Which Car Insurance Is Best

Choosing the right car insurance is an important decision that can have a significant impact on your financial security and peace of mind. With numerous options available in the market, it can be overwhelming to determine which insurance provider offers the best coverage and value. This comprehensive guide aims to provide you with the insights and knowledge needed to make an informed choice when selecting the best car insurance for your specific needs.

Understanding Your Car Insurance Options

The car insurance market is diverse, offering a range of coverage options and policy types to cater to different drivers and their unique circumstances. Understanding these options is crucial in your search for the best insurance provider.

Types of Car Insurance Policies

Car insurance policies can generally be categorized into three main types: liability-only, collision, and comprehensive. Liability-only insurance provides coverage for damages you cause to others’ property or injuries you inflict upon others due to an accident. Collision insurance covers damages to your own vehicle in the event of an accident, regardless of fault. Comprehensive insurance offers protection against non-collision incidents, such as theft, vandalism, or natural disasters.

Some insurance providers also offer specialized policies, such as high-risk auto insurance for drivers with multiple violations or accidents on their record, or classic car insurance tailored to the unique needs of antique and collector vehicles.

Factors Influencing Car Insurance Rates

Insurance providers determine rates based on a variety of factors, including your age, gender, driving history, the type of vehicle you drive, and where you live. Other considerations may include your credit score, marital status, and the number of miles you drive annually. Understanding how these factors influence rates can help you negotiate better deals and choose the most suitable insurance coverage.

