Insurance Bill

In the world of finance and legal matters, understanding the intricacies of insurance bills is essential for both individuals and businesses. An insurance bill, also known as a premium invoice, is a critical document that outlines the financial obligations and coverage details of an insurance policy. It is a contract between the policyholder and the insurance company, specifying the terms and conditions of the insurance agreement. This article aims to delve into the depths of insurance bills, exploring their components, significance, and the impact they have on financial planning.

Unraveling the Insurance Bill: A Comprehensive Overview

An insurance bill is more than just a piece of paper; it is a comprehensive summary of the insurance policy’s terms, conditions, and financial responsibilities. It serves as a reminder and a record of the agreement between the insured and the insurer. The bill provides a detailed breakdown of the coverage, premiums, and any additional fees or surcharges associated with the policy. Understanding the components of an insurance bill is crucial for making informed decisions and managing financial obligations effectively.

Key Components of an Insurance Bill

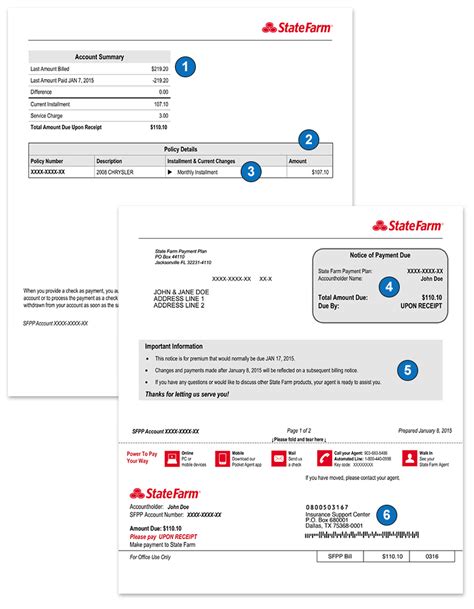

The insurance bill is divided into several sections, each containing vital information. Here’s a breakdown of the key components:

- Policy Details: This section provides an overview of the insurance policy, including the policy number, the insured's name and address, the coverage type, and the effective dates of the policy.

- Coverage Summary: A detailed description of the coverage limits, deductibles, and any specific exclusions or limitations is provided. This section ensures that the insured understands the scope of their coverage.

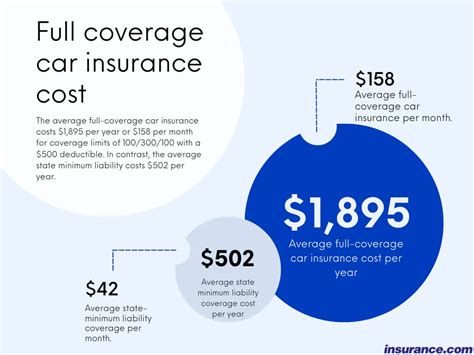

- Premium Calculation: The insurance bill explains how the premium amount was calculated. It may include factors such as the insured's risk profile, the coverage amount, and any applicable discounts or surcharges. Understanding the premium calculation helps the insured assess the value and affordability of their policy.

- Payment Options: Insurance bills often offer various payment options, such as monthly, quarterly, or annual installments. The bill will outline the due dates and any associated fees for late payments.

- Renewal Information: If the policy is up for renewal, the bill will provide details about the renewal process, including any changes in coverage or premiums. It may also include instructions on how to renew the policy and maintain continuous coverage.

- Additional Fees: Besides the premium, insurance bills may include additional fees, such as administrative charges, state taxes, or other surcharges. These fees are itemized and explained to ensure transparency.

- Policy Documents: In some cases, the insurance bill may include links or references to the full policy documents. These documents provide a comprehensive understanding of the legal terms and conditions of the insurance agreement.

The Impact of Insurance Bills on Financial Planning

Insurance bills play a significant role in financial planning and management. They provide a clear picture of the financial obligations associated with insurance coverage. Here’s how insurance bills impact financial planning:

- Budgeting: Insurance bills help individuals and businesses allocate their financial resources effectively. By understanding the premium amounts and payment schedules, they can budget accordingly and ensure timely payments.

- Cash Flow Management: For businesses, insurance bills are crucial for cash flow management. They allow for the allocation of funds to cover insurance expenses, ensuring that the business remains financially stable and compliant with insurance requirements.

