Dental Insurance

Dental health is a critical aspect of overall well-being, and access to quality dental care is essential for maintaining healthy teeth and gums. Dental insurance plays a pivotal role in ensuring individuals can afford the necessary treatments and procedures to keep their oral health in check. This comprehensive guide delves into the intricacies of dental insurance, exploring its benefits, coverage options, and how it empowers individuals to prioritize their dental health without financial strain.

Understanding Dental Insurance: A Comprehensive Overview

Dental insurance is a specialized form of health coverage designed to offset the costs associated with dental treatments and procedures. It offers policyholders a means to manage their oral health more effectively, providing financial support for a range of services, from routine check-ups and cleanings to more complex procedures like root canals and dental implants.

The primary goal of dental insurance is to make dental care more accessible and affordable for individuals and families. By offering coverage for a variety of dental services, these plans help reduce the financial burden of maintaining optimal oral health. Moreover, regular dental check-ups can lead to early detection of potential issues, enabling timely interventions and often more cost-effective treatments.

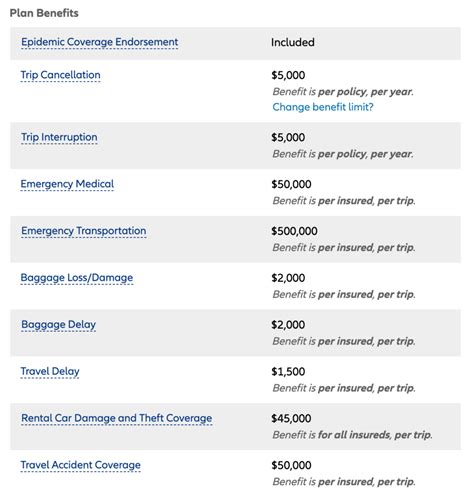

Key Components of Dental Insurance Plans

Dental insurance plans typically encompass a range of services, each with its own level of coverage. Understanding these components is crucial for making informed decisions about your dental care and financial planning.

- Preventive Care: This category includes routine check-ups, dental cleanings, X-rays, and other preventive measures. Most plans cover these services at 100% or with minimal out-of-pocket expenses.

- Basic Restorative Care: Basic restorative procedures like fillings, extractions, and root planing often fall under this category. Coverage for these services can vary, with some plans covering a portion of the costs.

- Major Restorative Care: Major procedures such as crowns, bridges, and root canals are typically covered at a lower percentage, usually around 50% of the total cost.

- Orthodontic Care: Dental insurance plans often provide coverage for orthodontic treatments, including braces and other corrective appliances. However, the coverage limits and age restrictions can vary significantly between plans.

- Dental Emergencies: Many plans offer coverage for unexpected dental emergencies, ensuring you can access immediate care without incurring substantial financial burden.

It's essential to carefully review the details of your dental insurance plan to understand the specific coverage limits, waiting periods, and any exclusions that might apply.

Maximizing Your Dental Insurance Benefits

To make the most of your dental insurance, it’s important to understand how to navigate the system and take advantage of the benefits offered. Here are some strategies to ensure you’re getting the most value from your plan.

Choosing the Right Dentist

Not all dentists accept every dental insurance plan. When selecting a dentist, ensure they are in-network with your insurance provider. This means they have an agreement with the insurance company to accept the plan’s allowed amount as full payment, often reducing your out-of-pocket costs.

If you prefer an out-of-network dentist, you may still be able to use your insurance, but you'll likely pay more out of pocket, and the insurance company may only reimburse you for a portion of the allowed amount.

Understanding Your Coverage and Exclusions

Familiarize yourself with the specifics of your dental insurance plan. Know the coverage limits, any deductibles or copays you might have to pay, and the waiting periods for certain procedures. Understanding these details can help you plan your dental care and financial obligations effectively.

Additionally, be aware of any exclusions or limitations in your plan. For instance, some plans might not cover certain cosmetic procedures or have age restrictions for orthodontic coverage. Knowing these limitations can help you make informed decisions about your dental treatment plans.

Scheduling Regular Check-Ups and Cleanings

Regular dental check-ups and cleanings are essential for maintaining good oral health and are often fully covered by dental insurance plans. These visits allow your dentist to detect and address any potential issues early on, preventing more significant problems and costly treatments down the line.

Moreover, by attending these regular check-ups, you demonstrate a commitment to your oral health, which can be beneficial when it comes to insurance claims and potential future treatments.

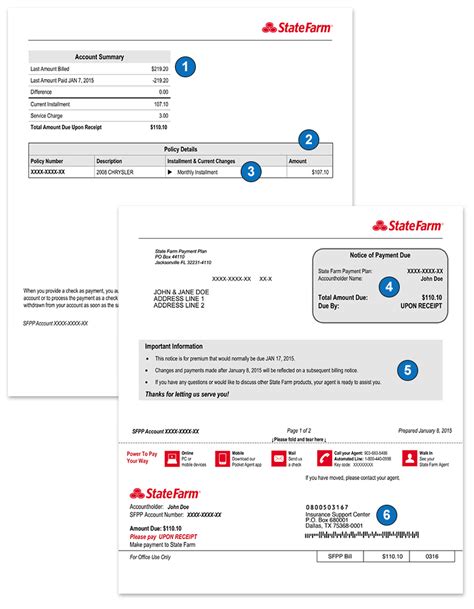

Managing Your Dental Care Budget

Dental insurance can significantly reduce the financial burden of dental care, but it’s important to manage your budget effectively. Plan your dental treatments in advance, especially if you’re considering more extensive or costly procedures. This allows you to understand the potential out-of-pocket costs and budget accordingly.

