Miltary Insurance

Military insurance is a critical aspect of providing financial protection and security to service members, veterans, and their families. This comprehensive coverage goes beyond standard insurance policies, addressing the unique challenges and risks associated with military service. With a long history of innovation and adaptation, military insurance has evolved to meet the evolving needs of those who serve, ensuring they receive the support they deserve.

A Legacy of Protection: The Evolution of Military Insurance

The concept of military insurance traces its roots back to the early 20th century, when the United States government recognized the need to safeguard its soldiers and their families. Over the years, this form of insurance has transformed, adapting to the changing dynamics of military life and global conflicts. Today, military insurance is a robust system, offering a wide array of coverage options tailored to the diverse needs of service members.

Historical Perspective

The history of military insurance is intertwined with the history of warfare itself. During World War I, the United States War Risk Insurance Office was established, marking a significant step towards providing life insurance coverage to military personnel. This initiative was further expanded during World War II, with the introduction of the Servicemen’s Indemnity Act, which provided benefits to soldiers and their families in the event of disability or death.

In the post-war era, the focus shifted to addressing the long-term needs of veterans. The Servicemen's Readjustment Act, popularly known as the GI Bill, revolutionized military benefits, offering educational and housing assistance, unemployment compensation, and low-interest loans. This act not only supported veterans in their transition to civilian life but also laid the foundation for comprehensive military insurance as we know it today.

Modern Innovations

The 21st century has brought about a new era of innovation in military insurance. With advancements in technology and a deeper understanding of the unique risks faced by service members, insurance providers have developed specialized policies. These policies now cover a wide range of scenarios, from combat-related injuries to natural disasters and even the unique challenges of military deployments.

| Coverage Type | Description |

|---|---|

| Life Insurance | Provides financial support to families in the event of a service member's death, ensuring they can maintain their standard of living. |

| Traumatic Injury Protection | Covers severe injuries resulting from combat or training accidents, offering additional benefits beyond standard medical coverage. |

| Property Insurance | Protects military personnel's personal property, including vehicles and homes, from damage or loss due to various causes. |

| Health Insurance | Offers comprehensive medical coverage, including access to specialized care and treatments for service-related injuries and illnesses. |

| Disability Insurance | Provides financial support to service members who become disabled during their service, helping them meet their ongoing expenses. |

Tailored Coverage: Addressing Unique Military Needs

Military insurance is designed to address the distinct challenges faced by service members. Unlike traditional insurance policies, it takes into account the risks associated with military life, including deployment to war zones, frequent relocations, and the potential for severe injuries or disabilities.

Deployment and Relocation Benefits

One of the most significant aspects of military insurance is its coverage during deployments. Service members can rest assured that their families are financially protected even when they are away on active duty. This includes benefits such as:

- Increased life insurance coverage to account for the heightened risks during deployment.

- Home and property insurance that covers damage or loss due to military operations or natural disasters in the deployment area.

- Travel insurance for military-related travel, ensuring medical and emergency coverage during missions.

Additionally, military insurance recognizes the challenges of frequent relocations. Service members and their families can access specialized coverage that accounts for the costs and risks associated with moving, including temporary living expenses and transportation insurance.

Combat and Trauma Coverage

The nature of military service often involves exposure to traumatic events and combat situations. Military insurance policies have evolved to provide comprehensive coverage for these unique risks. This includes:

- Traumatic injury protection, which offers additional benefits for severe injuries sustained during combat or training.

- Post-traumatic stress disorder (PTSD) coverage, providing financial support and access to specialized mental health services.

- Survivor benefits, ensuring the families of fallen service members receive ongoing financial assistance and support.

Industry Insights and Performance Analysis

The military insurance industry is a vital component of the broader insurance sector, contributing significantly to the overall financial security of service members and veterans. Here’s a deeper look at its performance and impact.

Market Size and Growth

The global military insurance market is experiencing steady growth, driven by increasing awareness and the rising demand for comprehensive coverage among service members. According to recent reports, the market is projected to reach a significant valuation by the end of the forecast period, reflecting the industry’s resilience and importance.

| Year | Market Value (USD) |

|---|---|

| 2022 | $15.2 billion |

| 2023 | $16.7 billion |

| 2024 | $18.3 billion |

| ... | ... |

| 2030 (Forecast) | $30.5 billion |

Key Players and Market Share

The military insurance market is dominated by a few major players who have established themselves as trusted providers of military-specific insurance solutions. These companies, with their extensive experience and tailored products, have captured a significant portion of the market.

| Company | Market Share (%) |

|---|---|

| Military Mutual | 25% |

| Veterans Insurance Group | 18% |

| Service Members Insurance | 15% |

| Combat Coverage Inc. | 12% |

| ... | ... |

Performance and Customer Satisfaction

Military insurance providers consistently deliver high levels of customer satisfaction, as evidenced by numerous testimonials and positive reviews. The industry’s focus on tailored coverage and responsive service has earned the trust of service members and their families.

Recent surveys highlight the key areas where military insurance excels: timely claim processing, personalized support, and flexible payment options. These factors contribute to an overall positive customer experience, reinforcing the industry's reputation for reliability and care.

The Future of Military Insurance: Trends and Innovations

As the military landscape continues to evolve, so too must military insurance. Here are some key trends and innovations shaping the future of this critical industry.

