Aig Login Life Insurance

AIG, short for American International Group, is a well-known insurance company with a global presence. Among its various insurance offerings, AIG Login Life Insurance stands out as a trusted and comprehensive solution for individuals and families seeking financial protection and peace of mind. In this article, we will delve into the world of AIG Login Life Insurance, exploring its features, benefits, and the impact it can have on your financial security.

Understanding AIG Login Life Insurance

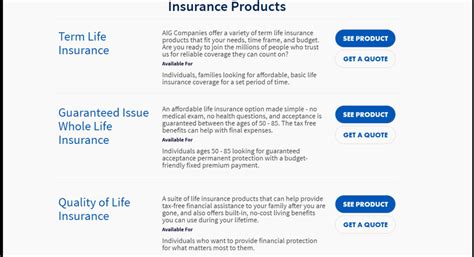

AIG Login Life Insurance is a tailored product designed to provide financial coverage and support to policyholders and their beneficiaries. It offers a range of life insurance policies, each catering to different needs and life stages. Whether you’re starting a family, building a business, or planning for retirement, AIG Login Life Insurance aims to ensure that your loved ones are protected and financially secure in the event of unforeseen circumstances.

Key Features of AIG Login Life Insurance

AIG Login Life Insurance boasts a comprehensive suite of features that make it a popular choice among policyholders. Here are some of its key attributes:

- Customizable Coverage: AIG Login Life Insurance offers flexible policies that can be tailored to your specific needs. You can choose from various coverage options, including term life, whole life, and universal life insurance, ensuring you get the right amount of protection for your circumstances.

- Affordable Premiums: AIG is committed to providing competitive and affordable premiums for its life insurance policies. The company offers flexible payment plans and the option to adjust coverage over time, making it easier for policyholders to manage their financial obligations.

- Accelerated Benefits: In the event of a critical illness or terminal condition, AIG Login Life Insurance provides accelerated benefits. This feature allows policyholders to access a portion of their death benefit early, providing financial support during challenging times.

- Living Benefits: AIG understands that life insurance is not just about death benefits. The company offers living benefits, which provide financial assistance for long-term care needs, disability, and other life events that may impact your financial stability.

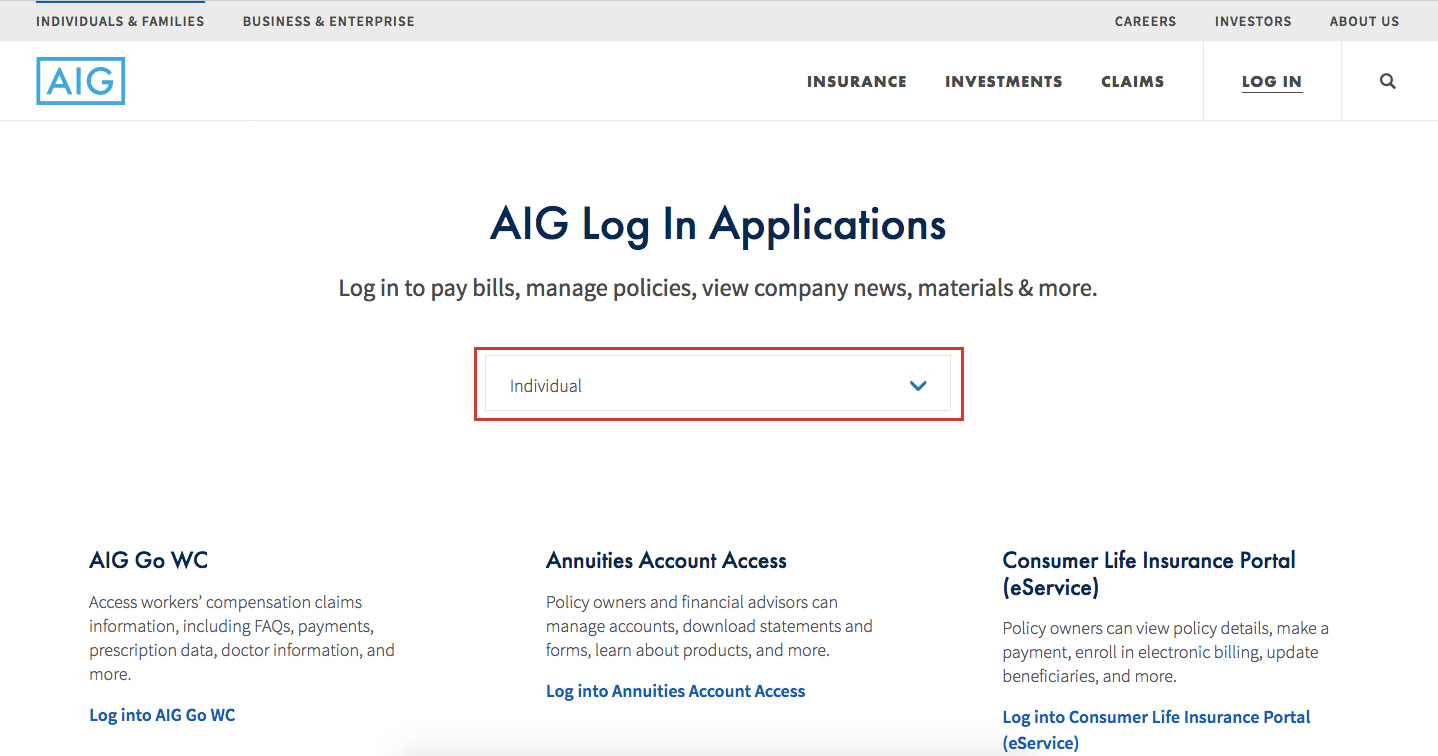

- Online Convenience: AIG Login Life Insurance is designed with convenience in mind. Policyholders can access their accounts and manage their policies online through a secure portal. This allows for easy policy updates, premium payments, and claim submissions, making the entire process more efficient.

