Supplemental Health Insurance For Medicare

Supplemental health insurance, often referred to as Medigap, plays a crucial role in the healthcare landscape for individuals enrolled in Medicare. As Medicare covers a significant portion of healthcare costs, it's important to understand the gaps it may leave and how supplemental insurance can bridge those gaps.

Understanding Medicare Coverage

Medicare, the federal health insurance program for Americans aged 65 and older, as well as those with certain disabilities, is divided into different parts, each covering specific aspects of healthcare.

Medicare Part A

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. It is typically premium-free for those who have worked and paid Medicare taxes for at least 10 years.

Medicare Part B

Part B covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and some preventive services. It requires a monthly premium payment.

Medicare Part C (Medicare Advantage)

Part C, or Medicare Advantage, is an alternative to Original Medicare (Part A and B). It is offered by private insurance companies and often includes additional benefits like prescription drug coverage and vision care. However, the specific benefits and costs can vary depending on the plan and the insurance provider.

Medicare Part D

Part D covers prescription drugs and is an optional add-on to Original Medicare. It requires a separate monthly premium and can vary in cost and coverage depending on the plan and the medications covered.

While Medicare provides a robust healthcare safety net, there are certain gaps in coverage that can result in significant out-of-pocket expenses. This is where supplemental health insurance, or Medigap, comes into play.

The Role of Supplemental Health Insurance (Medigap)

Supplemental health insurance, or Medigap, is designed to fill the gaps in Original Medicare coverage. It covers the deductibles, copayments, and coinsurance that Medicare does not cover. This means that with a Medigap plan, you may have little to no out-of-pocket costs when receiving Medicare-covered services.