- Risk Assessment: Insurance bills provide an opportunity for insured individuals and businesses to assess their risk exposure. By analyzing the coverage limits and deductibles, they can identify potential gaps in their insurance coverage and make informed decisions to mitigate risks.

- Comparison and Negotiation: Insurance bills serve as a basis for comparing insurance policies and providers. By reviewing the terms and premiums, insured parties can evaluate the value and cost-effectiveness of their current policy. This information can be used to negotiate better rates or explore alternative insurance options.

- Financial Strategy: Insurance bills are a part of a comprehensive financial strategy. They help insured parties optimize their insurance coverage, manage costs, and ensure that their assets and liabilities are adequately protected.

Tips for Managing Insurance Bills

Effective management of insurance bills is essential for maintaining financial stability and compliance. Here are some tips to help individuals and businesses navigate insurance bills:

- Read and Understand: Take the time to carefully read and comprehend the insurance bill. Familiarize yourself with the coverage details, premium calculations, and any additional fees. Understanding the bill empowers you to make informed decisions.

- Review Coverage: Regularly review your insurance coverage to ensure it aligns with your current needs and circumstances. As life changes, so do insurance requirements. Assess whether your coverage is sufficient or if adjustments are necessary.

- Compare and Shop Around: Don't settle for the first insurance bill you receive. Shop around and compare different insurance providers and policies. Look for competitive rates, comprehensive coverage, and flexible payment options to find the best value for your money.

- Ask Questions: If you have any doubts or queries regarding your insurance bill, don't hesitate to reach out to your insurance agent or provider. They can provide clarification and guidance to ensure you fully understand your policy and its financial implications.

- Set Reminders: Set up reminders for premium due dates to avoid late payments and potential penalties. Many insurance companies offer online payment portals and automated reminders to make the process more convenient.

- Seek Professional Advice: For complex insurance matters or when making significant changes to your coverage, consider seeking advice from a financial advisor or insurance specialist. They can provide expert guidance tailored to your specific needs and circumstances.

The Future of Insurance Billing

The insurance industry is evolving, and so are the methods of billing and payment. With technological advancements, insurance billing is becoming more streamlined and efficient. Here are some insights into the future of insurance billing:

- Digital Transformation: Insurance companies are increasingly adopting digital platforms and online tools for billing and payment. This shift towards digitization offers convenience, efficiency, and enhanced security for both insurers and insured parties.

- Automated Billing: Automation is set to play a significant role in insurance billing. Automated systems can generate bills, send reminders, and process payments, reducing manual errors and improving overall efficiency.

- Real-Time Data: With the integration of real-time data analytics, insurance companies can offer more personalized billing experiences. By analyzing risk factors and claim patterns, insurers can provide tailored coverage and pricing, benefiting both parties.

- Blockchain Technology: Blockchain technology has the potential to revolutionize insurance billing. It can enhance security, transparency, and efficiency in the insurance ecosystem, ensuring accurate and tamper-proof billing records.

- Pay-As-You-Go Models: Some insurance providers are exploring pay-as-you-go models, where premiums are calculated based on actual usage or exposure to risk. This dynamic billing approach offers flexibility and cost-efficiency for certain types of insurance, such as usage-based auto insurance.

Conclusion: Empowering Financial Decisions

Insurance bills are more than just financial obligations; they are tools for empowerment and informed decision-making. By understanding the components, significance, and impact of insurance bills, individuals and businesses can navigate the insurance landscape with confidence. Effective management of insurance bills ensures financial stability, risk mitigation, and the protection of assets. As the insurance industry embraces digital transformation and innovative billing models, the future of insurance billing looks promising, offering enhanced convenience and efficiency.

What should I do if I receive an insurance bill with an error or discrepancy?

+

If you notice any errors or discrepancies in your insurance bill, it is crucial to contact your insurance provider promptly. Provide them with the details of the error and request a correction. Most insurance companies have dedicated customer service teams to address such issues and ensure accuracy in billing.

Can I negotiate my insurance premiums or seek discounts?

+

Absolutely! Insurance premiums can often be negotiated, especially if you have a good claims history or are a long-term customer. Additionally, many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. Don’t hesitate to discuss potential discounts and negotiate terms with your insurance provider.

Are there any tax benefits associated with insurance premiums?

+

Yes, in certain cases, insurance premiums can provide tax benefits. For example, premiums paid for health insurance or life insurance policies may be eligible for tax deductions. It is advisable to consult with a tax professional to understand the specific tax implications and benefits associated with your insurance premiums.