Researching Car Insurance Companies

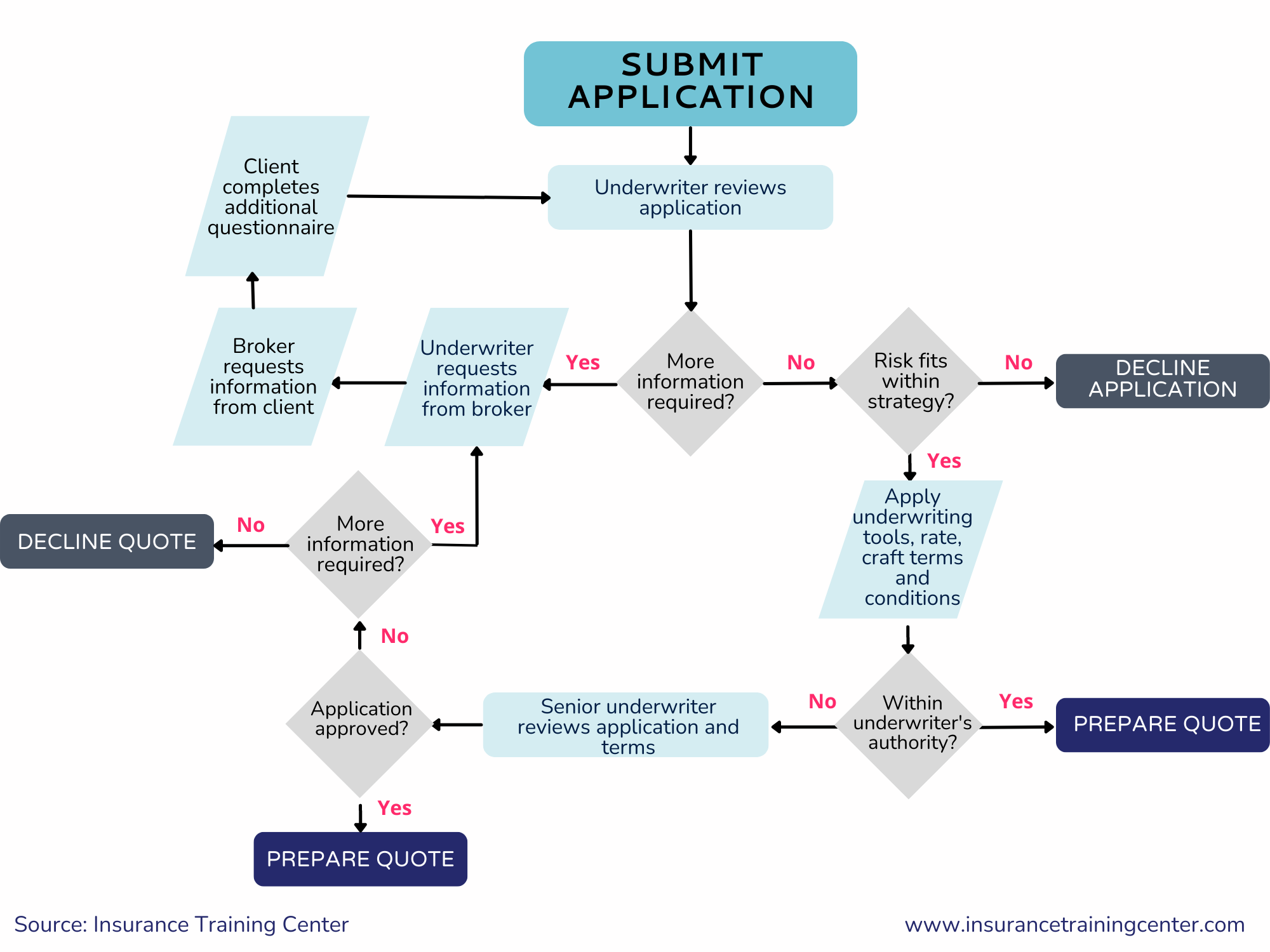

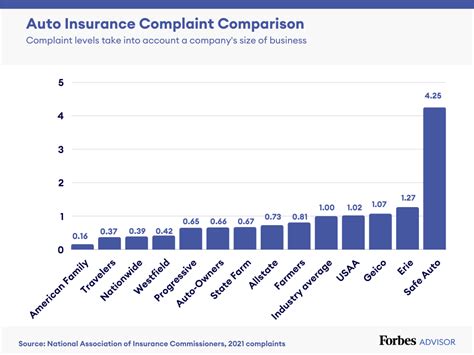

When researching car insurance companies, it’s important to look beyond just the cost of premiums. Consider the company’s financial stability, customer service reputation, and the range of coverage options they offer. Check for any complaints or negative reviews, as well as the company’s response to such issues. Additionally, assess the ease of filing claims and the timeliness of claim settlements.

Assessing Car Insurance Coverage

The coverage provided by your car insurance policy is a critical aspect to consider. While the minimum level of coverage required varies by state, it’s essential to ensure that your policy meets or exceeds these requirements. Here’s a breakdown of key coverage options to consider:

Liability Coverage

Liability coverage is a fundamental aspect of any car insurance policy. It protects you financially if you cause an accident that results in injuries to others or damage to their property. Most states require a minimum level of liability coverage, but it’s advisable to opt for higher limits to provide adequate protection in the event of a serious accident.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional, but highly recommended for most drivers. Collision coverage pays for repairs to your vehicle after an accident, while comprehensive coverage covers non-collision incidents, such as theft, vandalism, or damage caused by natural disasters. These coverages provide peace of mind and can help prevent financial strain in the event of an unexpected incident.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage provide financial support for medical expenses incurred in an accident, regardless of fault. While PIP coverage is mandatory in some states, it’s an optional add-on in others. Medical Payments coverage, on the other hand, is typically optional but can provide additional coverage for medical expenses not covered by PIP or health insurance.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is designed to protect you if you’re involved in an accident with a driver who has little or no insurance. This coverage pays for your injuries and property damage when the at-fault driver lacks sufficient insurance to cover the costs. UM/UIM coverage is mandatory in some states and highly recommended in others to ensure you’re fully protected.

Other Coverage Options

Car insurance providers offer a range of additional coverage options to cater to specific needs. These may include rental car reimbursement, gap insurance, custom parts and equipment coverage, and more. Consider your unique circumstances and assess which additional coverages might be beneficial for you.

