Average Cost Of Health Insurance Per Month

The average cost of health insurance per month is a crucial metric for individuals and families seeking to understand their financial obligations and plan their healthcare budgets effectively. This article aims to provide an in-depth analysis of the average monthly health insurance costs, covering various factors that influence these expenses and offering valuable insights to navigate the complex world of healthcare coverage.

Understanding the Average Health Insurance Costs

Health insurance is a vital aspect of modern life, providing financial protection and access to essential medical services. The average cost of health insurance per month varies significantly based on numerous factors, including geographical location, age, coverage type, and the specific plan chosen. Let’s delve into these factors to gain a comprehensive understanding.

Geographical Variations

One of the primary drivers of health insurance costs is the geographical location of the policyholder. Healthcare expenses and the availability of medical services can vary greatly from one region to another. For instance, metropolitan areas with higher living costs and advanced medical facilities often command higher insurance premiums. On the other hand, rural areas may offer more affordable options due to lower overhead costs.

| Region | Average Monthly Premium |

|---|---|

| Urban Centers (e.g., New York City) | $650 - $800 |

| Suburban Areas | $500 - $600 |

| Rural Communities | $400 - $550 |

These figures provide a general overview, but it's important to note that premiums can vary even within the same region, depending on the specific insurer and plan.

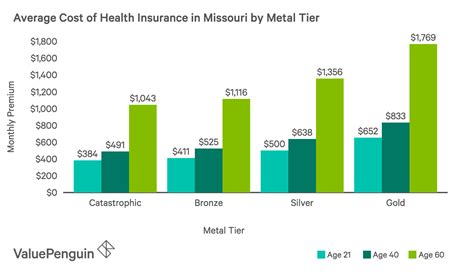

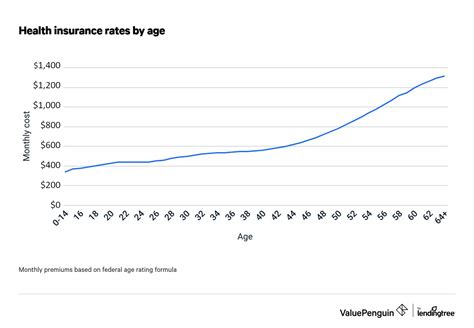

Age and Demographics

Another significant factor influencing health insurance costs is the age of the policyholder. Generally, younger individuals tend to pay lower premiums as they are less likely to require extensive medical care. However, as people age, their healthcare needs often increase, leading to higher insurance costs. This is why many countries have implemented policies to prevent age-based discrimination in health insurance.

| Age Group | Average Monthly Premium |

|---|---|

| 18 - 29 years | $350 - $450 |

| 30 - 44 years | $400 - $550 |

| 45 - 64 years | $500 - $700 |

| 65+ years | $700 - $900 |

It's worth noting that these averages can vary based on other demographic factors, such as gender, pre-existing conditions, and family size.

Coverage Types and Plan Options

The type of coverage chosen plays a pivotal role in determining health insurance costs. Different plans offer varying levels of coverage and benefits, which directly impact the monthly premium. Here’s a breakdown of common coverage types and their associated costs:

- HMO (Health Maintenance Organization): HMOs typically offer a lower average monthly premium, starting at around $300. However, they often require the policyholder to choose a primary care physician and may have more restrictions on specialist visits.

- PPO (Preferred Provider Organization): PPOs provide more flexibility in choosing healthcare providers and typically have a higher average monthly premium, ranging from $400 to $600. They often cover a broader network of doctors and hospitals.

- EPO (Exclusive Provider Organization): EPOs strike a balance between HMO and PPO plans, offering a restricted network of providers but with fewer restrictions than HMOs. The average monthly premium for EPOs falls between $350 and $500.

- POS (Point of Service): POS plans offer flexibility similar to PPOs but with the added requirement of choosing a primary care physician. The average monthly premium for POS plans can range from $400 to $650.

Additionally, the choice of deductibles, copayments, and out-of-pocket maximums within these plans can significantly impact the overall cost. Higher deductibles and out-of-pocket expenses often result in lower monthly premiums, while lower deductibles and copayments can increase the monthly cost.

The Impact of Employer-Sponsored Plans

For a significant portion of the population, health insurance is obtained through employer-sponsored plans. These plans are often more cost-effective as the employer contributes to the premium, reducing the financial burden on employees. The average monthly cost for employer-sponsored health insurance can vary widely, typically ranging from 200 to 500 per month, depending on the plan’s coverage and the employer’s contribution.

