California Auto Insurance Quotes Online

In the Golden State, obtaining auto insurance quotes online has become a popular and convenient way for drivers to secure the best coverage and rates. California's vast and diverse population, along with its unique driving conditions, makes it crucial for drivers to understand their insurance options and how to navigate the process effectively. This article aims to provide an in-depth guide on how to find the best California auto insurance quotes online, offering valuable insights and practical steps to ensure a smooth and successful experience.

Understanding California’s Auto Insurance Landscape

California is known for its strict insurance regulations, ensuring that all drivers carry adequate liability coverage. The state mandates a minimum of 15/30/5 liability insurance, which translates to 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and $5,000 for property damage.

However, given the high cost of living and the potential for expensive accidents in a densely populated state, many experts recommend purchasing higher liability limits. Additionally, California drivers often opt for comprehensive and collision coverage to protect against various risks, including theft, vandalism, and natural disasters.

Factors Influencing Auto Insurance Rates in California

The cost of auto insurance in California can vary significantly depending on several factors. Here’s a breakdown of the key considerations:

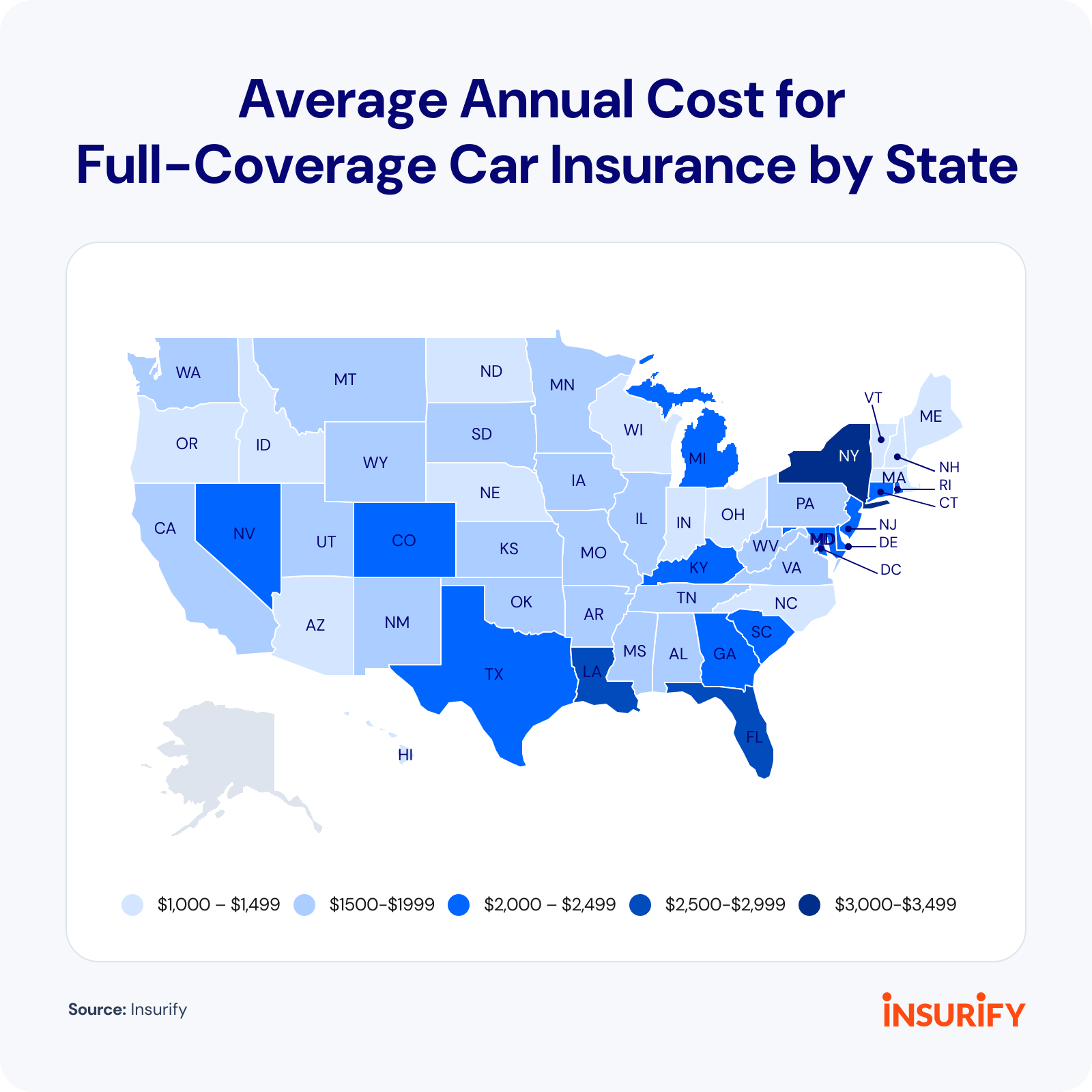

- Location: Insurance rates can differ greatly between cities and counties in California. Urban areas like Los Angeles and San Francisco often have higher premiums due to increased traffic and accident risks.