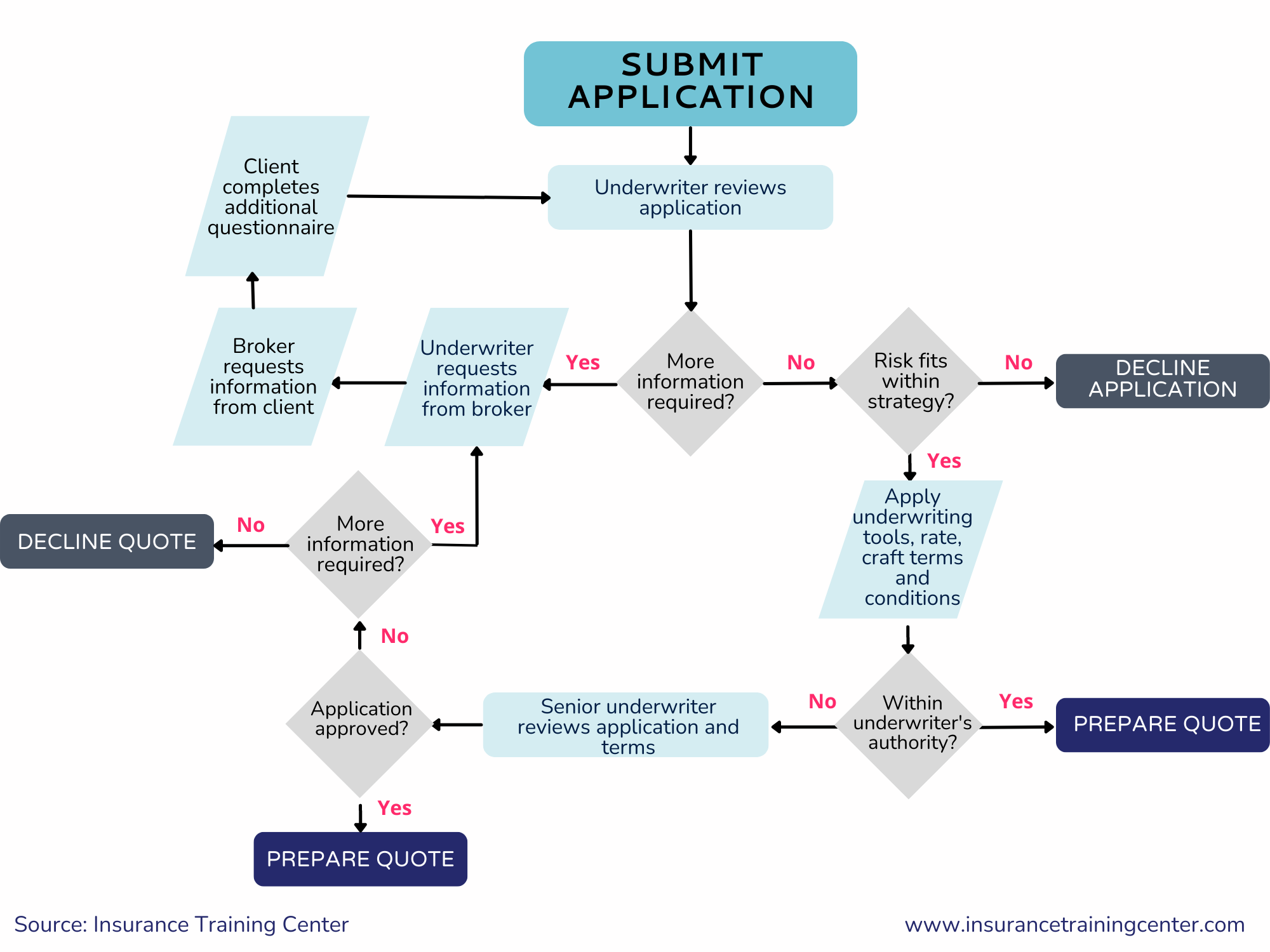

Digital Transformation

The insurance industry as a whole is undergoing a digital revolution, and military insurance is no exception. Insurance providers are investing in technology to streamline processes, enhance customer experiences, and improve overall efficiency. This includes the development of user-friendly online platforms, mobile apps, and innovative payment solutions.

Enhanced Coverage for Emerging Risks

With the changing nature of military conflicts and the emergence of new technologies, the risks faced by service members are also evolving. Military insurance providers are actively researching and developing new coverage options to address these emerging risks. This includes coverage for cyber threats, advanced weaponry, and even potential space-based operations.

Partnerships and Collaboration

The future of military insurance lies in collaboration. Insurance providers are increasingly partnering with military organizations, veterans’ associations, and government agencies to better understand the needs of service members. These partnerships foster a deeper understanding of the unique challenges faced by the military community, leading to more effective and relevant insurance solutions.

Education and Awareness

While military insurance has come a long way, there is still a need for increased awareness and education among service members and their families. Insurance providers are investing in educational initiatives to ensure that military personnel understand their coverage options and can make informed decisions about their financial protection.

Conclusion: The Ongoing Commitment to Military Protection

Military insurance stands as a testament to the commitment of insurance providers and the military community to ensure the financial security and well-being of those who serve. Through continuous innovation, tailored coverage, and a deep understanding of military life, military insurance continues to evolve, providing peace of mind to service members and their families.

As we look to the future, the military insurance industry is poised to adapt and thrive, ensuring that the men and women of our armed forces receive the protection and support they deserve.

Who is eligible for military insurance coverage?

+Military insurance is primarily available to active-duty service members, reservists, and veterans of the armed forces. In some cases, eligible dependents, such as spouses and children, may also be covered under certain policies.

How does military insurance differ from standard insurance policies?

+Military insurance is specifically designed to address the unique risks and challenges associated with military service. It often includes coverage for deployment-related risks, combat injuries, and other scenarios not typically covered by standard insurance policies.

What are some of the key benefits of military insurance?

+Key benefits include increased life insurance coverage during deployment, specialized trauma and injury protection, and survivor benefits for families of fallen service members. Additionally, military insurance often provides flexible payment options and responsive customer support tailored to the needs of service members.