Factors Influencing Health Insurance Costs

Several other factors can influence the average cost of health insurance per month. Understanding these factors can help individuals make more informed decisions when choosing a health insurance plan.

Pre-Existing Conditions

The presence of pre-existing medical conditions can significantly impact insurance costs. Insurers often assess the risk associated with these conditions and may charge higher premiums or even deny coverage. This is why it’s crucial to understand the implications of pre-existing conditions when selecting a health insurance plan.

Family Size and Coverage

The size of one’s family and the number of individuals covered under a health insurance plan can also affect the average monthly cost. Family plans typically offer coverage for the policyholder, their spouse, and any dependent children. The premium for such plans is often calculated based on the combined risk of all family members, which can result in higher costs.

Healthcare Utilization and Claims History

The frequency of healthcare utilization and the policyholder’s claims history can influence insurance costs. Insurers closely monitor claims data to assess the risk associated with each policyholder. Those with a history of frequent claims or extensive medical needs may face higher premiums or even non-renewal of their policy.

Lifestyle and Health Factors

An individual’s lifestyle choices and overall health can impact insurance costs. For example, smokers often face higher premiums due to the increased risk of smoking-related health issues. Similarly, individuals with unhealthy diets or sedentary lifestyles may be charged more, as these factors can contribute to various health problems.

Navigating Health Insurance Costs: Tips and Strategies

Understanding the average cost of health insurance per month is just the first step. To make informed decisions and potentially reduce these costs, consider the following tips and strategies:

- Compare Plans: Research and compare different health insurance plans to find the one that best suits your needs and budget. Consider factors like coverage, network of providers, and out-of-pocket expenses.

- Utilize Employer Benefits: If your employer offers health insurance, take advantage of it. Employer-sponsored plans often provide more affordable options due to the employer's contribution.

- Explore Government Programs: Depending on your income and family size, you may qualify for government-sponsored health insurance programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs offer low-cost or free coverage.

- Consider High-Deductible Plans: High-deductible health plans (HDHPs) often have lower monthly premiums. These plans are suitable for individuals who prioritize lower monthly costs and have minimal healthcare needs. However, be prepared for higher out-of-pocket expenses in case of unexpected medical emergencies.

- Take Advantage of Tax Benefits: Some health insurance plans, especially those paired with Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), offer tax benefits. These accounts allow you to save pre-tax dollars for eligible medical expenses, effectively reducing your taxable income.

- Maintain a Healthy Lifestyle: Leading a healthy lifestyle can not only improve your overall well-being but also potentially reduce your health insurance costs. Insurers often offer incentives or discounts for healthy behaviors, such as quitting smoking or maintaining a healthy weight.

Conclusion: A Comprehensive Approach to Health Insurance Costs

Understanding the average cost of health insurance per month is crucial for effective financial planning and access to quality healthcare. By considering various factors such as geographical location, age, coverage type, and individual circumstances, individuals can make informed decisions when choosing a health insurance plan. Additionally, by exploring tips and strategies to navigate health insurance costs, it is possible to find a balance between affordable coverage and comprehensive healthcare benefits.

What is the average monthly cost of health insurance for a family?

+The average monthly cost of health insurance for a family can vary significantly based on factors such as geographical location, the number of family members, and the chosen coverage type. On average, a family plan can range from 700 to 1,500 per month, but these figures can be higher or lower depending on specific circumstances.

Are there any ways to reduce health insurance costs?

+Yes, there are several strategies to reduce health insurance costs. These include comparing plans to find the most cost-effective option, utilizing employer-sponsored plans, exploring government-sponsored programs, considering high-deductible plans, and maintaining a healthy lifestyle to qualify for insurer incentives.

How do pre-existing conditions impact health insurance costs?

+Pre-existing conditions can significantly impact health insurance costs. Insurers assess the risk associated with these conditions, which may lead to higher premiums or even denial of coverage. It’s important to understand the implications of pre-existing conditions when selecting a health insurance plan.

What is the role of deductibles in health insurance plans?

+Deductibles in health insurance plans represent the amount an individual must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower monthly premiums, while lower deductibles can increase the monthly cost. Choosing the right deductible depends on individual financial circumstances and healthcare needs.