Liability In Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. However, the concept of liability in car insurance can be complex and often raises numerous questions. This comprehensive guide aims to delve into the intricacies of liability, exploring its various facets, and offering expert insights to help you navigate this critical component of your insurance policy.

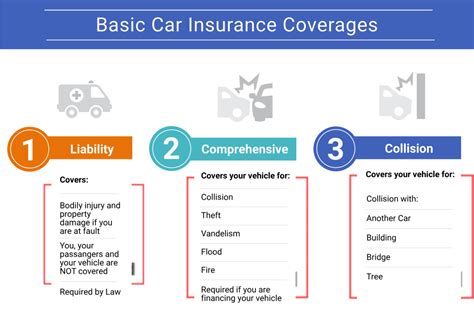

Understanding Liability in Car Insurance

Liability coverage is a fundamental component of car insurance policies, designed to protect policyholders from financial losses resulting from accidents they cause. It provides coverage for bodily injury and property damage claims made against the insured driver. In essence, liability insurance serves as a safeguard against the potentially devastating financial consequences of causing an accident.

The concept of liability is rooted in the principle of responsibility. When a driver causes an accident, they are responsible for the resulting damages, including medical expenses, vehicle repairs, and other related costs. Liability insurance steps in to cover these expenses, ensuring that the policyholder is not left with overwhelming financial burdens.

Bodily Injury Liability

Bodily injury liability is a critical aspect of car insurance, covering the costs associated with injuries sustained by other parties in an accident caused by the insured driver. This coverage includes medical expenses, rehabilitation costs, and even lost wages for the injured individuals. The limits of bodily injury liability coverage vary depending on the policy and state regulations.

For example, consider a scenario where a driver, insured with a policy offering $100,000 in bodily injury liability coverage per person and $300,000 per accident, causes an accident resulting in severe injuries to two passengers in the other vehicle. In this case, the insurance company would provide up to $100,000 for each injured person, totaling $200,000, with the remaining $100,000 going towards other expenses or damages.

| Bodily Injury Liability Limits | Policy Coverage |

|---|---|

| Per Person | $100,000 |

| Per Accident | $300,000 |

Property Damage Liability

Property damage liability coverage is another vital component of car insurance policies. It covers the costs associated with repairing or replacing damaged property belonging to others, such as other vehicles, fences, buildings, or even personal belongings. This coverage ensures that the policyholder is not held personally responsible for these expenses.

Imagine a situation where an insured driver accidentally collides with a parked car, causing significant damage to its front end. Property damage liability coverage would come into play, providing the funds necessary to repair or replace the damaged vehicle, ensuring that the insured driver is not left with the sole responsibility for these costs.

| Property Damage Liability Limits | Policy Coverage |

|---|---|

| Per Accident | $50,000 |

Determining Liability in an Accident

Determining liability in a car accident can be a complex process, often involving multiple factors and legal considerations. Insurance companies employ claims adjusters and investigators to assess the circumstances of an accident and assign fault. Factors such as traffic laws, witness statements, and physical evidence all play a role in determining liability.

In some cases, liability may be shared between multiple parties. For instance, if both drivers involved in an accident are found to have contributed to the collision, their respective insurance companies may negotiate a settlement based on the degree of fault assigned to each driver.

The Impact of Liability on Car Insurance Premiums

Liability coverage is a significant factor in determining car insurance premiums. Insurance companies consider various factors, including the policyholder’s driving history, location, and the limits of liability coverage chosen, to calculate the premium. Higher liability limits generally result in higher premiums, as they provide greater financial protection.

For instance, a driver with a clean driving record residing in a low-risk area may enjoy relatively affordable premiums for liability coverage. On the other hand, a driver with a history of accidents or traffic violations, or one residing in an area with a high incidence of accidents, may face higher premiums to reflect the increased risk.

| Factors Affecting Liability Premium | Description |

|---|---|

| Driving History | Clean records generally result in lower premiums. |

| Location | Areas with high accident rates may incur higher premiums. |

| Liability Coverage Limits | Higher limits typically result in higher premiums. |

Liability and Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is an additional coverage option that can complement liability insurance. While liability coverage protects against damages caused to others, PIP provides coverage for the policyholder and their passengers, regardless of who is at fault in an accident.