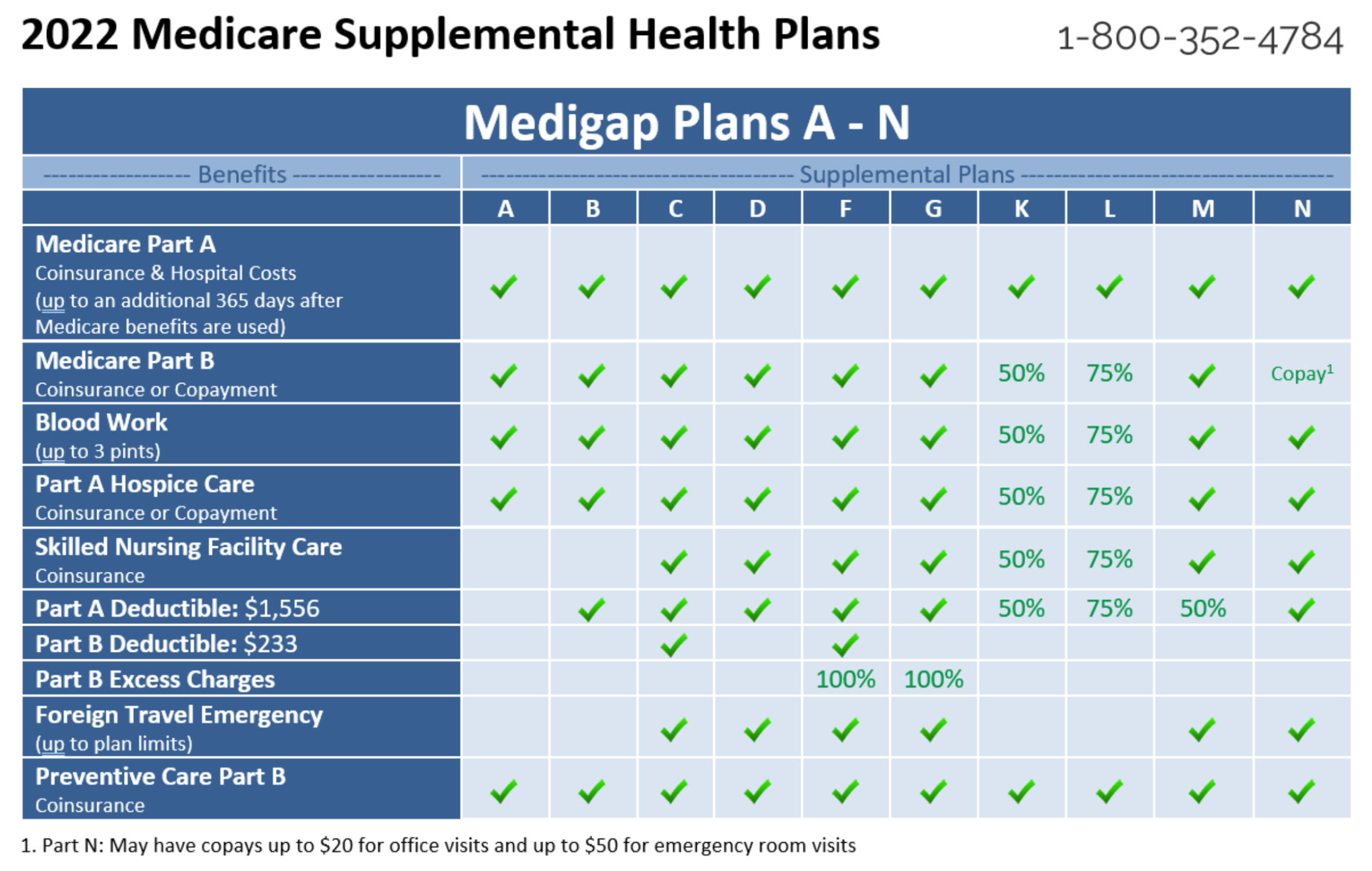

Medigap Plan Types

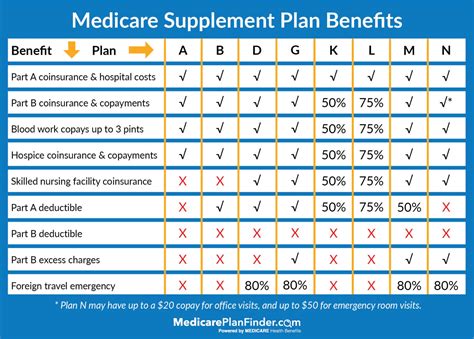

There are currently 10 standardized Medigap plan types (labeled A through N), each offering a different level of coverage. The specific benefits and costs can vary depending on the plan and the insurance provider.

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Basic coverage for Part A deductibles and Part B coinsurance |

| Plan B | Covers everything in Plan A, plus Part B deductible |

| Plan C | Comprehensive coverage, including foreign travel emergency |

| Plan D | Covers everything in Plan C, plus Part B excess charges |

| Plan F | Most comprehensive plan, covers all Part A and B deductibles, coinsurance, and excess charges |

| Plan G | Similar to Plan F, but without the Part B deductible coverage |

| Plan K and L | These plans cover a percentage of Medicare-covered services, and they have annual limits. Plan L covers more than Plan K. |

| Plan M | Covers basic benefits, with higher cost-sharing than Plan F or G |

| Plan N | Similar to Plan M, with lower cost-sharing |

It's important to note that Medigap plans are standardized, meaning that each plan of the same letter offers the same benefits, regardless of the insurance company. However, the cost of the plans can vary significantly between different insurance providers.

Eligibility and Enrollment

You are eligible for Medigap if you are enrolled in Medicare Part A and Part B and you pay the monthly Medigap premium. You have a 6-month open enrollment period when you first become eligible for Medicare Part A and Part B. During this period, you can enroll in any Medigap plan offered in your state without undergoing a medical underwriting process. This means that insurance companies cannot deny you coverage or charge you more due to pre-existing health conditions.

Benefits of Medigap

Medigap can provide significant financial protection, especially for those with chronic conditions or frequent medical needs. By covering the gaps in Medicare, it can help reduce out-of-pocket healthcare costs and provide peace of mind.

Considerations and Limitations

While Medigap can be a valuable addition to Medicare coverage, it's important to consider the following:

- Medigap plans do not cover prescription drugs. If you need prescription drug coverage, you'll need to enroll in a separate Medicare Part D plan.

- Medigap plans do not cover long-term care, dental care, vision care, or private-duty nursing.

- Not all insurance companies offer all Medigap plan types, and the specific plans available can vary by state.

- Medigap plans do not cover services that Medicare does not cover. For example, they do not cover long-term care or most dental care.

- Medigap plans can be expensive, especially for those with pre-existing conditions outside the open enrollment period.

Making Informed Decisions

Understanding the intricacies of Medicare and supplemental health insurance is essential for making informed decisions about your healthcare coverage. It's always advisable to consult with a licensed insurance agent or a healthcare professional to determine the best coverage options for your specific needs and budget.

Frequently Asked Questions

What is the difference between Medigap and Medicare Advantage (Part C)?

+

Medigap (Medicare Supplement Insurance) and Medicare Advantage (Part C) are two different types of health insurance plans. Medigap is designed to supplement Original Medicare (Part A and B) by covering the deductibles, copayments, and coinsurance that Medicare does not cover. On the other hand, Medicare Advantage is an alternative to Original Medicare, offering a comprehensive package of benefits, including prescription drug coverage, in a single plan. While Medigap fills the gaps in Original Medicare, Medicare Advantage typically provides more benefits but may have limitations on provider choices and network restrictions.

Can I have both Medigap and a Medicare Advantage plan at the same time?

+

No, you cannot have both Medigap and a Medicare Advantage plan simultaneously. When you enroll in a Medicare Advantage plan, you are typically required to disenroll from Original Medicare (Part A and B). Since Medigap plans are designed to supplement Original Medicare, they become irrelevant if you are not enrolled in Original Medicare. Therefore, if you choose to enroll in a Medicare Advantage plan, you would need to disenroll from your Medigap plan as well.

How much does a Medigap plan typically cost?

+

The cost of a Medigap plan can vary significantly depending on several factors, including the plan type, your location, and your age. Generally, the more comprehensive the plan, the higher the monthly premium. It’s also worth noting that Medigap plans can increase in cost over time, and some plans may have an annual premium increase. It’s advisable to shop around and compare prices from different insurance companies to find the most affordable option for your needs.

Are there any disadvantages to having a Medigap plan?

+

One potential disadvantage of Medigap plans is the cost. These plans can be expensive, especially for those who enroll outside of their initial 6-month open enrollment period. Additionally, Medigap plans do not cover prescription drugs, so if you need prescription drug coverage, you would need to enroll in a separate Medicare Part D plan. Furthermore, Medigap plans do not cover long-term care, dental care, vision care, or private-duty nursing, which means you may need to purchase additional insurance to cover these services.