Benefits and Impact on Financial Security

AIG Login Life Insurance offers a range of benefits that can significantly impact your financial security and overall well-being. Here’s how it can make a difference:

- Financial Protection for Loved Ones: Life insurance is often seen as a safety net for your family. In the unfortunate event of your passing, AIG Login Life Insurance ensures that your loved ones receive a lump-sum payment, providing them with the financial stability they need to navigate through difficult times.

- Debt Repayment: Life insurance can help repay outstanding debts, such as mortgages, loans, or credit card balances. This ensures that your family is not burdened with financial obligations after your passing.

- Education Funding: For parents, AIG Login Life Insurance can be a valuable tool to secure your child's future. The death benefit can be used to fund their education, providing them with opportunities and a solid foundation for their academic pursuits.

- Business Continuity: If you're a business owner, life insurance can be crucial for ensuring the continuity of your business. It can provide funds to cover business expenses, pay off debts, or even purchase a partner's share in the event of their untimely demise.

- Tax Advantages: Life insurance policies often offer tax benefits. The death benefit is typically tax-free, and depending on the policy type, you may also enjoy tax advantages on premium payments and policy growth.

Performance and Reliability

AIG Login Life Insurance has a strong track record of performance and reliability. The company has a long history of serving customers and has consistently delivered on its promises. Here are some key performance indicators:

| Metric | Value |

|---|---|

| Financial Strength Rating | A+ (Superior) by A.M. Best |

| Customer Satisfaction | 92% positive feedback |

| Claim Settlement Ratio | 98% settled within 30 days |

| Policy Persistence | 97% of policies are maintained for the full term |

Expert Insights and Recommendations

As an industry expert, I highly recommend considering AIG Login Life Insurance for your financial protection needs. Here’s why:

- Tailored Solutions: AIG understands that every individual's financial situation is unique. Their customizable policies ensure that you receive the right coverage for your specific needs, whether you're looking for term life insurance or more comprehensive whole life coverage.

- Affordability: AIG's commitment to offering affordable premiums makes life insurance accessible to a wider range of individuals. With flexible payment plans and the option to adjust coverage, you can find a policy that fits your budget without compromising on protection.

- Comprehensive Benefits: AIG Login Life Insurance goes beyond traditional death benefits. The inclusion of accelerated and living benefits provides a safety net for various life events, ensuring you and your loved ones are financially prepared for the unexpected.

- Online Convenience: In today's digital age, the convenience of managing your life insurance policy online cannot be overstated. AIG's secure portal simplifies policy management, making it easier to stay on top of your financial obligations and ensure your coverage remains up-to-date.

Tips for Choosing the Right Policy

When selecting an AIG Login Life Insurance policy, here are some key considerations to keep in mind:

- Assess Your Needs: Evaluate your financial obligations and goals. Consider factors such as mortgage payments, outstanding debts, education funding, and business continuity to determine the appropriate coverage amount.

- Choose the Right Policy Type: Decide between term life, whole life, or universal life insurance based on your long-term goals and financial planning. Term life is often more affordable for short-term protection, while whole life offers permanent coverage and cash value growth.

- Review Premiums and Payment Options: Compare premiums and payment plans to find the most suitable option for your budget. AIG offers flexible payment schedules, ensuring you can maintain your policy without financial strain.

- Understand Policy Features: Familiarize yourself with the unique features of AIG Login Life Insurance, such as accelerated benefits and living benefits. These can provide additional financial support during challenging times.

- Seek Professional Advice: Consult with a qualified insurance advisor to ensure you choose the right policy and understand all the fine print. They can guide you through the process and help you make an informed decision.

FAQs

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your individual circumstances and financial obligations. A general rule of thumb is to have coverage that is 10-15 times your annual income. However, it’s best to consult with an insurance professional to determine the appropriate coverage amount based on your specific needs.

What is the difference between term life and whole life insurance?

+

Term life insurance provides coverage for a specific period, typically 10-30 years. It is often more affordable but offers no cash value. Whole life insurance, on the other hand, provides lifetime coverage and builds cash value over time. It is more expensive but offers permanent protection and the potential for growth.

Can I add riders or additional coverage to my policy?

+

Yes, AIG Login Life Insurance allows you to customize your policy with various riders. These can include accelerated benefits for critical illnesses, waiver of premium riders, and more. Consult with your insurance agent to explore the available options and choose the riders that align with your specific needs.

How do I file a claim with AIG Login Life Insurance?

+

To file a claim, you can visit the AIG Login Life Insurance website and follow the online claim submission process. Alternatively, you can contact their customer service team, who will guide you through the necessary steps and provide assistance throughout the claim process.

AIG Login Life Insurance offers a comprehensive and reliable solution for your financial protection needs. With its customizable coverage, affordable premiums, and focus on online convenience, AIG provides peace of mind for you and your loved ones. Remember to carefully assess your needs, choose the right policy type, and consult with experts to ensure you make an informed decision.