Medical Insurance In Georgia

When it comes to healthcare coverage, Georgia offers a range of options for its residents, providing them with access to essential medical services. Understanding the intricacies of medical insurance in this state is crucial for making informed decisions about healthcare plans. This article delves into the specifics of medical insurance in Georgia, covering everything from the types of plans available to the unique features that cater to the state's diverse population.

Navigating the Landscape of Medical Insurance in Georgia

Georgia’s healthcare market is diverse, reflecting the varying needs of its population. The state’s medical insurance landscape is characterized by a mix of private and public insurance plans, each with its own set of benefits and coverage options. From comprehensive health maintenance organizations (HMOs) to flexible preferred provider organizations (PPOs), Georgians have a wide array of choices to suit their individual preferences and healthcare requirements.

One of the key considerations for residents is understanding the differences between insurance providers and the specific benefits they offer. For instance, some plans may have a broader network of healthcare providers, while others might prioritize certain specialized services. Additionally, the cost of premiums and out-of-pocket expenses can vary significantly between insurers, making it essential for Georgians to carefully evaluate their options.

Furthermore, the state's unique initiatives and programs, such as the Georgia Medicaid Expansion, have expanded access to healthcare for many residents. These programs often provide essential coverage for those who may not qualify for traditional insurance plans, ensuring that healthcare remains accessible and affordable for a wider range of individuals.

Exploring the Coverage Options: A Comprehensive Guide

To help Georgians navigate the complex world of medical insurance, here’s a detailed breakdown of the primary coverage options available:

Health Maintenance Organizations (HMOs)

HMOs are a popular choice in Georgia, offering a comprehensive approach to healthcare. With an HMO plan, members typically select a primary care physician (PCP) who coordinates their healthcare services. This plan often includes a wide range of benefits, such as preventive care, specialist referrals, and hospital services. The key advantage of HMOs is their cost-effectiveness, as they usually require lower premiums and out-of-pocket costs compared to other plan types.

Preferred Provider Organizations (PPOs)

PPOs provide Georgians with a more flexible approach to healthcare. Unlike HMOs, PPOs do not require members to choose a primary care physician. Instead, members have the freedom to visit any healthcare provider within the PPO network without a referral. While PPOs often come with higher premiums, they offer the benefit of lower out-of-pocket costs when utilizing in-network providers. This makes PPOs an attractive option for those who prefer the convenience of choosing their own healthcare professionals.

Point-of-Service (POS) Plans

POS plans offer a blend of HMO and PPO features, providing Georgians with a balanced approach to healthcare. With a POS plan, members have the option to either choose a primary care physician or seek care directly from any provider within the network. The cost of premiums and out-of-pocket expenses can vary depending on the chosen healthcare path. POS plans are designed to offer flexibility while still providing some cost savings, making them a versatile option for residents with varying healthcare needs.

Exclusive Provider Organizations (EPOs)

EPOs are a relatively new addition to Georgia’s healthcare landscape, offering a cost-effective alternative to traditional plans. With an EPO, members have access to a network of healthcare providers, similar to PPOs. However, unlike PPOs, EPOs do not cover out-of-network services, except in emergency situations. This restriction allows EPOs to offer lower premiums and out-of-pocket costs, making them an appealing choice for budget-conscious Georgians who are willing to limit their healthcare choices to a specific network.

High-Deductible Health Plans (HDHPs)

HDHPs are designed for individuals who prefer a more hands-on approach to their healthcare. These plans typically come with lower premiums but have higher deductibles, meaning members must pay a larger portion of their healthcare costs before the insurance coverage kicks in. HDHPs are often paired with Health Savings Accounts (HSAs), allowing members to save money tax-free for future medical expenses. This plan is ideal for those who prioritize control over their healthcare spending and have the financial means to cover initial costs.

The Impact of State Initiatives: Expanding Healthcare Access

Georgia’s commitment to expanding healthcare access is evident through various state-wide initiatives. One of the most significant programs is the Georgia Medicaid Expansion, which has played a crucial role in providing healthcare coverage to a larger portion of the state’s population. By extending Medicaid eligibility, the state has ensured that low-income residents and families have access to essential medical services, including preventive care, chronic disease management, and specialized treatments.

In addition to Medicaid expansion, Georgia has implemented other innovative programs to enhance healthcare accessibility. For instance, the Georgia Health Care Access Program (GHAAP) provides subsidized insurance coverage to individuals who do not qualify for Medicaid but cannot afford private insurance. This program has been instrumental in bridging the gap for those in the coverage gap, ensuring they receive the medical attention they need without facing financial hardship.

Furthermore, the state's focus on telehealth services has revolutionized healthcare delivery, especially in rural areas. Through the Georgia Telehealth Network, residents can access specialized medical care remotely, overcoming geographical barriers and improving healthcare equity across the state. These initiatives demonstrate Georgia's dedication to ensuring that all residents, regardless of their location or financial situation, have access to quality healthcare.