PIP coverage can include medical expenses, lost wages, and even funeral expenses, providing a comprehensive safety net for policyholders. In no-fault states, PIP coverage is often mandatory, ensuring that drivers and their passengers have immediate access to medical treatment and financial support after an accident.

| PIP Coverage Limits | Policy Coverage |

|---|---|

| Medical Expenses | $5,000 per person |

| Lost Wages | $2,500 per person |

| Funeral Expenses | $5,000 per person |

Uninsured and Underinsured Motorist Liability

Uninsured and underinsured motorist liability coverage is an important consideration when discussing car insurance. This coverage protects policyholders in situations where the at-fault driver either lacks insurance or has insufficient coverage to compensate for the damages caused.

In the event of an accident with an uninsured or underinsured driver, the policyholder's uninsured/underinsured motorist liability coverage can step in to provide compensation for bodily injury and property damage. This coverage ensures that policyholders are not left with the burden of covering these expenses on their own.

| Uninsured/Underinsured Motorist Liability Limits | Policy Coverage |

|---|---|

| Bodily Injury | $100,000 per person / $300,000 per accident |

| Property Damage | $50,000 per accident |

Legal and Ethical Considerations in Liability

Liability in car insurance is not solely a financial matter; it also involves legal and ethical considerations. When an accident occurs, determining liability is crucial for legal purposes, as it can impact the outcome of any potential lawsuits or legal proceedings.

From an ethical standpoint, liability coverage reflects a driver's responsibility and commitment to ensuring the safety and well-being of others on the road. It demonstrates a willingness to accept the financial consequences of one's actions, fostering a sense of accountability and social responsibility.

Conclusion: Navigating Liability with Expert Guidance

Understanding liability in car insurance is essential for every vehicle owner. It involves a delicate balance between providing adequate financial protection and managing the associated costs. By comprehending the various aspects of liability coverage, drivers can make informed decisions when selecting their insurance policies.

Working with insurance experts can provide valuable insights and guidance in navigating the complex world of liability insurance. They can help policyholders choose the right coverage limits, understand the potential risks, and ensure they are adequately protected in the event of an accident.

In the end, liability coverage is not just a legal requirement but a critical component of responsible vehicle ownership. It ensures that drivers can navigate the roads with confidence, knowing they have the necessary protection in place to handle any unforeseen circumstances.

How is liability determined in a car accident?

+Liability in a car accident is typically determined through a thorough investigation by insurance companies, involving claims adjusters and investigators. They consider various factors, including traffic laws, witness statements, and physical evidence, to assign fault. In some cases, liability may be shared between multiple parties based on their degree of fault.

What are the consequences of not having adequate liability coverage?

+Not having adequate liability coverage can lead to significant financial consequences if an accident occurs. If the damages exceed the limits of your liability coverage, you may be personally liable for the remaining amount, which can be substantial. It’s essential to review your coverage limits regularly and adjust them as needed to ensure adequate protection.

Can I choose higher liability limits to enhance my coverage?

+Yes, you have the option to choose higher liability limits to enhance your coverage. While this may result in higher premiums, it provides greater financial protection in the event of an accident. It’s a good idea to discuss your options with an insurance agent to find the right balance between coverage and affordability.

What is the role of Personal Injury Protection (PIP) in liability coverage?

+Personal Injury Protection (PIP) is an additional coverage option that complements liability insurance. While liability coverage protects against damages caused to others, PIP provides coverage for the policyholder and their passengers, regardless of fault. It includes medical expenses, lost wages, and funeral expenses, offering a comprehensive safety net.

How does uninsured/underinsured motorist liability coverage work?

+Uninsured/underinsured motorist liability coverage protects policyholders in situations where the at-fault driver lacks insurance or has insufficient coverage. In such cases, this coverage steps in to provide compensation for bodily injury and property damage, ensuring that policyholders are not left with the burden of these expenses.