Average Monthly Cost Of Health Insurance

Health insurance is a crucial aspect of healthcare management, providing individuals and families with financial protection and access to essential medical services. Understanding the average monthly cost of health insurance is essential for individuals and families seeking affordable coverage options. This comprehensive guide delves into the factors influencing health insurance costs, explores average monthly expenses, and offers insights into strategies for obtaining affordable coverage. By examining real-world data and industry trends, we aim to provide a detailed analysis of health insurance costs to empower individuals in making informed decisions about their healthcare coverage.

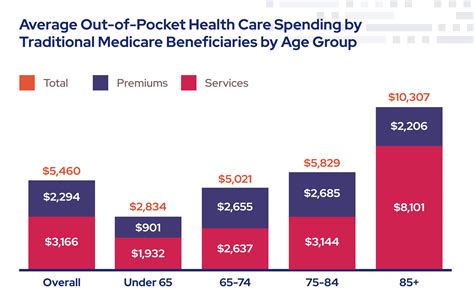

Understanding Health Insurance Costs: A Comprehensive Overview

Health insurance costs can vary significantly depending on various factors, including the type of coverage, the provider, the region, and individual health needs. The average monthly cost of health insurance can be influenced by several key aspects, each playing a unique role in determining the overall affordability of healthcare plans.

Factors Influencing Health Insurance Costs

The landscape of health insurance is complex, with numerous factors contributing to the overall cost of coverage. Here’s a closer look at some of the key determinants:

- Plan Type and Coverage Level: The type of health insurance plan significantly impacts costs. Common plan types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), each with varying levels of coverage and cost structures.

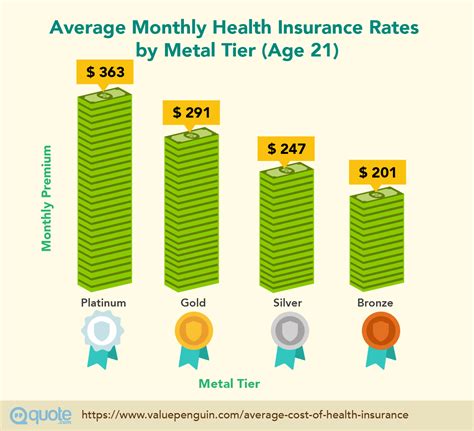

- Age and Gender: Age and gender are fundamental factors in determining health insurance costs. Typically, younger individuals tend to pay lower premiums, while older individuals and those with specific gender-related health concerns may face higher costs.

- Region and Location: The geographical location of an individual can greatly affect health insurance costs. Urban areas often have higher healthcare costs, impacting insurance premiums. Additionally, certain regions may have unique healthcare market dynamics, influencing insurance rates.

- Individual Health Status: Pre-existing medical conditions or chronic illnesses can impact health insurance costs. Insurers may adjust premiums based on an individual’s health status, with those in better health generally paying lower premiums.

- Family Size and Composition: The size and composition of a family can significantly affect insurance costs. Family plans often provide coverage for multiple individuals, with premiums varying based on the number of family members and their specific healthcare needs.

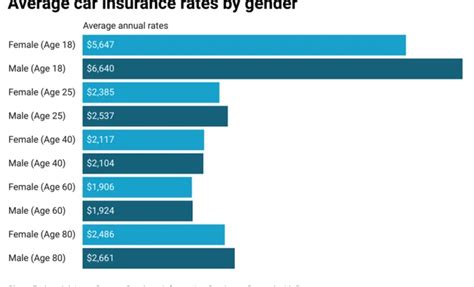

- Deductibles and Out-of-Pocket Costs: Health insurance plans typically involve deductibles and out-of-pocket expenses. Higher deductibles often result in lower monthly premiums, while lower deductibles may increase monthly costs but provide more financial protection during healthcare utilization.

- Provider Networks: The network of healthcare providers covered by an insurance plan can impact costs. In-network providers typically offer more affordable rates, while out-of-network care can be significantly more expensive.

