Medical Insurance Overseas

Medical insurance is an essential aspect of travel planning, especially when venturing overseas. The need for adequate health coverage becomes more apparent when faced with the realities of unexpected illnesses or injuries in a foreign land. Understanding the intricacies of medical insurance overseas is crucial to ensure a smooth and stress-free travel experience. This article delves into the world of medical insurance for international travelers, exploring the benefits, coverage options, and the critical aspects to consider when purchasing a policy.

Understanding Medical Insurance for Overseas Travel

Medical insurance for overseas travel, often referred to as travel health insurance or international health insurance, is designed to provide coverage for unexpected medical emergencies while an individual is traveling or residing abroad. These policies typically offer a range of benefits, from emergency medical treatment and hospitalization to coverage for prescription medications and emergency dental care.

The importance of medical insurance for overseas travel cannot be overstated. It not only provides financial protection against potentially high medical costs in foreign countries but also offers peace of mind, ensuring that travelers can access the necessary medical care without being burdened by the worry of unaffordable expenses.

Key Benefits of Medical Insurance Overseas

Travelers can expect a comprehensive suite of benefits when investing in medical insurance for their overseas adventures. These benefits may include:

- Emergency Medical Treatment: Coverage for immediate and necessary medical care, including treatments for illnesses or injuries.

- Hospitalization: Reimbursement for expenses incurred during hospital stays, which can be particularly beneficial in countries with expensive healthcare systems.

- Prescription Medications: Coverage for prescription drugs, ensuring travelers have access to necessary medications during their trip.

- Emergency Dental Care: Provision for unexpected dental issues, covering the cost of emergency dental treatments.

- Medical Evacuation: Some policies include the cost of medically necessary evacuations, transporting travelers to a facility better equipped to handle their condition.

- Repatriation: Coverage for the cost of returning the insured individual's remains to their home country in the event of death.

The specific benefits and coverage limits will vary depending on the policy and the insurance provider. It is essential for travelers to carefully review the policy details to ensure it aligns with their unique travel needs and circumstances.

Types of Medical Insurance for Overseas Travel

Medical insurance for overseas travel comes in various forms, each tailored to different types of travelers and their specific needs. Understanding the different types of policies available can help travelers make informed decisions and choose the most suitable coverage for their trip.

Single-Trip Travel Insurance

As the name suggests, single-trip travel insurance is designed for travelers embarking on a one-time trip. This type of insurance provides coverage for a specific duration, typically ranging from a few days to several months. It is ideal for short-term travelers, such as those going on vacation or business trips.

Single-trip policies often offer flexible coverage options, allowing travelers to choose the level of coverage they require. This could include basic medical coverage, trip cancellation and interruption protection, and baggage loss or delay coverage.

Multi-Trip Travel Insurance

Multi-trip travel insurance, also known as annual travel insurance, is an excellent option for frequent travelers. This policy provides coverage for multiple trips within a year, offering convenience and cost-effectiveness for those who travel regularly.

Multi-trip policies typically cover a range of travel-related incidents, including medical emergencies, trip cancellations, and baggage issues. They often come with higher coverage limits and additional benefits, making them suitable for travelers who require comprehensive protection for their frequent adventures.

Long-Term Travel Insurance

Long-term travel insurance is tailored for individuals planning extended stays abroad, often for work, study, or volunteer opportunities. These policies provide coverage for durations ranging from several months to a year or more.

Long-term travel insurance policies usually offer more comprehensive benefits, including medical coverage, trip cancellation, and personal liability protection. They are designed to cater to the unique needs of individuals spending an extended period overseas, ensuring they have the necessary protection throughout their stay.

Factors to Consider When Choosing Medical Insurance Overseas

When selecting a medical insurance policy for overseas travel, there are several critical factors to consider to ensure you choose the right coverage for your needs. These factors include:

Coverage Limits and Deductibles

Review the policy’s coverage limits and deductibles to understand the maximum amount the insurance provider will pay out in the event of a claim. Higher coverage limits may be necessary for travelers visiting countries with expensive healthcare systems.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition, it is crucial to choose a policy that provides coverage for these conditions. Some policies may exclude certain pre-existing conditions, so it’s essential to read the fine print and understand the exclusions.

Travel Destinations

Consider the countries you plan to visit and the associated healthcare costs. Some countries have higher medical expenses, and you’ll need a policy with sufficient coverage to cater to these costs.

Duration of Stay

The length of your trip or stay will influence the type of policy you choose. Single-trip policies are ideal for short-term travelers, while long-term or multi-trip policies are more suitable for extended stays or frequent travelers.

Activity Level and Adventure Sports

If you plan to engage in adventure sports or high-risk activities during your trip, ensure your policy covers these activities. Some policies may have exclusions for certain high-risk activities, so it’s important to read the policy carefully.

Reputation and Reliability of the Insurance Provider

Choose a reputable insurance provider with a solid track record of honoring claims. Check online reviews and ratings to ensure the provider has a good reputation and a reliable claims process.

How to Make a Claim on Your Medical Insurance Overseas

In the event of a medical emergency while overseas, knowing how to make a claim on your medical insurance is crucial. Here’s a step-by-step guide to help you through the process:

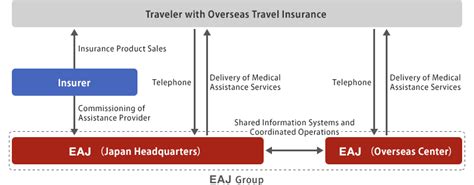

Step 1: Contact Your Insurance Provider

The first step is to contact your insurance provider as soon as possible after receiving medical treatment. Most providers have a 24⁄7 emergency assistance hotline, which you can call to notify them of the incident and receive guidance on the next steps.

