step guide to help you through:

- Report the Claim: Contact your insurance company as soon as possible after an accident or incident. Provide all the necessary details, including the date, time, location, and any relevant information about the other parties involved.

- Document the Scene: Take photos of the damage to your vehicle and the surrounding area. If there were witnesses, collect their contact information. This documentation can be crucial in supporting your claim.

- Cooperate with the Insurer: Your insurer will guide you through the claims process. Provide all the requested information promptly and cooperate fully. This helps expedite the process and ensures a smooth resolution.

- Understand Your Policy: Review your insurance policy to understand the coverage and any specific conditions or exclusions. This knowledge can help you navigate the claims process and ensure you receive the benefits you’re entitled to.

- Seek Repairs: Once your claim is approved, choose a reputable repair shop to fix your vehicle. Many insurers have preferred networks, but you’re not obligated to use them. Ensure the repairs are done to your satisfaction and within the scope of your policy.

- Follow Up: Stay in touch with your insurer throughout the claims process. If there are any delays or additional information required, respond promptly. Regular follow-ups can help keep your claim moving forward.

- Review and Learn: After your claim is resolved, take some time to reflect on the process. Were there any areas where you felt unprepared or overwhelmed? Use this experience to improve your insurance knowledge and be better prepared for future claims.

Conclusion: Empowered Decision-Making

Understanding car insurance quotes and the broader insurance landscape empowers you to make informed decisions about your coverage. By recognizing the factors that influence your quote, adopting a strategic approach to comparison, and staying abreast of industry advancements, you can ensure you’re protected for the road ahead. Remember, your car insurance policy is your financial safety net, and with the right knowledge and preparation, you can navigate the process with confidence.

How often should I review my car insurance policy?

+It’s a good practice to review your policy annually, especially when your policy is up for renewal. This allows you to stay updated on any changes in coverage, premiums, or discounts. Additionally, review your policy whenever your circumstances change, such as a move to a new location, a change in marital status, or the addition of a teen driver to your household.

Can I negotiate my car insurance rates?

+While insurance rates are primarily based on calculated risks and are not typically negotiable, you can take steps to potentially lower your premiums. This includes maintaining a clean driving record, comparing quotes from multiple insurers, and considering bundle discounts if you have multiple policies with the same provider.

What should I do if I’m involved in an accident?

+First, ensure your safety and the safety of others involved. Call the police to report the accident and obtain a police report, which can be valuable for your insurance claim. Document the scene with photos and collect contact information from witnesses. Contact your insurance company promptly to report the claim and follow their guidance for the claims process.