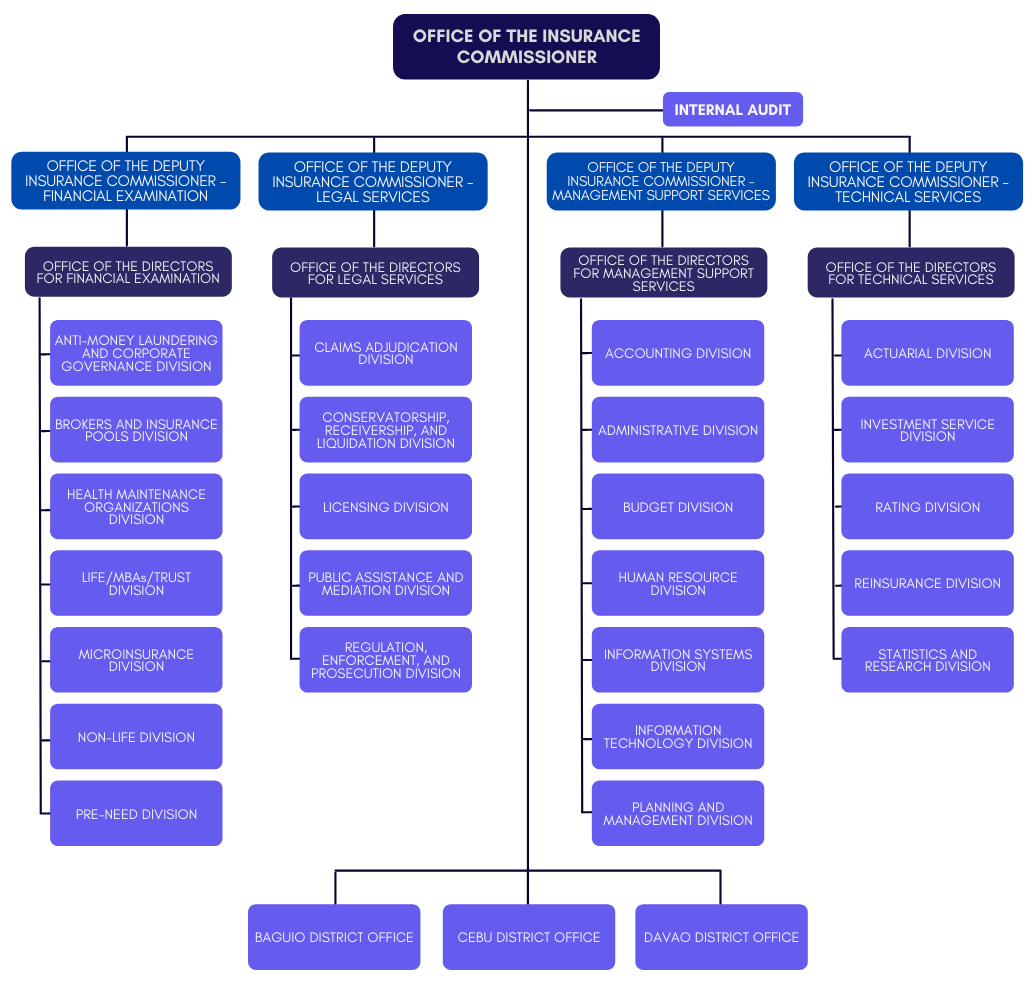

Average Monthly Costs: A Deep Dive into Real-World Data

To gain a comprehensive understanding of health insurance costs, let’s explore real-world data and industry insights. According to recent studies and industry reports, the average monthly cost of health insurance varies significantly based on various factors.

For individual coverage, the average monthly premium can range from approximately $250 to $600, with wide variations depending on the factors mentioned earlier. Younger individuals, for instance, may find premiums closer to the lower end of this range, while older individuals or those with pre-existing conditions may face higher costs.

Family plans, on the other hand, can be significantly more expensive. The average monthly cost for family coverage can range from $800 to $2,000, depending on the number of family members, their ages, and specific healthcare needs. It's essential to note that these averages are just estimates and actual costs can vary based on individual circumstances.

| Plan Type | Average Monthly Cost (Individual) | Average Monthly Cost (Family) |

|---|---|---|

| HMO | $300 | $1,000 |

| PPO | $400 | $1,200 |

| EPO | $280 | $950 |

Strategies for Affordable Health Insurance

Navigating the complex world of health insurance can be challenging, but there are strategies to help individuals and families secure affordable coverage. Here are some expert tips and insights to consider:

- Research and Compare Plans: Take the time to research and compare different health insurance plans. Consider factors like coverage, provider networks, and out-of-pocket costs. Online platforms and insurance brokers can provide valuable tools for comparing plans and identifying the most affordable options.