Comparing Car Insurance Rates and Companies

Comparing car insurance rates and companies is a crucial step in finding the best deal. While price is an important consideration, it’s not the only factor to evaluate. Here’s a comprehensive approach to comparing car insurance options:

Obtain Multiple Quotes

Request quotes from multiple insurance providers to compare rates. Online quote tools can be a convenient way to get quick estimates, but be sure to also speak with insurance agents to understand the coverage and any potential discounts you may qualify for.

Analyze Coverage and Limits

When comparing quotes, carefully examine the coverage limits and types included in each policy. Ensure that the policies you’re comparing offer similar coverage levels so that you’re making an apples-to-apples comparison. Consider your specific needs and circumstances to determine the most suitable coverage limits.

Assess Customer Service and Claims Handling

Customer service and claims handling are critical aspects of any insurance provider. Research the company’s reputation for customer satisfaction and claims handling efficiency. Look for reviews and ratings from independent sources, and consider reaching out to friends and family for personal recommendations.

Evaluate Financial Stability

The financial stability of an insurance company is crucial to ensure they can pay out claims in the event of an accident. Check the company’s financial ratings from reputable agencies such as A.M. Best, Moody’s, or Standard & Poor’s. A higher financial rating indicates greater stability and the ability to honor policy obligations.

Consider Discounts and Special Programs

Many insurance providers offer discounts and special programs that can significantly reduce your premiums. These may include safe driver discounts, good student discounts, multi-policy discounts, or loyalty rewards. Explore the discounts available with each provider and assess which ones you’re eligible for.

Read the Fine Print

Before committing to a policy, carefully read the fine print to understand any exclusions, limitations, or conditions that may apply. This ensures you’re fully aware of what’s covered and what’s not, and helps you make an informed decision.

Making an Informed Decision

Now that you’ve gained a comprehensive understanding of car insurance options, coverage, and the comparison process, it’s time to make an informed decision. Consider your specific needs, budget, and the reputation of the insurance provider. Assess the value and coverage provided by each policy, and don’t hesitate to seek clarification or additional information from insurance agents or customer service representatives.

Tailoring Your Coverage

Your car insurance policy should be tailored to your unique circumstances and needs. If you have a classic car, for example, you may require specialized coverage. Similarly, if you have a long commute or frequently drive in high-risk areas, you may need to adjust your coverage limits or consider additional endorsements.

Regularly Review and Update Your Policy

Car insurance needs can change over time, so it’s important to regularly review and update your policy. Life events such as marriage, buying a new home, or having children can impact your insurance needs. Additionally, changes in your driving habits, vehicle usage, or credit score can also affect your insurance premiums and coverage requirements.

Understanding Your Rights and Responsibilities

As a policyholder, it’s essential to understand your rights and responsibilities. Read your policy carefully to know what’s covered and what’s not. Familiarize yourself with the claims process and know what to do in the event of an accident. Additionally, stay informed about your state’s insurance laws and regulations to ensure compliance and protect your rights.

FAQ

What is the minimum car insurance coverage required by law?

+The minimum car insurance coverage required by law varies by state. However, most states require liability coverage, which includes bodily injury liability and property damage liability. It’s important to check your state’s specific requirements to ensure you’re meeting the legal minimum.

How can I lower my car insurance premiums?

+There are several ways to lower your car insurance premiums. You can shop around for quotes from multiple providers, consider increasing your deductible, maintain a clean driving record, and explore discounts offered by insurance companies. Additionally, keeping your credit score high can also help reduce premiums.

What should I do if I’m involved in a car accident?

+If you’re involved in a car accident, the first step is to ensure your safety and the safety of others involved. Call the police to report the accident and exchange information with the other driver(s). Take photos of the accident scene and any visible damages. Contact your insurance provider as soon as possible to report the accident and begin the claims process.