Additionally, explore any flexible spending options or health savings accounts (HSAs) offered by your employer or insurance provider. These accounts can help you set aside pre-tax dollars specifically for dental and medical expenses, providing an additional financial buffer for your dental care needs.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a crucial role in promoting and maintaining good oral health. By providing access to affordable dental care, these plans encourage individuals to prioritize their oral hygiene and seek regular dental check-ups.

Early Detection and Prevention

Regular dental visits facilitated by insurance coverage enable dentists to identify potential oral health issues at an early stage. This early detection can lead to more effective and less invasive treatments, often resulting in better long-term outcomes and reduced overall treatment costs.

Moreover, preventive care, such as routine cleanings and X-rays, can help identify and address issues like gum disease, cavities, and oral infections before they become more serious and costly to treat.

Improved Access to Specialized Treatments

Dental insurance plans that offer coverage for specialized treatments, such as orthodontics, periodontics, and endodontics, provide individuals with access to a broader range of dental services. This expanded access ensures that those with more complex dental needs can receive the specialized care they require.

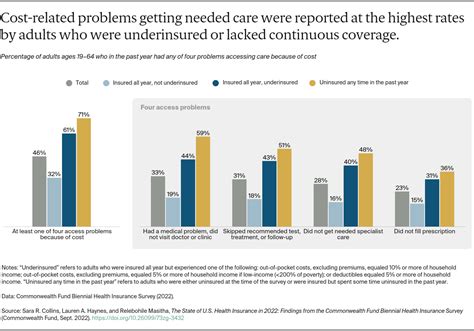

Reduced Financial Barriers

The financial support provided by dental insurance plans can significantly reduce the cost of dental care. This is especially beneficial for individuals and families who might otherwise struggle to afford necessary dental treatments, helping to ensure that everyone has the opportunity to maintain good oral health.

By reducing financial barriers, dental insurance encourages individuals to seek the dental care they need, leading to improved overall health and well-being.

The Future of Dental Insurance: Trends and Innovations

The dental insurance landscape is evolving, with emerging trends and innovations aimed at enhancing coverage and accessibility. Here’s a glimpse into the future of dental insurance and the potential impact on policyholders.

Telehealth and Virtual Dental Care

The integration of telehealth services into dental care is a growing trend. Virtual dental consultations and remote monitoring of oral health are becoming more prevalent, offering convenience and accessibility to policyholders. This technology enables dentists to provide initial assessments, follow-ups, and even prescribe medications without the need for an in-person visit, making dental care more efficient and cost-effective.

Expanded Coverage for Preventive Care

There’s a growing emphasis on preventive dental care, with some insurance providers expanding their coverage to include additional preventive services. This includes offerings like fluoride treatments, dental sealants, and oral cancer screenings. By focusing on preventive care, insurance companies aim to reduce the need for more costly restorative treatments in the long run.

Incentivizing Healthy Habits

To encourage policyholders to adopt and maintain healthy oral hygiene practices, some insurance providers are introducing incentive-based programs. These programs might offer rewards or discounts for meeting certain oral health milestones, such as regular check-ups or achieving a certain level of oral hygiene.

Personalized Dental Plans

The future of dental insurance may also involve more personalized plans. These plans could take into account an individual’s specific dental needs and history, offering tailored coverage and potentially reducing unnecessary costs. For instance, a plan might offer enhanced coverage for individuals with a history of gum disease or those requiring specialized orthodontic treatment.

Conclusion: Empowering Oral Health with Dental Insurance

Dental insurance is an essential tool for ensuring individuals can access the dental care they need to maintain optimal oral health. By understanding the intricacies of your dental insurance plan and adopting strategies to maximize its benefits, you can make informed decisions about your dental care and financial planning.

As the dental insurance landscape continues to evolve, policyholders can expect improved coverage, enhanced accessibility, and more personalized plans. These innovations will further empower individuals to take control of their oral health, leading to improved overall well-being.

How do I choose the right dental insurance plan for my needs?

+

When selecting a dental insurance plan, consider your current and future dental needs. Assess the coverage limits, deductibles, and any exclusions or limitations. Choose a plan that aligns with your dental priorities, whether it’s focusing on preventive care, addressing specific dental issues, or planning for potential major procedures. Additionally, ensure the plan includes a network of dentists that meets your geographic and personal preferences.

Can I use my dental insurance for cosmetic dental procedures?

+

Cosmetic dental procedures, such as teeth whitening or veneers, are typically not covered by standard dental insurance plans. These procedures are considered elective and are often excluded from coverage. However, some insurance providers offer additional coverage for cosmetic procedures, but it’s usually at a higher cost and with more restrictive conditions.

What happens if I exceed my dental insurance plan’s annual coverage limit?

+

If you exceed your dental insurance plan’s annual coverage limit, you’ll be responsible for paying the full cost of any additional dental services out of pocket. It’s important to be aware of your plan’s coverage limits and plan your dental treatments accordingly. Some plans offer the option to roll over unused benefits to the next year, while others may provide a grace period for exceeding the limit.

Are there any alternatives to traditional dental insurance plans?

+

Yes, there are alternatives to traditional dental insurance plans. One popular option is dental savings plans, which offer discounted rates on dental services without the use of insurance. These plans typically require an annual fee and provide access to a network of participating dentists. Another alternative is dental discount cards, which offer immediate savings on dental services without the need for claims or paperwork.

How can I reduce my out-of-pocket costs when using dental insurance?

+

To minimize out-of-pocket costs when using dental insurance, it’s essential to understand your plan’s coverage and exclusions. Schedule regular preventive care visits, as these are often fully covered. Plan major procedures in advance to ensure you understand the potential out-of-pocket costs. Additionally, consider utilizing in-network dentists to take advantage of reduced rates and potential cost savings.