- Driving Record: A clean driving record is essential for obtaining affordable insurance. Even a single traffic violation or accident can significantly impact your rates. Insurance companies in California consider the past 3 to 5 years of driving history when assessing your risk profile.

- Age and Gender: Younger drivers, especially those under 25, tend to pay higher premiums due to their lack of driving experience. Additionally, gender can play a role, with some insurers charging slightly different rates for male and female drivers.

- Vehicle Type: The make, model, and year of your vehicle are important factors. Sports cars and luxury vehicles generally cost more to insure due to their higher repair and replacement costs.

- Credit History: In California, insurers are allowed to use your credit-based insurance score as a factor in determining your rates. Maintaining a good credit history can lead to more favorable insurance premiums.

- Coverage Preferences: The coverage options you choose will impact your premium. Higher liability limits and additional coverage types can increase your overall cost, but they provide more comprehensive protection.

The Benefits of Online Auto Insurance Quotes in California

Obtaining auto insurance quotes online in California offers several advantages to drivers seeking the best coverage at the most competitive rates. Here’s a closer look at some of the key benefits:

Convenience and Accessibility

One of the primary advantages of online insurance quotes is the convenience they offer. Drivers can easily access multiple insurance providers and compare rates and coverage options from the comfort of their homes or on the go using their mobile devices. This accessibility saves time and effort, allowing individuals to quickly gather the information they need to make informed decisions about their auto insurance.

Transparent Comparison

Online platforms provide a transparent and comprehensive view of the insurance landscape. Users can easily compare quotes from various insurers, ensuring they receive the best value for their money. This level of transparency empowers drivers to understand the differences in coverage, deductibles, and premiums, enabling them to choose the policy that aligns with their specific needs and budget.

Personalized Recommendations

Many online insurance quote platforms utilize advanced algorithms to provide personalized recommendations based on individual driver profiles. These recommendations take into account factors such as driving history, vehicle type, and coverage preferences to suggest the most suitable policies. By leveraging data-driven insights, drivers can access tailored options that meet their unique requirements, ensuring they receive the coverage they need without unnecessary add-ons.

Real-Time Updates

Online insurance quote platforms offer real-time updates on policy changes and market fluctuations. This ensures that drivers always have access to the most current information, allowing them to stay up-to-date with the latest offerings and adjust their coverage accordingly. Whether it’s a change in personal circumstances, a new vehicle purchase, or a shift in insurance provider rates, online quotes provide the flexibility to make timely adjustments and secure the best possible coverage.

Step-by-Step Guide to Finding the Best California Auto Insurance Quotes Online

Navigating the online insurance quote process in California can be straightforward and efficient when following these steps:

Step 1: Gather Essential Information

Before starting your online quote journey, ensure you have the following details readily available:

- Your driver's license number and expiration date.

- The make, model, and year of your vehicle(s).

- Your current insurance coverage details (if applicable) or the desired coverage limits you wish to obtain.

- Personal information, including your date of birth, gender, and marital status.

- Your driving history, including any accidents, traffic violations, or claims made in the past 5 years.

Step 2: Explore Online Insurance Quote Platforms

There are numerous online platforms that offer auto insurance quotes. Some of the popular options in California include:

- Insurance Company Websites: Major insurance providers like GEICO, Progressive, and State Farm often have user-friendly quote platforms on their websites. These direct quotes provide a clear picture of the coverage and rates offered by the specific insurer.

- Comparison Websites: Websites like Insurance.com, TheZebra.com, and Compare.com allow you to compare quotes from multiple insurers side by side. These platforms aggregate information from various companies, making it easier to identify the best deals and coverage options.

- Broker Websites: Insurance brokers, such as CoverHound and Policygenius, act as intermediaries between you and multiple insurance providers. They can offer personalized recommendations and help you find the most suitable policy based on your needs.

Step 3: Enter Your Information

Once you’ve chosen a platform, you’ll need to enter the essential information gathered in Step 1. Be as accurate as possible to ensure you receive quotes that align with your specific situation.