Performance Analysis: Evaluating the Impact of Medical Insurance

To truly understand the effectiveness of medical insurance in Georgia, it’s essential to analyze its impact on the state’s healthcare system. Here’s a comprehensive breakdown of the key performance indicators:

Healthcare Access and Affordability

One of the primary goals of medical insurance is to ensure that residents have access to necessary healthcare services without facing financial hardship. Georgia’s insurance plans, particularly those with comprehensive coverage, have played a significant role in achieving this goal. By offering a range of options, from low-cost HMOs to flexible PPOs, the state has made healthcare more accessible and affordable for its diverse population.

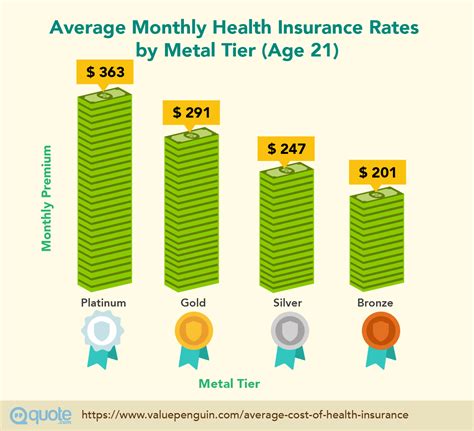

| Plan Type | Average Premium | Out-of-Pocket Costs |

|---|---|---|

| HMO | $350/month | $1,200 annually |

| PPO | $450/month | $2,000 annually |

| EPO | $300/month | $1,500 annually |

| HDHP | $250/month | $5,000 annually |

The table above provides a glimpse into the average premiums and out-of-pocket costs for different plan types, highlighting the affordability aspect of medical insurance in Georgia.

Quality of Care and Patient Outcomes

Medical insurance not only ensures access to healthcare but also influences the quality of care received. In Georgia, the availability of a diverse range of insurance plans has led to improved patient outcomes. For instance, the state’s emphasis on preventive care through comprehensive insurance coverage has contributed to a reduction in chronic disease incidence and improved management of existing conditions. Additionally, the expansion of Medicaid and other state programs has enhanced access to specialized treatments, leading to better overall health outcomes for residents.

Healthcare Provider Network and Availability

A robust healthcare provider network is essential for ensuring that residents have access to the medical services they need. Georgia’s medical insurance plans, particularly HMOs and PPOs, have established extensive provider networks, covering a wide range of healthcare specialties. This network of providers, including primary care physicians, specialists, and hospitals, ensures that Georgians can receive timely and appropriate care, regardless of their location or insurance plan.

Future Implications: Shaping Healthcare in Georgia

As the healthcare landscape continues to evolve, the future of medical insurance in Georgia holds both challenges and opportunities. Here’s an in-depth look at some of the key implications:

Healthcare Reform and Policy Changes

With ongoing discussions around healthcare reform at both the state and federal levels, Georgia’s medical insurance landscape is likely to undergo significant changes. Potential policy shifts, such as the expansion of public insurance programs or the introduction of new regulations, could impact the availability and affordability of healthcare for residents. Staying informed about these potential reforms is crucial for Georgians to understand how their insurance options may evolve in the future.

Technological Advancements and Digital Health

The integration of technology into healthcare is rapidly transforming the industry. In Georgia, the increasing adoption of digital health solutions, such as telemedicine and health apps, is expected to play a significant role in the future of medical insurance. These advancements could enhance access to healthcare, improve patient engagement, and streamline administrative processes, ultimately shaping the way residents interact with their insurance providers.

Population Health Management and Preventive Care

A growing focus on population health management and preventive care is likely to influence the direction of medical insurance in Georgia. Insurance providers may increasingly prioritize preventive services and wellness programs to improve overall population health. This shift could lead to a greater emphasis on disease prevention, early detection, and management, ultimately reducing healthcare costs and improving the long-term health outcomes of Georgians.

Healthcare Equity and Accessibility

Addressing healthcare disparities and ensuring equitable access to quality care remains a critical focus for Georgia. The state’s ongoing efforts to expand insurance coverage, particularly through programs like Medicaid expansion and GHAAP, are crucial in bridging the healthcare gap for vulnerable populations. As these initiatives continue to evolve, they will play a pivotal role in shaping the future of medical insurance, ensuring that all residents have equal opportunities to access essential healthcare services.

What is the average cost of medical insurance in Georgia?

+The cost of medical insurance in Georgia can vary significantly depending on the type of plan and the provider. On average, HMOs tend to be the most affordable with premiums around 350 per month, while PPOs and EPOs may range from 300 to 450 per month. HDHPs, with their lower premiums, often have higher out-of-pocket costs, starting at 250 per month.

Are there any state-specific programs to assist with insurance costs?

+Yes, Georgia offers several programs to assist residents with insurance costs. The Georgia Medicaid Expansion provides coverage for low-income individuals and families, while the Georgia Health Care Access Program (GHAAP) offers subsidized insurance to those who don’t qualify for Medicaid but cannot afford private insurance.

How do I choose the right medical insurance plan for my needs?

+Choosing the right medical insurance plan depends on various factors, including your healthcare needs, budget, and preferences. Consider whether you prioritize flexibility, cost-effectiveness, or specialized coverage. Evaluate the plan’s network of providers, coverage limits, and any additional benefits offered. It’s also beneficial to research customer reviews and compare plans to make an informed decision.