Cheapest Car Insurance For Florida

Finding the cheapest car insurance in Florida can be a challenging task due to the state's unique insurance laws and diverse market. Florida is known for its competitive insurance rates, but the actual cost of coverage can vary significantly depending on various factors. In this comprehensive guide, we will explore the factors influencing insurance rates, analyze different coverage options, and provide valuable insights to help you secure the most affordable car insurance in Florida.

Understanding Florida’s Insurance Landscape

Florida stands out among US states with its no-fault insurance system, known as the Personal Injury Protection (PIP) law. This law requires drivers to carry PIP coverage, which provides benefits for medical expenses and lost wages after an accident, regardless of fault. While this system aims to streamline the claims process, it also contributes to the complexity of insurance pricing in the state.

Key Factors Influencing Rates

Several factors play a significant role in determining the cost of car insurance in Florida:

- Personal Information: Your age, gender, marital status, and driving record can impact your rates. Young drivers and those with a history of accidents or violations may face higher premiums.

- Vehicle Details: The make, model, and year of your car, as well as its safety features and usage, can affect insurance costs. High-performance vehicles or those prone to theft may result in higher premiums.

- Coverage Type and Limits: The type of coverage you choose, such as liability-only or comprehensive, and the coverage limits you select, will influence your insurance costs.

- Location: Where you live and drive your vehicle can impact your rates. Urban areas with higher traffic volumes and accident rates may have higher insurance costs.

- Driving Habits: Your annual mileage, whether you commute or drive for pleasure, and your average daily driving distance can affect your insurance rates.

Analyzing Coverage Options

To find the cheapest car insurance in Florida, it’s essential to understand the different coverage options available and their associated costs. Here’s a breakdown of the key coverages:

Liability Insurance

Liability insurance is mandatory in Florida and covers damages to others in an accident for which you are at fault. It includes bodily injury liability and property damage liability coverage. The state’s minimum liability limits are 10,000 for property damage, 10,000 for bodily injury per person, and $20,000 for bodily injury per accident. However, many experts recommend purchasing higher limits to ensure adequate protection.

Personal Injury Protection (PIP)

As mentioned earlier, Florida’s PIP law requires drivers to carry PIP coverage. This coverage pays for your medical expenses and a portion of lost wages after an accident, regardless of fault. The minimum PIP coverage limit is $10,000, but you can opt for higher limits to enhance your protection.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who has little or no insurance. It covers your medical expenses, lost wages, and property damage. Florida does not mandate this coverage, but it is highly recommended to ensure you’re not left with substantial out-of-pocket expenses after an accident.

Collision and Comprehensive Coverage

Collision coverage pays for repairs to your vehicle if you’re in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages caused by non-accident events such as theft, vandalism, weather-related incidents, and collisions with animals. While these coverages are optional, they provide essential protection for your vehicle.

Additional Coverages

Florida also offers various additional coverages, including rental car reimbursement, towing and labor coverage, and roadside assistance. These coverages can add value to your insurance policy but may also increase your overall premium.

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers damages to others in an accident you caused. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages after an accident. |

| Uninsured/Underinsured Motorist Coverage | Protects you if involved in an accident with an uninsured/underinsured driver. |

| Collision Coverage | Pays for repairs to your vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Covers damages caused by non-accident events. |

Strategies to Secure the Cheapest Insurance

Now that we’ve explored the coverage options, let’s delve into some strategies to help you find the most affordable car insurance in Florida:

Compare Quotes from Multiple Insurers

The insurance market in Florida is highly competitive, so it’s essential to shop around and compare quotes from different insurers. Each company uses its own formula to calculate rates, so you may find significant variations in premiums. Online comparison tools can be valuable in this process, allowing you to obtain quotes from multiple insurers with just a few clicks.

Understand Your Coverage Needs

Assess your specific coverage needs based on your personal circumstances and driving habits. While it’s tempting to opt for the cheapest policy, ensure that it provides adequate protection. Consider your financial situation and the potential risks you may face on the road. Balancing cost and coverage is crucial to finding the best value.

Choose Higher Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your premium. However, this strategy requires careful consideration, as it means you’ll have to pay more upfront in the event of a claim. Assess your financial situation and comfort level with higher deductibles before making this decision.