Step 2: Provide Necessary Documentation

Your insurance provider will require certain documents to process your claim. This typically includes a completed claim form, original medical bills and receipts, a detailed report from the treating physician, and any other relevant documentation.

Step 3: Follow the Provider’s Instructions

The insurance provider will guide you through the claim process, which may involve additional steps or requirements. It’s important to follow their instructions carefully to ensure a smooth and timely claim settlement.

Step 4: Keep Records and Receipts

Throughout the claim process, keep records of all communications with your insurance provider, as well as any receipts or documents related to your medical treatment. These records can be useful for reference and may be requested during the claim review process.

Real-Life Case Studies: Medical Insurance Overseas in Action

Understanding how medical insurance works in real-life scenarios can provide valuable insights into its importance and effectiveness. Let’s explore a couple of case studies to see how medical insurance overseas has made a difference for travelers:

Case Study 1: Emergency Medical Treatment in Europe

John, an American traveler, was vacationing in Europe when he suddenly fell ill and required immediate medical attention. His travel insurance policy covered the cost of his emergency treatment, hospitalization, and follow-up care, ensuring he received the necessary medical attention without incurring significant financial burden.

Case Study 2: Adventure Sports Coverage in South America

Sarah, an avid adventurer, purchased a travel insurance policy that covered adventure sports. During her trip to South America, she participated in whitewater rafting and unfortunately suffered an injury. Her insurance policy covered the cost of her emergency treatment and even provided additional support, such as arranging for her to be transferred to a better-equipped medical facility.

These real-life examples demonstrate the critical role medical insurance plays in protecting travelers and providing them with the necessary medical care while overseas. By choosing the right policy, travelers can rest assured that they are covered in the event of an emergency, allowing them to focus on their travel experiences without worry.

Future of Medical Insurance for Overseas Travel

The landscape of medical insurance for overseas travel is constantly evolving, driven by technological advancements, changing consumer needs, and global health trends. Here’s a glimpse into the future of medical insurance for international travelers:

Digitalization and Convenience

The insurance industry is increasingly embracing digitalization, offering travelers convenient and accessible ways to purchase and manage their policies. This includes online platforms that provide real-time quotes, allow for easy policy comparisons, and offer streamlined claim processes.

Customizable and Flexible Policies

As travelers’ needs become more diverse, insurance providers are likely to offer more customizable and flexible policies. This could include the ability to choose specific coverage options, such as enhanced medical coverage, trip cancellation protection, or adventure sports coverage, allowing travelers to tailor their policies to their unique needs.

Integration of Telehealth Services

The integration of telehealth services into medical insurance policies is another emerging trend. This could involve providing travelers with access to virtual consultations with healthcare professionals, which can be particularly beneficial in remote locations or when immediate medical attention is required.

Enhanced Data Security

With the increasing prevalence of cyber threats, insurance providers will need to invest in robust data security measures to protect their customers’ personal and financial information. This includes implementing advanced encryption technologies and regularly updating security protocols to ensure data privacy and integrity.

Expanded Coverage for Mental Health

There is a growing recognition of the importance of mental health support for travelers. As such, insurance providers may expand their coverage to include mental health services, such as access to telemedicine for mental health counseling or coverage for psychiatric emergencies.

Increased Focus on Wellness and Prevention

In addition to covering medical emergencies, insurance providers may place a greater emphasis on wellness and prevention. This could involve offering incentives for travelers to engage in healthy activities or providing resources and guidance to help travelers maintain their health while abroad.

The future of medical insurance for overseas travel promises to be innovative and responsive to the changing needs of international travelers. By staying informed about these developments, travelers can make informed decisions and choose policies that provide the most comprehensive protection for their unique travel experiences.

How much does medical insurance for overseas travel typically cost?

+The cost of medical insurance for overseas travel can vary widely depending on several factors, including the duration of the trip, the traveler’s age and health status, the destination country, and the level of coverage desired. On average, single-trip policies can range from 50 to 300 or more, while annual or long-term policies can cost several hundred dollars or more per year. It’s essential to compare quotes from different providers to find the best value for your specific needs.

Can I purchase medical insurance for overseas travel after I’ve already left my home country?

+In most cases, it is possible to purchase medical insurance for overseas travel even after you’ve left your home country. However, it’s important to note that some policies may have restrictions or exclusions for certain pre-existing conditions or activities if the policy is purchased after travel has commenced. It’s always best to purchase insurance before your trip to ensure comprehensive coverage.

What happens if I need to make a claim on my medical insurance while overseas?

+If you need to make a claim on your medical insurance while overseas, the first step is to contact your insurance provider’s emergency assistance hotline as soon as possible. They will guide you through the claim process, which typically involves providing documentation such as medical bills, receipts, and a detailed report from the treating physician. It’s important to keep records of all communications and expenses to facilitate the claim settlement process.

Are there any countries where medical insurance for overseas travel is not necessary?

+In some countries, such as certain European nations, visitors may be covered by the local healthcare system or have access to reciprocal healthcare agreements. However, it’s important to research the specific healthcare arrangements of your destination country and ensure you have adequate coverage, as some countries may have limitations or restrictions on the type of care provided to visitors.

What should I do if my medical insurance provider denies my claim?

+If your medical insurance provider denies your claim, it’s important to carefully review the reasons provided for the denial. Ensure that you understand the policy’s terms and conditions, and verify that all required documentation was submitted. If you believe the denial is unjustified, you can appeal the decision by providing additional evidence or clarification. It’s advisable to seek professional advice if needed.