Step 4: Compare Quotes

After submitting your information, you’ll receive a list of quotes from different insurers. Compare the quotes based on the following factors:

- Coverage Options: Ensure that the quotes provide the coverage you need, including liability, collision, comprehensive, and any additional coverage you desire.

- Premiums: Compare the monthly or annual premiums to understand the cost of each policy. Consider both the initial premium and any potential increases over time.

- Deductibles: Assess the deductibles for collision and comprehensive coverage. Higher deductibles can lower your premiums, but they also mean you'll pay more out of pocket if you need to file a claim.

- Policy Benefits: Look for additional benefits or perks offered by the insurer, such as accident forgiveness, rental car coverage, or roadside assistance.

- Customer Reviews: Research the insurer's reputation and customer satisfaction ratings to ensure they provide reliable service and prompt claim processing.

Step 5: Choose the Right Coverage and Provider

After carefully evaluating the quotes, select the policy and insurance provider that best meets your needs and budget. Consider factors such as coverage, cost, and the insurer’s reputation for customer service and claim handling.

Step 6: Purchase Your Policy

Once you’ve decided on a policy, you can purchase it directly through the online platform or by contacting the insurance provider. Make sure to review the policy documents carefully before finalizing your purchase.

Tips for Optimizing Your California Auto Insurance Quotes

To ensure you get the most accurate and favorable auto insurance quotes in California, consider the following tips:

- Bundle Policies: If you own multiple vehicles or have other insurance needs (such as homeowners or renters insurance), consider bundling your policies with the same insurer. This can lead to significant discounts and savings.

- Increase Deductibles: Opting for higher deductibles can reduce your premiums. However, ensure that the chosen deductible amount is affordable in the event of an accident or claim.

- Maintain a Clean Driving Record: A clean driving history is crucial for obtaining lower insurance rates. Avoid traffic violations and practice safe driving habits to keep your record clear.

- Improve Your Credit Score: As mentioned earlier, your credit history can impact your insurance rates. Work on improving your credit score by paying bills on time and reducing debt to potentially lower your premiums.

- Research Discounts: Many insurers offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty rewards. Ask about available discounts and ensure you're taking advantage of all applicable savings.

Common Misconceptions About California Auto Insurance Quotes

There are several misconceptions surrounding auto insurance quotes in California. Let’s address a few of them to provide clarity:

Misconception 1: Online Quotes are Always Accurate

While online quotes provide a good starting point, they are not always 100% accurate. Insurance providers may require additional information or documentation during the policy application process, which could impact the final premium. Always review the policy details and ask questions to ensure you understand the coverage and costs involved.

Misconception 2: All Insurers Offer the Same Coverage

Different insurance providers may offer similar coverage options, but the specific terms and conditions can vary. It’s important to read the fine print and compare policies carefully to ensure you’re getting the coverage you need at a competitive price.

Misconception 3: Shopping Around is Time-Consuming

Obtaining multiple quotes can seem like a tedious process, but it’s a crucial step to ensure you’re getting the best value. With the convenience of online platforms, you can compare quotes from various insurers within a short timeframe, making it an efficient way to find the right coverage.

Conclusion: Taking Control of Your Auto Insurance Journey

Navigating the world of auto insurance in California can be complex, but with the right knowledge and tools, you can confidently secure the best coverage at the most competitive rates. By understanding the factors that influence insurance premiums and utilizing the convenience of online quote platforms, you can take control of your auto insurance journey and make informed decisions that protect your finances and provide peace of mind.

How often should I review and update my auto insurance policy in California?

+It’s recommended to review your auto insurance policy annually or whenever there are significant changes in your personal circumstances, such as a new vehicle purchase, marriage, or a move to a different city. Regular reviews ensure that your coverage remains adequate and that you’re taking advantage of any applicable discounts or policy enhancements.

Can I switch insurance providers in California if I find a better deal online?

+Absolutely! California allows for open competition among insurance providers, and you have the freedom to switch insurers if you find a better deal or are dissatisfied with your current coverage. However, ensure you understand the cancellation process and any potential fees associated with switching policies.

Are there any resources or tools available to help me understand auto insurance terms and coverage options in California?

+Yes, the California Department of Insurance provides valuable resources and educational materials to help drivers understand their insurance options and rights. Their website offers guides, brochures, and a helpful glossary of insurance terms. Additionally, many insurance providers offer online tools and resources to assist in policy selection and understanding.