Take Advantage of Discounts

Insurance companies in Florida offer various discounts to policyholders. Some common discounts include safe driver discounts, multi-policy discounts (bundling your car insurance with other policies like homeowners or renters insurance), good student discounts, and loyalty discounts. By exploring these discounts and qualifying for as many as possible, you can significantly reduce your insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as telematics insurance, is an innovative approach that bases your premium on your actual driving behavior. Insurance providers install a device in your vehicle or use an app to track your driving habits, such as speeding, hard braking, and time of day. If you drive safely and responsibly, you may be eligible for lower premiums. This option is particularly beneficial for safe drivers who want their insurance costs to reflect their positive driving record.

Review Your Coverage Regularly

Insurance rates and your personal circumstances can change over time. Regularly reviewing your coverage and shopping around for new quotes can help you stay on top of the most affordable options. Consider reviewing your policy annually or whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married.

Florida’s Unique Insurance Considerations

Florida’s insurance market has some unique aspects that you should be aware of when seeking the cheapest car insurance:

The Florida Hurricane Catastrophe Fund (FHCF)

The FHCF is a state-run insurance program that provides reinsurance coverage to insurers in the event of a hurricane. This fund helps stabilize insurance rates and ensures insurers can meet their obligations after a catastrophic event. Understanding how the FHCF affects your insurance costs can provide valuable insights into the overall insurance landscape in Florida.

Florida’s Insurance Fraud Issues

Florida has a history of insurance fraud, particularly related to PIP claims. To combat this issue, the state has implemented measures to reduce fraud, such as stricter claim requirements and increased scrutiny of PIP claims. As a result, some insurers may charge higher premiums to cover the cost of fraud prevention measures. Understanding these issues can help you make more informed decisions when choosing an insurance provider.

Florida’s Unique Driving Risks

Florida’s climate and geographic location present unique driving risks, such as hurricanes, floods, and wildlife collisions. These risks can impact insurance rates, as insurers consider the potential for natural disasters and the resulting claims. Understanding these risks and taking appropriate precautions, such as purchasing comprehensive coverage and maintaining a safe driving distance from wildlife, can help mitigate potential costs.

Conclusion: Finding the Best Value in Florida

Finding the cheapest car insurance in Florida requires a thorough understanding of the state’s insurance landscape, your personal circumstances, and the coverage options available. By comparing quotes, assessing your coverage needs, taking advantage of discounts, and exploring innovative options like usage-based insurance, you can secure the most affordable and comprehensive insurance policy for your vehicle. Remember, the key to success is striking a balance between cost and coverage to ensure you’re adequately protected on Florida’s roads.

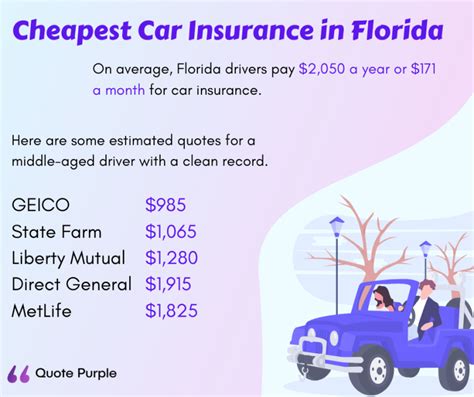

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida varies depending on various factors, including your age, driving record, and coverage limits. As of [most recent data available], the average annual premium in Florida is estimated to be around [average premium amount] for a minimum liability policy and [average premium amount] for a full coverage policy. These averages can serve as a benchmark, but your specific premium may differ.

Are there any ways to lower my car insurance costs in Florida without sacrificing coverage?

+Yes, there are several strategies to reduce your car insurance costs without compromising coverage. Some of these include increasing your deductible, bundling your insurance policies (e.g., combining car insurance with homeowners or renters insurance), maintaining a clean driving record, and exploring usage-based insurance options. Additionally, regularly reviewing and comparing quotes from different insurers can help you identify the most affordable options.

What factors should I consider when choosing car insurance in Florida?

+When choosing car insurance in Florida, consider factors such as your coverage needs (liability-only or full coverage), your budget, and the reputation and financial stability of the insurance provider. Assess your personal circumstances, including your driving habits, the value of your vehicle, and any specific risks you may face (e.g., living in a hurricane-prone area). Additionally, read reviews and seek recommendations to ensure you’re selecting a reputable insurer.

How does Florida’s no-fault insurance system affect my car insurance costs?

+Florida’s no-fault insurance system, known as Personal Injury Protection (PIP), requires drivers to carry PIP coverage. While this coverage provides benefits for medical expenses and lost wages after an accident, regardless of fault, it can also impact your insurance costs. Some insurers may charge higher premiums to cover the cost of PIP claims. However, understanding your PIP coverage and comparing quotes can help you find the most affordable option.