- Consider High-Deductible Plans: High-deductible health plans (HDHPs) often come with lower monthly premiums. These plans are ideal for individuals who prioritize lower monthly costs and have minimal healthcare needs. However, it’s essential to ensure that the plan’s deductible and out-of-pocket limits align with your financial capabilities.

- Utilize Tax-Advantaged Accounts: Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can provide significant tax benefits. These accounts allow individuals to set aside pre-tax dollars to cover eligible medical expenses, reducing the overall financial burden of healthcare costs.

- Explore Government Programs: Government-sponsored programs like Medicaid and the Children’s Health Insurance Program (CHIP) offer affordable or no-cost coverage for eligible individuals and families. It’s worth exploring these options to determine eligibility and access the benefits they provide.

- Employer-Sponsored Plans: Many employers offer group health insurance plans as part of their employee benefits package. These plans often provide more affordable coverage options due to the larger group size. If available, employer-sponsored plans can be a cost-effective choice.

- Stay Informed about Subsidies: The Affordable Care Act (ACA) offers subsidies to help individuals and families with low to moderate incomes afford health insurance. These subsidies can significantly reduce monthly premiums. Stay updated on eligibility criteria and apply for subsidies if you qualify.

Future Implications and Trends

The healthcare industry is constantly evolving, and the future of health insurance costs is shaped by various factors. Here’s a glimpse into some potential trends and implications:

- Technological Innovations: The integration of technology in healthcare, such as telemedicine and digital health solutions, has the potential to reduce costs by improving efficiency and accessibility. These innovations may lead to more affordable healthcare options and influence insurance costs.

- Changing Demographics: The aging population and changing demographics can impact health insurance costs. As the population ages, the demand for healthcare services increases, potentially driving up insurance costs. However, proactive healthcare management and preventative care initiatives may help mitigate these effects.

- Policy and Regulatory Changes: Government policies and regulatory shifts can significantly impact health insurance costs. Changes in healthcare legislation, such as the expansion or modification of government-sponsored programs, can influence the affordability and accessibility of health insurance for individuals and families.

- Healthcare Market Competition: Increased competition among healthcare providers and insurance companies can drive down costs. As the market becomes more competitive, insurers may offer more affordable plans to attract customers, benefiting individuals seeking cost-effective coverage.

Conclusion

Understanding the average monthly cost of health insurance is a crucial step in navigating the complex world of healthcare coverage. By examining the factors influencing costs, exploring real-world data, and considering strategies for affordable coverage, individuals and families can make informed decisions about their healthcare needs. The evolving landscape of health insurance, shaped by technological advancements, demographic shifts, and policy changes, presents both challenges and opportunities for affordable healthcare access. Stay informed, compare plans, and explore the range of options available to secure the best health insurance coverage for your unique circumstances.

What is the average monthly cost of health insurance for a single individual in the United States?

+The average monthly cost of health insurance for a single individual in the United States can vary based on several factors, including the state, age, and the type of coverage. On average, it ranges from 250 to 600 per month. However, this range can be significantly influenced by individual circumstances and the chosen plan.

How can I find affordable health insurance options for my family?

+Finding affordable health insurance for your family involves research and careful consideration. Explore different plan types, such as HMOs, PPOs, and EPOs, and compare their coverage and costs. Consider family-specific plans offered by insurers, which often provide discounts for multiple family members. Additionally, government-sponsored programs like Medicaid or the Children’s Health Insurance Program (CHIP) can offer affordable or no-cost coverage for eligible families.

Are there any tax benefits associated with health insurance premiums?

+Yes, there are tax benefits associated with health insurance premiums. Individuals and families can take advantage of Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to set aside pre-tax dollars for eligible medical expenses. These accounts offer tax advantages, reducing the overall financial burden of healthcare costs.