Average Cost Of Insurance

The average cost of insurance is a topic of interest for many individuals and businesses alike, as it provides an insight into the financial commitments and considerations associated with various insurance policies. This comprehensive guide aims to delve into the factors influencing insurance costs, offering an in-depth analysis of the average expenses individuals can expect when seeking insurance coverage. By examining real-world data and industry trends, we aim to equip readers with the knowledge to make informed decisions about their insurance needs and expenses.

Understanding the Landscape of Insurance Costs

Insurance costs can vary significantly based on a multitude of factors, creating a diverse landscape of prices. These factors include the type of insurance policy, the level of coverage desired, the insured’s personal circumstances, and the geographic location. For instance, auto insurance premiums can fluctuate based on the make and model of the vehicle, the driver’s age and driving history, and the local traffic conditions and accident rates. Similarly, health insurance costs are influenced by the insured’s age, pre-existing conditions, and the extent of coverage required.

The Impact of Coverage and Policy Types

The type of insurance policy significantly influences the average cost of insurance. Different policies cater to distinct needs, and the level of coverage desired can drive up the premium. For example, a comprehensive auto insurance policy, which offers a wide range of coverage including collision, comprehensive, and liability, will typically be more expensive than a basic liability-only policy. Similarly, in health insurance, a policy with a lower deductible and broader coverage for prescription drugs and specialized treatments will generally be more costly than a high-deductible plan.

| Insurance Type | Average Annual Cost |

|---|---|

| Comprehensive Auto Insurance | $1,200 - $1,800 |

| Basic Auto Liability Insurance | $500 - $1,000 |

| Health Insurance (Low Deductible) | $5,000 - $8,000 |

| Health Insurance (High Deductible) | $3,000 - $5,000 |

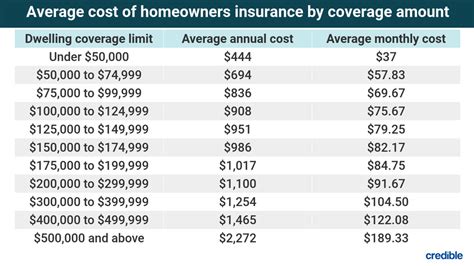

| Homeowner's Insurance | $1,000 - $2,000 |

Additionally, the average cost of insurance can be influenced by the insurer's risk assessment. Insurance companies analyze a variety of factors to determine the risk associated with insuring an individual or entity. This assessment can lead to variations in premiums, even for similar policies. For instance, an individual with a history of traffic violations may face higher auto insurance premiums compared to a cautious driver with a clean record.

Geographic Location and Its Influence

Geographic location plays a significant role in determining the average cost of insurance. Insurance rates can vary considerably based on regional factors such as the cost of living, crime rates, natural disaster risks, and local laws and regulations. For instance, areas with a high risk of natural disasters like hurricanes or earthquakes may have higher insurance premiums to account for potential claims. Similarly, regions with a higher crime rate might experience higher auto insurance rates due to the increased risk of theft or vandalism.

Furthermore, the average cost of insurance can be influenced by local market competition. In areas with a high concentration of insurance providers, there might be more competitive pricing, leading to lower average costs. Conversely, regions with limited insurer options may have fewer price variations, resulting in higher average insurance costs.

Real-World Examples and Industry Insights

To illustrate the variability in insurance costs, let’s consider some real-world examples. In the auto insurance industry, a 30-year-old driver with a clean driving record in a low-risk urban area might expect to pay around 800 annually for basic liability coverage. However, the same driver in a high-risk suburban area with a history of accidents could face premiums as high as 2,000 for the same coverage.

In the health insurance sector, a 40-year-old individual with no pre-existing conditions might pay approximately $4,000 annually for a low-deductible plan with comprehensive coverage. On the other hand, a person with a pre-existing condition such as diabetes could face significantly higher costs, with premiums potentially exceeding $10,000 per year.

Industry Trends and Future Implications

The insurance industry is continually evolving, and several trends are shaping the future of insurance costs. One notable trend is the increasing use of telemedicine and digital health services, which are influencing the cost of health insurance. With the rise of virtual doctor visits and online health consultations, there is potential for reduced healthcare costs and, subsequently, lower insurance premiums. However, the full impact of these trends on average insurance costs is yet to be fully realized.

Another trend impacting insurance costs is the increasing focus on risk mitigation and prevention. Many insurance companies are incentivizing policyholders to adopt safer behaviors and practices through discounts and rewards. For instance, auto insurance companies may offer discounts to drivers who use telematics devices that track driving behavior, while health insurance providers might reduce premiums for individuals who maintain a healthy lifestyle or participate in wellness programs.

Furthermore, the advent of big data analytics and artificial intelligence is revolutionizing the insurance industry. These technologies are enabling insurers to make more accurate risk assessments and price insurance products more competitively. By analyzing vast amounts of data, insurers can identify patterns and trends that were previously difficult to detect, leading to more precise pricing models and potentially lower average insurance costs over time.

What factors can I control to reduce my insurance costs?

+There are several factors within your control that can influence your insurance costs. For auto insurance, maintaining a clean driving record, taking defensive driving courses, and shopping around for the best rates can help reduce costs. In health insurance, leading a healthy lifestyle, utilizing preventive care services, and considering high-deductible plans with health savings accounts can help lower premiums. Additionally, for homeowner's insurance, maintaining a safe and secure home, and bundling policies with the same insurer can lead to discounts.

How do insurance companies determine risk and set premiums?

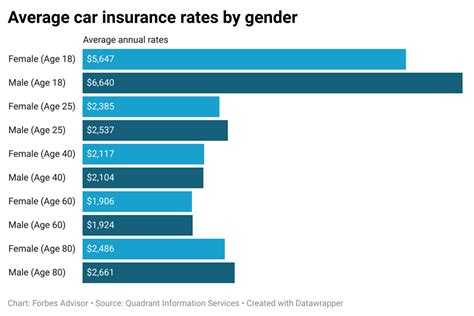

+Insurance companies use a variety of factors to assess risk and set premiums. These factors can include personal information such as age, gender, and occupation, as well as geographic location, credit score, and claims history. For auto insurance, driving record and vehicle type are key factors. In health insurance, pre-existing conditions and lifestyle habits are considered. Insurers use actuarial science to analyze these factors and determine the likelihood of a claim, which informs the setting of premiums.

Are there any ways to save money on insurance without sacrificing coverage?

+Yes, there are strategies to save on insurance costs without compromising coverage. One approach is to increase your deductibles, which can significantly lower premiums, especially for health and homeowner's insurance. Additionally, bundling multiple policies with the same insurer often leads to discounts. For auto insurance, safe driving habits and taking advantage of telematics programs can result in lower rates. It's also important to regularly review and compare policies to ensure you're getting the best value.

In conclusion, understanding the average cost of insurance involves a deep dive into various factors such as policy types, coverage levels, personal circumstances, and geographic location. By being aware of these influences and staying informed about industry trends, individuals can make more informed decisions about their insurance needs and expenses. The insurance landscape is ever-evolving, and staying proactive can lead to significant savings without compromising on necessary coverage.